Intelligent cash application software to revolutionize your AR

Cash Application

Schedule a consultation

Maximize match rates with our advanced cash application software

A healthy cash flow is your company’s lifeline. And that relies heavily on strong match rates between invoices and remittances. Unfortunately, inefficient manual practices can make cash application unnecessarily complicated.

The Cash Application solution from Billtrust helps turn the entire process into a manageable one through AI and automation — giving you control over your workflow. And your cash flow.

Transform your cash application process

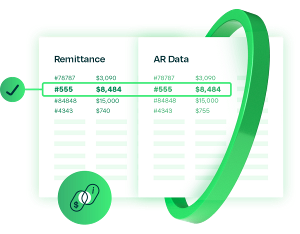

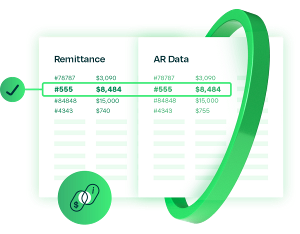

Your match rate is an indicator of your cash application efficiency. An expanding customer base, diverse payment methods, decoupled remittances, and manual processes can all lead to a less-than-desirable match rate. And that translates into cash not hitting your bank account as soon as you’d like.

If you want to boost efficiency, it makes sense to automate as many hands-on AR processing tasks as possible.

Using AI, Cash Application simplifies the time-consuming complexities of applying all your customers’ payments to the right accounts and invoices.

Cash Application uses confidence-based (not rule-based) machine learning to learn from your unique invoice structure and learn your customers' remittances and buyer patterns.

The benefits of Billtrust’s cash application software

Billtrust's cash application automation software revolutionizes your accounts receivable process, offering advantages over manual methods. Our AI-powered solution transforms how businesses handle payments, ensuring faster, more accurate, and efficient operations.

Key features of Billtrust's cash application software

Billtrust's cash application software is packed with powerful features designed to streamline your AR processes:

- AI-Powered automated matching: Our software uses advanced AI to automate payment matching to open invoices, easily handling even the most complex scenarios.

- Comprehensive electronic payment acceptance: Expand your payment capabilities with our cash application software, which efficiently processes electronic payments, including ACH, credit cards, and wire transfers.

- Intelligent exception handling: Billtrust's cash application automation software automatically identifies and categorizes exceptions, enabling quick resolution and faster reconciliation while minimizing manual review.

- User-friendly customer payment portal: Offer your customers a straightforward experience with our self-service portal, where they can view invoices, make payments, and manage account details effortlessly.

Why Cash Application from Billtrust makes financial sense

Cash Application: Maximize straight-through processing

Billtrust Cash Application transforms AR by employing confidence-based matching to deliver industry-leading match rates.

Billtrust Cash Application by the numbers

Industry-leading

$100B+

Success stories from our customers

Acushnet

Manufacturing

Companies you know rely on Billtrust Cash Application

Move finance forward with AI-powered solutions

Get to know the Billtrust Unified AR Platform.

Explore our unified solutionCredit

Make better credit decisions and streamline your credit approval process with automation.

eCommerce

Boost your online sales with our AI-powered webstore, integrated with the top ERP systems.

Invoicing

Automate your invoicing process, save time and get paid faster.

Payments

Get paid faster by offering your customers multiple payment channels.

Collections

Efficiently collect outstanding accounts with AI-powered tools and customizable workflows.

Frequently Asked Questions

Check out the FAQs for general questions. Find helpful answers quickly to get the information you need.

Cash application software significantly enhances financial accuracy by automating the process of matching incoming payment information to outstanding invoices. It uses advanced algorithms to analyze payment data, remittance data, and invoice details, reducing the risk of human error associated with manual data entry. This automation ensures that payments are applied to the correct accounts and invoices, leading to more accurate financial records and reporting. Billtrust's cash application solution, for example, leverages AI and machine learning to achieve industry-leading match rates, further improving financial accuracy for businesses of all sizes.

Cash application software is designed to handle a wide range of payment scenarios, including complex and unusual ones. Advanced systems like Billtrust's use AI to adapt to unique payment patterns and remittance formats. When the software encounters a payment it can't automatically match, it flags it for manual review, providing all available information to help resolve the issue quickly. Over time, the system learns from these exceptions, continuously improving its ability to handle diverse payment scenarios automatically. This allows it to accurately process and match payments even in situations with decoupled remittances or diverse payment methods, reducing the need for manual intervention.

Security is a top priority for cash application software providers. These solutions typically employ bank-grade encryption to protect sensitive financial data both in transit and at rest. Many also offer role-based access controls, allowing companies to restrict data access based on employee roles. Regular security audits and compliance with industry standards such as PCI DSS ensure that the software maintains the highest levels of data protection. It's always advisable to verify the specific security measures of any software you're considering. Billtrust, for instance, prioritizes the security of financial data in their cash application solution, offering robust protection measures to safeguard their clients' sensitive information.