Basics of accounts receivable management

Accounts receivable (AR) management is fundamental to maintaining a healthy cash flow. It involves keeping track of customer debts, issuing invoices, and ensuring timely payments. Without effective AR management, businesses may struggle to have enough cash on hand for day-to-day operations and expenses.

The process includes several key components:

- Accurate invoicing based on goods or services provided

- Efficient payment collection processes

- Monitoring of customer payment behavior

- Timely follow-up on outstanding invoices

Some businesses may also need to handle more complicated billing scenarios or subscription models as part of their AR management strategy. As the complexity of AR processes grows, many companies turn to specialized software solutions to streamline their operations and improve efficiency. This is where accounts receivable automation software comes into play.

Read the blog → 10 questions when choosing accounts receivable software for digital payments

What is accounts receivable software?

Companies use accounts receivable software to perform accounting and financial reporting. The solutions may include invoice processing, general ledger, payment processing and more. Accounts receivable software provides businesses with many benefits, including automating routine accounting tasks, eliminating manual errors, keeping your books accurate and more.

Growing businesses need a quality accounts receivable program to ensure their accounting and financial records are accurate and in order. Without it, your company may suffer because of inaccuracies and difficulty collecting receivables on time or at all. If this happens, you may not have enough cash to cover day-to-day operations and operating expenses.

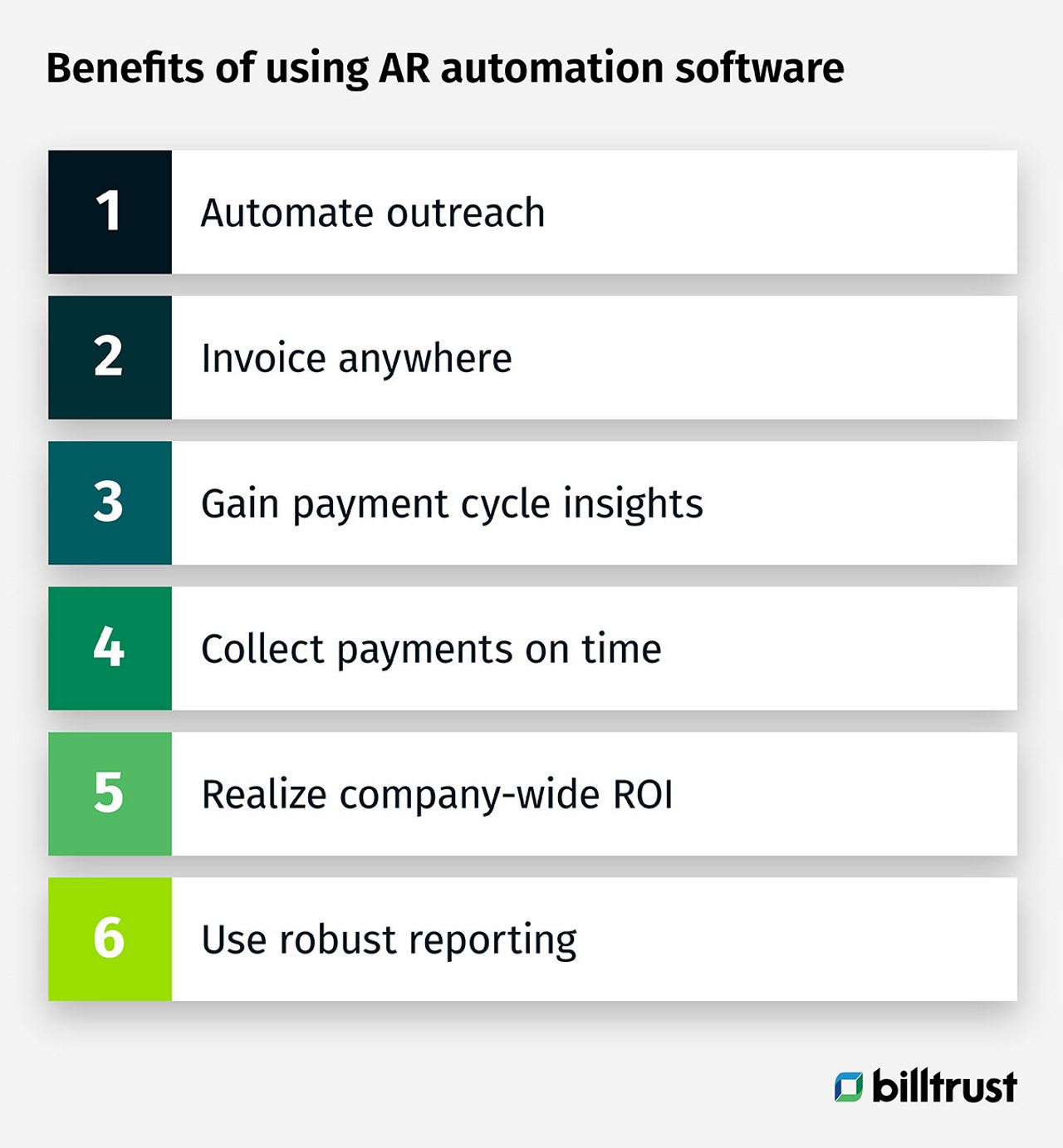

What are the benefits of using AR software?

If you want to get paid faster, implementing accounts receivable software can help your company to do the following:

- Automate outreach

- Invoice anywhere

- Gain payment cycle insights

- Collect payments on time

- Realize company-wide ROI

- Use robust reporting

The sample of benefits shows how accounts receivable software can support your company in becoming more efficient when it comes to collecting your receivables. In fact, accelerating your cash flow provides your company the opportunity to improve its financial position. Make it easy for your customers to view and pay their invoices on time electronically by removing manual processes. Using automation seamlessly moves your customers through the order-to-cash cycle so that you can convert your receivables to cash quickly and strengthen your cash flow throughout the year.

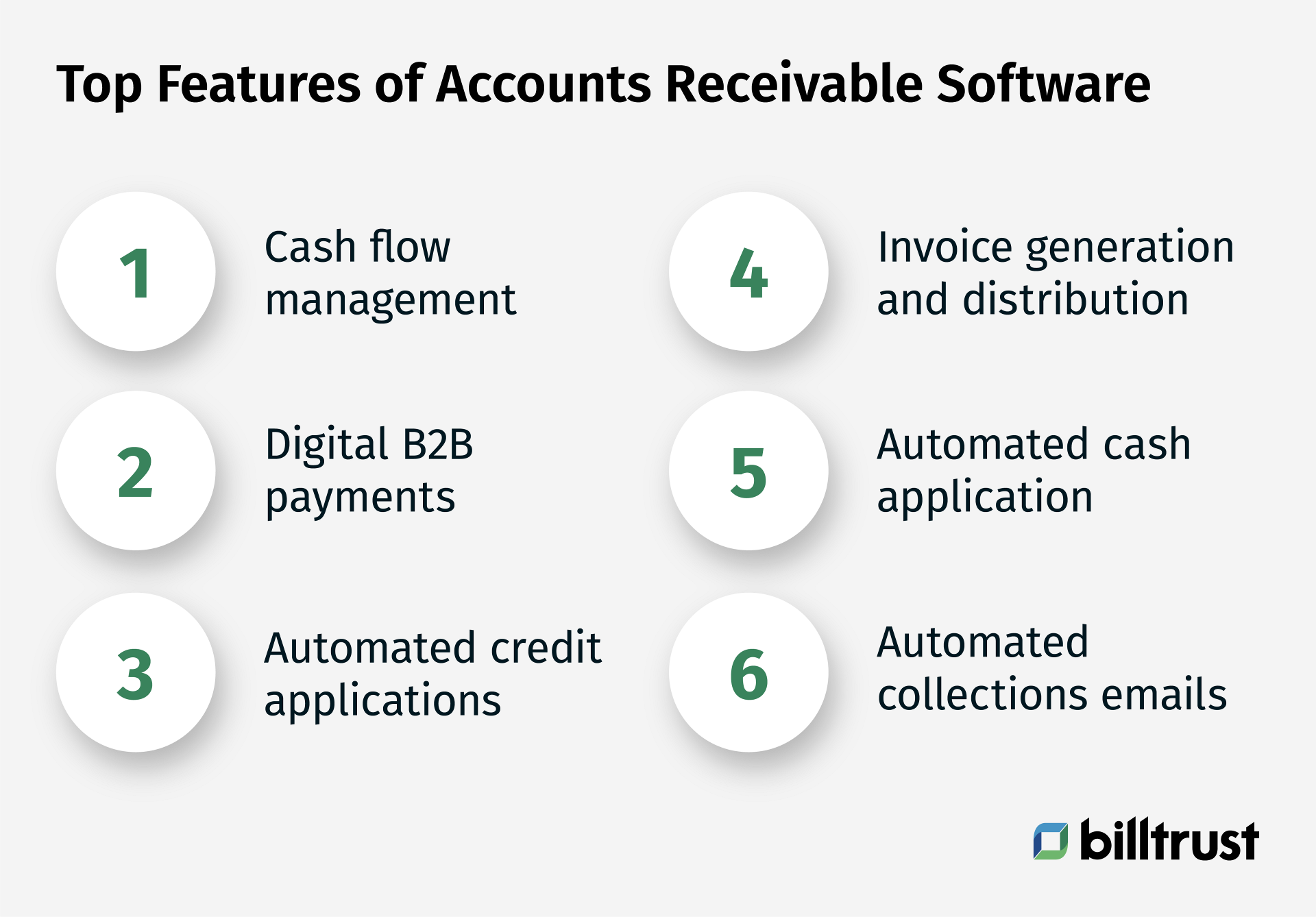

Top Features of Accounts Receivable Software

Accounts receivable software automates a company’s credit management, cash application, invoicing, payments, collections and other processes. It provides leadership with a better way to manage the cash flow cycle and customer relations and provides greater accuracy.

The optimal accounting software may vary depending on the company size and goals regarding accounts receivable management. Below are the features to look for in AR software.

- Cash flow management

- Digital B2B payments

- Automated credit applications

- Invoice generation and distribution

- Automated cash application

- Automated collections emails

Cash flow management

By consolidating your sales, invoicing, and payment processes with a single AR software vendor, you can reduce the friction between making sales and posting payments while increasing your cash flow.

Digital B2B payments

It should be easy and economical to accept and reconcile payments through all the major channels: ACH payments, credit cards, emails, wire transfers, and EFTs.

Automated credit application

Automated credit applications move your customers more quickly through the application process, gathering third-party data and helping you make faster decisions.

Invoice generation and distribution

APIs integrate with leading AP portals to deliver invoices quickly so that you may avoid the labor and expense associated with manually keying invoice data. Self-service billing and payment portals allow your customers to view and pay invoices 24/7.

Automated cash application

Intelligent cash applications software can deliver market-leading match rates even with missing or decoupled remittances by automating the process of remittance capture.

Automated collections emails

How realistic is it that collectors have time to email every customer to remind them to pay their invoice? It’s not. With automated email, you have the opportunity to create the email template, set up who should receive an email, and allow the accounts receivable software to do the rest. You can rest easy knowing that your account portfolio is being nurtured.

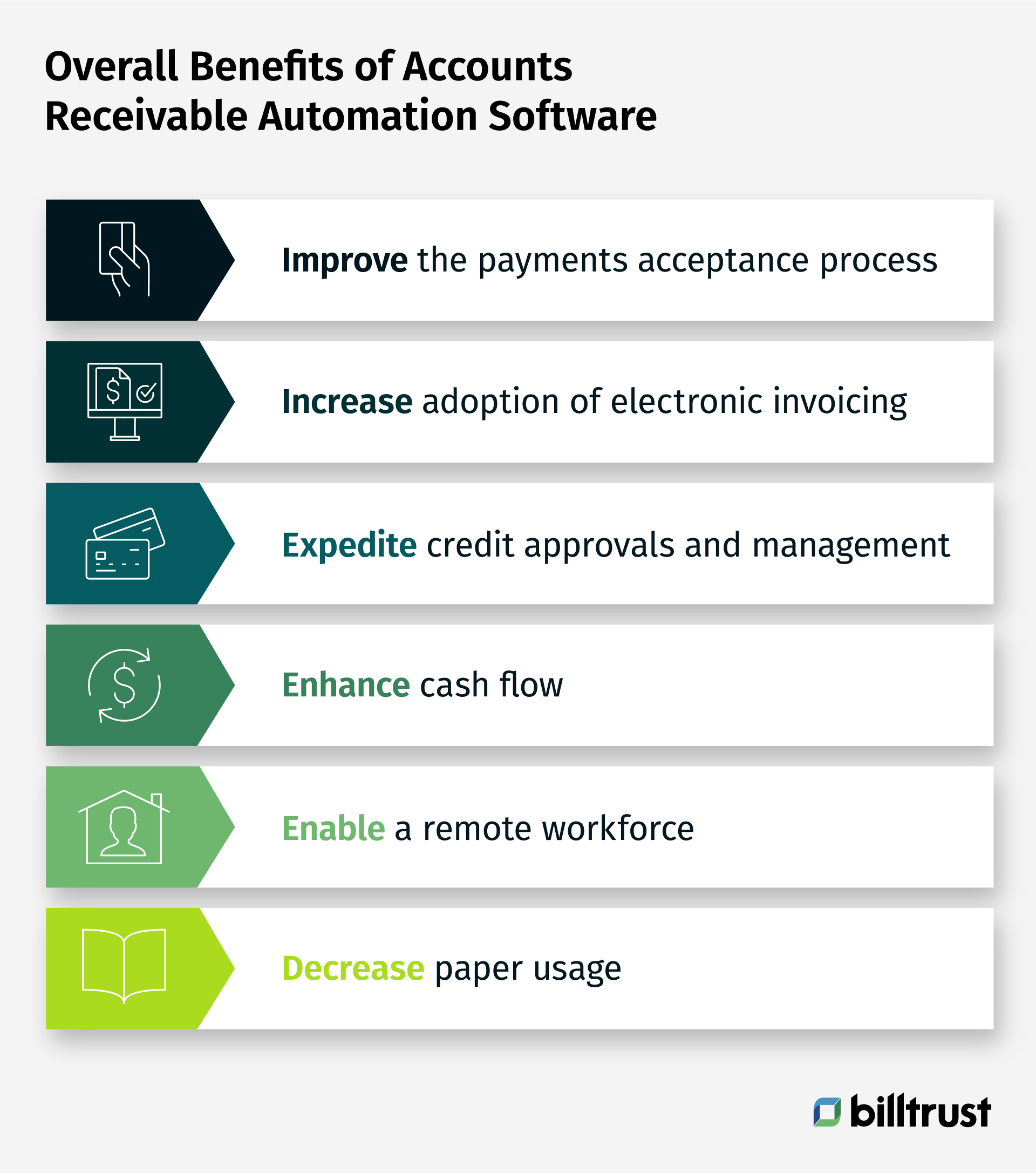

The Benefits Companies Receive from Using Accounts Receivable Software

You may be wondering about the benefits companies have received from utilizing accounts receivable software.

Improve the payments acceptance process

Automating your payments process allows you to accept your customers’ preferred form of payment more efficiently. You’ll make your cash application easier and may also save on the costs associated with accepting credit card payments.

Increase adoption of electronic invoicing

How many of your customers already accept electronic invoices? Suppose you’d like to increase your company’s adoption rate. Billtrust can analyze your current customer base and see which of your customers are accepting electronic invoices from other suppliers. We can encourage them to receive electronic invoices from your company as well.

Expedite credit approvals and management

Using a manual process to manage your credit approvals and management slows down the process. Plus, you may not receive an accurate picture of your credit risk. Onboarding your customers with credit application forms gives you better visibility from start to finish. You can also automatically obtain current bureau data and access information about customers you may have in common with your peers. Also, AI-assisted data analytics can help you with scoring so that you make better credit decisions.

Download the ultimate guide to digital accounts receivable

Enhance cash flow

If you don’t get paid on time, you may not have enough cash to pay your operating expenses. Using accounts receivable automation software allows you to manage your receivables better and gives you a clearer picture of your cash flow position. If you make it easier for your customers to pay, you may improve your cash quicker than you thought possible.

Enable a remote workforce

More companies have embraced a remote workforce for many reasons, from having access to the best talent to reducing offices' overhead. As long as your employees have access to a reliable internet connection, you can have employees anywhere in the world. You have the opportunity to connect with other time zones and countries. For example, you may have collection employees on the West Coast of the United States who work after your East Coast headquarters closes for the business day. Your team’s processing may continue for more hours daily.

Decrease paper usage

Paper invoices, envelopes and checks are standard in accounting departments; processing paper may result in multiple errors that you can’t keep track of during the month. Small business owners who use cloud-based AR systems may discover that their accounts receivable process improves because less paper means more speed, flexibility and data from implementing SaaS processes.

With receivable automation, managing your accounts receivables can remove the guesswork from determining how much time you must spend on figuring out which customers to call, when and why. Furthermore, it may speed up the collection of past due invoices, which may improve the position of your balance sheet and other financial statements.

Accounts receivable and payment management software helps your business in many ways. In fact, Paystream Advisors found that companies using accounts receivable management software can automate manual tasks and get organized faster, which may:

- Increase the time spent on contacting customers for payment to 62% from 20%.

- Reduce the time spent on managing disputes to 13% from 40%.

- Reduce the time spent prioritizing and preparing for calls to 6% from 15%.

Implementing an automated receivable solution may be a step in the right direction if you want to improve your business's cash flow.

How to leverage emerging technology to automate accounts receivable

Technology moves fast and company executives must take steps to ensure their businesses use the latest tools available to them. Three emerging technologies are driving the transformation of accounts receivable: processing mining, AI machine learning and automation.

Process mining may offer you deeper insights into your internal processes and provide data that you need about your customers, their behavior and how likely they are to pay you. This is where AI and machine learning come in handy. By using AI and ML technology, you get a complete view of your customers and better understand them. Automating basic processes can reduce repetitive tasks and manual data entry and help you to optimize your accounts receivable in the long run.

Keep in mind that the technology used to automate accounts receivable includes many moving pieces. For example, you can generate more auto-approvals with a credit application component because creditors can set parameters for outcomes for customers. Invoicing electronically through APIs and robotic process automation systems works with accounts payable portals to automatically send invoices, reducing the need and expense of a manual system.

Not only does the use of automated accounting systems increase the efficiency of an accounting department, but it may result in greater cash flow and revenue in the long run, which leads to a stronger balance sheet.

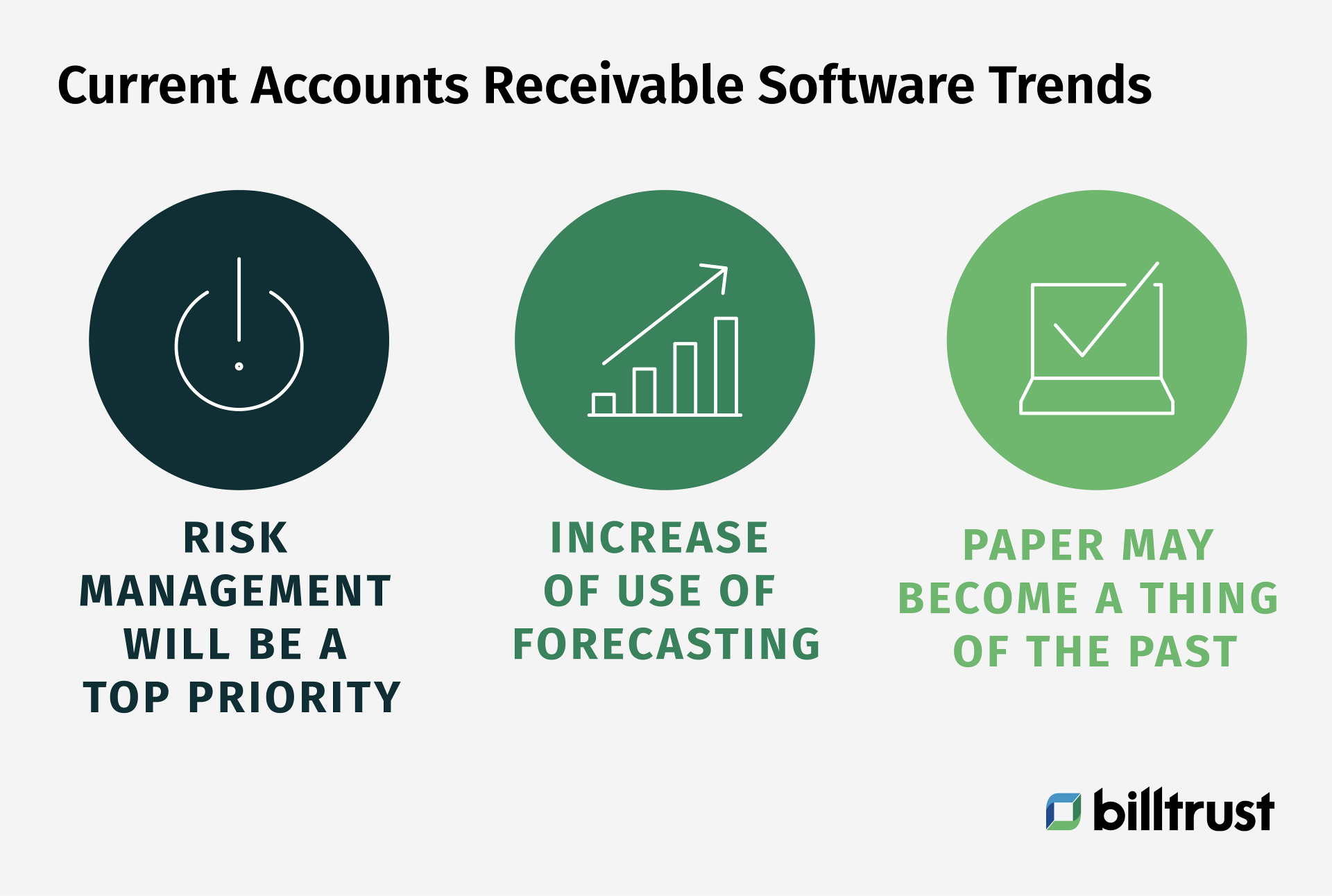

Current accounts receivable software trends

Several accounts receivable software trends have emerged throughout the years. Below are a few worth mentioning that you may want to consider.

Risk management will be a top priority

During the pandemic, many accounts receivable departments learned the hard way what may happen when customers don’t pay. This is why you need to identify the risk before it’s too late and cash flow is impacted. You must establish a data-driven view of the likelihood of your customers paying. Plus, you may consider using segmentation (like in marketing departments) techniques to identify customers who are unlikely to pay and how to approach them differently.

How to decide which accounts receivable software to use

With many accounts receivable software options available, you may struggle with choosing the best one for your business. Consider why you want to automate your current AR process. Perhaps you’d like to improve your day's sales outstanding (DSO), increase your cost savings and operational efficiency, improve your customer experience or standardize your processes.

Once you’ve identified the right accounting software for your business, you’ll want to evaluate each vendor carefully. You may want to consider whether the SaaS AR provider has experience with your industry, product, service and company size. You may also want to know if an automation software company understands any regulations that may impact your business. Most importantly, consider the level of support you may receive locally and geographically and the resources that may be available to you and your team.

Read the blog → Shopping for accounts receivable software in 2024

Accounts receivable (AR) software frequently asked questions

The FAQs below may help you understand more about accounts receivable software to make the best-educated decision for your company.

As the leading accounts receivable software company, Billtrust focuses on making it easier for companies to get paid, resulting in an accelerated and steady cash flow stream. Using an integrated, cloud-based AR platform can drive higher operational efficiency, grow revenue and increase profitability.

Free software may not provide you with all of the software you need. Most of the time, it’s limited because you have to upgrade to unlock other capabilities.

Some of the benefits of using Billtrust’s automated accounts receivable software are:

- Improve the collection of payments

- Increase adoption of electronic invoicing

- Expedite credit approvals and management

- Automate cash application

- Enhance cash flow

- Enables a remote workforce

- Decrease paper usage

With receivable automation, managing your accounts receivables can remove the guesswork from determining how much time you must spend on figuring out which customers to call, when and why. Furthermore, it may speed up the collection of past due amounts, which may improve the position of your balance sheet and other financial statements.

Accounts receivable and payment management software helps your business in many ways. In fact, Paystream Advisors found that companies using accounts receivable management software can automate manual tasks and get organized faster, which may:

- Increase the time spent on contacting customers for payment to 62% from 20%.

- Reduce the time spent on managing disputes to 13% from 40%.

- Reduce the time spent prioritizing and preparing for calls to 6% from 15%.

Automate AR with automation software

Want to learn more about accounts receivable automation software from Billtrust? Fill out the contact form.