Collections is all about strategy. The rules of the game are simple enough: the receivables are out there and your company has a right to them. But this game has an opposing team, and to make things even more complicated, they’re your customers!

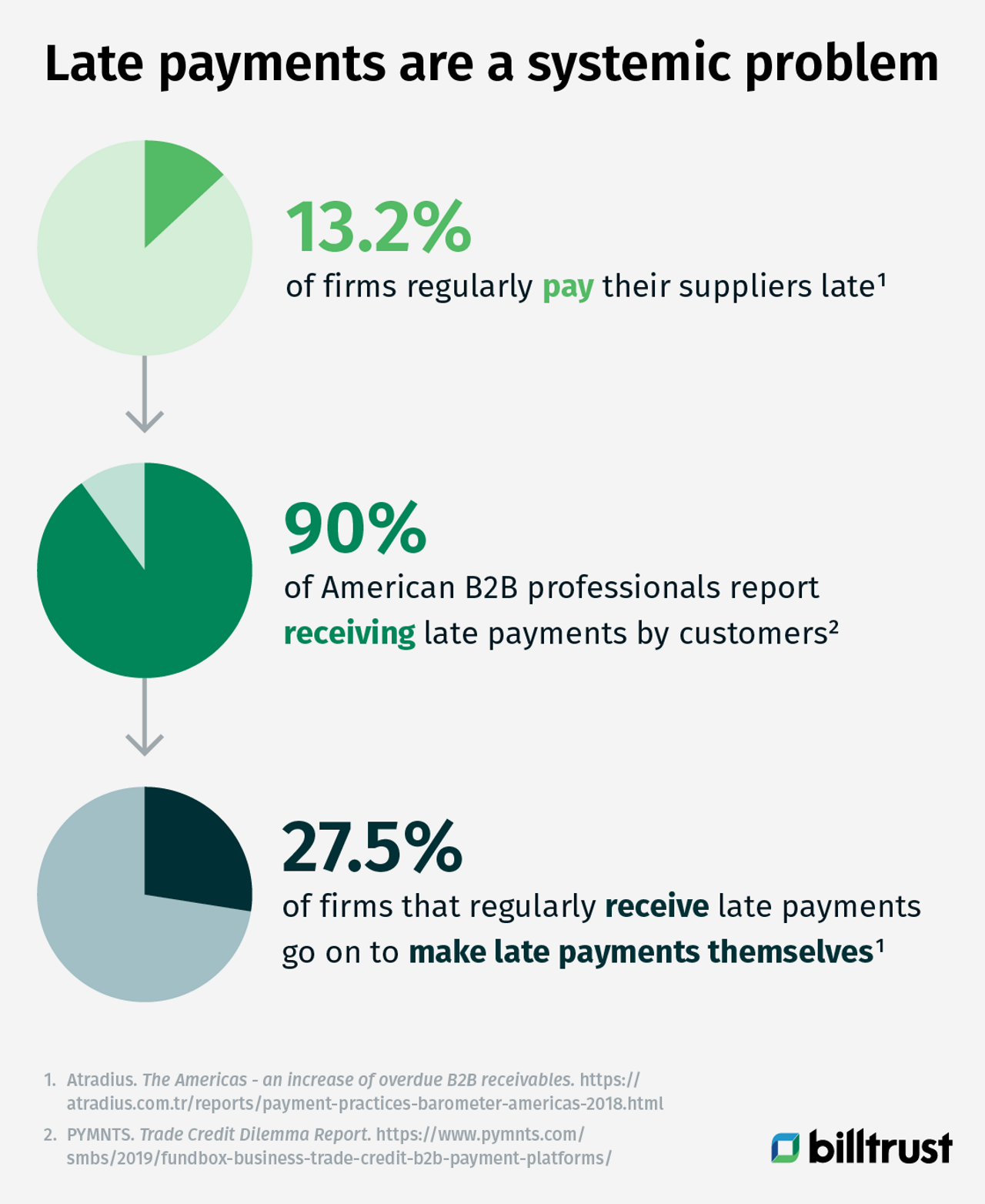

Right now, $3.1 Trillion is owed to U.S. suppliers. Much of that debt isn’t due yet, but a disconcerting percentage is delinquent. And those delinquencies are no accident. It is common practice for buyers to pay late as a cash flow management strategy, and it’s often a strategy they have little choice but to follow. According to the 2019 Trade Credit Dilemma Report, 13.2% of firms regularly pay their suppliers late. But of firms that are regularly paid late themselves, 27.5% regularly make late payments.

Late payments are a systemic problem

Ninety percent of American B2B professionals report receiving late payments by customers. Late payments drive up DSO and tie down cash flow. Collectors know they need to do better, but they’re up against some major challenges:

COVID-19 related business disruptions

- Cash flow has been interrupted leading to delinquencies and calls for extended credit terms. Nearly two thirds of B2B companies changed their credit terms in 2020.

- Offices have been closed – letting collections calls go unanswered.

Late payments as a cash flow strategy

- Buyers delay making payments in order to use cash for other expenditures

Late payments due to overworked AP departments missing deadlines

- Manual AP activities can lead to errors and oversights

Late payments due to electronic payments sent by AP providers and subsequently rejected by AR departments

- Without insight into suppliers’ payment preferences, AP providers will attempt to make virtual card payments that are unacceptable to some suppliers.

It’s a lot to deal with. But there are strategies and tools available to today’s collectors that can help them succeed in even the most challenging business conditions.

Five ways to run a more effective collections operation

1. Accept more credit cards

Accepting card payments can take pressure off of cash strapped buyers. Credit card issuers send payments on behalf of their customers and don’t require them to pay for 30 days.

In essence, when a supplier accepts a credit card payment, they are extending the credit window of their buyer by 30 days. This can make the difference between a buyer who is strategically paying late and one who pays on time.

2. Send automatic notices for accounts coming due

Many collectors know that a simple reminder that a payment is late or coming due is all many buyers need to send a payment. The world of accounts payable is just as full of complex and manual tasks as the accounts receivable world, and due dates can slip by.

But sending an email or making a phone call to remind a buyer to pay takes up a collections specialist’s time. Most collectors prioritize their biggest and most delinquent accounts with good reason.

Automating reminders to pay is the perfect solution. With automated contacts, the entire receivables portfolio can be nurtured by the collections team and, hopefully, less accounts will become delinquent.

3. Put the collections department on one strategy

Each collector is unique and takes a unique approach to their work. Collections is very much a relationship-based role, so there should always be room for individual personalities.

But collections departments work best when all collectors prioritize their work in ways that best reflect the overall business goals of their firms.

Automated collections software helps collectors align their strategies to be maximally efficient and flexible. Collections software also gives managers insight into their collector’s effectiveness.

4. Automated daily task lists

There’s a lot to remember when one is a collections specialist. Dozens or hundreds of contacts are made every day. There are promises to pay, partial payments, disputes that need to be escalated and prior behavior to take into consideration.

Collectors must keep copious notes and it is often difficult for one collector to pick up the accounts of another.

New software solutions promise a better way to go about the day-to-day work of collecting.

Automated collections software serves as a repository for information about accounts and AI-driven processes generate daily task lists for collectors.

Task lists are created based on management-approved best practices and they guide collectors through their activities for the day, prompting them to record their progress and generating insights for management.

5. Treat your collectors more like a sales organization

Collections professionals are often overlooked because they are forced into a reactive role. In reality, collections professionals are very similar to sales teams. At a high level, collections, like sales, is responsible for bringing money into the organization. And when it comes to processes, collections teams think through accounts just the way salespeople do. However, collections teams generally lack the technology and support that sales teams have to execute their workflows strategically.

Today’s sales teams, for example, have the technology tools needed to determine things like the highest probability of prospects to convert, the best time to contact buyers, the best way to contact them and so on. With these types of workflow tools, collections teams can take a much more strategic approach. After all, the best time to collect is not when the invoice is past due. With automation and machine learning, collections can reach out to customers at the right time and avoid unnecessarily friction-filled interactions that are more likely to occur the longer a payment is outstanding.

Learn more about running an effective collections team

If you’d like to learn more about how to run an effective collections team, please reach out to our sales team using the contact form on this page.