When it comes to business, one of the most crucial things you can do is establish a good credit policy. Your credit policy will dictate how you extend credit to your customers, how you collect payments, and what you do in the event of non-payment. In addition, an effective credit policy can help you manage your cash flow, reduce bad debt, and improve your bottom line.

What is a credit policy?

First of all, let’s consider what a credit policy exactly entails. In fact, it is a set of rules and procedures that defines the credit and payment conditions for your customers. By putting this in place, you create a firm foundation for your employees, and you can take a clear stance in the event of late payments.

By drawing up a formal credit policy, you will be better able to defend yourself against non-payment. This is a must, especially for industries and sectors that have a reputation for slow payments.

With a credit policy, you can, for example, allow customers to divide very large invoices into partial payments. These smaller installments make it easier for your customer to pay, while each installment contributes to your company's cash flow.

Why have a credit policy?

Credit policies vary greatly among companies, with smaller companies typically preferring to avoid offering credit and instead invoice immediately upon receiving an order. Consequently, enforcing a credit policy is usually a lower priority for these companies. Conversely, larger companies commonly implement credit policies.

While experienced credit managers and controllers may be able to assess risk and determine account-specific credit limits, it is recommended to minimize any ambiguity that could lead to confusion or misunderstandings of credit approvals, especially when new employees may not share the same understanding.

There are plenty of reasons why you should think carefully about your credit policy and put it in an official document. Everything revolves around the degree of risk you as a company wish to run with your customers. Maximizing turnover while minimizing risk is what it’s all about.

A few reasons why a credit policy is necessary:

- A consistent approach is ensured when everyone in your company is aware of the credit conditions and which ones are applicable to specific customer types.

- Considerable efficiency gains can be achieved when employees are informed about the credit policy, as they are able to make informed decisions without having to seek permission or guidance from colleagues. This is particularly beneficial for new employees who can be immediately informed about the policy as part of their training material.

- With a good credit policy, you actually set your expectations before the sales agreement is concluded. When the invoice is sent out, your buyer knows what is going to happen, even if payment is late. In this case, you also have the necessary leverage should legal proceedings arise.

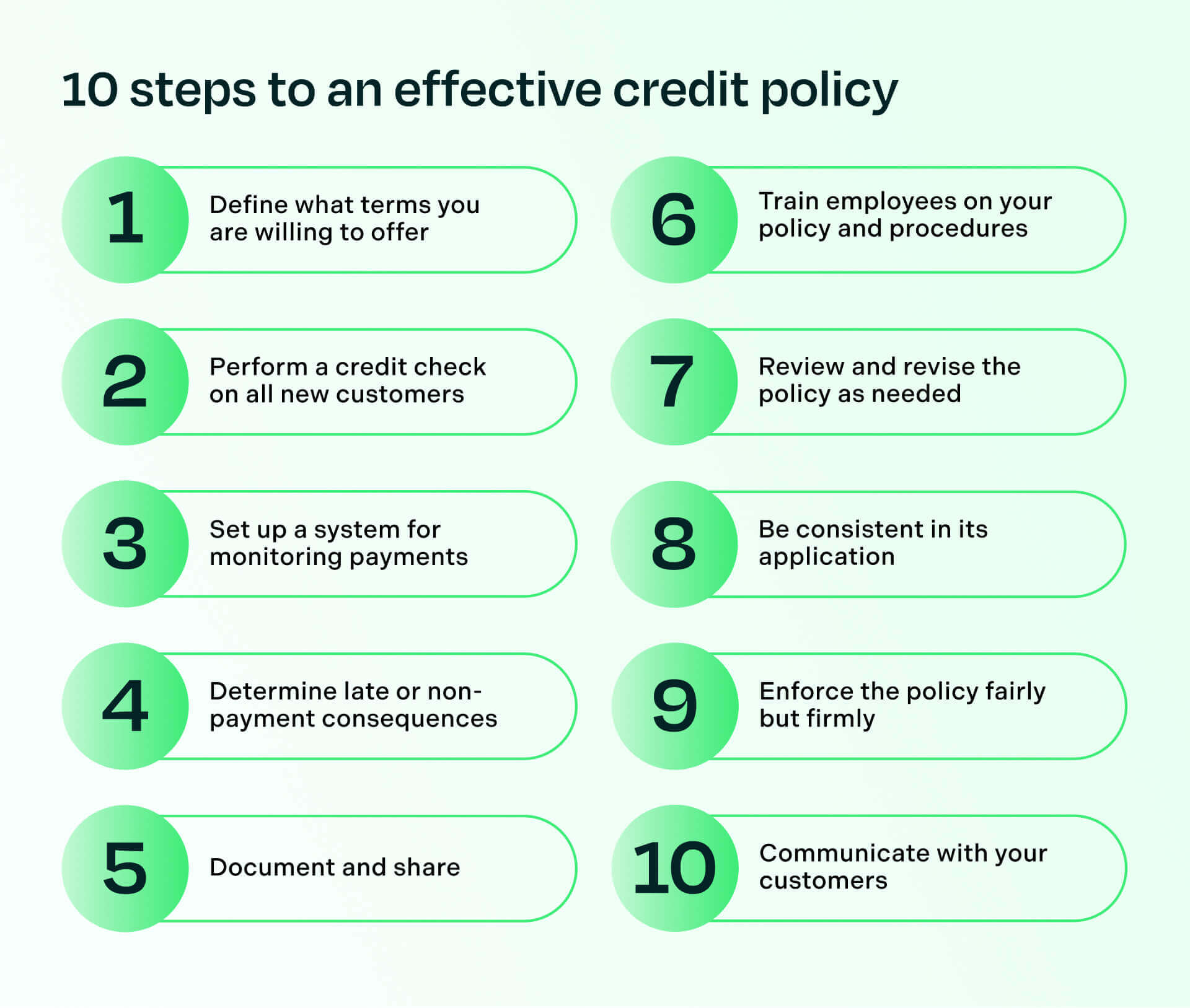

10 steps to an effective credit policy

Now you know the advantages of having a credit policy, so how can you get started?

By following these ten steps, you can begin creating a credit policy that is suitable for your business.

1. Define what terms you are willing to offer

The first step in creating an effective credit policy is to decide what terms you are willing to offer your customers. This includes how much credit you are willing to extend, what interest rate you will charge, and when payments are due. Of course, you'll need to consider your business's cash flow and profit margins when making these decisions.

2. Perform a credit check on all new customers

Before extending credit to a new customer, you'll need to perform a credit check. This will help you determine if they will likely pay their bills on time. A couple of ways to do this include using a credit reporting service or pulling a copy of their credit report. The fastest and most accurate way is with automated credit applications.

3. Set up a system for monitoring payments

Once you've extended credit to a customer, keeping track of their payments is important. This can be done using software, manually or by hiring collections professionals. Monitoring payments will help you stay on top of your customers' account balances and ensure they are paying on time.

4. Determine the consequences for late or non-payment

It's important to have a system to deal with late or non-payment. This could include charging late fees, suspending credit privileges or sending the account to collections. You'll need to decide what actions you will take in advance to enforce your policy consistently.

5. Document and share

Once you've decided on the details of your credit policy, it's time to write it down and share it with relevant parties. This will help ensure that everyone involved understands the policy and what is expected of them. Your credit policy should be easy to read and understand, so consider hiring a professional to help you write it.

Clearly define the role and responsibilities of each team member. Determine when other departments in the company – outside the finance team – come into play. And see if there are efficiency improvements that can be made in that area. You'll also want to ensure that your employees understand the consequences of violating the policy.

6. Train employees on your credit policy and procedures

Once your credit policy is in place, it's critical to have the necessary people trained. This includes running credit checks, monitoring payments and taking action in the event of late or non-payment.

Take into account the availability of resources to implement your credit policy. You can optimize the efficiency of the credit process by utilizing software and built-in automation.

7. Review and revise the policy as needed

The ideal credit policy for your company cannot be determined in an instant. It often involves a lot of trial and error. It takes a while before you can make a good estimate of which companies carry a high credit risk and which do not.

Credit policies are dynamic and not set in stone. As your business grows, enters new markets, and economic conditions change in different countries, it may be necessary to regularly review and revise your policy to accommodate these changes.

8. Be consistent in its application

One of the most important aspects of an effective credit policy is consistency. You'll need to apply the policy across all your customers consistently. This means treating everyone the same, regardless of personal relationships.

9. Enforce the policy fairly but firmly

The next step in creating an effective credit policy is enforcement. You'll need to ensure that you are fairly but firmly enforcing the policy with all your customers. This means taking action when payments are late or accounts receivable become delinquent.

10. Communicate with your customers

Finally, it's important to communicate your credit policy to your customers. This includes letting them know what terms you are offering, how you will monitor their payments and the consequences for late or non-payment. Good communication will help your customers understand your policy and what to expect.

Implementing an effective credit policy can be a game-changer for your business. Develop a well-thought-out plan to keep your finances, minimize bad debt and improve your bottom line.