Days Sales Outstanding (DSO) is used globally as a key financial indicator. It can help you understand a company's cash flow profile. But some credit and collections practitioners have mixed feelings about DSO, because it doesn’t tell the whole story of a company's accounts receivable success.

Though DSO is often used to measure a company’s ability to collect their receivables, there are factors that influence DSO that have nothing to do with accounts receivable management. DSO deserves a deeper look.

Defining Days Sales Outstanding

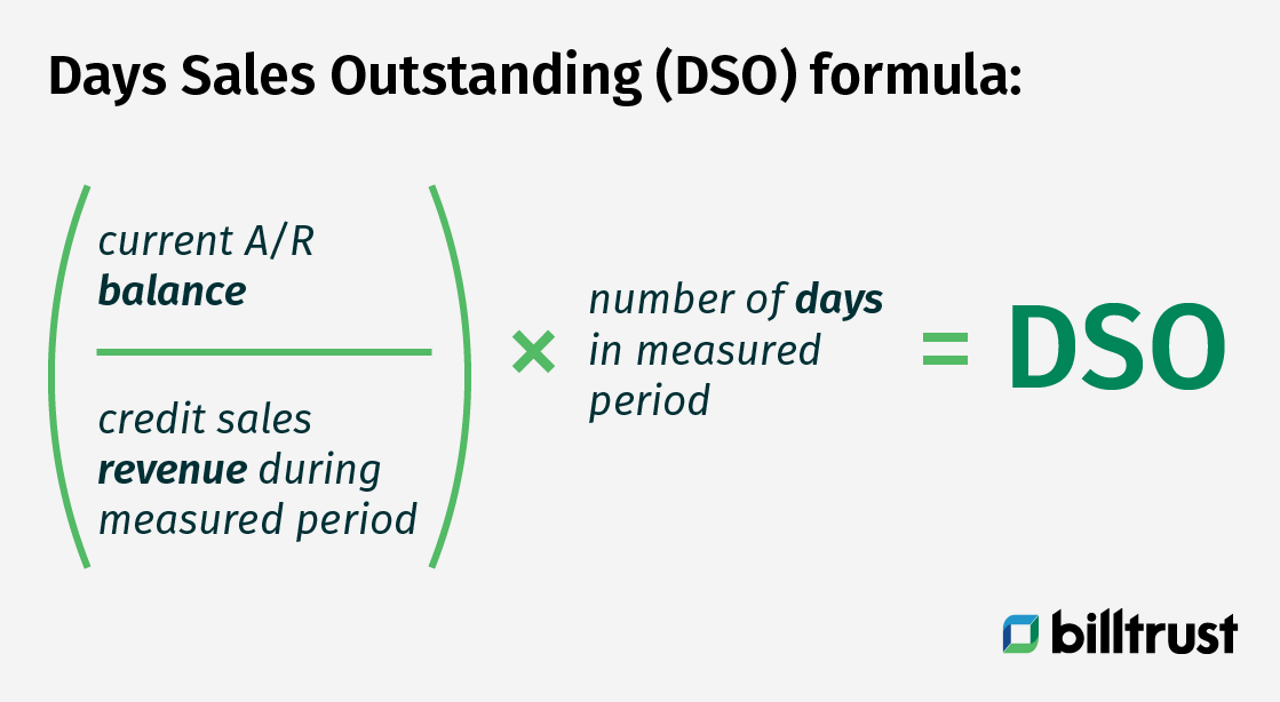

The formula for calculating annual Days Sales Outstanding (DSO) is:

Annual DSO = (Average accounts receivable balance / 12 months of revenue) × 360 days.

When calculating DSO, a good source for the average accounts receivable balance is an average of the quarterly AR balances for the year.

For example, if a company had the following quarterly AR balances:

Q1: $8 million

Q2: $10 million

Q3: $14 million

Q4: $8 million

We can see that this company’s revenue is seasonal. We’ll average the AR balance for the year at $10 million and use that for our average accounts receivable balance.

If the company’s revenue for the year is $50 million, we can calculate the annual DSO thusly:

(10 million / 50 million ) × 360 = 72

The company in the example has an annual DSO of 72 days.

Understanding Days Sales Outstanding

DSO is often confused for “the time it takes to fully collect unpaid invoices.” Mathematically, there is no direct relationship between DSO and the number of days it takes a company to get paid.

DSO is an indicator of how many average days worth of sales are tied up in receivables.

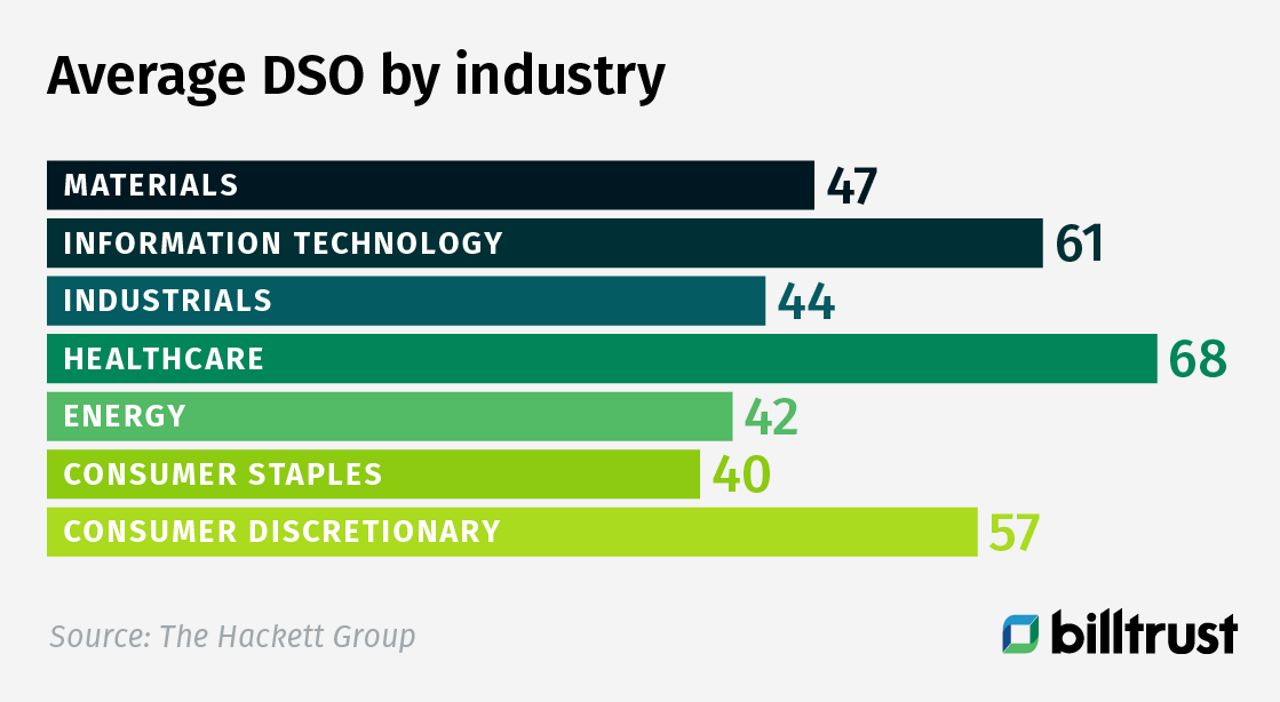

The average DSO varies wildly by industry, as demonstrated by recent research from The Hackett Group:

Why the love / hate for DSO?

Many credit managers and collections managers have a love/hate relationship with DSO. The complex feelings stem from DSO’s inconsistent reliability as an indicator of accounts receivable team success.

When DSO goes up, it may fairly be assumed that the credit and collections team is having a harder time collecting outstanding receivables. But DSO can go up for reasons beyond the control of the finance team. If average sales drop, but outstanding receivables remain the same, DSO will go up.

Looking at our earlier example, let’s assume that average receivables are still at $10 million, but 12 month revenue has dropped to $40 million. Let’s plug those numbers into our DSO calculator:

(10 million / 40 million) x 360 = 90

DSO has risen from 72 days when 12-month revenue was $50 million to 90 days DSO. The finance team has maintained the level of outstanding receivables, but because there was a major drop in 12-month sales, DSO is up and it looks like the finance team is losing control!

This example begins to explain why collections professionals have mixed feelings about the metric, and why DSO may not always be the best measure of a credit and collections team’s true effectiveness and efficiency.

“If you were to speak with a credit and collections manager about their opinions on DSO, their thoughts most likely would be that it provides only one perspective of the overall picture. More importantly we should look at complementing metrics to provide us a true reflection of how we are performing. While DSO is fine – and by its nature uses sales as a criteria which we have minimal influence on – we should also measure trends such as collector effectiveness, overdue percent, dispute aging and closure rates.”

Billtrust’s VP of Product Strategy, Art Hernandez

How to use DSO more effectively

DSO is valuable as a shorthand indicator that helps a company understand how their accounts receivable collections process compares to others in their industry. Changes in DSO (up or down) reflex changes in key inputs from a company's balance sheet.

The best way to use DSO is to put it in context. And the Collection Effectiveness Index (CEI) is one of the best contextual indicators for DSO that there is. Learn more about CEI here.

Want to learn more about DSO and the impact it has on your business? Simply reach out to Billtrust.