This post was originally published in June 2020 and was updated on February 16, 2024.

DSO stands for Days Sales Outstanding and it represents the average number of days that it takes for a company to convert a sale into a payment.

In the business-to-business environment, it is typical for companies to sell their products and services on credit with the customer paying within a designated number of days. This time between a sale and receipt of payment must be managed carefully, as nearly all of a company’s activities are dependent on healthy cash flows.

A DSO that is trending upwards can predict cash flow problems for a company because it can indicate that they are expending resources to deliver on their sales, but are having greater difficulty quickly collecting their receivables.

DSO can be calculated on a monthly, quarterly or yearly basis.

How do you calculate DSO?

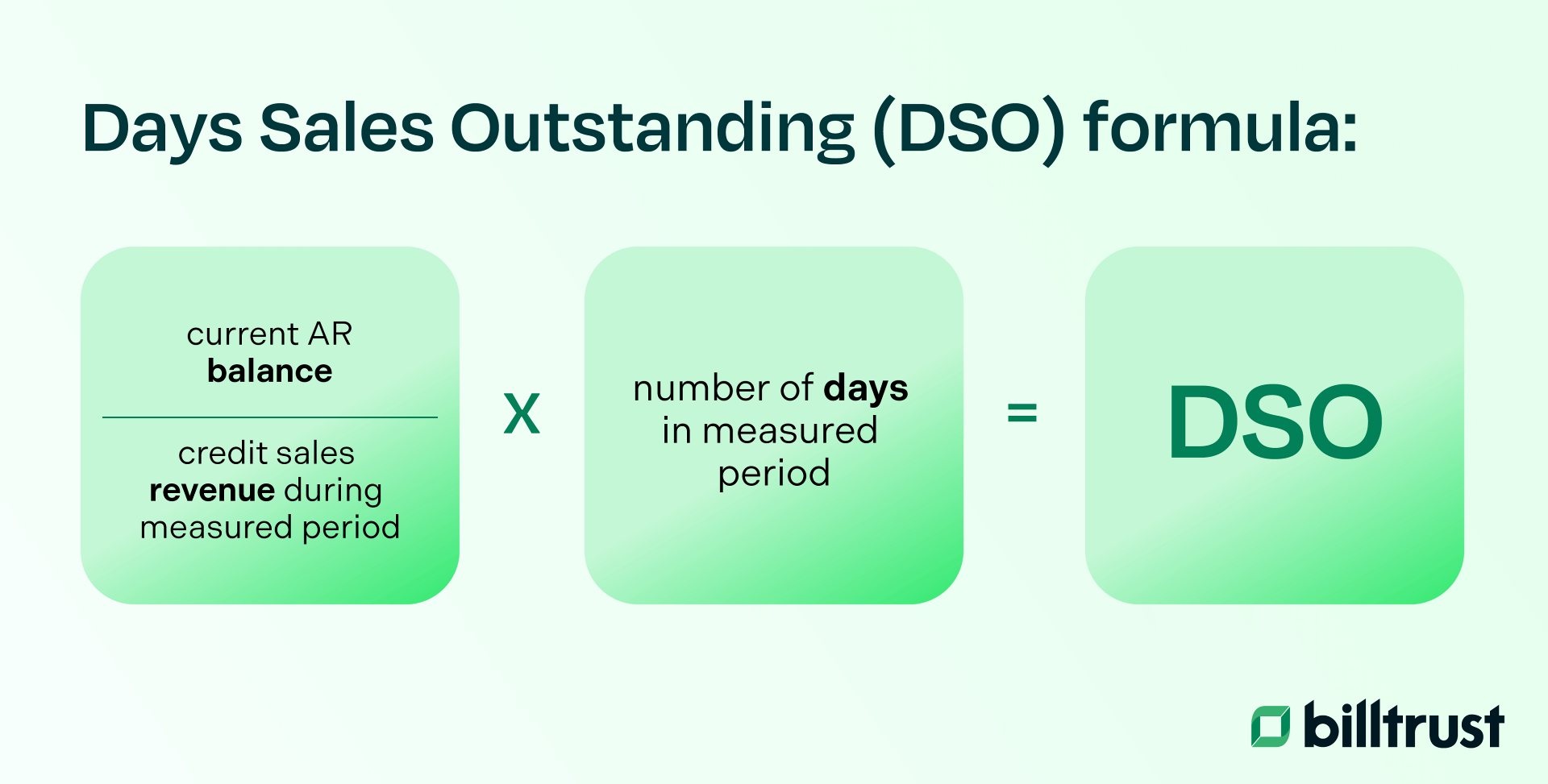

You can calculate DSO (Days Sales Outstanding) by taking your Current AR Balance, dividing it by your Credit Sales Revenue During Measured Period, then multiplying that number by the Number of Days in Measured Period.

Let’s break that down into its component parts.

Measured Period: As we mentioned above, DSO can be calculated on a monthly, quarterly or yearly basis. This will affect the Measured Period portion of the Days Sales Outstanding formula. If we are calculating monthly DSO, the measured period will be the number of days in that month, likewise for quarterly or yearly DSO.

Current AR Balance: A company’s AR balance is the dollar value of their accounts receivable.

Credit Sales During Measured Period: The dollar value of sales made during the period with payment agreed to be made later.

Example: Let’s say you run a B2B company that generates about $365 million in credit sales. We can say on average, one day’s sales is about $1 million. If your average AR balance for a given month is $48 million, that means you have 48 days worth of sales sitting on your book. DSO for the company is 48 days.

What does DSO tell you?

DSO tells you how long it takes your company to access the Cash that you are owed. Cash is essential to running a business. The higher a company’s DSO, the less access they have to the cash that they are owed. Less available cash means less for investment and growth. Higher DSO also means more of their customers’ credit is tied up, which can lower sales potential.

What’s a “good DSO”?

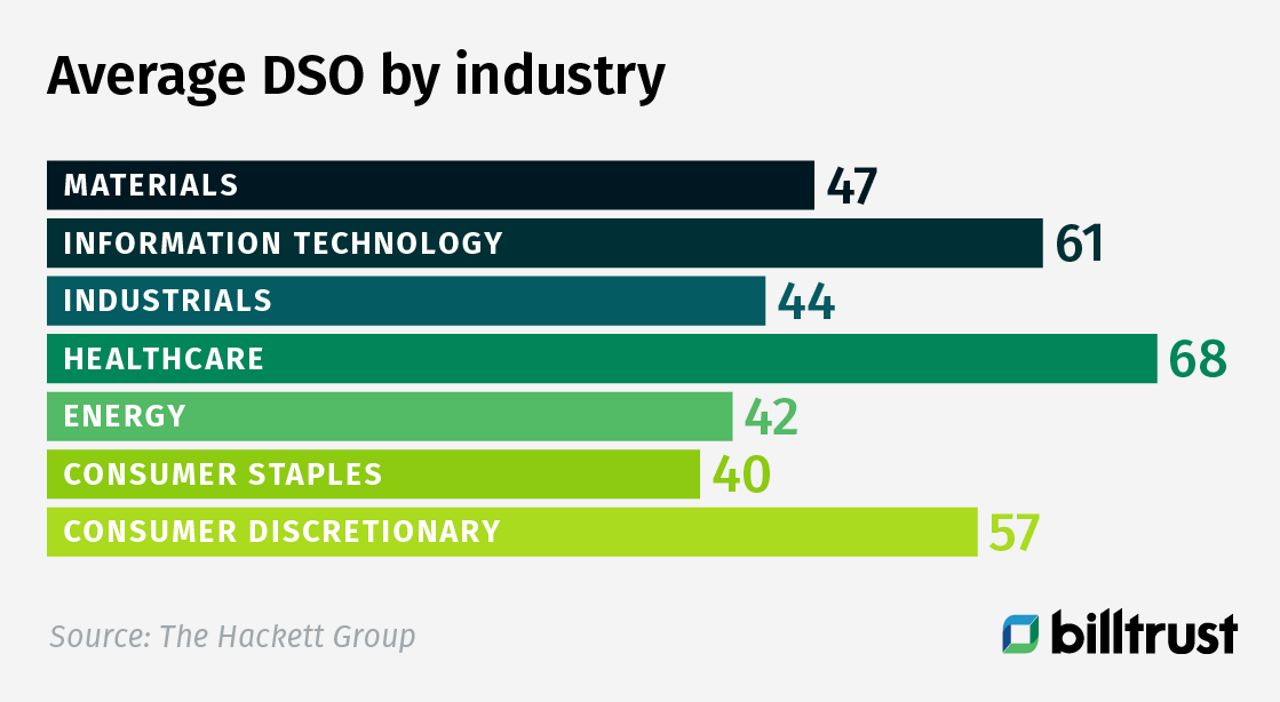

Good DSO is dependent on the industry. DSO can vary from month to month over the course of a business cycle, especially if an organization is seasonal. DSO even varies wildly by industry.

Companies will often compare their DSO (Days Sales Outstanding) with their industry average. If their DSO is higher than average, they might take that as an indication that there are activities they can pursue to lower it and increase their cash flow.

How do you lower DSO?

You can lower DSO using a variety of actionable methods.

The easiest way is to reduce sales. If a company stops making sales and their customers continue to pay what they owe at the current rate, outstanding receivables will drop compared to the average day’s sales for the period. Obviously, this is not an appealing situation for a company to find themselves in. The fact that lower DSO can result from a negative business outcome reveals that DSO should be viewed as just one indicator amongst the many that business managers should consider.

Companies can also lower their DSO by demanding tighter payment terms when selling on credit. If a company routinely offers 60 days to pay terms to their customers and finds their DSO hovering around 60, they may find they can lower it by switching their customers to 30 days to pay terms. Their cash flow may improve, but this could alienate customers and even hamper sales.

The most beneficial way for a company to lower DSO is by automating and optimizing their order-to-cash process.

- AR automation can result in invoices that are sent and received more quickly, prompting quicker payment.

- Flexible and automated payment acceptance processes may motivate buyers to pay via faster channels i.e., an ACH payment vs a mailed paper check.

- Automated cash application solutions apply payments more quickly.

- Automation-assisted collections solutions help collectors do their work more efficiently, leading to faster payments.

What else should I consider?

DSO doesn’t tell the whole story, but instead provides a quick, informal look into cash flow. For a more precise view of your order-to-cash process, take into consideration multiple indicators like collector effectiveness, overdue percent, dispute aging and closure.

To learn how accounts receivable automation can improve your DSO and cash flow, connect with Billtrust.