This blog was originally published in October 2017 and was updated in October 2024 with more information about the cash application process, including the importance of automating cash application for efficiency, reducing human error, and more.

What is cash application?

At its core, cash application refers to a critical process within the accounts receivable (AR) operations of a business, wherein incoming payments are matched and applied to their corresponding invoices. This ensures that payments received are accurately reflected in the company's financial records. To accomplish this, the payments must first be processed through various channels (e.g., bank transfers, checks, credit card payments), and subsequently, the exact amounts are aligned with the specific invoices they are meant to settle. Cash application, when executed efficiently, provides a real-time snapshot of a company's cash flow and receivables, enabling better financial management and forecasting.

How is cash application used?

The usage of cash applications in business operations unfolds through a series of important steps designed to streamline the process and bolster accuracy. Initially, the process begins with the collection of payments from customers, which can be achieved through various methods, including direct bank transfers, online payments, or physical checks.

Following this, businesses often encounter payments that aggregate amounts for multiple invoices, necessitating a breakdown and application to each specific invoice accurately. Subsequent steps involve meticulous data entry of payment details into an accounting or ERP system, reconciliation to match each payment with its corresponding invoice, and the crucial resolution of any discrepancies or mismatches identified.

The final stages encompass reporting and analytics, where the applied payments contribute to generating insightful reports on financial health, customer payment behavior, and potential cash flow issues. This highlights the incorporated value of cash application in managing financial operations efficiently.

Why is cash application important?

The importance of cash application in business can hardly be overstated, given its significant impact on several critical areas. Efficiently managed cash application processes enhance cash flow management by ensuring that payments are applied quickly and accurately, providing a real-time view of a company's financial standing. This, in turn, improves decision-making related to financial planning.

Additionally, the process plays a vital role in boosting customer satisfaction by minimizing billing and account errors, thus reducing payment disputes and enhancing the customer experience. From a risk management perspective, accurate payment matching assists in the early detection of discrepancies, mitigating risks related to fraud, accounting errors, and financial misstatements.

Furthermore, operational efficiency benefits from the automation of cash application processes, reducing manual labor, and the associated risk of human error. Lastly, a streamlined cash application process is instrumental in enabling more accurate and timely financial reporting and analysis, providing invaluable insights for forecasting, budgeting, and evaluating a business's financial health. In essence, a robust cash application process supports not only liquidity and cash flow but also underpins sound accounting practices, customer satisfaction, and strategic financial planning and analysis.

What is the cash application process? Steps in the process

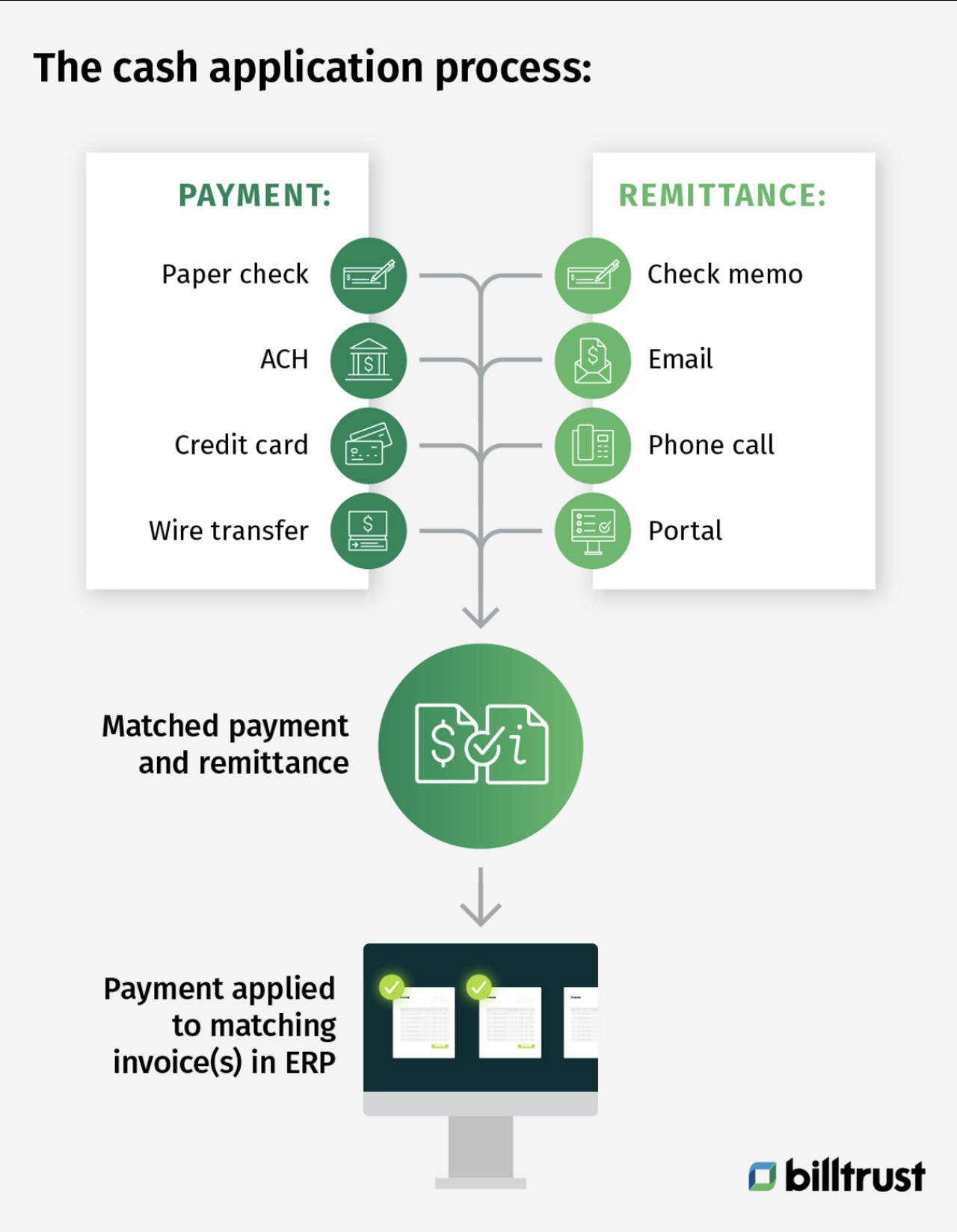

The cash application process involves matching incoming payments to their corresponding invoices and accounts. Check, ACH, wire, and credit card payments are reviewed and then matched to open invoices, and those invoices are marked as paid.

Let’s examine the cash application process in more detail and consider how streamlining it can benefit your business:

- Aggregating payments and remittances: Collecting all incoming payments and associated remittance information from various channels.

- Matching payments to invoices: Identifying and matching received payments to the corresponding open invoices.

- Coding deductions: Processing and applying any deductions or adjustments as per the remittance advice.

Role of technology in streamlining cash application

Technology plays a pivotal role in enhancing the cash application process. With advancements in AI and automation, businesses can streamline this process significantly. Automated systems can reduce manual tasks, improve accuracy, and facilitate better team collaboration. For instance, AI-powered tools can automatically match payments to invoices by reading and interpreting payment remittances, which reduces the need for manual intervention and minimizes errors. This technology not only speeds up the process but also provides real-time updates, allowing for more efficient cash flow management.

Automation in cash application

Automation technologies, such as AI and machine learning, have revolutionized the cash application process. Here’s how these technologies contribute to streamlining the process:

- Automated remittance aggregation: AI can automatically gather and categorize remittance information from various sources, such as email, electronic data interchange (EDI), and online portals. This eliminates the need for manual data entry and reduces the risk of errors associated with handling multiple formats and sources of payment information.

- AI-powered invoice matching: Machine learning algorithms can analyze payment remittances and invoices to accurately match payments to the correct invoices. These algorithms learn from historical data and patterns, continuously improving their accuracy over time. This capability significantly speeds up the matching process and reduces manual effort.

- Remote deposit capture: Advanced technologies also enable remote deposit capture, allowing businesses to deposit checks electronically without needing to physically visit the bank. This process integrates with the cash application system to automatically update the payment status, further streamlining the process and enhancing cash flow management.

- Predictive analytics: AI-driven predictive analytics can forecast payment behaviors and trends based on historical data. This insight helps businesses manage their cash flow more effectively by anticipating payment delays and adjusting credit policies accordingly.

- Error detection and resolution: Machine learning can identify and flag discrepancies and potential errors in real-time, allowing for quicker resolution. Automated systems can also suggest corrective actions, reducing the time spent on manual troubleshooting and improving overall accuracy.

Read now → Stay ahead of disputes by managing short-pay situations [ Blog ]

Cash application is complicated

One of the most important things to understand about cash application is that no two companies follow the exact same process. A variety of factors can play into the cash application process, such as the number of customers, the quantity of invoices, the delivery methods used to send invoices, payment methods and more. The process can be complex due to the handling of multiple sources and formats of invoices, receipts, and remittances. It often involves time-consuming data capture and matching, which can lead to challenges in maintaining accuracy and efficiency. As a general rule, however, the process involves going through a handful of steps before coming to completion.

These can include (among others):

- Setting up accounts for new customers.

- Receiving payments for products and/or services rendered.

- Entering payment information into the appropriate software or database.

- Reconciling bank accounts.

- Investigating any payment discrepancies that are discovered.

Manual vs. automated cash application

There are essentially two ways in which the cash application process can be performed—manually or automatically. With a manual process, a cash application specialist or accounts receivable (AR) staffer goes through each payment and remittance, matching them with their associated invoices by looking at the customer name and number printed on the invoice. This information is then posted to the company’s ERP and repeated for the next customer.

The manual approach is labor-intensive, time-intensive and is not easily scalable. Additionally, there is room for human error.

Cash application automation is becoming more common. Cash application automation not only helps to cut down on the amount of time the process takes, but it can also greatly reduce the chances of human error. The more complex an organization's cash application process becomes for an organization, the more pressing the need for automation will be.

Challenges in manual cash application

Manual cash application processes present several significant challenges:

- Human error: Manual processes are highly susceptible to human error. Cash application specialists may misinterpret payment details, make data entry mistakes, or incorrectly match payments to invoices. These errors can lead to payment misapplication, which can disrupt financial reporting and impact customer relationships.

- Time consumption: The manual process is time-intensive. Specialists must manually review and match payments, often involving repetitive tasks such as sorting through large volumes of transactions and handling diverse payment formats. This lengthy process can delay the recognition of revenue and affect cash flow. Automation not only streamlines these tasks but also frees up your team to focus on strategic, value-adding work such as financial planning and analysis, ultimately driving business growth and innovation.

- The complexity of matching payments to invoices: Matching payments to invoices manually can be complex, especially when dealing with multiple payment sources and formats. Discrepancies between payment amounts and invoice details require extensive investigation and resolution, which adds to the time and effort required to complete the process.

- Slowed cash flow: Manual cash application can be time-consuming, adversely affecting cash flow. Delays in processing payments and reconciling invoices can lead to slower revenue recognition and hinder a company’s ability to use cash for operational needs.

The benefits of automation in cash application

Having an efficient cash application process offers numerous advantages:

- Faster processing times: Automation accelerates the matching of payments to invoices, significantly reducing the time required to complete the process. This enables businesses to use the cash more quickly for operational needs and reduces delays in recognizing revenue.

- Improved accuracy: Automated systems reduce the risk of human error by eliminating manual data entry and matching tasks. AI-driven tools can accurately interpret remittances and apply payments correctly, resulting in fewer discrepancies and more reliable financial records.

- Controlled costs: Automation helps maintain predictable operational costs by decreasing the need for manual labor and minimizing errors that can lead to costly corrections. Additionally, automated processes can handle higher volumes of transactions without requiring proportional increases in staff, making it a cost-effective solution for growing businesses.

- Enhanced scalability: Automated systems can easily scale with your business. As transaction volumes increase, automation can handle the additional workload without the need for significant changes or additional resources.

- Better customer experience: By streamlining the cash application process, businesses can offer more flexible payment options and faster processing times, leading to improved customer satisfaction. Automation also helps in promptly addressing payment issues and maintaining accurate records, which enhances overall customer service.

Read now → Optimize your AR strategy with days sales outstanding tracking [ Blog ]

The bottom line: automate your cash application process

For accounts receivable professionals, the cash application process is often associated with headaches, frustration and dead ends. Much of this comes down to the fact that many companies are still handling cash application manually, which is now an antiquated methodology. Billtrust offers accounts receivable solutions that can be scaled to fit your business perfectly, including cash application automation.

Read now → Make collections more effective with AR collections tactics [ Blog ]