This post was originally published in June 2019 and was updated in October 2024, with additional information on how to interpret and improve Collection Effectiveness Index (CEI) scores, new insights on the importance of multiple payment formats, customer prioritization, and more.

In a recent blog post, we discussed Days Sales Outstanding (DSO) and its impact beyond the finance department. We also shared how DSO, while offering valuable insight into accounts receivable (AR) performance, isn’t the best metric for measuring collector effectiveness. In this post we’ll discuss another metric used by finance professionals, that when coupled with DSO, tells a more holistic credit and collections story.

Defining collection effectiveness index

The Collection Effectiveness Index, or CEI, is a calculation of a company's ability to retrieve their AR from their customers. In other words, CEI compares the amount that was collected in a given time period to the amount of receivables that were available for collection. A CEI near 80% or above indicates a highly effective collections process, while a CEI of around 50% and below is considered low and should be further evaluated. Why does tracking CEI matter though? More or less, this metric can directly show you the speed it takes to convert A/R to a closed out, paid account.

Let’s take a look at an example to further explain how DSO and CEI are different. Two companies could have the same DSO, but the state of their collections risk could differ. A business can have a percentage of their receivables in newly or recently passed due buckets and a percentage of their receivables in higher aging buckets including 90+ days. The breakdown of those receivables and what aging buckets they’re in then determines the likelihood that they’ll be able to collect and ultimately get paid.

Read now → Track your collection performance with days sales outstanding insights [ Blog ]

Breaking down CEI

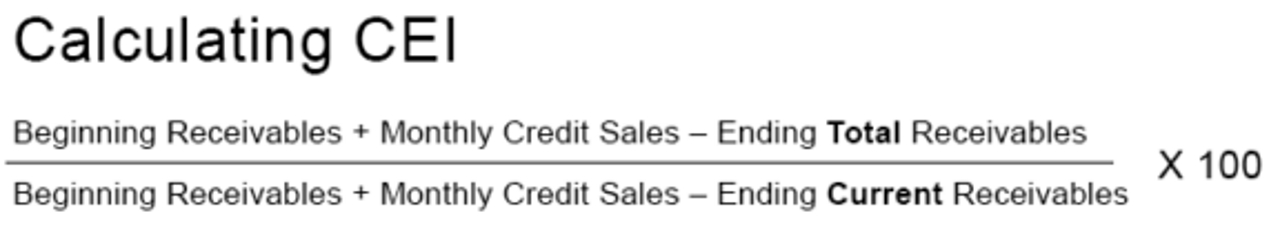

Now that we’ve explained what CEI is, let’s go through an example of how to calculate. First, let’s define some terms we’ll use to explain the formula beforehand.

- Beginning receivables is a company’s open receivables at the start of the month. It’s also the ending total receivables for an organization from the previous month. For example, if a business had an ending total receivables of $30 million on February 28th, the beginning receivables for March 1st would also be $30 million.

- Monthly credit sales is how much money is made via sales in that month.

- Ending total receivables is all of the open receivables including current and overdue receivables.

- Ending current receivables are strictly the open receivables that are not overdue.

With those terms now in context, below is the formula that you would use to calculate CEI for your company.

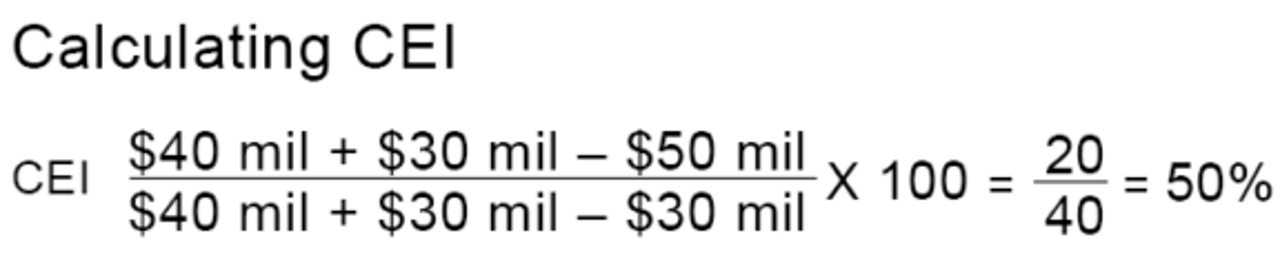

Let’s look at an example with real numbers below.

CEI nirvana would be as close to 100% as possible. Although, a more realistic CEI of 80% or 90%, would also be preferable compared to a score like 50%.

Another thing to note about CEI is that it takes into account the weight of your invoices. To better explain this, assume a business had two overdue invoices, one for $100 that was one day overdue and the other was $1,000,000 that was 45 days overdue. It wouldn’t be completely accurate to say that the average for the overdue invoices was 23 days. This is simply because their age and amount are drastically different.

Collection effectiveness index example

Consider a company with $1 million in beginning receivables, $2 million in credit sales, and $800,000 in ending receivables. The CEI would be:

This indicates that only 10% of the receivables were collected relative to the credit sales, signaling potential inefficiencies in collections.

Collection effectiveness index calculator

Calculate collection effectiveness index (CEI)

To simplify the calculation process, utilize online CEI calculators that automatically compute the index based on input data. These tools streamline the process and provide instant results, helping you quickly assess and act on your collections performance.

Understanding the importance of collection effectiveness index

1. Clarity on your payment collection practices

CEI offers insight into how well your payment collection practices are working, identifying gaps and areas for improvement.

2. Timely assessment of your collection policies

Regular assessment using CEI helps ensure that your collection policies are effective and adapted to changing business conditions.

How to interpret the collection effectiveness index

1. Incorrect or delayed invoicing

Incorrect or delayed invoicing can skew your CEI, leading to inaccurate assessments of collection effectiveness. Ensure invoices are accurate and timely to maintain a reliable CEI.

2. Weak credit policies and lenient payment terms

Weak credit policies and lenient payment terms can increase overdue receivables, negatively impacting CEI. Strengthening credit policies and enforcing stricter payment terms can improve your index.

3. Absence of flexible payment formats

Offering limited payment formats can hinder collections. Providing multiple payment options can enhance customer convenience and improve CEI.

4. Lack of customer portfolio prioritization

Not prioritizing your customer portfolio can lead to inefficiencies in collections. Focus on high-value and high-risk customers to optimize your CEI.

How to improve the collection effectiveness index

Electronic workflows and escalations

Implementing electronic workflows and automated escalations can streamline the collections process, reducing manual errors and improving efficiency.

Additional layer of customer experience

Enhancing customer experience through improved communication and service can lead to faster payments and better CEI.

Manage delinquent accounts properly

Proactively managing delinquent accounts and employing effective collection strategies can significantly improve your CEI.

Multiple payment formats

Offering various payment options can increase the likelihood of timely payments and positively impact your CEI.

Invoice management

Effective invoice management, including accurate and timely invoicing, is crucial for maintaining a high CEI.

Strong credit policies

Enforcing strong credit policies ensures that only creditworthy customers are extended credit, reducing the risk of overdue receivables.

The Collection Effectiveness Index is a vital metric for assessing and improving your collections process. By understanding and optimizing your CEI, you can enhance your company's cash flow and overall financial health. For a comprehensive analysis, consider leveraging tools and resources to monitor and improve your CEI effectively.

Read now → Reduce bad debt through effective accounts receivable fraud prevention [ Blog ]

FAQ

To measure the effectiveness of collections, you can use several key performance indicators, with CEI being one of the most comprehensive. Other metrics include DSO, the aging schedule of accounts receivable, percentage of current receivables to total receivables, and the bad debt to sales ratio. These measures, when used together, can offer a detailed view of the collection department's performance.

A good Collection Effectiveness Index (CEI) reflects a high percentage of accounts receivable that have been successfully collected in a given period. Generally, a CEI score closer to 100% is considered excellent, indicating that nearly all receivables have been collected. Specifically, a CEI above 80% is often viewed as good and demonstrates effective collections processes and credit policies within an organization. However, the benchmark for a "good" CEI can vary depending on the industry and market conditions. It's important for each business to compare its CEI against industry norms and historic company performance for a more nuanced interpretation.

CEI measures the effectiveness of the collections process, while DSO calculates the average number of days it takes to collect receivables. Both metrics provide valuable insights but focus on different aspects of collections.

CEI focuses on the ability to collect receivables within a specific time frame, offering an assessment of the effectiveness of the collections efforts during that period. It is calculated based on the opening receivables, plus monthly credit sales, minus closing total receivables, compared to the total receivables due at the beginning of the period plus monthly sales, minus current receivables.

DSO, on the other hand, calculates the average number of days it takes for a company to collect payments after a sale has been made. A lower DSO indicates that a company can convert its receivables into cash faster, suggesting better efficiency in collections. The formula involves dividing the total accounts receivable during a certain period by the total net credit sales, then multiplying the result by the number of days in the period.

The Collection Effectiveness Index (CEI) measures the effectiveness of an organization's accounts receivable collection efforts over a specific time period. It assesses the portion of receivables that have been collected compared to what was available to be collected, starting with the beginning receivables added to the credit sales and then subtracting the ending total receivables. CEI provides insights into how well the company manages and collects its debts, indicating how successful the business is at converting credit sales into cash and managing credit risk.

Making ROI tangible

Companies are always going to be focused on ROI and for good reason. Yet for a collections analyst, the faster they can get an invoice paid in full, the quicker their company can realize their cash flow and impact top-line revenue. While metrics like DSO and CEI help tell part of the collections story on their own, together they are more impactful and help share a full financial view.

Want to learn more about DSO and CEI and what they can tell you about your business? Reach out to sales@billtrust.com.