Cash application is one of the most labor-intensive processes burdening accounts receivable teams today. Many firms employ full-time staff solely responsible for applying cash to open invoices. Despite having a dedicated cash application team, the reconciliation process is still prone to human error.

It is understandable that accounts receivable (AR) departments are exploring better ways to automate cash application and reach higher levels of straight-through processing. Where should your AR team start to tackle these challenges?

In this blog, we’ll discuss how to overcome common cash application challenges, and five industry best practices to drive B2B digital payment adoption and maximize your cash application team’s efficiency.

What slows down cash application?

First, let’s discuss the most common challenges that slow down cash application, namely:

- Tracking down remittances from many different sources

- Manual cash application processes

- Applying cash for paper check buyers

Tracking down remittances from many different sources

Cash application starts when an accounts receivable (AR) specialist applies a remittance to a payment within your ERP system. The most tedious step is tracking down remittances from different sources, whether they be remits from ACH, wire transfer, paper check, or AP Portal.

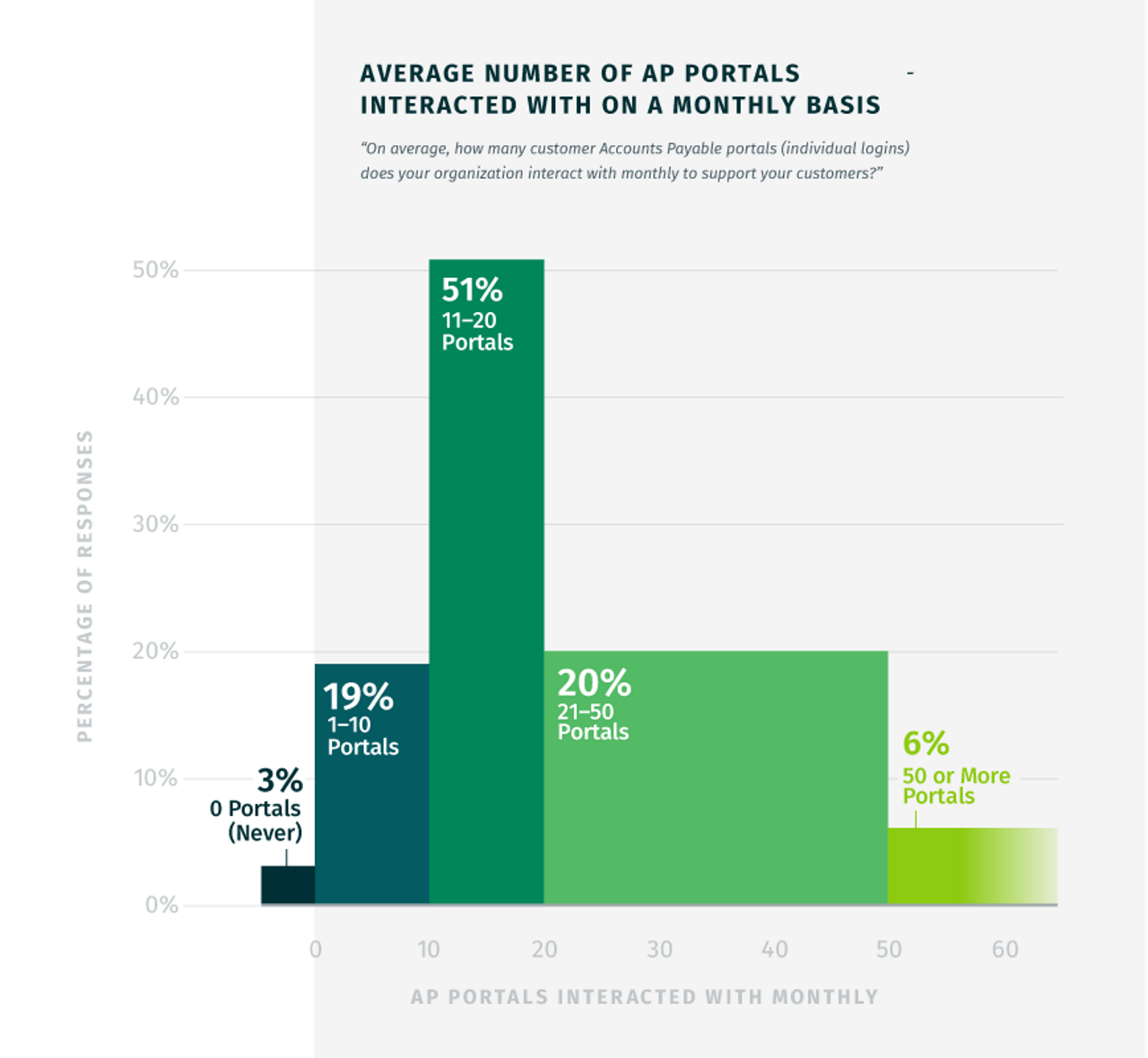

According to an industry study of AR departments, the average firm interacts with between 11 and 15 AP Portals every month.

What does this mean for your AR team? More manual work logging into third-party websites and downloading remittance files for cash application.

Once your cash application specialist has the remittance file, he or she must manually enter it into your ERP system. Manual data entry is notorious for producing human error, leading to lower match rate accuracy. Not only is data entry slower, but when your customers pay you with paper checks, which 40% of B2B buyers currently do, they slow down your cash application process even more.

Why do paper check buyers slow down cash application? There are several reasons.

AR departments have to wait for checks to arrive in the mail, wait for checks to process in their bank lockbox, and then finally deposit them into their accounts – substantially extending DSO and delaying the time-to-post payment by weeks for every payment.

Best Practice #1: Drive digital payment adoption

To avoid slower cash application associated with paper checks, it is an industry best practice to incentivize more of your customers to use electronic payment methods instead of paper checks.

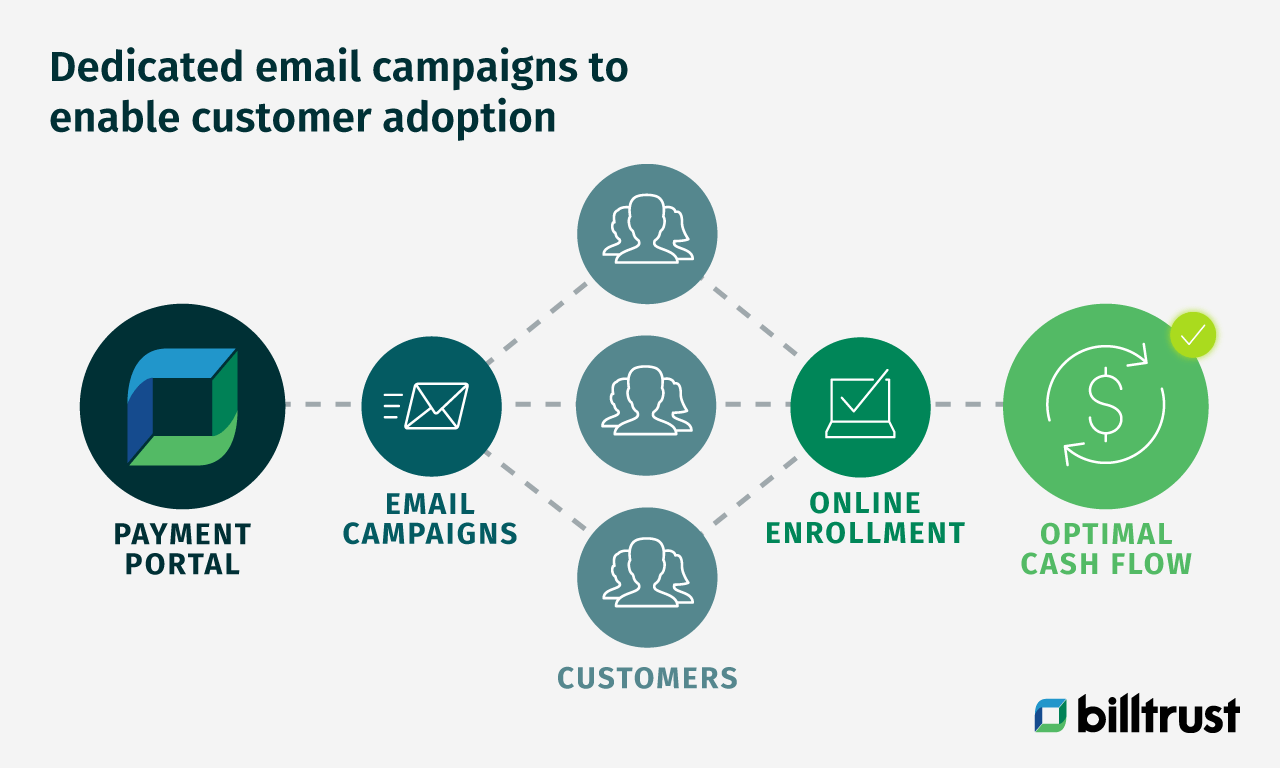

First, set up a self-service payment portal where customers can view and pay their invoices 24/7.

Once this self-service portal is set up, you can run email campaigns to persuade more of your customers to pay online and even offer a discount to online payors as an incentive. These digital payment adoption campaigns can be managed internally by your staff or externally by a team of experts like Billtrust, which offers dedicated email campaigns to convert check payors to digital methods.

Four industry best practices to maximize team efficiency

Now that you’re driving more customers to pay online, you’ve significantly accelerated cash application. The next step is to maximize your cash application team’s efficiency and overcome the challenges we mentioned earlier – tracking down remittances and manual processes – with a robust cash application automation solution.

Let’s consider four more industry best practices every AR Manager should be apply when searching for a cash application automation solution:

Best Practice #2: Search for remittance standardization capabilities

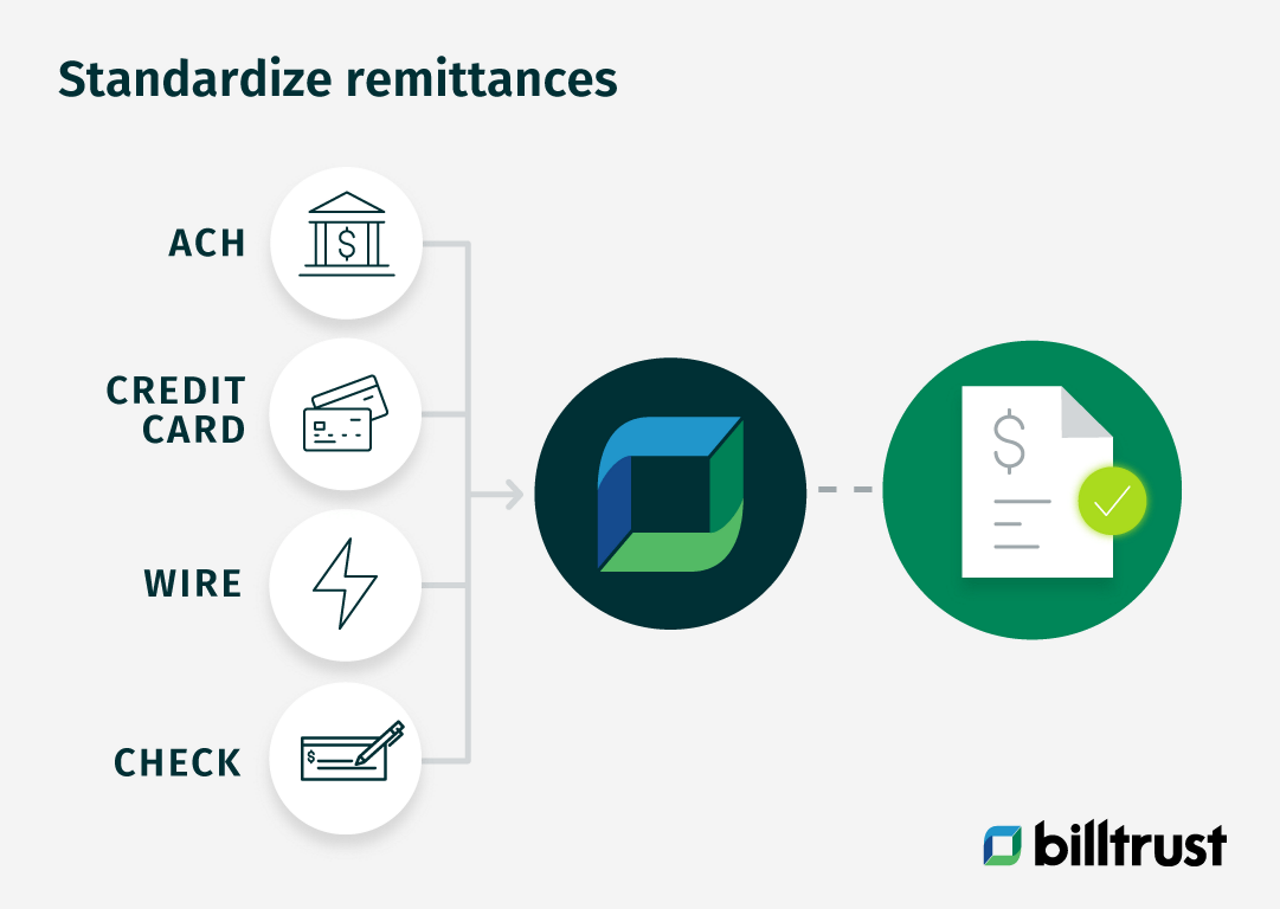

Remittance files come in many different formats and from many different sources, whether from ACH, credit card, wire transfer, check, or accounts payable (AP) portal.

It’s an industry best practice to adopt a cash application automation solution that has the ability to standardize remittances into the same format for simpler cash application. Billtrust recently rolled out a new Cash Application 10.0 Solution that can take nonstandard remittance data from all of these sources and automatically standardize them for streamlined cash application – an industry first technology.

Best Practice #3: Adopt dedicated machine learning technology for cash application

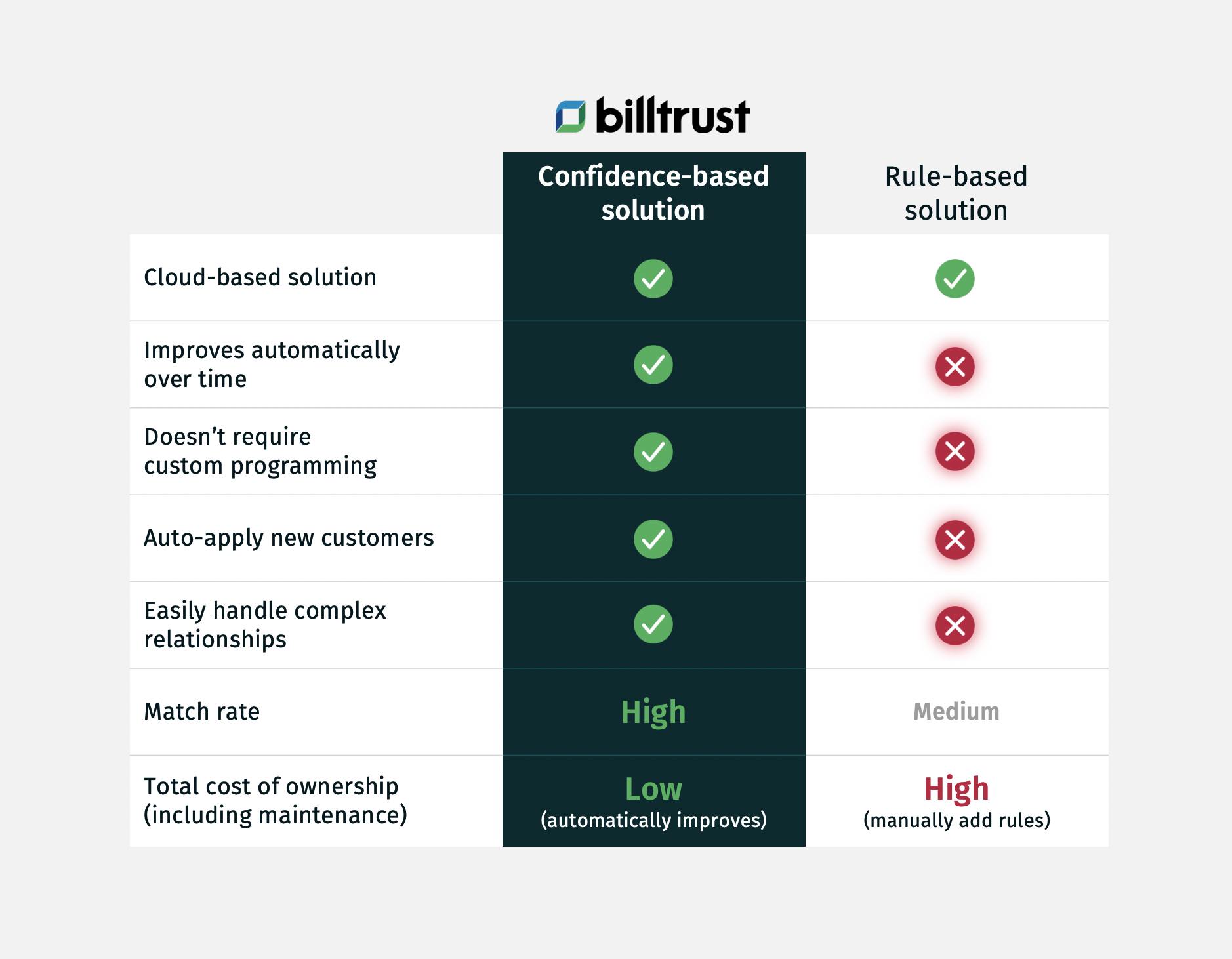

Many automated cash application software solutions offer machine learning capabilities to enhance straight-through processing, but not all machine learning is the same. Some cash application software is marketed as having “machine learning capabilities”, but they still leverage inefficient rule-based cash applications that require custom programming every time an invoice matching rule needs to be updated. Updating rules can take several days and costs thousands of dollars in developer maintenance fees annually.

A less expensive approach is to adopt a cash application solution with dedicated machine learning models. These solutions don’t require your staff to manually update matching rules with custom programming. Rather, the cash application system is tailored for your firm – it learns from your ERP, your user behavior, and your customers’ unique invoice structure, automatically improving match rate accuracy over time without human intervention. Billtrust can help with this truly innovative approach to automation with unparalleled machine learning, boosting your team’s efficiency.

Best Practice #4: Streamline exception handling

Let’s face it. Regardless of your level of automation, there will always be a few exceptions to your cash application rules. The key to maximizing your team’s productivity is making the exception-handling process as simple as possible. To do this, another industry best practice is to adopt a cash application software that enables you to process remittance files and invoices side-by-side within the same application

Some solutions allow cash application specialists to view invoices and remits in separate windows, enabling AR team to process about 20 exceptions per hour at the time expense of opening multiple windows. However, high-end solutions like Billtrust Cash Application 10.0 show side-by-side remittance and invoice images in the same application window, doubling the amount of exceptions you can process to 40 per hour. A few extra clicks may not seem significant, but they add up when you multiply several clicks by thousands of remits processed per month.

Best Practice #5: Lower your technical learning curve

The quote, “If we build it, they will come” from the movie Field of Dreams seems like a truism, but in the world of accounts receivable (AR) automation and technology, this simply doesn’t hold true. In order for cash application teams to gain the most value from an automation tool, they need to learn how to best apply the technology to their daily jobs.

Complex software doesn’t make this easy, but there are cash application software solutions with more user-friendly interfaces available that your staff can quickly gain proficiency at in a day or less. Needless to say, it’s a best practice to adopt a cash application automation solution with a low technical learning curve.

Final Thoughts – Don’t Wait for Small Problems to Become Crises

If you apply these five best practices listed below, you can build a world class cash application team and achieve new levels of performance, resulting in higher match rates and lower DSO.

- Drive digital payment adoption

- Search for remittance standardization capabilities

- Adopt a dedicated machine learning model for cash application

- Streamline exception handling

- Lower your technical learning curve

Don’t wait for tedious manual cash application, the pain of processing paper checks, and the time-consuming hunt for nonstandard remittances to impede your growth.

Want to learn more?

Talk to Billtrust today to learn about how our new Cash Application 10.0 solution can help you scale operations and maximize team efficiency.