This blog was originally published in February 2018 and was updated in October 2024 with more information about credit card processing fees, including tips on how to lower fees by implementing Level 2 and Level 3 credit card data, using automation to streamline virtual credit card payments, and more.

What are credit card processing fees?

Credit card processing fees are the costs that businesses must pay each time a customer uses a credit card to make a purchase. These fees are an integral aspect of the digital payment ecosystem, facilitating the streamlined and secure transfer of funds from a buyer's credit account to a merchant's bank account. They are calculated as a percentage of the transaction amount, sometimes accompanied by a small fixed fee. The exact amount can vary based on several factors, including the type of card used (i.e. credit, debit, rewards, etc.), the merchant's payment processor, and the specifics of the individual transaction. Understanding these fees is crucial for businesses of all sizes, as they directly affect the net revenue from sales.

Types of credit card processing fees

Understanding the different types of credit card processing fees can help merchants make informed decisions when choosing a payment processor and can also aid in identifying areas where costs might be minimized.

Assessment fees

Assessment fees are charged by the credit card networks (i.e. Visa, MasterCard, American Express, and Discover) and are paid by the payment processors on behalf of the merchants. These fees are typically a very small percentage of each transaction and contribute to the operational costs of maintaining and securing the card networks. These fees are universal and non-negotiable, applied to all transactions processed through the network.

Payment processing fees

Payment processing fees constitute the bulk of the cost associated with each credit card transaction and are paid to the payment processor or merchant services provider. This fee is for the service of facilitating the transaction between the merchant, the card network, and the issuing bank. It includes the costs of transaction processing, fraud detection, and the provision of customer service. Payment processing fees can vary significantly depending on the provider, the nature of the transaction, and the level of service provided.

Interchange fees

Interchange fees are perhaps the most significant component of credit card processing costs. They are set by the card networks but are paid to the bank that issued the customer's credit card (the issuing bank). The purpose of interchange fees is to cover the cost of handling credit card transactions, including risk assessment, fraud mitigation, and the provision of credit. These fees vary widely based on the type of card used (i.e., rewards cards often have higher interchange fees), the transaction size, and the merchant's industry. Interchange fees are subject to periodic adjustments by the card networks and can have a significant impact on a merchant's total processing costs.

Read now → Lower your fees with ACH payment solutions [ Blog ]

What is the formula for calculating credit card processing fees?

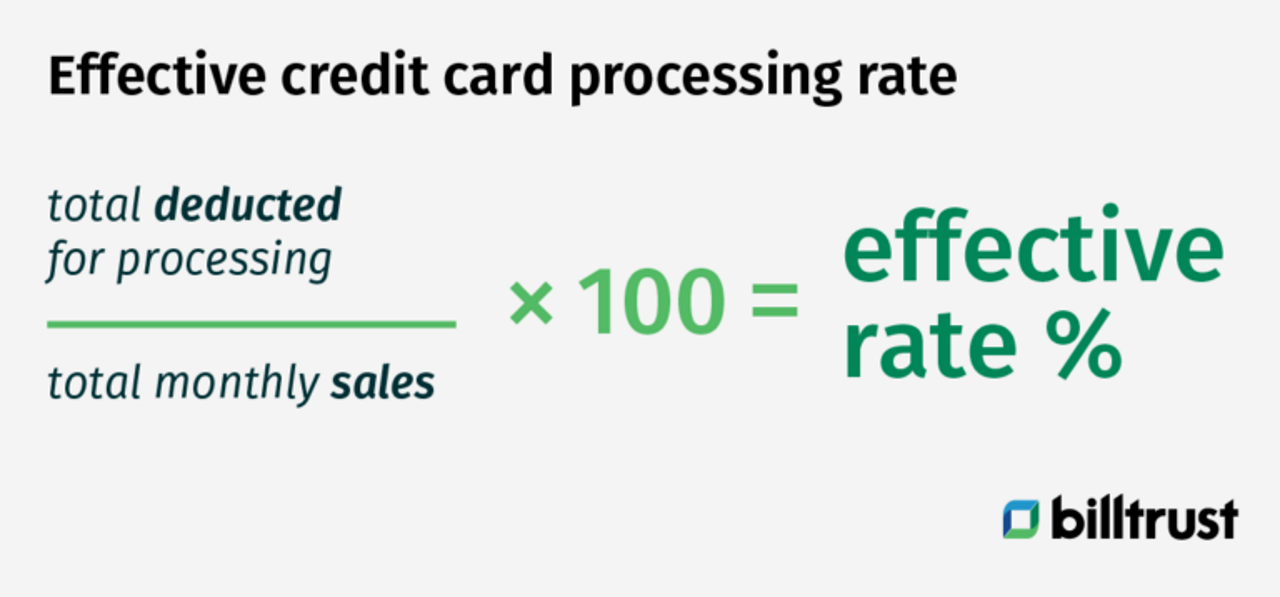

The first step in calculating your credit card processing fees is finding your effective rate. First, you’ll need to pull out your credit card statement. Next, you’ll need to take the total amount deducted for processing and divide it by the amount of your total monthly sales that are paid using credit cards.

The result is your effective rate, the total amount your credit card company is charging you.

How does my effective rate compare to others?

When the typical B2B organization initially looks at its effective rate, it’s usually between 2.5% and 3%. Within that effective rate are several different types of fees:

Interchange rate: Makes up the largest portion of the fee. Goes to the issuer (usually issuing banks) to fund cardholder operations and rebates.

Markup: Goes to the merchant processor which the supplier uses to accept card payments.

Assessment: Goes to the network (Visa, Mastercard, Discover, American Express) to allow the issuer to transmit the payment from the cardholder to the merchant.

If your organization simply accepts these fees as the cost of doing business, it’s time to rethink that position.

How to lower my effective rate and reduce credit card processing fees

You can lower your effective rate and total credit card fees by defining a smart credit card acceptance policy along with implementing technology that will lower your monthly fees and costs associated with credit card transactions such as cash application.

A smart credit card acceptance strategy combined with innovative automation can help you slash those fees up to 1%.

Three ways that can help you lower credit card processing fees include:

- Use address verification services: Incorporating Address Verification Services (AVS) can drastically reduce credit card processing fees by verifying the cardholder's address during the transaction. This verification not only enhances security but also reduces the cost associated with fraudulent transactions, which in turn can lead to lower fees.

- Avoid fraud: Implementing strong fraud prevention measures can directly impact your credit card processing fees. By reducing the risk of fraudulent transactions, merchants can decrease the number of chargebacks and disputed charges, which often carry high fees and penalties, ultimately leading to more favorable processing rates.

- Negotiate with payment processors: Merchants have the opportunity to negotiate better terms with their payment processors. By understanding your transaction volume and needs, you can discuss lower rates or fewer charges. It's beneficial to regularly review your merchant services agreement and compare rates from different processors to ensure you're getting the best deal possible.

How to create a credit card policy

Defining your company’s credit card acceptance policy is tough. Buyers love paying with credit cards – and everyone wants to make their customers happy. But the rebates and additional lines of credit that your buyers enjoy come with costs for you: Credit card processing fees and manual labor.

Some suppliers choose not to accept credit cards, but in challenging economic environments or competitive industries being willing to accept credit cards is a competitive advantage.

To make a cost effective credit card acceptance strategy, a company needs to first understand exactly how much they’re spending each month to process their customers’ credit cards.

The cost of credit card transaction fees

The cost of credit card transaction fees can significantly impact both merchants and businesses, encompassing a variety of charges like interchange fees, assessment fees, and payment processing fees. Interchange fees, charged by the issuing bank, generally constitute the largest portion of these costs and vary based on the type of card, transaction size, and merchant industry. Assessment fees are smaller and paid to the credit card networks for the use of their infrastructure. Payment processors also charge for facilitating transactions, with fees that can vary widely. These combined costs can reduce the net revenue that merchants receive from sales, making it crucial for businesses to understand and strategically manage their credit card processing fees to minimize expenses and maximize profitability. Each fee plays a role in the overall expense of accepting credit cards, highlighting the importance for merchants to negotiate better rates and implement fraud prevention strategies to lower these costs.

Read now → Protect your revenue by avoiding bad debt expenses [ Blog ]

Are there different pricing models for processing fees?

Because of specific ranges for each major credit card network, credit card processing fees may fluctuate. In fact, the average credit card processing fee may change over time. One reason for fluctuations is due to pricing models. Merchants may be able to accept one that best fits their needs. Here are the different pricing models:

Tiered pricing: As the name implies, credit card transactions may be available in different buckets or tiers.

For instance, certain transactions may be charged at a higher or lower percentage in fees. Merchants who process most of their credit card transactions in the lowest tier may find the tiered pricing model works best for them.

Flat rate pricing: A credit card processor will charge merchants a flat or fixed rate for each credit card transaction plus a small fee ($.20 to $.30 per transaction).

Merchants with a flat-rate pricing model have a better chance of anticipating their credit card processing costs over time.

Interchange Plus pricing: This model from card networks includes the interchange rate for each credit card transaction plus any predetermined add-on fees.

With the Interchange Plus pricing model, merchants may pay the interchange rate plus a smaller fee per credit card transaction or an additional percentage.

What influences credit card transactions fees and the various percentages charged by card issuers?

Since many factors may influence the pricing models, it’s why transaction fees from various credit card issuers (or other financial institutions and fintech companies) may be assessed at different percentages. For instance, American Express may charge between 2.5 percent to 3.5 percent because they're a closed network, meaning they are the only one that can issue credit cards. VISA® and Mastercard® can be issued by other banks.

Keep in mind that there are many costs involved in credit card processing fees, which can affect the total cost of accepting credit cards over time. Anything you can do to reduce costs, for example, implementing accounts receivable automation software, may give you a better return on investment (ROI) in the long run.

How do I accept credit cards and increase margins at the same time?

Here are a few tips that can help you develop your own efficient and cost effective credit card acceptance strategy:

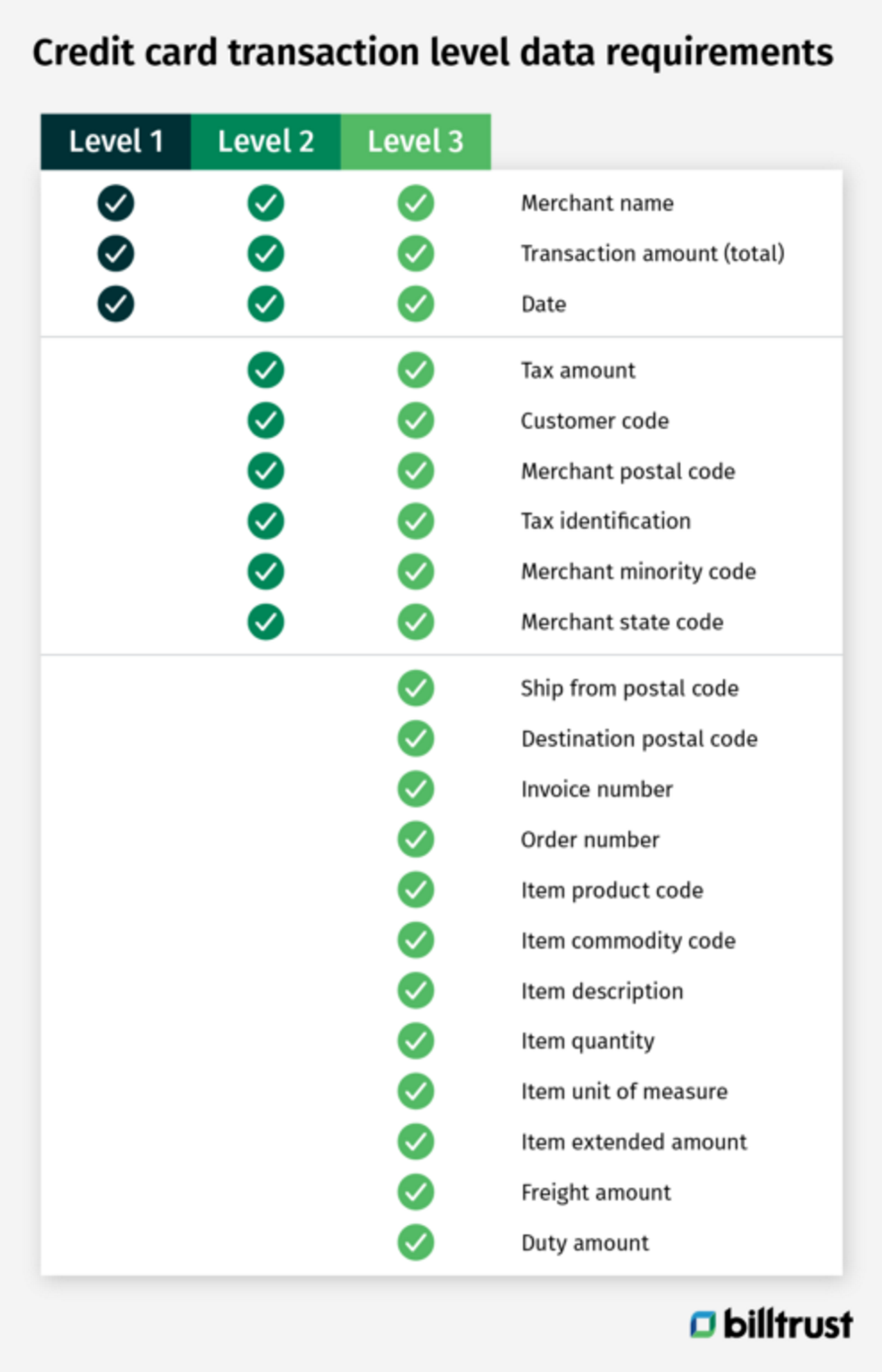

Tip 1: Make sure your credit card solution is processing your customers’ payments using Level 2 or Level 3 credit card data.

Level 1 data is what you would commonly transmit in a retail purchase, with just basic information about the buyer, the seller and the transaction. Level 2 and Level 3 transactions contain many more points of data, like item SKU numbers, addresses and tax information.

Card processors consider transactions that come with more data to be more secure and less likely to be fraudulent or in error, so they reward Level 2 and Level 3 transactions with lower fees.

Tip 2: Design smart payment policies to encourage buyers to pay quickly and prevent them from using credit cards outside of the early payment window.

This is easier to do than you think. More and more buyers are using AP providers to handle their accounts payable. These AP providers are often issuers of credit cards themselves and are eager to pay via virtual credit cards on behalf of their customers.

At Billtrust, we have heard from many customers that their buyers’ AP providers are able to promise credit card payment within 7 days of the receipt of invoice, while warning that paper check payments could come as late at 60 days from receipt of invoice.

This isn’t all good news, because credit card payments do come with fees (monthly fee) and manual processing requirements. But the difference between receiving a payment within 7 days and having to wait up to 60 days for payment is enormous. There are major cash flow and working capital advantages to getting paid faster. More and more Billtrust customers are starting to embrace card payments as they work to maximize their benefits and minimize their drawbacks.

Tip 3: Leverage AR automation to eliminate the manual work of processing emailed virtual credit cards.

Many buyers transmit their virtual card payment information by email or phone. This not only exposes sensitive payment data, but it requires AR professionals to open emails, key in payment information and manually match payments to invoices.

Reducing credit card processing fees (monthly fee) with automation

Automation removes the resources needed to process emailed credit cards, adds Level 2 and Level 3 interchange savings and you’ll be able to see the value of automation each month in your credit card statement as your effective rate decreases over time.

Virtually any automated process will be faster, more efficient and cost less than the manual alternative. This is especially true for your accounts receivable team’s payment acceptance process.

Accounts receivable management software can lower costs

To learn how accounts receivable automation can help lower your workload and costs when accepting credit card payments, please contact a Billtrust team member.

Read now → Use accurate cash application to minimize fees [ Blog ]