This post was originally published in January 2022 and was updated in October 2024, with additional information about the strategies for improving accounts receivable collections, the use of automation tools to streamline the process, and more.

What are accounts receivable collections?

Accounts receivable, or AR, collections is the process of recovering debts owed to a company. The first step is to identify the debtor and then find a way to contact them and ask for payment. If this fails, collection agencies may be contacted to try and recover the debt. Read on to learn more about the meaning of accounts receivable collections, whether it’s an operating activity, how to manage AR collections, accounts receivable management and more.

What does accounts receivable collection mean?

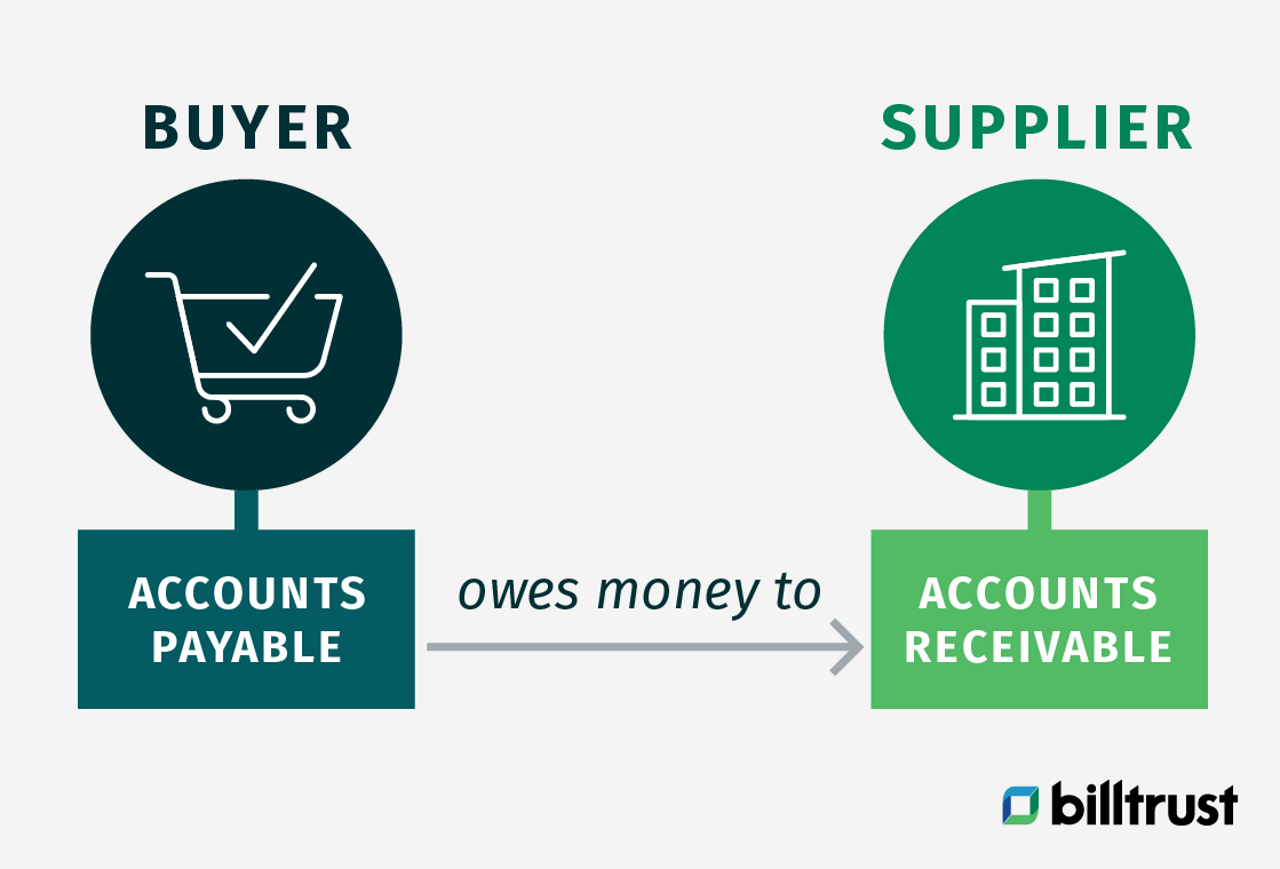

Accounts receivable are the amounts owed to a business by its customers for goods or services that are not yet paid. “Account Receivable” is an essential balance sheet item for any business. You can think of it as the "sales on account" or the amount of money owed to your business by customers who have yet to make a payment.

Accounts receivable specialists are responsible for contacting customers who owe money to the company, negotiating payment terms and following up with delinquent customers.

The accounts receivable collections process

- Invoice issuance: The initial step involves creating and sending out detailed invoices to customers. Accurate invoicing is crucial for ensuring prompt payment.

- Payment reminder: Sending reminders helps keep the invoice top-of-mind for customers and can prompt quicker payment.

- Dunning: This process involves escalating reminders and communication if payment is not made. Dunning letters vary in tone and urgency based on the age of the debt.

- Debt collection: When internal efforts fail, collection agencies may be enlisted to recover outstanding debts.

- Billing optimization: Streamlining billing processes, such as electronic invoicing and automated reminders, can enhance collection efficiency.

Read now → Minimize collection risks by improving credit management [ Blog ]

Is collecting accounts receivable an operating activity?

Collecting accounts receivable is a necessary part of any organization. To operate, a company must have some form of cash flow. Accounts receivable collections is a revenue stream for companies that falls under the category of operating activities because it aims to improve the cash flow for a company. AR collections is designed to make more money from its current customers by collecting money they owe now. And most companies try to collect in 30 days or at least 90 days.

When a company collects money from its customers, it becomes easier for that company to pay its debts. However, just because the company has the money doesn't mean it's theirs yet. They must collect the money from their customers to make it an operating activity.

How are these receivables and collections reported? A company's accounting department records accounts receivable and AR collections on its balance sheet. If a company has a receivable, an account receivable is created, and its balance is recorded as an expense while the related revenue is recognized. An account receivable collection is an asset, however, as it represents incoming cash.

How do you manage receivable collections?

Managing receivable collections is a significant and delicate responsibility for any retail or retail-related company. To efficiently collect money from customers, you need to know what your customers want and offer it. The more of their needs you can meet, the better chance they will pay for your product or service.

Though managing AR collections can be a complex process, many business strategies can help ensure your receivables get collected. You can manage receivable collections more efficiently by implementing a few different strategies, such as creating a receivable policy, sending out payment reminders and creating effective invoices. Customer analytics and automated AR solutions offer the best way to track, collect and invoice their customers. These automated processes ensure that invoices are collected promptly, preventing you from being left with uncollected receivables which lead to cash flow issues.

How to improve your accounts receivable collections

While collecting on past due invoices is always a priority for most companies, it needs to be done strategically. Ignoring the accounts receivable (AR) process can significantly reduce your cash flow and hurt your company’s bottom line. Improving your accounts receivable collections is not just about getting more money in the bank but also about improving customer relations.

There are many ways in which you can improve your accounts receivable collections including:

Research your cash flow history.

The first step is to look at your cash flow and identify the time period that has the highest percentage of invoices that are beyond their terms. Using this information, you can then determine whether an increase in collection efforts will help you improve your accounts receivable collections and maximize profits.

Optimize your sales process.

One way is by properly managing the sales process and ensuring that your invoices reflect the agreed payment terms and conditions between parties. You can also set up a system that will automatically remind clients of their bills and send reminders for payment options.

Optimize payment options.

A great way to increase payment compliance is to make it easier for customers to pay. You can do this by allowing customers to pay on your website, over the phone or through email invoices.

Offer past-due balance discounts and webinars.

Offer past-due balance discounts to incentivize consumers to pay off their balances early. You can also offer webinars with experts who have studied the effects of debt on people's financial lives to help them better understand how paying off debts can improve their financial situation in the long term. Consider further incentivizing customers by offering them a discount or reward for signing up for a webinar.

Use an automated AR workflow management software/solution.

Automated payments are the best way to increase compliance as paying paper invoices is always a time-consuming process. This is because customers have to find your invoice, write a check, and mail it in. Now with invoice automation software, customers can pay invoices from anywhere. This eliminates the need to wait for the mailman or drive to the bank. Consider an AR workflow management software or adopt an AR automation solution. These will help you track balances and better monitor when customers need to pay their invoices, creating an optimal accounts receivable management system for your business.

Read now → Simplify your collections process with cash application tips [ Blog ]

Strategies for effective receivable collections

Foundational methods and procedures for collections

- Clear communication: Establish clear lines of communication with customers regarding payment terms and expectations.

- Consistent follow-up: Regular follow-ups can prevent overdue payments and reduce the need for more aggressive collection measures.

- Negotiation: Be prepared to negotiate payment terms with customers to facilitate collections while maintaining good business relationships.

Best practices for securing signatures and ensuring compliance

- Securing signatures: Ensure that all agreements and modifications are documented with proper signatures to avoid disputes and ensure enforceability.

- Process orchestration: Coordinate all aspects of the collections process to ensure consistency and compliance with internal policies and external regulations.

Challenges & solutions in receivable collections

- Delayed payments: One of the most common issues, which can be mitigated through proactive communication and follow-ups.

- Disputes: Address disputes promptly and professionally to resolve issues that may delay payment.

- Inefficient processes: Streamline collections processes through automation and best practices to reduce inefficiencies and improve recovery rates.

Leveraging software for accounts receivable management

Modern AR management often involves advanced software solutions to optimize processes:

- Automation: Automated systems streamline invoicing, reminders, and payment tracking, reducing manual effort and errors.

- Data analysis: Tools that analyze payment patterns and customer behavior can help predict and manage potential collection issues.

- Integration: Integrating AR software with other business systems (like ERP and CRM) ensures seamless operations and accurate data flow.

Differences between accounts receivable and collections

Understanding the distinction between accounts receivable and collections is crucial:

- Accounts receivable defined: This refers to the total amount of money owed to a business by its customers for services or goods delivered.

- Collections defined: This involves the activities undertaken to recover the outstanding amounts from customers.

- Real-world scenarios: For instance, a company may have an accounts receivable balance that includes overdue invoices. Collections efforts focus on recovering these overdue amounts to improve cash flow.

Final thoughts on accounts receivable collections

Accounts receivable collections is a crucial component of the business world, and, as a business owner, you’re likely already aware that the most critical factor in your company’s success is its cash flow. Accounts receivable collections management involves collecting balances on invoices. Debt collection agencies can help you manage unpaid invoices through several methods, including phone calls, mailings and legal proceedings.

AR collections are a top priority for small businesses. A business’s ability to manage its AR is a crucial indicator of its financial health. However, several factors can cause an accounts receivable balance to increase exponentially, such as the lack of up-to-date resources or insufficient cash flow.

Gaps in accounts receivable collections can hinder accounts from timely payment and in full. Wondering how you can optimize your accounts receivable collections? Consider automated accounts receivable (AR) services, such as Billtrust, to ensure that your company continues to operate at peak performance!

Read now → Safeguard your collections from bad debt expenses [ Blog ]

FAQ

When accounts receivable are collected, it indicates that a business is receiving payment from its customers for goods or services provided on credit. This process impacts a business in several significant ways:

- Cash flow improvement: The primary effect of collecting accounts receivable is an increase in the company's cash flow. This is crucial for the day-to-day operations of the business, including paying salaries and suppliers and investing in growth activities.

- Reduced credit risk: Collection of receivables lowers the risk of bad debts, where customers fail to pay for goods or services received. It improves the company's financial health and reduces the need for bad debt provisions.

An Accounts Receivable (AR) Collections Clerk is primarily responsible for overseeing the collection of outstanding invoices owed to the company. Their duties typically include:

- Contacting customers: They communicate with customers via phone, email, or letters to remind them of their outstanding payments.

- Negotiating payments: They work with customers to negotiate payment plans for settling dues.