This post was originally published in January 2022 and was updated in October 2024, with more detailed information on the causes of bad debt, methods for estimating bad debt expense, and more.

What is bad debt expense?

The term "bad debt" refers to accounts receivable that are unlikely to be collected. For example, when a company experiences a shortfall in cash flow, it may have to write off some of the debts it is owed. This process of writing off debts is known as an “accounts receivable write-off” or “bad debt expense” because the company has become less likely ever to see that money again. This type of debt can be found on a company's balance sheet as an asset and liability.

What leads to the occurrence of bad debts?

Bad debts occur when customers who have purchased goods or services on credit fail to repay the borrowed amount within the stipulated time frame, rendering the debt uncollectable. This financial risk is inherent in any business that extends credit to its customers. Although bad debts are often considered a normal cost of doing business, understanding why they happen is crucial for minimizing their impact. Here are several key reasons that contribute to the occurrence of bad debts:

- Financial instability of customers

One primary reason for bad debts is the financial instability or deterioration of a customer's financial condition. Economic hardships, such as job loss, significant business setbacks, or unexpected expenses, can lead to a customer’s inability to fulfill their payment obligations. - Lack of credit management

Bad debts can also stem from poor credit management practices within a business. Failure to conduct thorough credit checks, extending credit to high-risk customers, or not following up on overdue accounts promptly increases the risk of non-payment. - Economic downturns

Wider economic downturns significantly impact the ability of individuals and businesses to settle their debts. In times of recession or economic instability, customers may prioritize essential expenses and delay or default on payments to creditors, leading to increased bad debts. - Customer bankruptcy

When a customer files for bankruptcy, the chances of debt recovery diminish significantly. Legal protections often prevent creditors from collecting debts from individuals or businesses that have declared bankruptcy until the court resolves the situation. - Fraudulent transactions

Bad debts can also arise from fraudulent activities. For instance, if goods or services are purchased with stolen credit card details or through other fraudulent means, the seller risks not receiving the payment due to chargebacks and dispute resolutions favoring the victim of the fraud. - Accounting and billing errors

Mistakes in billing processes or accounting errors can lead to disputes or misunderstandings about the amount owed. Such disputes, if not resolved promptly, can result in non-payment and eventually bad debts. - Customer disputes

Disputes over the quality of goods delivered or services rendered can lead to withheld payments. If these disputes are not amicably resolved, they can result in bad debts. - Lack of communication

Inadequate communication between the business and its customers concerning payment expectations and credit terms can cause misunderstandings and non-payment scenarios. Clear communication is crucial in managing customer expectations and reducing the risk of bad debts.

Read now → Avoid bad debt with strong credit management practices [ Blog ]

Is bad debt an operating expense?

Whether bad debt expense is an operating expense is a contentious issue, and whether such a debt expense is an operating expense is a question that requires extensive consideration. The answer to this question can depend on one's interpretation of the terms "bad debts" and "operating expenses." A broad definition of "operating expenses" could include bad debt expense, but it also could not.

The IRS defines operating expenses as "expenses that are ordinary and necessary to the operation of the business.” These could include bad debt expenses, but they could not be included. This makes it difficult for a business to know whether or not to include these debt expenses in its operating expenses.

Some argue that debt should be classified as an operating expense because it's necessary to run the company. In their view, this would allow for more accurate reporting. They argue that doubtful debt shouldn't be reported as a liability because the money is owed to creditors and not to shareholders.

Others say that bad debt expense should be classified as a non-operating expense because the company itself has not caused the problem, it’s not recorded on the income statement, and it is not an operating expense. They argue that it is a mistake to classify this expense as a non-operating one because it is recorded on the cash flow statement and affects its cash position. Another argument favoring classifying bad debt as a non-operating expense is that bad debt comes from lending money to their customers, and they are unlikely to get it back.

Many small businesses aren't sure if they should classify bad debt expense as an operating expense (and hence, deductible) or an interest expense (and therefore, not deductible). However, it's crucial to classify these expenses correctly to ensure that they are accounted for in the appropriate balance sheet account. Not sure how to classify your these kinds of debt expenses? Working with an external accountant or CPA is a solid way to ensure that you stay on track and get the most up-to-date guidance on your business’ in-house accounting questions.

How to calculate and account for bad debt expense

Bad debt expense, as a concept, is based on the presumption that some portion of a company’s accounts receivable will become uncollectible, and it does not depend on any adjustments. This makes the doubtful debt a challenging expense to calculate. There are two methodologies, however, you may use: the aging and allowance methods.

Aging method

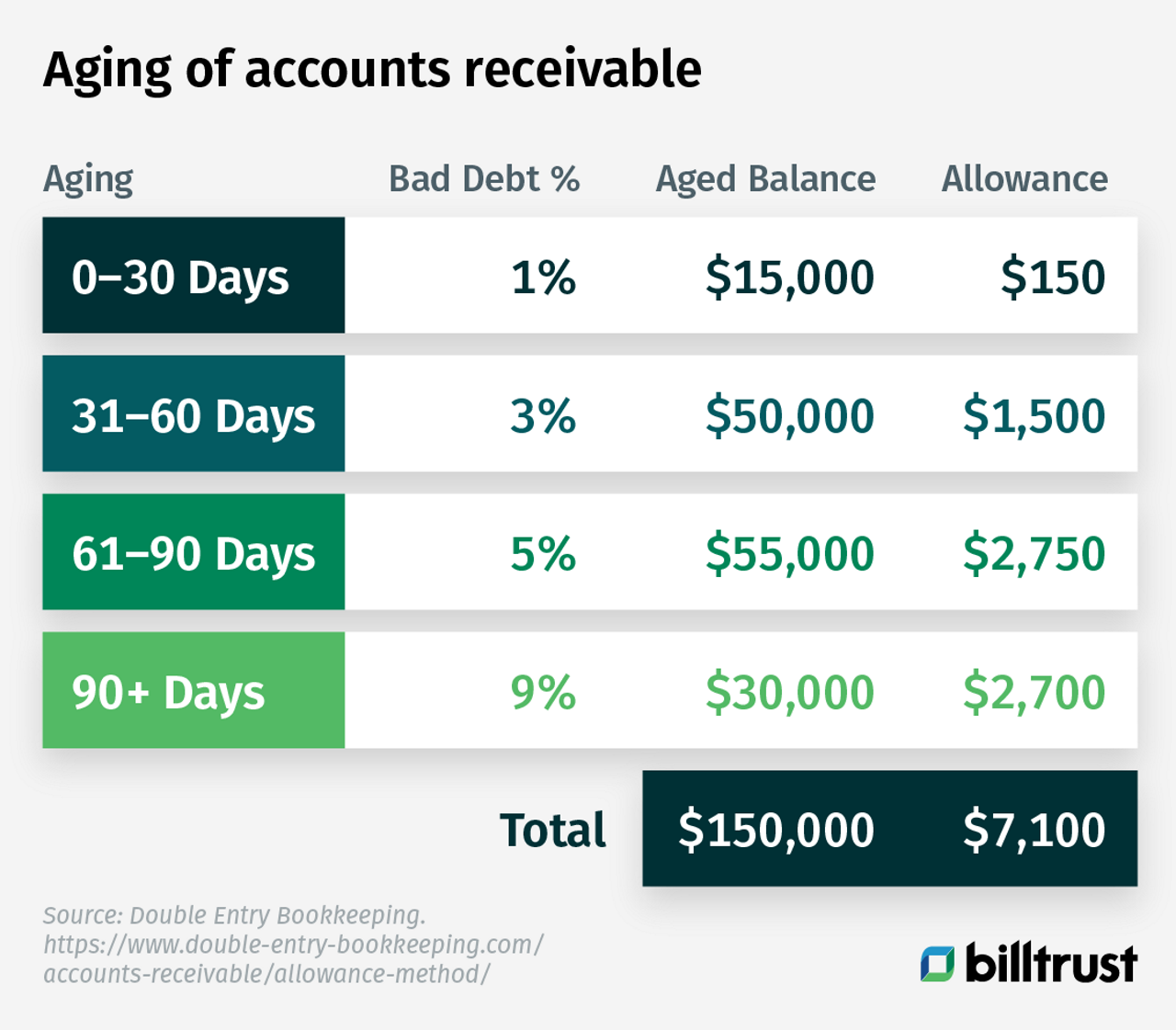

The aging method (developed in 1934) is arguably the most popular and easiest method for calculating bad debt expense. The accounts receivable aging method involves the balancing of uncollectible accounts receivable. This is estimated by projecting the percentage of doubtful debts over a defined period.

Allowance method

The allowance method is to estimate the amount of bad debt by deducting receivables related allowances from total accounts receivable. This method requires that a company evaluate the percentage of customers that will not pay for their order and then calculate the allowance for these debts.

The allowance for bad debts can be calculated by dividing the anticipated bad debt by the total amount of sales expected and multiplying this figure by 100.

Direct write-off method

The direct write-off method is a straightforward approach to accounting for bad debt. In this method, bad debt is only recorded when a specific account is deemed uncollectible. Once identified, the uncollectible amount is written off directly as an expense in the income statement. While simple, this method can result in irregular expense reporting and doesn't align with the matching principle, as it only recognizes bad debts when they occur, which may not be in the same period as the sales.

Percentage of sales method

The percentage of sales method estimates bad debt expense based on a fixed percentage of a company's credit sales. This percentage is determined from historical data, reflecting the average portion of sales that become uncollectible. At the end of each period, the company multiplies its total credit sales by this percentage to calculate bad debt expense, which is then recorded as an expense. This method follows the matching principle, ensuring bad debt is recorded in the same period as the related sales.

Percentage of receivables

The percentage of receivables method estimates bad debt expense by applying a percentage to the total outstanding accounts receivable at the end of the period. This percentage is based on historical data and reflects the portion of receivables likely to become uncollectible. The result adjusts the allowance for doubtful accounts on the balance sheet, ensuring that the company reflects the estimated future losses from unpaid receivables. This method focuses on the balance sheet and better aligns with the actual risk of uncollected payments.

Read now → Minimize bad debt through effective AR collections [ Blog ]

Examples of bad debt expense

Bad debt expense is an account receivable that is no longer considered collectable because a customer is unable to fulfill their obligation to pay an outstanding debt due to financial difficulty or bankruptcy. This kind of expense is a common occurrence in businesses that offer goods or services on credit. Recognizing bad debts is crucial for an organization to present an accurate picture of its financial health. Below are several examples of situations that commonly lead to bad debt expenses:

- Customer bankruptcy

- Account receivable aging

- Customer disputes

- Fraudulent transactions

- Economic downturns

- Erroneous billing or accounting errors

- Customer disappearance or unresponsiveness

Strategies to maximize recovery and minimize bad debt expense

- Credit checks: Perform thorough credit checks before extending credit to customers.

- Clear credit terms: Establish and communicate clear terms for credit, including due dates and penalties for late payments.

- Aging reports: Regularly review accounts receivable aging reports to identify and act on overdue accounts promptly.

- Collection efforts: Implement effective collection strategies and consider employing third-party collection agencies for significantly overdue accounts.

- Legal action: As a last resort, legal action may be taken to collect outstanding debts, although this is often costly and not guaranteed to recover the owed amount.

Acknowledging and managing bad debt is an essential part of financial management for any business offering credit. By understanding common causes and implementing strategic safeguards, a business can mitigate the impact of bad debt on its finances.

Where does bad debt expense go on financial statements?

The main point of bad debt expense is to show how much money was not collected on a receivable account. Thus, such a debt expense is usually recorded as a bad debt loss on the company's income statement. Journal entries are more of an accounting concept, but they can record your doubtful debt expenses. It's recorded when payments are not collected or when accounts are deemed uncollectable.

Bad debts will appear under current assets or current liabilities as a line item on a balance sheet or income statement. For example, the bad debt expense account shows the amount of money a company has lost from customers who have fallen behind on their payments.

Is provision for bad debts an expense?

Bad debt results from a company's inability to collect on amounts owed by their clients. Provisions for such debts are made by estimating what is expected to be collected. Over time, this provision should be created as these doubtful debts become apparent, using information like the number of days past due, the amount owed, and any other relevant information.

Provision for bad debts is not considered an expense. Instead, it is an asset deducted from its accounts payable (liabilities) account. A provision is an accounting term for a company's estimate of the money that will not be collected on receivables. A provision is created when there are doubts about the company's ability to collect on receivables or when the company anticipates that it will not collect on receivables in future periods. This estimate is based on past data and observations and any anticipated events.

When can you write off a bad debt?

Generally, when a consumer or business has not paid back their debt, they are considered to have incurred a bad, or doubtful, debt, which is debt is a receivable that will never be paid in full or if it's doubtful that it ever will. You can write off this debt when there has been no activity on the account for 180 days.

Typically, your receivables are written off when they become uncollectible because you cannot make the sale to collect the receivables, or because the customer has gone into bankruptcy and there is no means of collecting any outstanding amounts.

The IRS states that you can write off any debt owed to you by an individual or company if the following three conditions are met:

- The debt is unconditionally uncollectable.

- The debtor has agreed to discharge the liability in bankruptcy or insolvency proceedings or it has been discharged in bankruptcy or insolvency proceedings.

- You have taken the following actions:

a) You have taken reasonable collection action and determined that further pursuit would be unavailing;

b) You have written off the debt, including any interest incurred on the debt, on your books and records.

c) You have reduced your basis by the amount of this debt.

Read now → Forecast your bad debt with cash flow forecasting [ Blog ]

FAQ

Bad debts, in simple words, are monies owed to a company that are no longer expected to be paid by the debtor.