This post was originally published in November 2021 and was updated in October 2024, with more information about ACH payments, including details on costs associated with ACH, the security benefits of ACH versus debit card transactions, and more.

Around the world, ACH is referred to as BACS (Bankers Authorized Clearing System). In the UK, it’s an Electronic Funds Transfer (EFT), Direct Debit or Pre-Authorized Debit. Whatever the term used, it’s a domestic transfer of a single currency—funds don’t cross borders, and the currency doesn’t change. For our purposes, we’ll refer to “ACH.”

In this article, we will talk about what ACH means and how it works, offer tips on how to convince customers to pay by ACH, and more. Let’s get started.

How does an ACH payment work?

Automated Clearing House (ACH) transfers are funds transferred electronically between bank accounts across the United States. ACH is run by an organization called Nacha (previously NACHA - National Automated Clearing House Association). It may also be known as the ACH network or ACH scheme.

An ACH is used in the U.S. as a form of electronic funds transfer (EFT). It’s also known as a “direct payment” because money is transferred from one bank account to another without cash, credit card networks, paper checks or wire transfers.

It’s interesting to note that the ACH network has been around since the 1970s. In 2020, ACH moved financial transactions worth more than $61.9 trillion in 2020, up 11 percent from the previous year. Transactions included business-to-business (B2B) payments, consumer, government and international payments. These transactions may positively or negatively impact cash flow, depending on whether you receive or send monies.

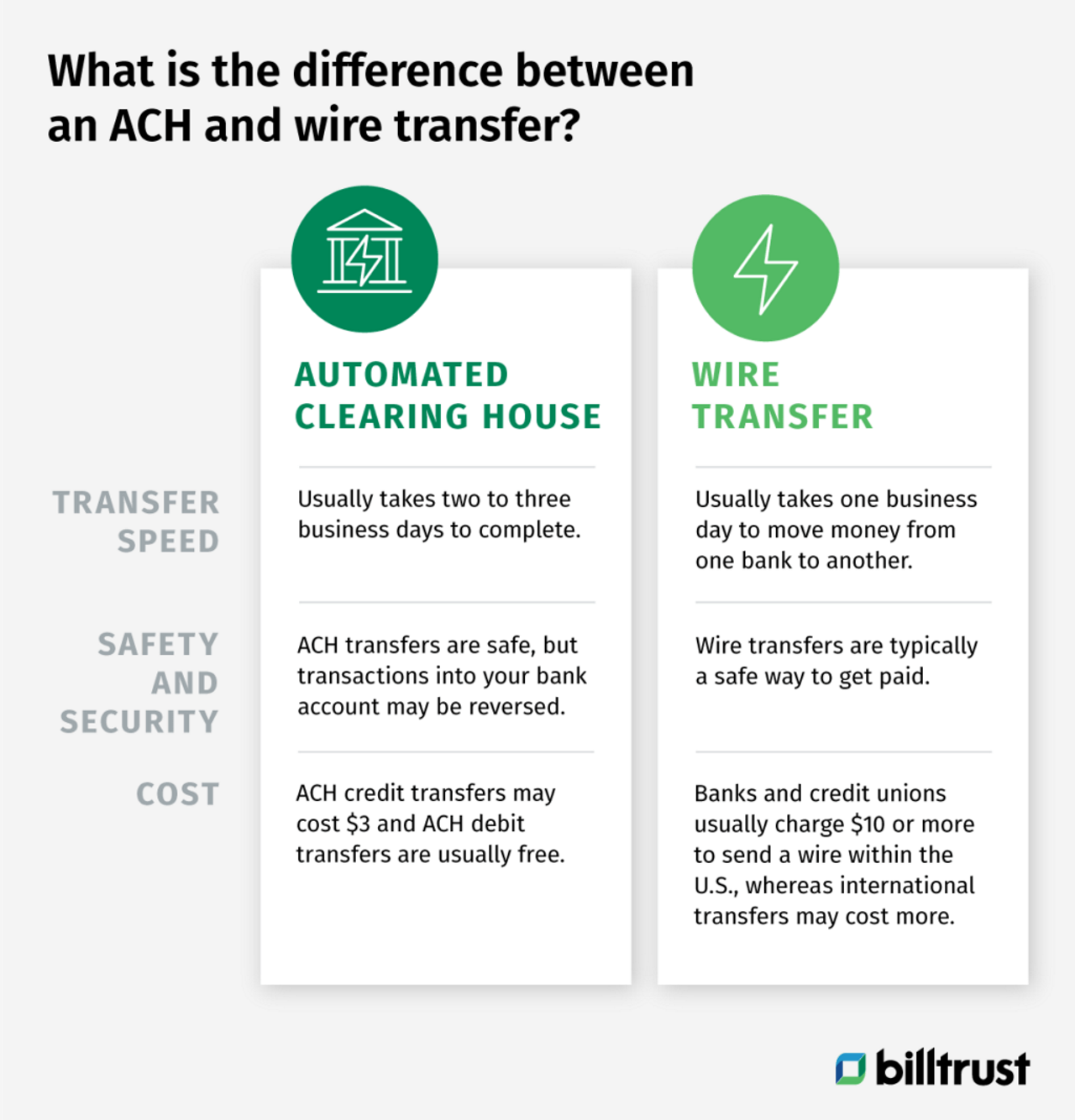

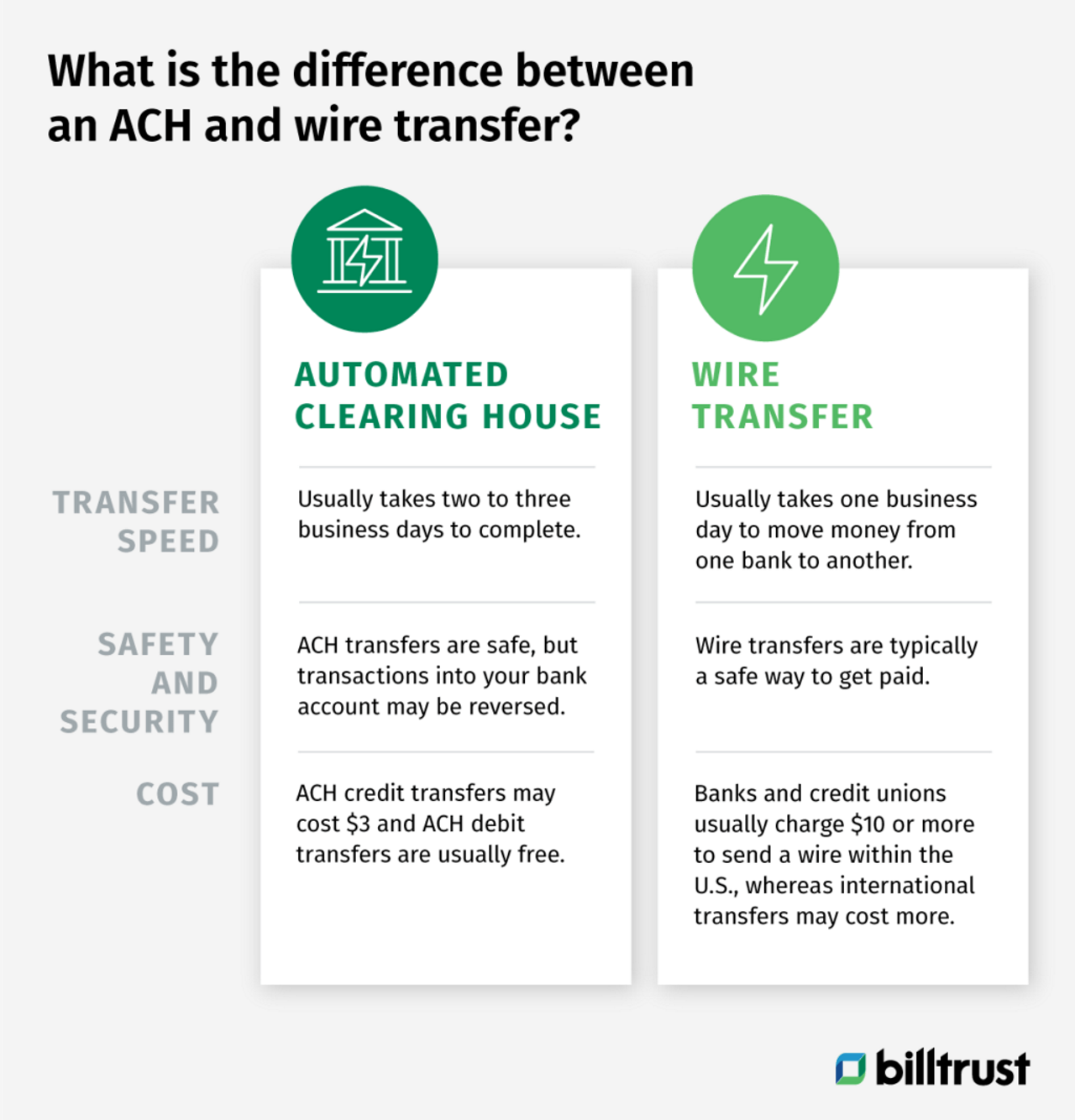

Even though an ACH and wire transfer both move funds electronically from one bank account to another, they’re not the same. ACH payments are more cost effective, whereas a wire transfer costs the sender and receiver money. According to MyBankTracker, the average fee for an incoming bank wire transfer is $15, while an outgoing wire transfer may cost $29 at banks.

Wire transfers cost more because they’re processed on a transaction-by-transaction basis from bank to bank, while ACH transactions are batched for processing through a clearinghouse. Wire transfers take about one business day or less to complete.

Costs associated with ACH payments?

While ACH payments offer several benefits, including convenience and reduced environmental impact compared to paper checks, they do come with associated costs. Understanding these costs is vital for both businesses and individuals to manage their finances effectively.

Some of these fees include:

- Initial Setup Fees

- Transaction Fees

- Monthly Fees

- NSF (Non-Sufficient Funds) Fees

- Batch Fees

- Potential Hidden Fees

Read now → Simplify collections by integrating AR collections strategies [ Blog ]

What are common examples of ACH transactions?

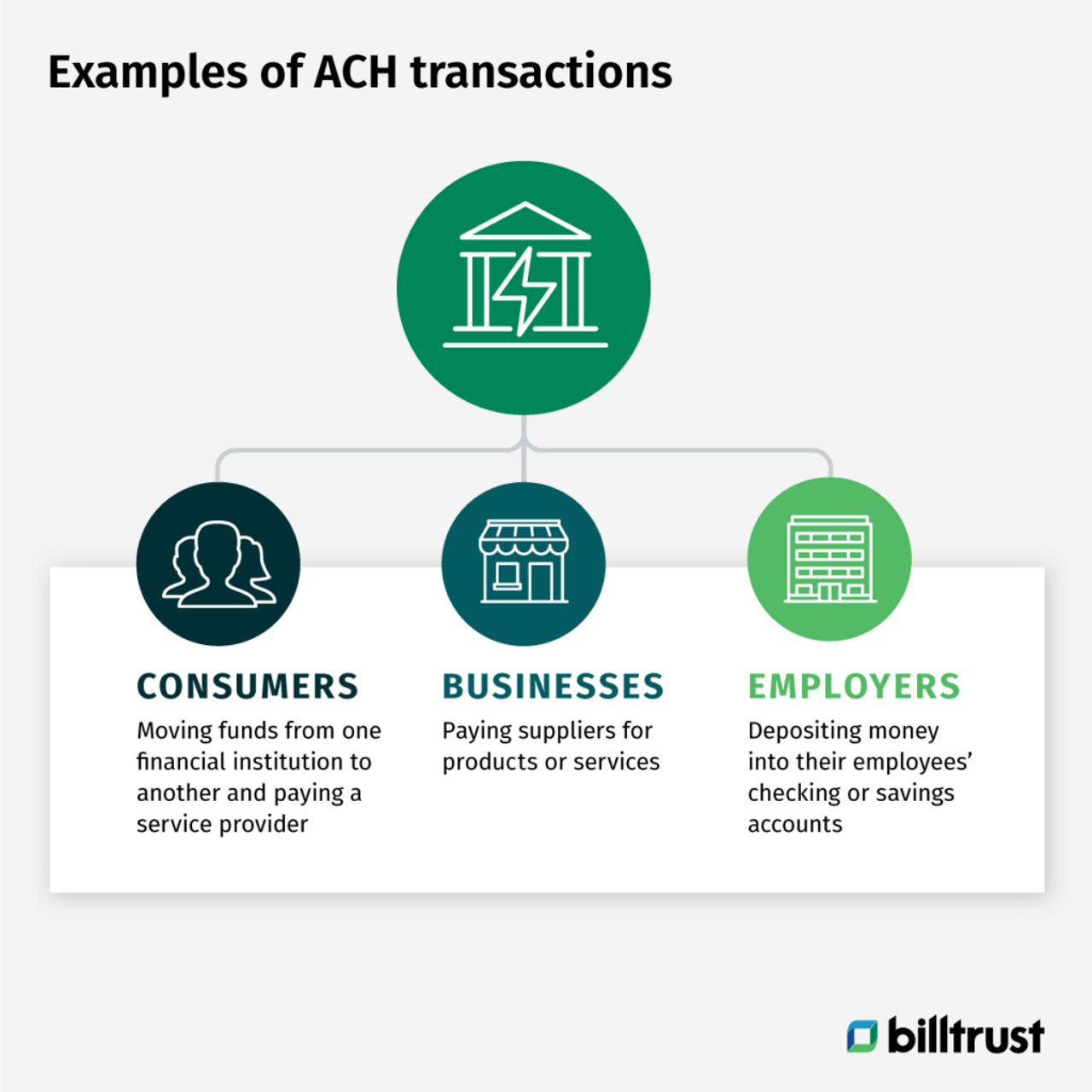

Some common examples of ACH transactions include direct deposits and direct payments:

- Consumers moving funds from one financial institution to another (ACH direct deposits)

- Businesses paying suppliers for products or services (ACH direct payment)

- A consumer paying a service provider (ACH direct payment)

- Employers depositing money into their employees’ checking or savings accounts (ACH direct deposits)

It’s not uncommon for a hold to be placed on your bank account. This means you’ve authorized payment, and

it will be deducted or deposited, and your bank is aware of the transaction.

To complete any ACH payment processing, the

organization requesting funds to be sent or received requires bank account information from the other

party involved.

What is considered an ACH payment?

An ACH payment is an electronic bank-to-bank transaction in the U.S. made through the ACH network instead of going through card networks such as Mastercard and Visa.

Remember that ACH payments aren’t made in the UK, Eurozone or anywhere else outside of the U.S. It’s a US-based payments system only. And the ACH network applies to banking, so it's not possible to process ACH payments from debit cards or credit cards.

Businesses and individuals can send and receive ACH payments which are done through ACH debit and ACH credit.

Two main categories of ACH payments

The ACH scheme encompasses several different types of payments which we’ll explore below.

What is ACH credit?

An ACH credit is often known as direct deposits and pushed from one bank account to another using the U.S. Automated Clearing House Network (ACH network). These may cost around $3 for sending funds between bank accounts. However, many “so-called” transfers are free. For instance, when an employer pays its employees by depositing electronic funds into their checking or savings accounts each month, they’re called ACH credits because the employer pushes the money to the employee accounts.

What is an ACH debit?

An ACH debit, also known as an ACH transaction initiated by the payee, are usually free and are funds that are “pulled” in. An example is when someone authorizes their bank or mortgage company to “sweep” their mortgage payments directly from their checking account every month. Those are regularly occurring ACH debits, and the bank or mortgage company takes those receivable payments into their account.

Types of ACH payments

B2B customers who want to pay with ACH must authorize the vendor or biller for automatic withdrawal from their account. For consumers, common types of ACH payments include utilities and car payments.

Business-to-business customers provide their bank account and routing number information to their company bank account while consumers provide their checking or savings account. They both give authorization by signing an agreement allowing monies to be withdrawn.

Here are two types of ACH payments:

Automatic payments

Automatic recurring payments are swept from an account each time a bill is due. For instance, a utility company charges for its monthly invoices and pulls the funds on the due date because the customer agreed to the arrangement.

On-demand payments

You may create a link between your customer’s bank account without authorizing automatic payments. Customers often opt for on-demand payments because it gives them control over when funds are transferred. After all, they’re approved each time.

Are ACH payments safe and secure?

Systems have vulnerabilities and aren’t perfect, but ACH is secure. However, some common problems may include:

- Identifying fraudulent transactions.

- Storing a customer’s banking details and/or credentials securely.

- Reducing the risk of a customer reversing an ACH transaction in an attempt to change the payment for a good or service they already have received.

Solutions for the above may include but aren’t limited to:

- Keeping bank credentials and details secure through encryption, secure vault payments and tokenization.

- Reviewing accounts for patterns of fraud. For example, transaction history assessments and current balance checks.

- Validating financial accounts through digital authorizations and micro-validation transactions.

Which is safer: an ACH or debit card?

ACH transactions are generally considered safer than debit cards due to their direct bank-to-bank nature and stricter authentication processes. ACH and debit card transactions pull money from a customer's bank account through different methods. While ACH transfers offer enhanced security, debit cards provide more immediate access to funds. Keep in mind that ACH transfers and debit card transactions have other costs and dispute resolution policies. However, when compared to debit or credit card processing fees, the difference can often work out in your favor.

Read now → Lower your payment processing costs with credit card fee reduction tips [ Blog ]

How long do ACH payments take to process?

Delivery of ACH payments is usually faster than sending checks through the mail, especially since the USPS changed their delivery schedule and because the recipient needs to process the mail and deposit checks. Depending on the amount, banks may hold part of deposited checks for 1-2 business days, therefore, it may take up to one week to make a payment via paper checks. This is why so many businesses are choosing an electronic payment solution.

Payment timelines are based on rules from the Nacha. ACH credits may be delivered within the same day or in one to two business days, while ACH debits must be processed by the next business day. A bank or credit union may hold these ACH transferred funds, so the delivery time varies. For instance, employee paychecks are usually available on the day they’re made.

Even though Nacha rules ensure that payments can be processed the same day they’re sent, it's up to financial institutions if they charge for expediting payments.

Benefits of paying by ACH

Using ACH payments to receive and send money offers companies several benefits.

Fast and convenient—ACH payments are usually processed faster than checks through the mail. Companies have to process payments and deposit checks into their bank account. It may take a week or more to make payments via paper checks vs. ACH payments that may be available the same or next business day or within a day or two.

Secure—Checks sent through the mail may get lost or stolen. If someone steals your check, it may be cashed or altered before it’s reported as missing. Plus, banks usually charge stop payment fees ($25 to $35) on missing checks. Transferring funds electronically means information is protected by bank-level encryption. And you can easily track ACH payments for you and your customers since they appear on bank statements.

Low cost—ACH fees range from a few cents ($.50 per transaction) to a few dollars depending on volume and transaction size. Costs are more favorable compared to domestic wires ($15 or more), credit cards (mainly in the 2%-4% range) and paper checks (varies, but usually a few dollars).

Disadvantages of paying by ACH

Transaction limits—Financial institutions limit the amount of money you can send via an ACH transfer. Limits may include daily limits, monthly or weekly limits and per-transaction limits. Banks may also impose limits (and penalties) such as prohibiting international transfers. Plus, certain ACH transactions may not be unlimited while others may not, or there may be limits for transfers to another bank or for bill payments.

Risk—As with anything in business, there is an element of risk with ACH transactions because you may not know for hours or days if a debit transaction cleared or if there has been a breach of some sort. Because of the risk, some companies may be slow to adopt ACH payment processing.

Timing—Not every bank sends ACH transfers for processing at the same time. Therefore, when you choose to send an ACH, the timing matters. Check with your financial institution about cut-off times for transfers to ensure they are processed for the same or next business day. Keep in mind that same-day ACH processing is growing. However, it’s best to check with your bank about the timeframe for ACH transfers.

Final thoughts on ACH transactions

ACH transfers can be a fast and convenient way to send and receive funds and as a way to make customers love to pay you. Either way, make sure you understand your company’s bank policies for ACH direct deposits and direct payment. Also, be aware of ACH transfer scams that may lead to fraud. And, keep in mind that the USPS has slowed down, which may increase the amount of time it takes to receive paper checks from customers and may slow down your cash flow.

Either taking advantage of the ACH network or encouraging your customers to make ACH payments may positively impact your cash flow in the long run. And keep in mind that using the ACH network and accounts receivable (AR) automation software together can take your business to the next level.

Read now → Learn how ACH impacts your days sales outstanding [ Blog ]

FAQ

Common examples of ACH transactions include direct deposits and direct payments including:

- Consumers moving funds from one financial institution to another (ACH direct deposits)

- Businesses paying suppliers for products or services (ACH direct payment)

- A consumer paying a service provider (ACH direct payment)

- Employers depositing money into their employees’ checking or savings accounts (ACH direct deposits)

ACH credits may be delivered within the same day or in one to two business days, while ACH debits must be processed by the next business day. A bank or credit union may hold ACH transferred funds, so the delivery time varies.