This post was originally published in October 2017 and was updated in October 2024, with more information about Days Sales Outstanding, including the importance and limitations of DSO, what is a good or healthy DSO, and more.

Are you worried about your company's Days Sales Outstanding (DSO)? Are you actively searching for ways to optimize your DSO and gain a deeper understanding of its underlying factors?

DSO is a vital financial metric or key performance indicator (KPI) that measures the efficiency of your accounts receivable management. It reveals how effectively your company collects payment for its products or services.

It is crucial for businesses to understand and track their DSO to ensure optimal financial health. In simple terms, a high DSO means that a company takes longer to collect payments from its customers, which can have a negative impact on its cash flow and profitability.

However, here's the crucial insight: the number that makes a good DSO is unique to each company. There is no one-size-fits-all solution. To optimize your DSO, it's essential to understand the unique factors that affect your DSO. By analyzing your industry, customer base, payment terms, and billing processes, you can determine what is an acceptable DSO for your company.

To get a more accurate picture of future DSOs, it's beneficial to implement accounts receivable forecasting. This process involves projecting future accounts receivable using historical DSO data. Models that factor in revenue growth and trend analysis can provide a more accurate forecast, helping businesses anticipate cash flow needs and adjust their strategies accordingly

Achieving a good DSO can lead to a significant impact on your company's financial health. With faster payment processing, you can free up cash flow, reduce bad debt, and improve profitability. Additionally, a good DSO can enhance your company's reputation and relationships with customers by fostering a more efficient and streamlined payment process.

In this article, we discuss the definition of DSO, how to calculate it, the importance and limitations of DSO, and best practices on how to improve it.

What is Days Sales Outstanding (DSO)?

Day Sales Outstanding (DSO) is a measurement of the average number of days a company typically takes to collect revenue once a sale has been completed. It’s a key performance indicator for analyzing accounts receivables and of a company's cash flow and liquidity.

A high DSO means that a company takes a longer time to collect its accounts receivable, which can be an indication of potential problems in the collection process.

A low DSO, on the other hand, indicates that a company is collecting its payments quickly and efficiently.

Why is Days Sales Outstanding (DSO) important?

DSO is an indicator of how many average days worth of sales are tied up in receivables. By reducing Days Sales Outstanding (DSO), your company can free up cash for investments, payroll, and purchasing, enhancing its financial flexibility.

There are a number of valuable insights that a business can derive from calculating DSO, including:

- Identifying customers who are not paying their bills on time

- Understanding the effectiveness of credit and collection policies

- Evaluating the efficiency of your order-to-cash process

- Budgeting for cash flow

- Monitoring the impact of changes to the business

Typically conducted on a monthly or quarterly basis (and occasionally annually), this analysis is instrumental in evaluating your company's efficiency in converting sales into tangible revenue.

If a company can lower their Days Sales Outstanding (DSO), they can increase the cash available to their business for investments, payroll and purchasing.

Read now → Learn how effective cash application improves DSO [ Blog ]

How to calculate Days Sales Outstanding

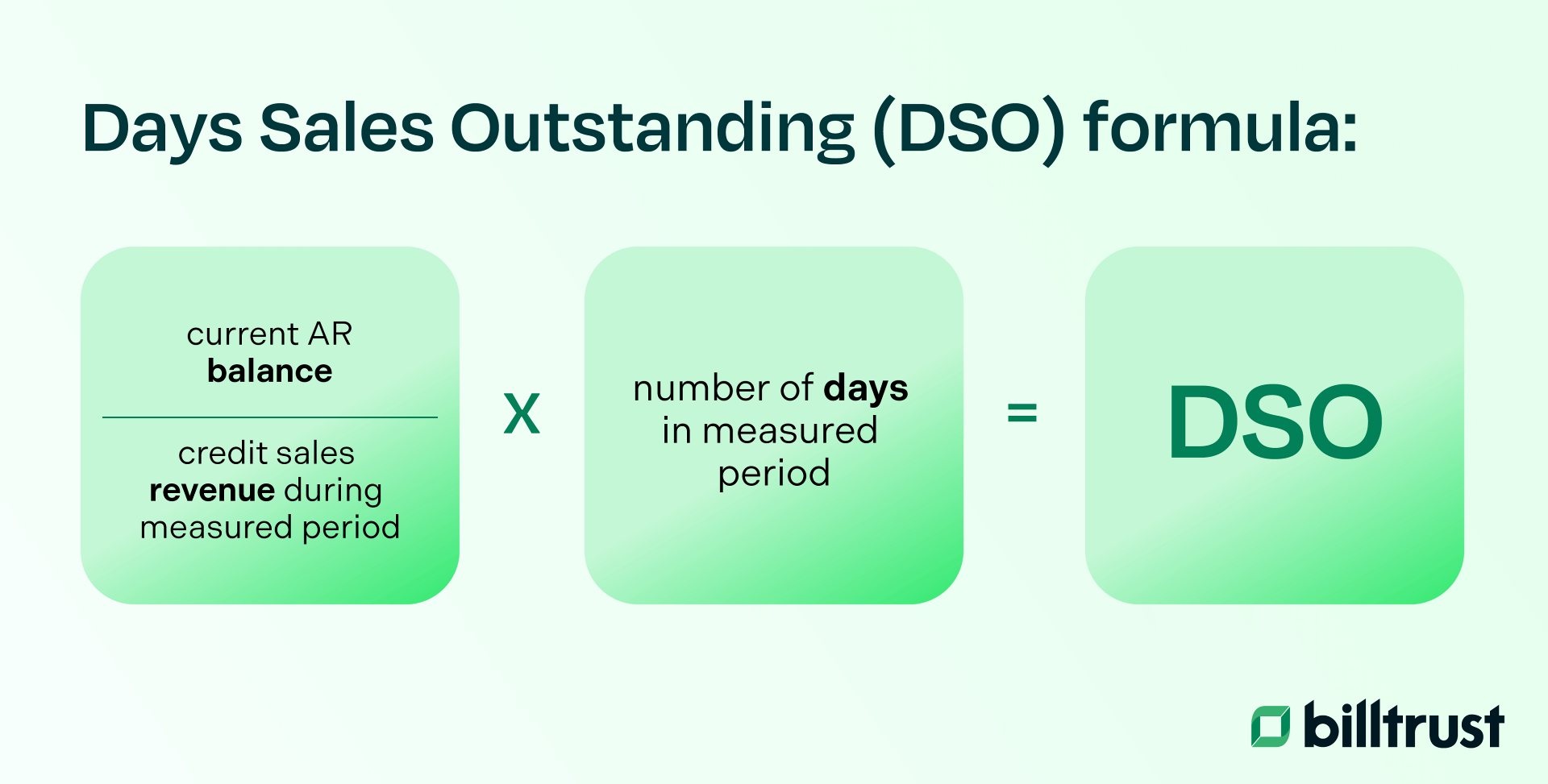

The formula to calculate DSO is relatively straightforward. The simplest and most frequently used method is taking your current accounts receivables balance, dividing it by your credit sales revenue during the measured period, then multiplying that number by the number of days in the measured period.

Let's break that down into its component parts.

Measured Period: As we mentioned above, DSO can be calculated on a monthly, quarterly or yearly basis. This will affect the Measured Period portion of the formula. If we are calculating monthly days sales outstanding (DSO), the measured period will be the number of days in that month, likewise for quarterly or yearly DSO.

Current AR Balance: A company’s AR balance is the dollar value of their accounts receivable.

Credit Sales During Measured Period: The dollar value of sales made during the period with payment agreed to be made later.

Read now → Calculate your collection performance with the collection effectiveness index [ Blog ]

Days Sales Outstanding calculation example

Let’s say you run a B2B company that generates about $365 million in yearly credit sales. We can say on average, one month's sales is about $30 million. If your average accounts receivable (AR) balance for a given month is $48 million, that means you have 48 days worth of sales sitting on your book. In this scenario, it takes your company an average of 48 days to collect its accounts receivable.

DSO = (48 ÷ 30) x 30 days = 48

How to calculate monthly DSO

To calculate monthly DSO, follow this formula:

(Accounts Receivable / Total Credit Sales) × Number of Days.

First, gather the total accounts receivable at the end of the month and the total credit sales for that period. Divide the accounts receivable by the credit sales, and then multiply the result by the number of days in the month. A lower DSO indicates faster payment collection, while a higher DSO suggests longer delays in receiving payments. Monitoring this metric regularly helps businesses manage their cash flow more effectively.

Days Deduction Outstanding (DDO)

Another important metric to consider is Days Deduction Outstanding (DDO). DDO is calculated by dividing outstanding deductions by average deductions over a certain period. It provides insight into how well a business manages its deductions, which can affect overall DSO. High DDO can indicate inefficiencies in handling deductions that could further strain cash flow and impact DSO.

Accounts Receivable Turnover Ratio

This ratio evaluates how efficiently a business manages and collects its receivables. The Accounts Receivable Turnover Ratio is calculated by dividing net credit sales by the average accounts receivable during the period. A higher ratio indicates better efficiency in managing receivables. Comparing this ratio with your DSO can provide additional insights into how effectively your company is handling its receivables.

Best Possible Days Sales Outstanding (BSO)

To gauge how efficient your collections process can be, you should consider the Best Possible Days Sales Outstanding (BSO). BSO refers to the lowest possible DSO a company can achieve, often used for benchmarking and performance comparison within industries. By setting a goal aligned with your BSO, you can strive for continuous improvement and more effective collection strategies.

Importance and limitations of DSO

Tracking DSO is crucial for your business as it offers valuable insights into your financial well-being. By monitoring this metric, you can effectively manage your financial health. A high DSO may suggest challenges in payment collection, potentially causing cash flow issues. Conversely, a low DSO reflects efficient payment collection and a healthy cash flow.

However, it's essential to note that DSO has its limitations:

- DSO does not take into account any of the company's prepayments.

- DSO does not consider the creditworthiness of customers. A company can have a low DSO if it only sells to customers with excellent credit scores.

- Seasonal variations can significantly affect DSO, and it's important to keep this in mind when analyzing the data.

- DSO calculations do not consider delayed payments or renegotiated payment terms, which can impact actual collection times.

- It relies on credit sales, so it may not accurately represent companies that primarily operate on a cash basis.

What is a good or healthy DSO?

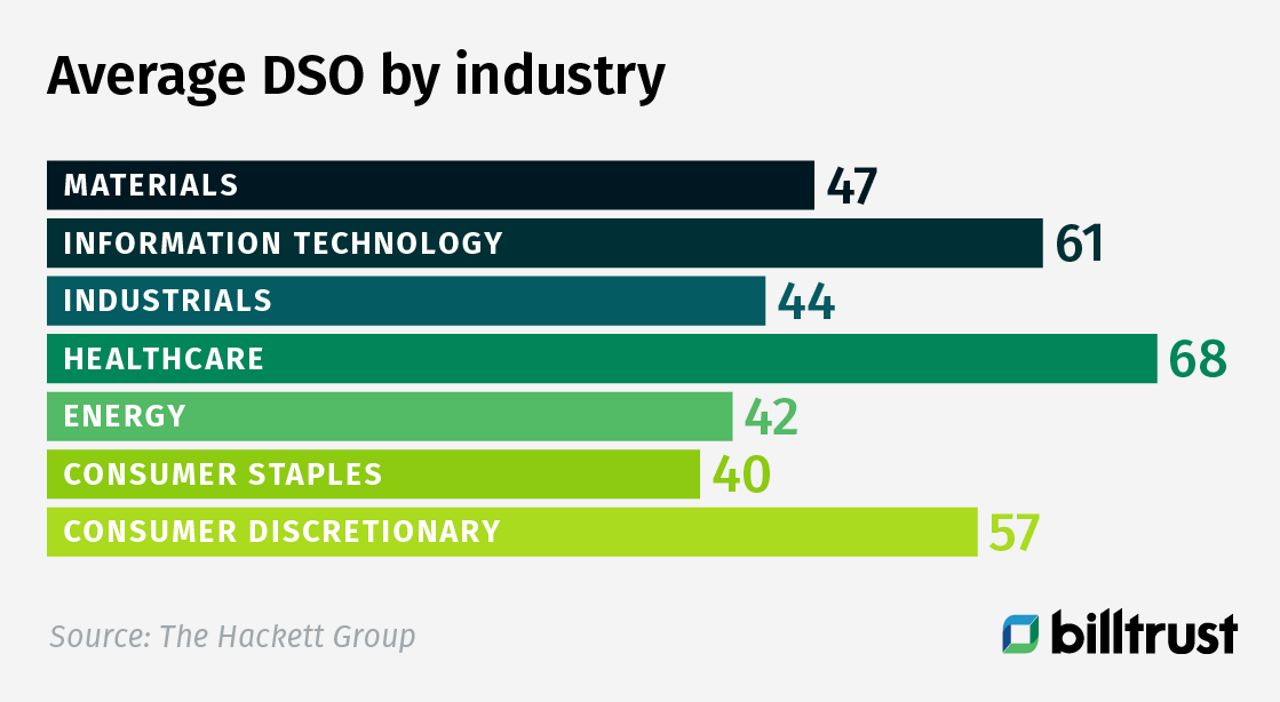

Finding out about the DSO of your industry is a great first step. The good news is that studies regularly get published with DSO numbers. The only caveat is that the data is almost always based on the financials of listed firms.

While the DSO numbers you'll discover in these studies are insightful, it's important to recognize that there can be significant differences in DSO figures between companies, even within the same industry. Factors such as the size and age of the company, its customer base, its business model, the type of customers it serves, or the efficiency of its invoicing and collection processes all play a role.

For example, a company that operates in a high-risk industry such as construction may have a higher DSO figure due to the longer payment terms required by its customers. On the other hand, a company that operates in a low-risk industry such as retail may have a lower DSO figure as its customers are likely to pay promptly.

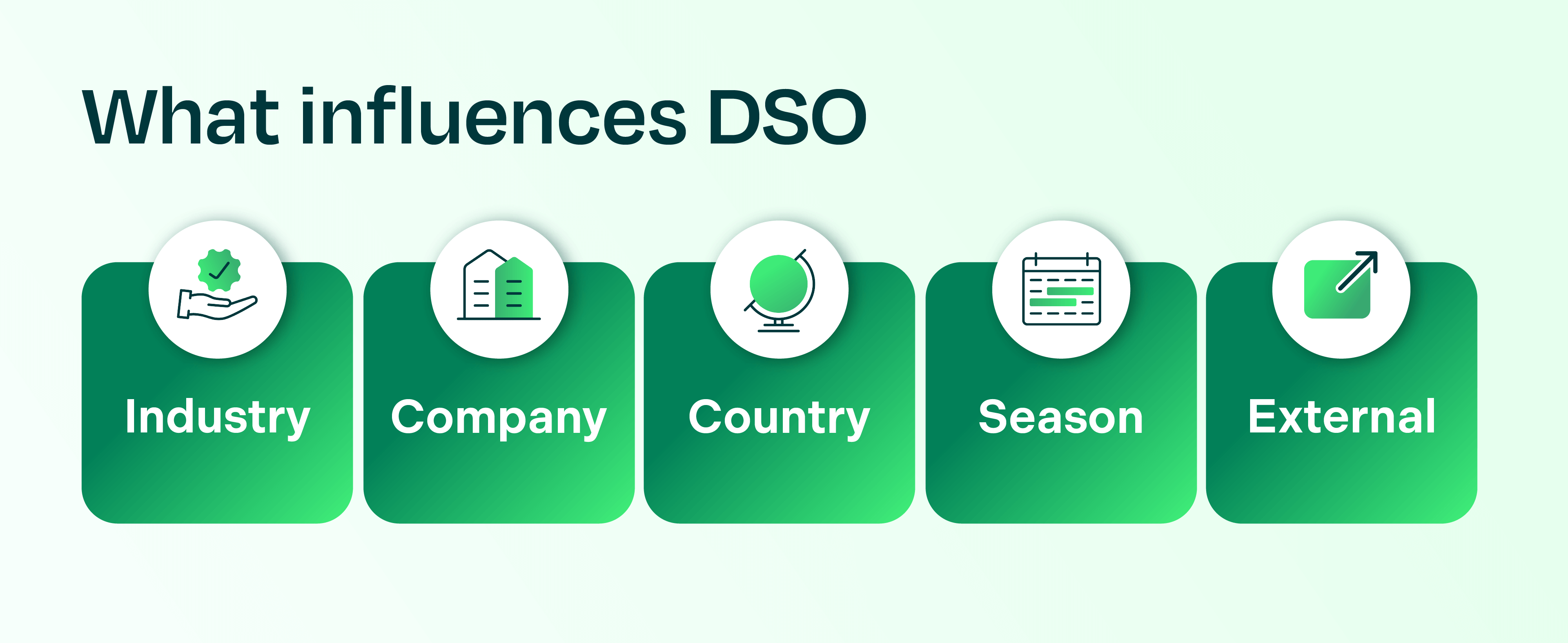

When interpreting DSO, multiple variables influence this number:

- Industry-specific. The historical or average DSO within an industry gives an idea of what's normal or typical, and businesses should aim to improve or at least be at par with it. If their DSO is higher than average, they might take that as an indication that there are activities they can pursue to lower it and increase their cash flow. For example, if the industry average DSO is 45 days, a company with a DSO of 60 days should aim to improve or lower their DSO to stay competitive.

- Company-specific. Additionally, companies may have different financial goals that impact their DSO figures. For instance, a company that prioritizes revenue growth may accept longer payment terms to win more sales, resulting in a higher DSO figure. In contrast, a company that prioritizes cash flow may offer discounts to customers who pay promptly, resulting in a lower DSO figure.

- Different countries have different payment cultures. In some countries, it is part of the business culture to pay faster, meaning the DSO is relatively low; in other countries, people take longer to pay. European countries illustrate this disparity, with Germany and the Nordics exhibiting shorter average DSO, whereas Southern European countries like Spain and Italy tend to have longer DSO periods.

- Seasonal factors are at play too. DSO is not a static number and can fluctuate from month to month or season to season over the course of a business cycle, especially if an organization is seasonal. Variations in company turnover can significantly impact DSO. If you receive a large order in the spring, this can distort the DSO a few months later.

For accurate benchmarking, comparing the DSO of the same period from the previous year provides a more precise insight. Using a 12-month average fails to consider months with higher or lower sales, potentially skewing the DSO measurement. - External factors have an effect. Finally, external factors have an effect on customers’ payment behavior and thus DSO. Items where companies have less control over include:

- Macroeconomics: Cycles of economic growth and recessions alternate. When the economy or certain sectors falter, this may have an impact on the financial possibilities for some companies.

- New technology: The arrival of new technologies – and often new competitors – can quickly turn an entire industry on its head.

- Pandemic or public health crisis: The arrival of Covid-19 was totally unexpected and had a major impact on the world economy.

- Geopolitical events: Trade wars, falling currencies and price wars can occur quite suddenly. This represents a considerable challenge for companies operating in these regions or sectors.

Read now → Reduce fraud risks with accounts receivable fraud prevention tips [ Blog ]

How does Days Sales Outstanding (DSO) may affect your company’s financial health?

When your customers owe your company money, it impacts your cash flow which results in less revenue because past due accounts that surpass 120 days are more difficult to collect. If this happens, the opportunity for you to grow your company may not happen because you won’t have enough cash.

Losing revenue puts you in a vulnerable position because you may have to seek outside financing to increase your cash flow. If you don’t have the funds to pay your monthly operating expenses, your interest payment may increase your cash burden. If you hire a collections company to collect outstanding receivables, they may ask for a percentage of the balance.

Best practices to improve your DSO

While benchmarking against the sector's average DSO, the countries you’re serving or similar companies can be a helpful starting point, it's essential to consider the unique circumstances of your own company when evaluating your performance.

This involves analyzing factors such as your customer base, sales channels, invoicing and collection processes and financial goals, to determine whether your DSO is at an acceptable level for your business.

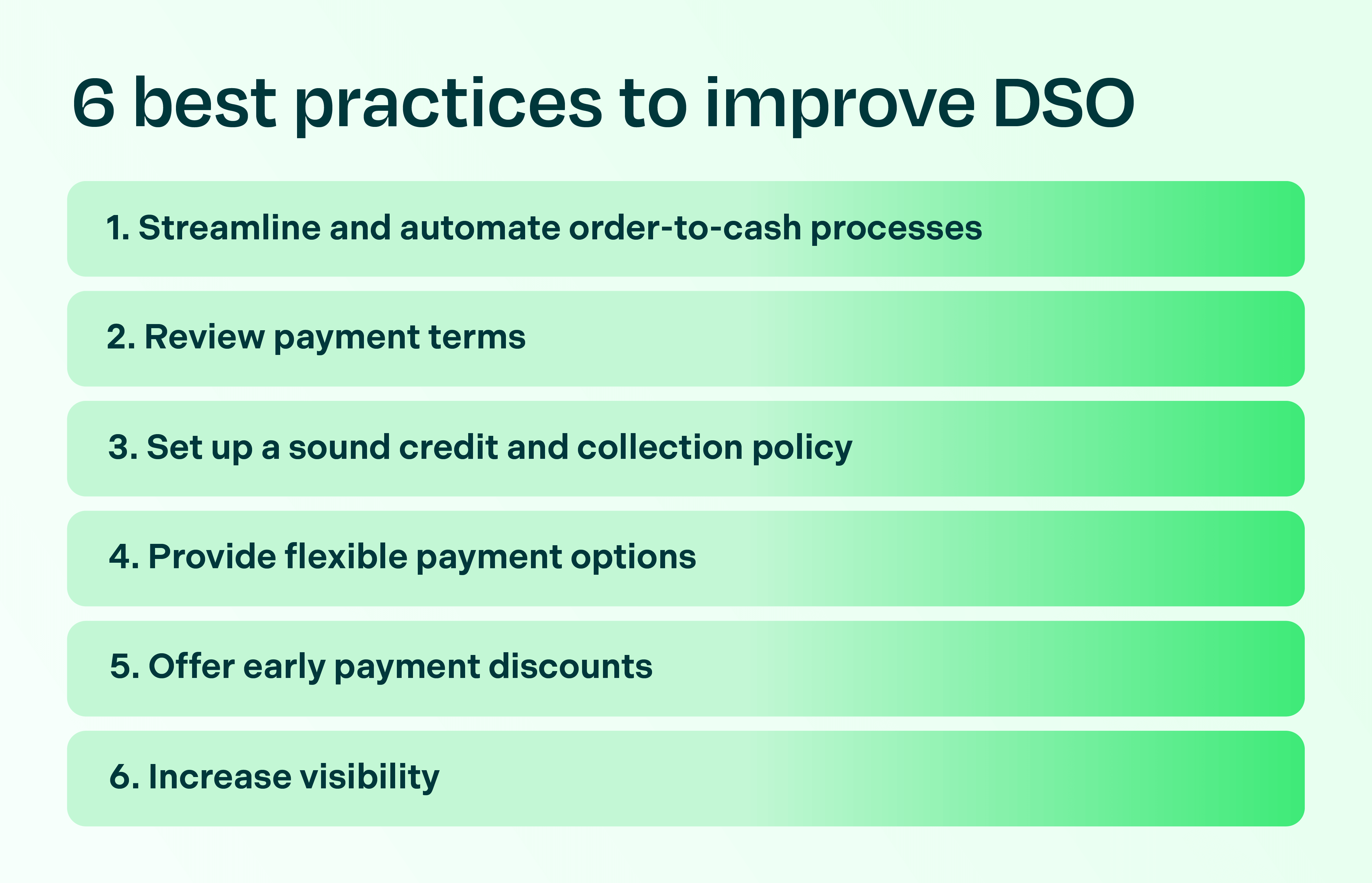

There are several best practices that your company can implement to improve - or lower - its DSO.

- Streamline and automate order-to-cash processes. One of the most effective ways to improve efficiency in AR automation is by streamlining your processes. By adopting electronic invoicing, you can accelerate invoice transmission and reception while minimizing manual errors. Through automated cash application, payments can be applied promptly, and a contemporary collections solution can facilitate more efficient and customer-friendly outreach to overdue accounts. This results in faster payment processing and potentially lower DSO figures. It's a good idea to review this process regularly.

- Review payment terms. You should always consider how the payment terms affect the payment behavior of your customers. If your company routinely offers 60 days to pay terms to customers and finds DSO hovering around 60, you may find you can lower it by switching customers to tighter 30 days to pay terms. Factors that influence payment terms are increased competition (payment terms must become more flexible), large customers exerting pressure to pay later or larger projects (with large part payments depending on milestones achieved).

- Set up a sound credit and collection policy. How well do you know your customers? Do you regularly check their creditworthiness? What was their payment behavior in the past? Declining payments via credit is one way to lower DSO. Even better is establishing a good credit policy: it will dictate how you extend credit to your customers, how you collect payments, what you do in the event of non-payment, and can include credit insurance if necessary. An effective credit policy can help you manage your cash flow, reduce bad debt, and improve your bottom line.

- Provide flexible payment options. To enhance customers' payment behavior and improve your DSO, offering diverse payment options, for example, ACH, is essential. Providing convenient ways for customers to pay accelerates the payment process and is highly valued by customers. When sending invoices and reminders, make sure to include a payment link in digital communications or a QR code on physical letters.

- Offer early payment discounts. Companies have the opportunity to incentivize prompt payment or offer discounts to customers who settle their accounts in a timely manner. The extent of the discount can be determined based on your company's current financial position and the value placed on expediting cash flow. Alternatively, instead of a discount, you may consider offering an additional service or a complimentary product as an added benefit.

- Increase visibility. Reducing DSO requires a team effort. Not just the credit management team, but other departments and individuals can all play a role. An unpaid invoice can be a starting point for investigating the cause of the non-payment. Could it be related to the way you sell? Or how you handle other internal processes?

How to reduce and lower your DSO

Reducing DSO is essential for improving cash flow and maintaining a healthy financial position. To lower your DSO, you can implement several strategies, such as tightening credit terms, offering early payment incentives, and automating invoicing and payment reminders. Regularly reviewing your customers' payment patterns and addressing overdue accounts promptly can also help. By focusing on efficient billing processes and maintaining strong relationships with customers, businesses can collect payments faster and improve their overall cash flow.

Read now → Improve your AR strategy with insights on credit management [ Blog ]

How to use DSO more effectively

To safeguard against fluctuations and external influences, it's crucial to regularly calculate, track, and review your DSO. This valuable metric serves as an indicator of your accounts receivable collections process relative to industry standards. Changes in DSO, whether increasing or decreasing, reflect corresponding shifts in key inputs from your company's balance sheet. Stay proactive and make necessary adjustments based on these insights.

The best way to use DSO is to put it in context. The Collection Effectiveness Index (CEI) is one of the best contextual indicators for DSO that there is. CEI is a calculation of a company's ability to retrieve their AR from their customers. In other words, CEI compares the amount that was collected in a given time period to the amount of receivables that were available for collection.

A metric that measures the efficiency and effectiveness of the collections team and procedures, CEI is often used alongside DSO to gain a comprehensive view of accounts receivable performance. CEI compares the amount collected to the amount available for collection in a given period. This metric helps to identify the efficiency of your collections efforts and provides a more detailed perspective on your DSO.

Wrapping up how to calculate days sales outstanding

Days Sales Outstanding (DSO) is a critical financial metric that reflects a company's efficiency in collecting its receivables. It's influenced by various factors, ranging from internal processes such as payment terms and credit policies to external factors including macroeconomic conditions, technological advancements, and geopolitical events.

While benchmarking your DSO against industry norms is useful, it's vital to consider the unique circumstances of your own business. For a more precise view of your order-to-cash process, take into consideration multiple indicators like collector effectiveness, overdue percent, dispute aging and closure. While there isn't a one-size-fits-all answer to what a good DSO ratio is, companies should aim to keep their DSO as low as possible to stay competitive within their industry.

Implementing practices such as reviewing payment terms, setting up sound credit and collection policies, streamlining order-to-cash processes, providing flexible payment options, and offering early payment discounts can help improve your DSO. Efficiency, automation, and digitization in the order-to-cash process are the key to success, and with the right tools, this achievement is well within your grasp. Remember, the goal is not just to achieve an industry-standard DSO but to optimize it in a way that best suits your business's specific needs and circumstances.

Want to learn more about how accounts receivable automation from Billtrust can help lower your company’s DSO? Simply fill out the contact form.

Read now → Streamline your receivables process with cash forecasting techniques [ Blog ]

FAQ

The best formula for DSO (Days Sales Outstanding) is:

DSO = (Accounts Receivable / Total Credit Sales) x Number of Days.

DSO = (Average Accounts Receivable / Total Credit Sales for 12 Months) x 365.