This blog post was originally published in June 2020 and was updated in October 2024 with more information about accounts receivable (AR), including the impact of AR automation, the significance of metrics like Days Sales Outstanding (DSO), and more.

What is accounts receivable (AR)?

Accounts receivable refers to the money a company is owed by its customers for goods and services that have been delivered but not yet paid for. Accounts receivables are listed as current assets on the balance sheet and play a critical role as liquid assets, reflecting the amount of cash that is expected to be collected in the near term.

The accounts receivable process involves invoicing customers for goods or services that have been delivered, pursuing payment and then processing and recording payment.

The importance of having accounts receivable for companies

Having accounts receivable is crucial for companies as it represents sales that have been made but not yet paid for in cash, effectively functioning as a line of credit extended by the business to its customers. This component of the balance sheet is not just a reflection of a company’s operational efficiency and credit policies but also a vital source of its short-term liquidity.

Properly managing accounts receivable helps ensure a steady inflow of cash, which is essential for maintaining daily operations, such as paying for raw materials, salaries, and other overhead costs. Moreover, it also enables companies to improve their cash flow forecasting, financial planning, and budgeting processes.

By allowing customers to purchase goods or services on credit, companies can enhance their sales volumes and customer loyalty by offering flexible payment terms.

However, it is also crucial to strike a delicate balance in managing receivables to prevent liquidity issues arising from delayed payments. Therefore, having an efficient accounts receivable process is indispensable for the financial health and operational smoothness of any business.

Example of Accounts Receivable

An example of accounts receivable is a furniture manufacturer that has delivered furniture to a retail store. Once the manufacturer bills the store for the furniture, the payment owed is recorded under accounts receivable. The furniture manufacturer awaits payment from the store.

To better understand accounts receivable, consider the following additional illustrative examples:

- Service-based example: A consulting firm provides a series of management consulting services to a client. After completing the work, the firm sends an invoice for $10,000. This amount is recorded as accounts receivable on the firm’s balance sheet until the client makes the payment. Until the invoice is paid, the amount remains an asset that is expected to turn into cash.

- Retail example: A retailer sells $5,000 worth of merchandise to a business client on credit. The retailer issues an invoice and records this amount as accounts receivable. The retailer anticipates receiving this payment within 30 days. During this period, the $5,000 is reflected as an asset on the retailer’s balance sheet.

- Subscription-based example: A software company offers annual subscriptions to its products. A client subscribes for a year and pays $1,200 upfront. If the payment is made in installments, the company may record this as a receivable. For instance, if the client agrees to pay $100 per month, each monthly payment will be recorded as an accounts receivable until it is fully paid.

- Freight and shipping example: A shipping company delivers goods to a retailer and invoices them for $8,000. The amount is recorded as accounts receivable until the retailer settles the invoice. During this period, the shipping company monitors the receivables and follows up to ensure timely payment.

Impact of unpaid receivables

Unpaid receivables can have significant consequences for a business. If receivables are not collected, companies may need to write off bad debts, which can impact their financial health. Additionally, businesses might consider selling outstanding debt to third-party collectors, which can provide immediate cash but often at a discounted rate, impacting overall profitability.

Read now → Safeguard your business against accounts receivable fraud [ Blog ]

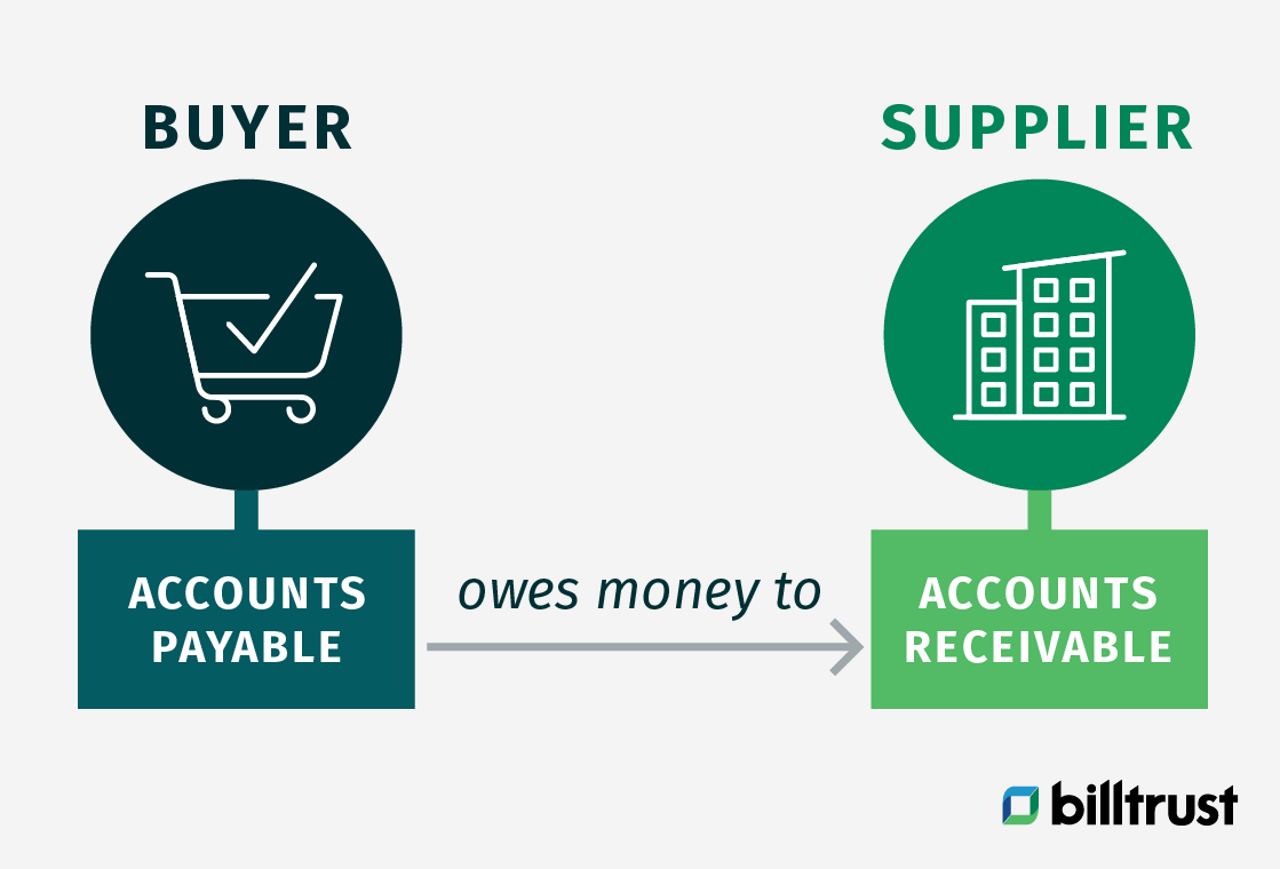

Accounts receivable vs accounts payable

Accounts receivable (AR meaning in business) refers to money owed to a business by its customers. Accounts payable refers to money a business owes to its suppliers.

When Business A delivers a product or service to Business B, Business A records that account as “receivable” because they have the right to receive funds from Business B.

Business B would record the same account as “payable” because they have an obligation to pay Business A.

Accounts receivable are viewed as assets because they come with expected future revenue. Accounts payable are viewed as liabilities, because they represent debts owed to other businesses.

It is a common practice in business to deliver goods and services before receiving payment. Because of this, businesses must work hard to manage their cash flow or else risk running out the necessary funds to keep their business functioning.

What are net receivables?

Net receivables refer to the amount of accounts receivable minus any expected uncollectible receivables. This figure provides a more accurate picture of the actual cash expected to be collected.

Goals of accounts receivable

Accounts receivable (AR) is the money that a business is owed by its customers. The goal is to collect this money as fast (30 days or less) as possible. Plus, lessen the costs of processing the transactions and maintain good relations with their customers. Large receivables that are slow to collect can be a major challenge to a company's cash flow and viability. A company may hire a collection agency to help, but it creates an added expense.

Benefits of maintaining accounts receivable

The main benefits of maintaining your accounts receivable are:

- Improved cash flow

- Insight into your cash position

- Faster replenishment of customer credit enables more sales

- Reduced processing costs

- Shorter order to cash cycle

- Better customer relations

Accounts receivable (AR) automation can help companies manage their accounts receivable quickly and accurately. Accounts receivable requires the careful recording and comparison of many points of data. It's best to handle them fast to keep cash flowing, automation is especially well-suited to the task

Accounts receivable financing can be a useful tool in the management of accounts receivable because it allows companies to borrow money against their receivable balances. They can use it to improve their cash flow and maintain operations.

Accounts receivable process

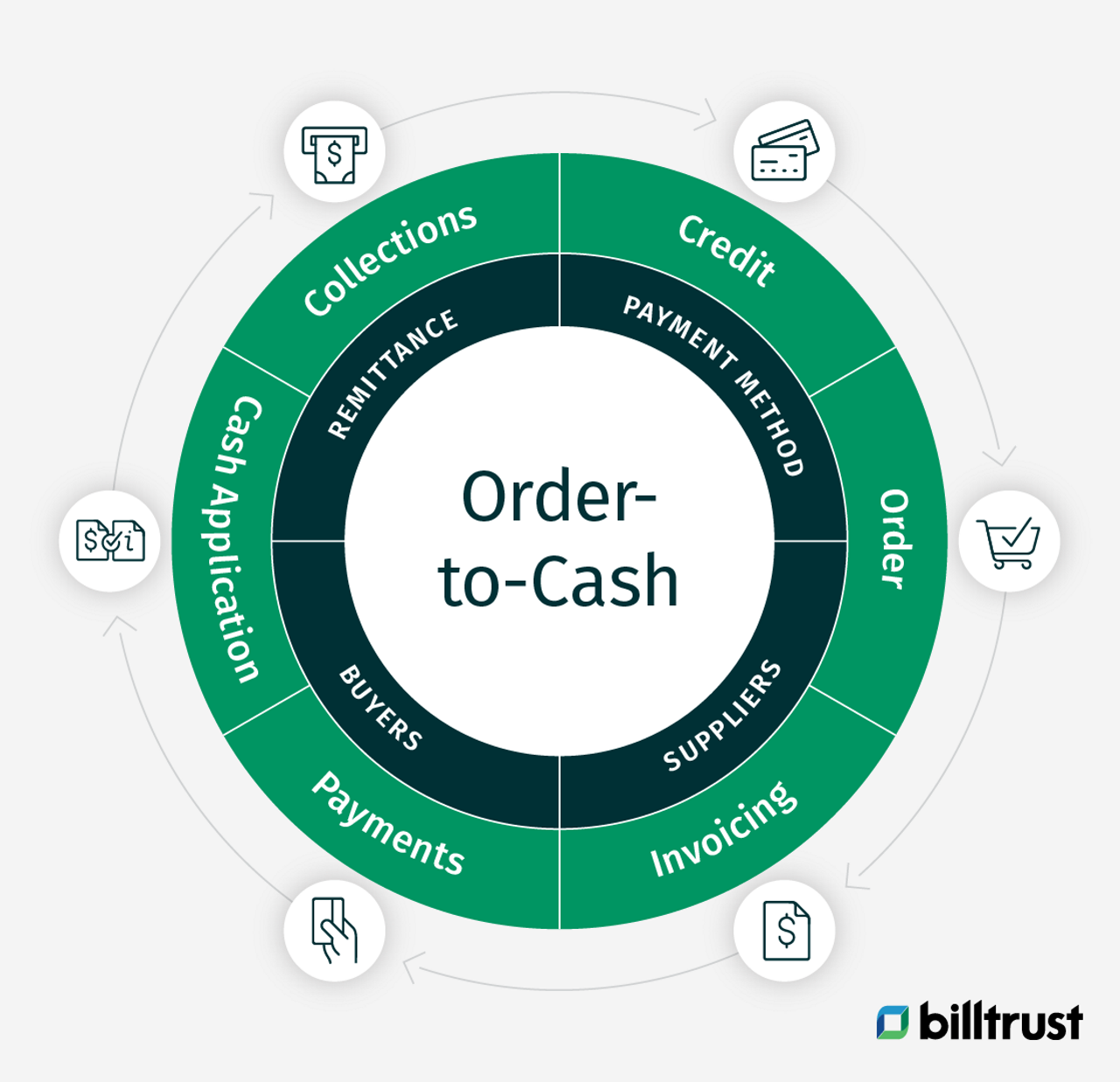

The accounts receivable process involves:

Credit - Invoicing - Payment - Cash Application - Collections

Credit

The first step of the order-to-cash cycle is credit. It is the job of a credit professional to decide how much credit to grant a customer.

To determine how much credit to grant a customer, a credit professional will pull credit reports on the customer from the credit bureaus, consult the customer's bank and ask other businesses about their experiences with the customer (referred to as trade reports).

Invoicing

Once a company delivers a good or service, accounts receivable professionals must now invoice the customer for the amount owed. This may be either a paper bill sent through the mail, or increasingly, through ePresentment or electronic billing. Electronic invoices include older formats such as faxes and phone (interactive voice response). Newer, more efficient formats include emailed bills and bills presented via portals.

Quick generation of invoices and delivering them to customers is important and time-sensitive work. The faster a customer receives an invoice, the faster they should pay and realize cash for the business.

Payment acceptance

Customers will try to pay their suppliers in the ways that are most convenient and beneficial to them. This may include paper checks, ACH payments, wire-transfers or virtual credit cards.

The supplier must decide which form of payments they are willing to accept and set up processes to maximize the efficiency of receiving payments through their chosen channels.

There are costs and efforts associated with receiving each type of payment and businesses must balance honoring their customers' payment preferences with their own interests.

Cash application

Once payments arrive via the various payment channels, cash must be “applied” to accounts. This means recognizing that a certain amount of cash has been received and marking an invoice as PAID.

This is more complex than it seems. Companies can receive hundreds or thousands of payments each month. Cash Application specialists must then “match” cash received with invoices.

The faster that received cash is applied, the faster a business can reliably use it for operations and the faster a customer’s credit can be replenished, enabling them to order more goods.

Collections

When payment is not received and applied by the agreed-upon date, an account becomes delinquent and transferred to collections or even a collection agency.

It is the job of collectors to contact customers and try to get them to pay. A collector (may be from a collection agency) has the complicated job of connecting with customers, understanding their reasons for delinquency and trying to work with them to realize payment for the company.

Accounts receivable performance metrics

Key metrics for measuring accounts receivable performance include:

- Days sales outstanding (DSO): Measures the average number of days it takes a company to collect payments after a sale.

- Accounts receivable turnover ratio: Measures how efficiently a company collects its debts. It is calculated by dividing net credit sales by the average accounts receivable balance.

- Cash conversion cycle: Indicates how long it takes for a company to convert its receivables into cash.

Read now → Enhance collections efforts with AR collections strategies [ Blog ]

Risks of accounts receivable

The risks associated with having a high accounts receivable balance include insufficient cash flow, risk of default from customers, an increase in doubtful accounts and a slowed sales cycle due to exhausted customer credit.

Businesses can work to ensure that they have healthy receivables. For instance, by employing best practices and automated solutions. These give insight into the state of their accounts and enable them to manage them in a quick and accurate manner. The accounts receivable turnover ratio may also provide some insight too.

What is accounts receivable automation?

Accounts receivable (AR) automation refers to technology solutions that automate many of the repetitive and manual tasks that constitute AR management.

Automation accounting software can give AR professionals greater insight into their accounts. It can also do the following:

- Generate reports.

- Display statuses and provide a centralized repository for customer invoices.

- Point out issues that need immediate attention.

The larger a business grows, the more complex the work of managing receivables becomes. As we can see from the above example, receivables management is a time-sensitive practice. As such, a business must have the capacity to manage its accounts receivable in a timely-fashion or else risk cash flow problems.

Traditionally, accounts receivable management capacity has increased by growing an organization so that more professionals can perform accounts receivable (AR) tasks. This comes with overhead costs that can counterbalance the benefits of growth. Additionally, the growing complexity of a company’s accounts receivable (AR) can lead to the following:

- More errors.

- Bad experiences for customers.

- Inefficient workflows regardless of the size of the AR management workforce.

AR accounting automation software can use machine learning to automate even complex tasks. The use of predictive algorithms can generate suggestions about what tasks AR professionals should take on next to work most efficiently and even how they should approach issues in their work.

FAQ

Learning about accounts receivable is not inherently difficult; it can be quite straightforward, especially with some basic accounting knowledge or interest. The complexity can vary depending on the size of the business and the complexity of the transactions. For someone new to accounting principles, mastering the basics—like understanding what accounts receivable is, how it impacts the cash flow, and how to record and manage it—can take some time and practice. However, with the use of accounting software and clear systematic processes, managing accounts receivable can be simplified and integrated into daily business operations smoothly.

The main purpose of accounts receivable is to allow a company to manage and collect funds that customers owe for purchases made on credit. This financial function is crucial for maintaining a healthy cash flow by ensuring that money owed to the company is tracked, invoiced, and collected in a timely manner. By effectively managing accounts receivable, a business can improve its liquidity, reduce the risk of bad debt, and strengthen its financial standing, enabling it to cover operational costs, invest in growth opportunities, and maintain positive customer relationships through clear and professional communication regarding payment expectations and follow-ups.