Collections

Resources | Blog

Latest Collection blogs

-

Dunning letter management: Optimize your collections strategy

Unlock faster cash flow and better AR efficiency with AI-powered KPIs. See how automation transforms your cash application process.

-

Optimize your collections process with these essential collection letter templates

Struggling with late payments? Use these proven collection letter templates to speed up collections and protect cash flow.

-

Is accounts receivable debit or credit? What finance professionals need to know

Confused about accounts receivable as a debit or credit? Learn the accounting rules and financial impact every finance leader should know.

-

Accounts receivable insurance: The missing piece in your AR risk management strategy

Protect your cash flow—discover how AR insurance and automation combine to minimize credit risk and drive financial stability.

-

Stop chasing payments: How accounts receivable collections software changes the game

AR collections software takes the guesswork out of getting paid—boost cash flow, cut DSO, and keep customers happy.

-

From Delays to Dollars: Smarter Collections Strategies for Transportation Companies

Struggling with managing cash flow in the transportation industry? Discover best practices to help you improve your collections.

-

Billtrust Expands Automated Collections Software with CEI Analytics

Billtrust’s dashboard offers new metrics and innovative ways to enhance the efficiency of your collections efforts.

-

Average Collection Period: Smart Strategies for Accelerating B2B Payments

Want cash to flow faster? Zero in on your Average Collection Period to turn this financial metric into a strategic lever.

-

Outsource accounts receivable services for manufacturing: Automation vs Outsourcing

Outsource or automate accounts receivable for manufacturing? Learn the key differences & best practices to optimize cash flow & efficiency.

-

How to improve cash flow in a manufacturing business: Best practices and solutions

Cash flow issues in manufacturing? Discover proven strategies & automation solutions to optimize working capital and financial stability.

-

Transportation collections software guide: Maximizing AR performance in logistics

Boost cash flow & streamline collections with transportation AR software. Discover key features & strategies to optimize your finances.

-

Accounts receivable for the construction industry: Tips for success

Struggling with cash flow in construction? Master accounts receivable management with automation to accelerate payments and boost growth.

-

How to automate healthcare and life sciences payments: Best practices & strategies

Streamline healthcare payments with automation. Discover best practices and implementation strategies to improve efficiency and cash flow.

-

How to reduce days in AR in healthcare and life sciences invoicing: Tips to speed payments

Accelerate claim payments & reduce AR days in healthcare and life sciences invoicing with automation for better cash flow and patient care.

-

How does an increase in accounts receivable affect cash flow?

Discover how increasing accounts receivable affects cash flow and explore strategies to optimize working capital for sustainable growth.

-

Benefits of cash application automation for businesses: Complete analysis

Discover how cash application automation streamlines AR processes, enhances accuracy & accelerates cash flow for businesses that can profit you.

-

What is a consequence of inefficient management of accounts receivable?

Unlock the secrets of efficient accounts receivable management & discover how poor AR processes can impact your business's financial health.

-

What is accounts receivable turnover?

Accounts receivable turnover is an essential metric for measuring how fast a company can get the money it is owed by its customers.

-

What is cash on delivery (COD) and how does it work?

Cash on delivery means the customer pays for goods upon delivery but it has drawbacks for both the buyer and the seller, like delays & risk.

-

How to automate accounts receivable: From manual to modern AR

Transform accounts receivable with automation. Reduce manual work, improve cash flow & modernize your AR processes for greater efficiency.

-

Digital credit management solutions for modern finance teams

Streamline credit decisions with digital solutions. Automate workflows, assess risks with AI, and boost satisfaction for finance teams.

-

How to calculate cash collected from accounts receivable: Methods for modern finance teams

Master cash collection calculations with modern methods to optimize accounts receivable processes and improve your financial decision-making.

-

How to improve days sales outstanding for better cash flow

Learn how to improve days sales outstanding (DSO) with proven strategies and automation to boost cash flow and operational efficiency.

-

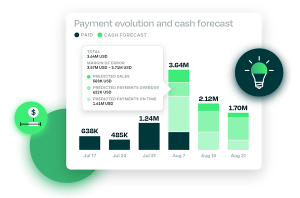

Predict payment behavior of your customers

Artificial intelligence (AI) can help recognize customers’ payment activity, leading to greater cash flow.

-

How to create an effective credit policy

Empower your business with a robust credit policy to fuel growth, mitigate risks, and secure long-term success.

-

Reducing Recessionary Risks

It’s critical to automate your organization's system and reduce cycle times so that you get paid faster.

-

Largest customer marketplace ranks Billtrust Overall Leader in AR software

G2.com names Billtrust as the overall leader in accounts receivable automation.

-

10 strategies for optimizing your accounts receivable to maximize your ROI

Discover 10 strategies for optimizing accounts receivable to get the most out of your AR operations.

-

How to get paid faster: 10 pro tips to optimize payments

Get paid faster with these 10 tips for optimizing your payments process: automating approvals, paying suppliers sooner and more.

-

Your top ten questions about streamlining international receivables and collections

In a global economy, it can be difficult to keep up with international receivables. Learn the top ten questions to ask yourself before implementing your next cross-border payment solution.

-

Stress-free accounts receivable solutions for smoother cash flow

Reduce the time spent on accounts receivable and invoice collection and eliminate the headaches that come with waiting for payment.

-

How to handle your customer not paying: Tactics that work

Are your customers not paying? Learn the most effective tactics for handling customers who don’t pay their invoices. \r\n

-

Troubleshooting high operating costs in AR: A guide for your business

If you're seeing high operating costs in your accounts receivable, it's time to take action. This guide will help you identify the source of the problem and find a solution.

-

How accounts receivable automation helps legal firms thrive

It’s imperative for them to adopt accounts receivable (AR) automation to optimize billing and client relationships.

-

Accounts receivable services for a more efficient business

It's essential to understand that accounts receivables are the lifeblood of your company as effective AR services can help you stay on top of all aspects of managing your cash flow.

-

How AR solutions equal faster payments for transportation firms

See how AR automation solves multiple challenges for transportation firms– some old, some new.

-

A credit process that collectors will love

Want to improve your order-to-cash cycle? Get tips from Billtrust on how to improve your invoicing and cash application which leads to faster collections.

-

How a smart collector approaches disputes

Learn how a smart collector approaches customer disputes. Using a collections dispute resolution can help you resolve them quicker.

-

How better invoicing and cash application leads to faster collections

Improve your order-to-cash cycle with invoicing and cash application solutions that can lead to faster collections.

-

The state of AR: Insights into a transforming landscape

Billtrust commissioned a study of accounts receivable and is sharing AR insights, including the state of payments and the dangerous paradox facing departments.

-

The top reasons for customer dissatisfaction and how to manage them

Discover the top reasons for customer dissatisfaction, what they want, and what you can do to manage complaints today.

-

Accounts receivable software for small business: Cash flow management & more

How can accounting software help your business grow? Optimize your accounts with our guide to accounts receivable software for small business today!

-

Find out now, how to handle AR forecasting challenges in your business

Financial forecasting is one of the most critical and challenging elements of the cash flow forecasting process because it’s tied to your business’s cash flow and financial health.

-

Take your AR to the next level with these accounts receivable process improvement ideas

You can improve the accounts receivable process to streamline AR and ensure that payments come in with less hassle.

-

Smart ways to improve accounts receivable collections using technology

Level up your accounts receivable collections techniques to ensure that your company makes the most of its finances.

-

Your bookkeeping guide for staying on track all year long

Check out our bookkeeper’s guide for staying on track in the new year for definitions, advice, and more.

-

Accounts receivable outstanding: Meaning, reducing outstanding AR & more

Accounts receivable outstanding is an important metric used in financial analysis for calculating a company’s liquidity.

-

Unlocking working capital: How accounts receivable finance transforms cash flow management

Accounts receivable financing is the process of receiving capital based on a portion of a company’s accounts receivable.

-

Accounts receivable collections

Accounts receivable collection period means the period (in days) in which customer credit sales are collected.

-

What is the average collection period formula?

The average collection period is the amount of time a person or company has to repay a debt. For U.S.-based companies, it's usually around 30 days.

-

Serving global customers locally | Billtrust & iController

The acquisition of iController, a Belgium-based credit & collections solution, will expand Billtrust's offerings to serve global customers locally.

-

Are your accounts receivable (AR) processes modernized?

Access our four-stage spectrum on an AR team’s modernization journey and improve your AR processes.

-

What is accounts receivable turnover?

Accounts receivable turnover is an essential metric for measuring how fast a company can get the money it is owed by its customers.

-

Why Billtrust and iController fit together

In October of 2021, Billtrust announced that it had acquired iController, a Belgium-based provider of collections solutions.

-

The top 10 accounts receivable strategies for driving financial growth

See the top 10 accounts receivable strategies from Billtrust, including evaluating your AR processes, implementing AR automation solutions and more.

-

Cash Flow: The components, analysis, statement and more

Learn how cash flow impacts your business, the importance of managing and analyzing cash flow, the statement and more.

-

What type of professional training do collection agents need?

Collection agents will benefit from continuing education and training.

-

What are the 6 W’s of collecting (and how to apply them)

Learn from Billtrust how your professional collectors can use the 6W's of collecting: Who, What, When, Where, Why and how.

-

Accounts receivable turnover ratio: Formula, definition and examples

The accounts receivable turnover ratio: What it indicates, calculation, example, limitations and more.

-

What is your view of collections professionals?

Learn from what collection professionals do, from communication to customer service.

-

What is accounts receivable automation software?

Accounts receivable software can make the process of getting paid easier by optimizing payments and increasing your company’s cash flow.

-

Understanding Accounts Receivable Bookkeeping

Accounts receivable bookkeeping is the accounting process of recording, tracking and reporting on the accounts receivable of a business.

-

Managing your O2C process through employee absences

Your order-to-cash (O2C) process doesn’t need to stop when someone is sick or on vacation. You can keep your accounts receivable team on track.

-

Your AR work from home setup

Ensure the extended success of your accounts receivable operation as your AR team works from home.

-

A step-by-step guide to the order-to-cash cycle

Master the order-to-cash cycle to boost efficiency and enhance financial performance with our comprehensive step-by-step guide.

-

Everything you need to know about AR automation

Take the anxiety out of updating your order-to-cash process, from why accounts receivables need to embrace digital processing to the benefits of AR automation.

-

How to run an effective collections team

Learn five ways to run an effective collections team including automating daily tasks and more.

-

Calculating the value of accounts receivable automation with Forrester's Total Economic Impact model

Learn why Forrester’s Total Economic Impact (TEI)™ model is one of the most robust methods of evaluating the value of investment in AR automation software.

-

What Is Credit Management And What Are Its Benefits?

Credit management involves reviewing, analyzing and setting the terms of requests for credit for a business in order to minimize the risk.

-

What is cash management?

Managing the inflows and outflows of your organization's cash is vital to ensuring its viability within a competitive marketplace.

-

4 ways to elevate the role of the credit and collections professional during COVID-19

Learn the four ways to elevate the role of the credit and collections professional during COVID-19 including mitigating risk with machine learning.

-

What is DSO?

DSO, or days sales outstanding, is the average number of days that it takes for a business to convert a sale into a payment.

-

What is accounts receivable?

Accounts receivable refers to the money a company is owed by its customers for goods and services that have been delivered, but not yet paid for.

-

What Can B2B Learn from Amazon’s CX?

B2B companies can learn from Amazon and win with customer experience if they adopt order-to-cash automation to optimize the customer experience and transactional experience.

-

Collection Effectiveness Index (CEI): Definition & Calculation

What is the calculation effectiveness index (CEI)? It’s the calculation of a company’s ability to retrieve their AR from their customers.

-

How to use Days Sales Outstanding (DSO)

How the relationship between invoicing, DSO and collections loosens cash flow and helps companies grow and why there’s a love/hate for DSO.

-

New Year, New Goals: Five resolutions for your AR team

Optimize your AR team's productivity with tips on how to reduce DSO, increase cash allocation match rates and improve account collections.

-

3 ways that picking the perfect holiday present, is like picking the right AR solution

Choosing the perfect holiday gift is like choosing the right accounts receivable (AR) solution for your business.

-

4 Ways to Manage Cash Flow More Effectively

Cash flow is a critical component for all businesses because without it, you can’t buy supplies, pay for services and equipment and more. Learn how to improve your cash flow management.

-

Days Sales Outstanding (DSO) Formula and Importance

Days sales outstanding (DSO) measures the number of an average day's sales that are in receivables awaiting collection.

View blogs by topic

Browse blogs by your unique role

Read blogs focused on your industry

Billtrust Blog: AR management, cash application and more

The Billtrust Blog provides valuable accounting insights, expert advice on automated AR best practices, and practical tips and strategies to enhance your AR processes. Stay updated with regularly published articles.