This post was originally published in July 2020 and was updated in October 2024 with additional information about the benefits of credit management, key steps to establish client creditworthiness, and more.

What is credit management?

Credit management is the discipline of reviewing, analyzing and setting the terms of requests for credit for a business.

In the world of business-to-business (B2B) commerce, sales of goods and services are commonly made on credit with payment to come sometime after delivery. After a salesperson has made a sale for their company, it is the job of a credit manager to determine whether or not the company will allow the sale to be made on credit as well as how big the line of credit should be. This is called “credit decisioning.”

The goal of credit managers is to facilitate sales while minimizing risks, for instance, bad debt for their businesses.

What are the benefits of credit management?

Credit management is crucial in both personal and business finance. It encompasses strategies and practices aimed at maximizing a company's creditworthiness or an individual's credit score. By effectively managing credit, individuals and businesses can access several benefits that contribute to financial stability and growth.

Firstly, good credit management helps in reducing the cost of borrowing. Lenders are more likely to offer favorable interest rates to borrowers with a history of timely repayments and prudent debt management. This can result in significant savings over time, especially for businesses that rely on loans for expansion or capital investments.

Secondly, it enhances the ability to obtain financing. With a solid credit management strategy, businesses and individuals improve their credit scores, making them more attractive to banks and financial institutions. This opens up opportunities for more extensive lines of credit, better loan terms, and increased negotiating power.

Lastly, efficient credit management mitigates financial risks by preventing overextension of credit and ensuring that repayments are manageable. This not only helps in maintaining good financial health but also in building trust with creditors, which can be invaluable during financial downturns or when unexpected needs arise.

Read now → Reduce your bad debt expenses with proper credit checks [ Blog ]

How does the credit process work?

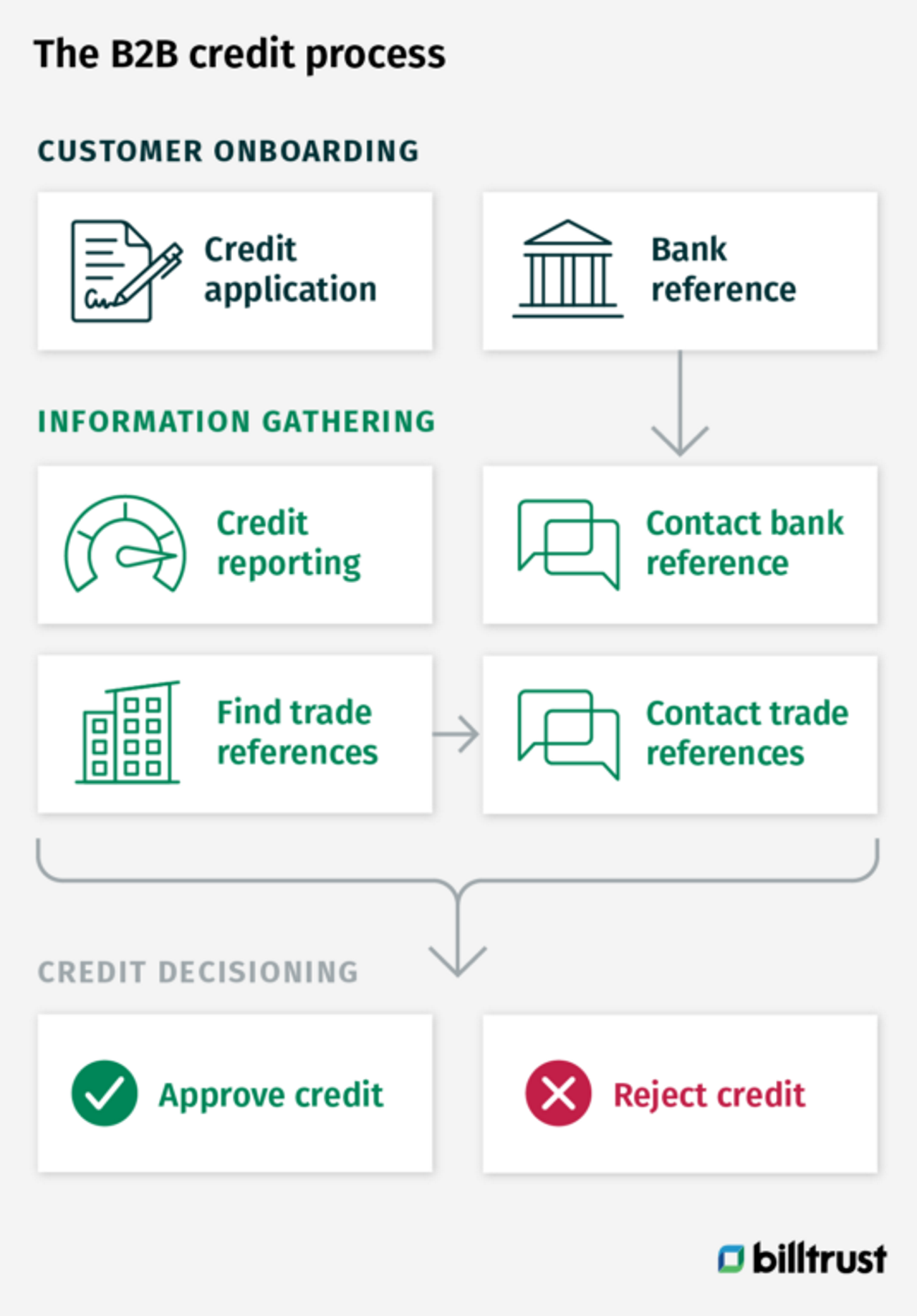

The credit process begins with customer onboarding. In order to be considered for a line of credit with a business, a potential buyer must fill out a credit application. The application will list information about the potential buyer and will include a bank reference (ie. a contact at the potential buyer’s financial institution).

The credit management team will endeavor to gather valuable information about the potential buyer’s business. They may contact the bank reference provided by the potential buyer and inquire about their finances. They will also gather credit reports from the major credit bureaus to learn about their credit history. If possible, the credit management team will reach out to other businesses that the potential buyer has bought on credit from (referred to as trade references) in order to learn about their experiences with the business.

This credit management process is very labor intensive, manual and slow. The credit management department faces two conflicting pressures: On one side, they are pressured to make a quick decision, so that their company can complete the sale and move towards collecting payment. On the other, the team must gather enough information to make a responsible decision and prevent their company from providing goods and services that will not be paid for. Should a customer not pay on time, the debt collection process will begin and there's a potential the credit department's company may incur a bad debt.

Establishing client creditworthiness

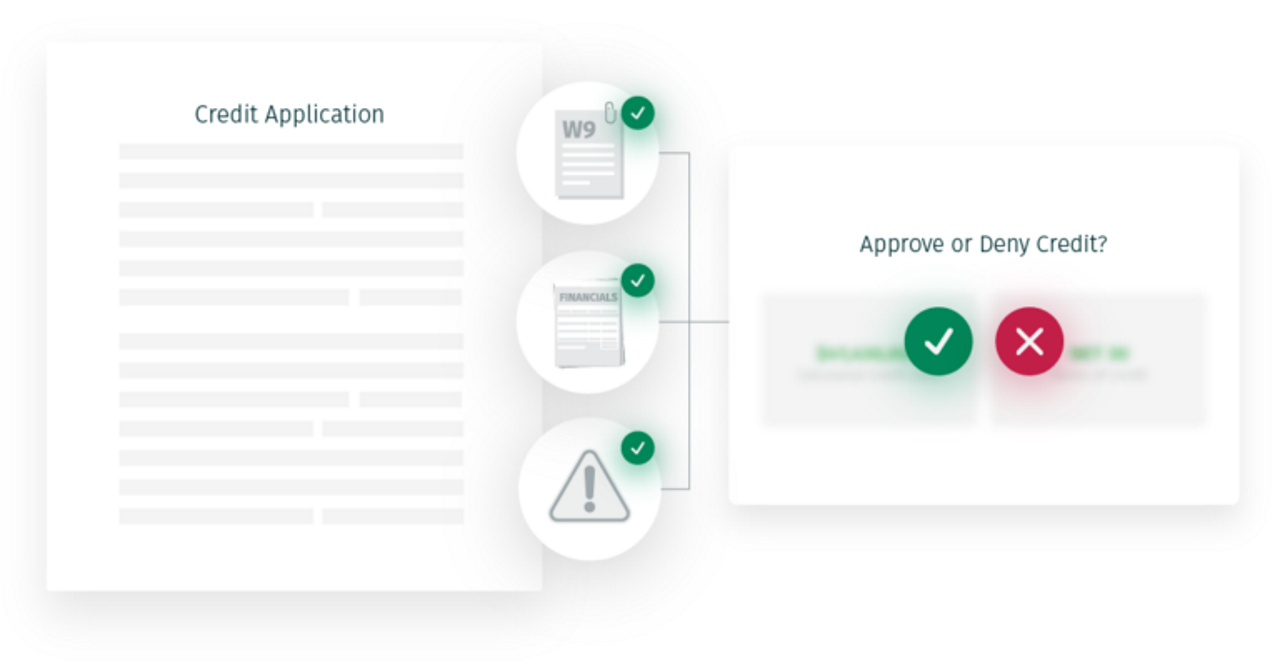

Establishing client creditworthiness is essential for managing credit risk. It involves evaluating a customer’s financial stability and reliability to ensure their ability to repay credit. Key steps include:

- Gathering financial information:

Credit applications: Collect details such as financial statements, business history, and bank references.

Financial statements: Review balance sheets, income statements, and cash flow statements to assess financial health.

- Utilizing credit bureaus:

Credit reports: Obtain reports from bureaus like Experian, Equifax, or Dun & Bradstreet to review credit history, payment behavior, and outstanding debts.

Credit scores: Analyze these scores to gauge the risk of extending credit.

- Checking trade references:

Feedback from other businesses: Contact companies that have previously extended credit to the customer to understand their payment history.

Trade reference evaluation: Assess the reliability and payment behavior based on feedback received.

- Conducting financial analysis:

Risk assessment: Use collected data to evaluate risks, considering industry factors and market conditions.

Credit limits: Set appropriate credit limits and terms based on the risk assessment.

- Ongoing monitoring:

Regular reviews: Continuously track financial status and payment behavior of existing customers to adjust credit limits as needed.

Steps in the credit management process

Managing credit effectively involves a series of well-defined steps:

- Evaluating customer creditworthiness:

Credit application review: Start by assessing the credit application submitted by the customer, including financial statements and bank references.

Credit history analysis: Examine credit reports from major credit bureaus to understand the customer's payment history and credit score.

Trade references: Contact other businesses that have extended credit to the customer to gather feedback on their payment behavior and reliability. - Setting credit limits:

Determination of credit limits: Based on the evaluation, establish an appropriate credit limit that balances risk and potential sales. This involves considering the customer’s creditworthiness, business stability, and historical payment patterns. - Monitoring payments:

Ongoing monitoring: Continuously track the customer’s payment patterns and outstanding balances. Regularly review credit limits and adjust them as needed based on changes in the customer’s financial status or payment behavior. - Handling delinquent accounts:

Collection efforts: Implement procedures for managing overdue accounts, including sending reminders, negotiating payment terms, and escalating to collections if necessary.

Resolution strategies: Develop strategies for resolving payment disputes and recovering outstanding debts, including working with collection agencies if needed.

Read now → Improve your credit policy with insights on credit card processing fees [ Blog ]

What are the skills of credit managers?

Successful credit managers require strong analytical skills, knowledge of statistics, and the utmost confidence making decisions that will affect a company's bottom line. But they also require the following skills.

Customer service

Credit managers and collections professionals play a customer service role. They offer assistance to current and potential customers, from answering questions to fixing problems, and providing great service. It's important for credit managers to build and develop strong relationships with customers so that they continue to do business with the company.

Communication

Communication skills are a must for credit managers. After all, ineffective communication can lead to ineffective collections, customer service and decisions, which can impact cash flow. For this reason, it's essential for credit managers to have clear and firm communication and establish clear expectations so that customer relationships remain strong both internally and externally.

Negotiation

Credit managers often have a much information to make an educated decision that will benefit the company versus setting it up for an unnecessary risk. Keep in mind that negotiation also applies to internal customer because you'll want to make those you work with happy too. Being customer and people centric, having a true interest in working with both external and internal customers and coming up with solutions to make everyone happy without hurting your company requires a strong negotiator.

Legalese

Even though most companies have a legal team, both internally and externally, having a working knowledge and understanding of local, state, and federal laws can help credit managers avoid creating unintentional liability for a company. When in doubt, credit managers should consult a company's legal department before moving forward with a decision.

How do credit managers make decisions?

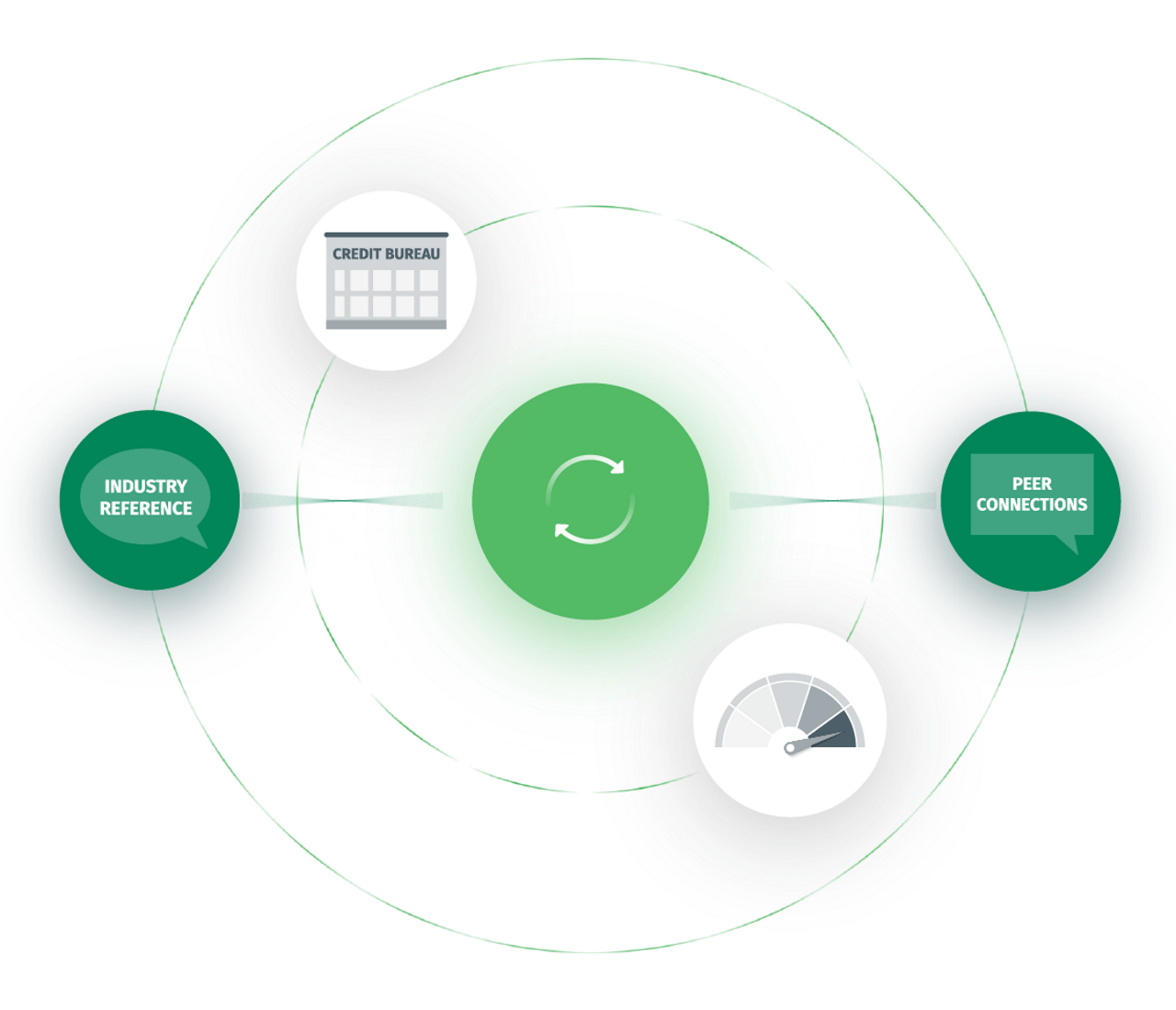

Credit Managers analyze data from a variety of sources to make educated credit decisions. After gathering information from a potential buyer’s bank, the credit bureaus and trade references, credit management teams will perform an analysis. This analysis may include calculating the business viability of the potential buyer, an indicator of the probability that the buyer will still be in business when payment comes due. The analysis may also include an accounting of their own firm’s outlay of credit. Credit managers endeavor to reduce their own company’s overall risk of cash flow shortages.

How do collections relate to credit?

Credit and collections activities are often combined into one department. Credit managers endeavor to set credit terms in such a way that buyers will be willing and able to pay on time, but when they don’t, collections activities begin. And like credit managers, collections professionals benefit from having strong communication, customer service and negotiation skills

Credit managers set the terms for collections activities when they initially grant the credit to buyers, and they direct the various enforcement actions that collectors will take to realize revenue for their company.

Key indicators of the effectiveness of the credit and collections department are Days Sales Outstanding (DSO) and percent overdue.

One crucial function of the collection agency or collection department is getting older invoices paid off quickly, so that the buyer’s line of credit will be replenished and they can make further orders. Once again, customer service skills will be crucial. Plus, a company that can't collect from their customers may create bad debt on their balance sheet.

How to improve credit management

To enhance credit management, businesses should adopt digital payments, automate cash applications, and manage invoice disputes effectively. These strategies help streamline processes, reduce errors, and maintain positive customer relationships.

- Encourage digital payments: Promote the use of digital payment methods to streamline transactions, reduce processing time, and minimize errors associated with manual payments.

- Automate cash applications: Implement automation to speed up cash application processes, reduce manual tasks, and improve accuracy in matching payments to invoices.

- Handle invoice disputes effectively: Establish clear procedures for addressing and resolving invoice disputes quickly to avoid delays in payment and maintain good customer relationships.

Credit Decisioning and the management process can be sped up by accounts receivable automation technology while producing better decisions. This is achieved in two ways:

Automating the onboarding process: The manual collection of credit application information, bank references, credit bureau reports and trade references is a slow process that involves multiple players working in coordination. Automation technology speeds the collection of material and can reduce onboarding time from weeks to days.

Artificial Intelligence powered credit analysis: AI can take in account a wide range of material including business viability scores, market intelligence and global economic trends to predict future payment likelihoods more accurately and more quickly than credit managers working without AI assistance.

Credit management automation can benefit your business

If you'd like to learn how credit management automation can benefit your business, please contact us today.

Read now → Strengthen your credit control with AR collections [ Blog ]