Credit card processing fees are the costs a supplier must pay when they accept a credit card payment. These fees are not fixed and may include payments to multiple parties. On average, suppliers will pay between 1.8% and 2.5% of the total value of the transaction in fees.

Who gets the fees?

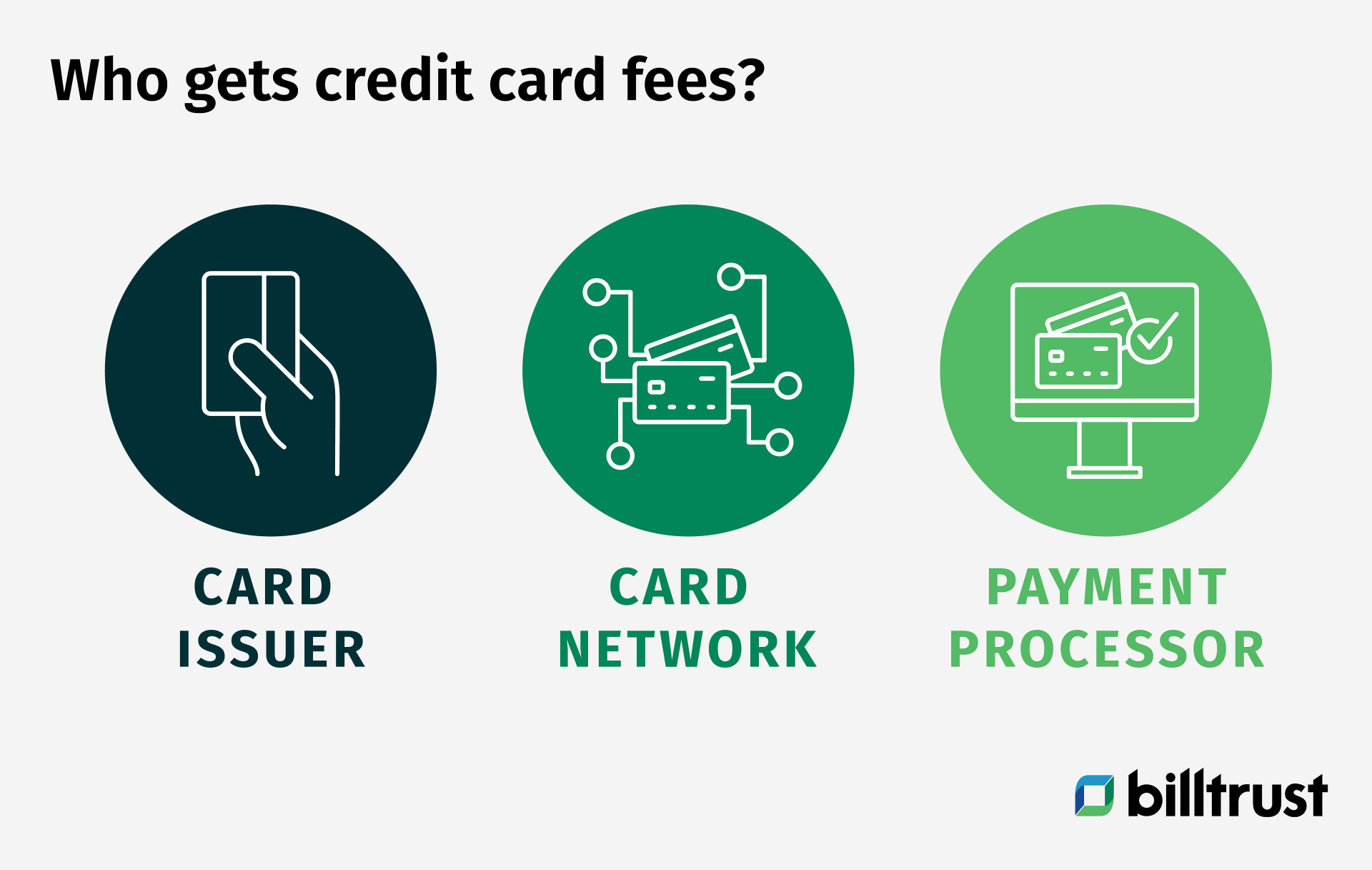

In every credit card transaction, there are three parties that may charge suppliers a fee.

The credit card issuer: This is the financial institution that issues the card. The issuer is generally a bank like Chase or Bank of America.

The credit card network: These are the companies that facilitate the transaction between the issuer and the merchant. The major credit card networks are Visa, Mastercard, Discover and American Express.

The payment processor: This is the company responsible for securing and carrying out the transaction. There are many third-party processors for suppliers to choose from.

Breaking down the fees

Credit card fees can be broken down into interchange, markup, dues and assessments.

Interchange: Makes up the largest portion of the fee. Goes to the issuer to fund cardholder operations and rebates.

Markup: Goes to the merchant processor which the supplier uses to accept card payments.

Assessment: Goes to the network (Visa, Mastercard, Discover, American Express) for allowing the issuer to transmit the payment from the cardholder to the merchant.

What influences the interchange rate?

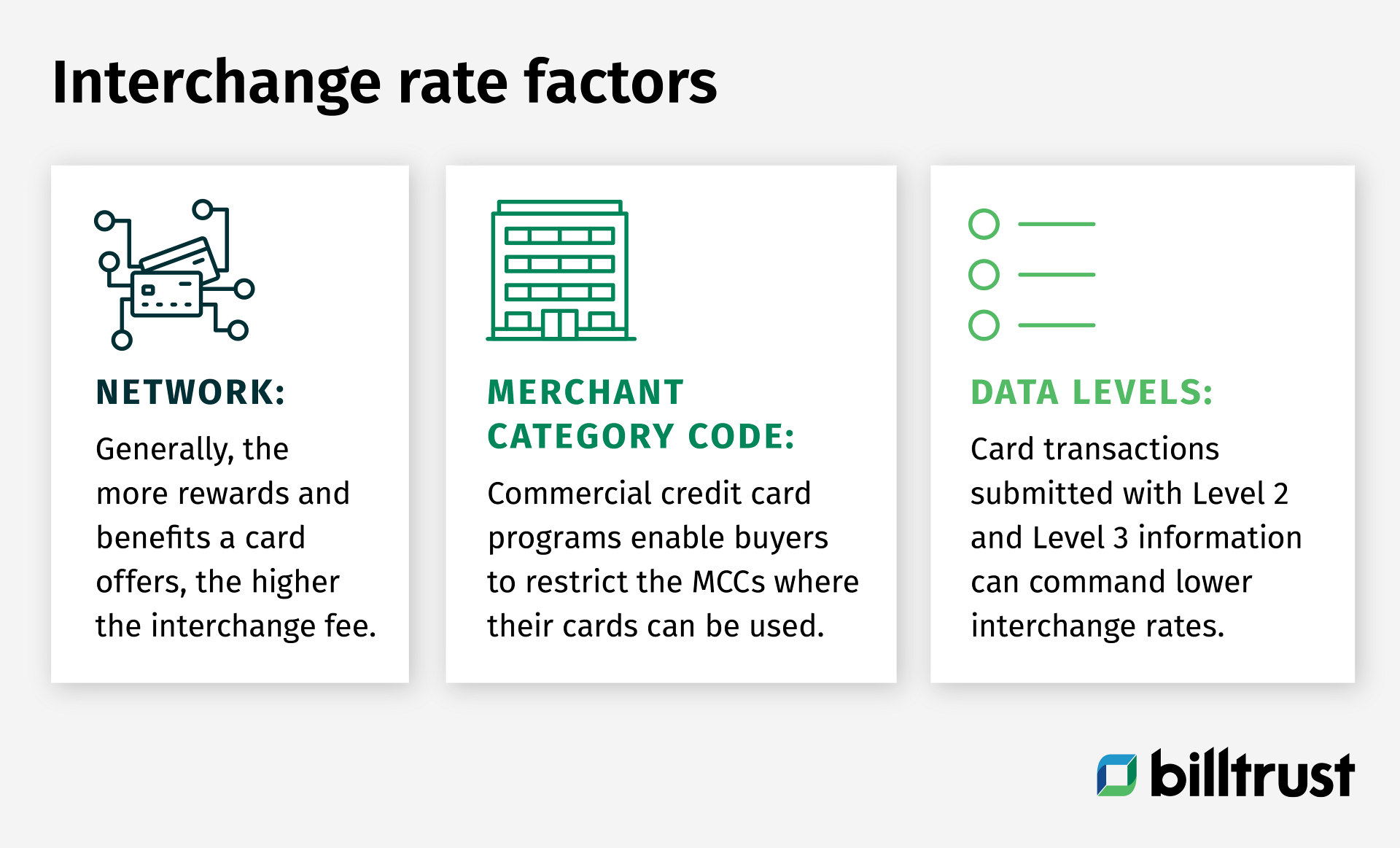

Interchange rates are based on a number of factors:

Network

Each of the four major credit card networks charges a different interchange rate and these rates are subject to change.

Merchant Category Code (MCC)

MCCs are four digit numbers that classify the types of transactions a cardholder is making. These classifications can be influenced by the category of the supplier’s business.

Data levels

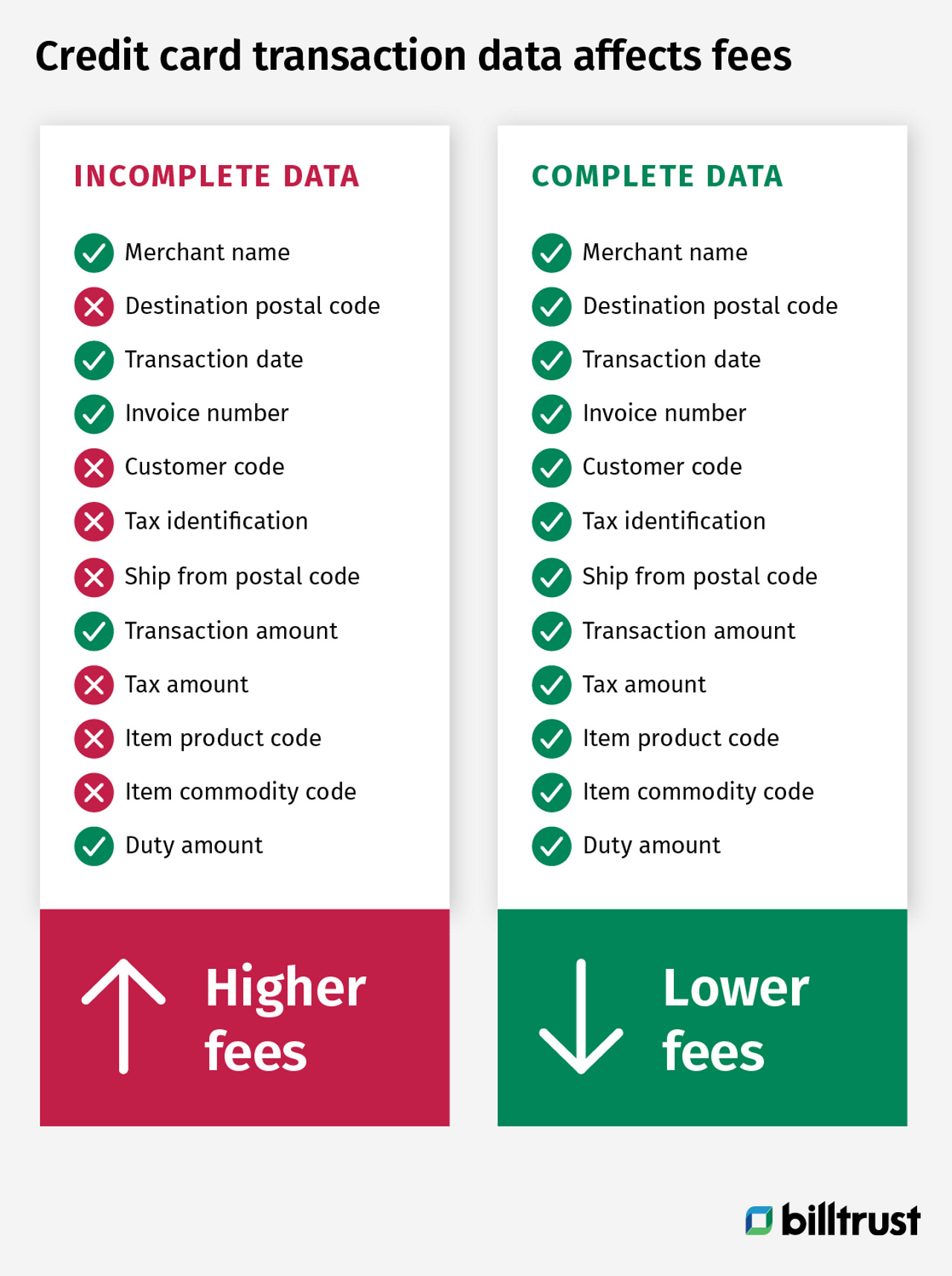

Credit card processing is categorized by three levels of data: 1, 2 and 3. Each level describes a certain amount of information about the payment. Level 1 includes the least information and Level 3 the most.

Card transactions submitted with Level 2 and Level 3 information can command lower interchange rates because credit card issuers have more confidence in the transaction being legitimate. But it can be challenging to submit Level 2 and Level 3 data with each transaction.

Each card type that supports Level 2 defines its own standards for the additional information required. Potential fields include:

- Purchase order number

- Destination Zip

- Tax indicator

- Tax amount

- Requestor name

- Destination address

- Destination city

- Destination state

Level 3 payments require all of the information of Level 2 along with additional information. These additional fields may include:

- Item ID or SKU

- Item description

- Unit price

- Extended price

- Unit of measure (each)

- Commodity code

- Line discount

How can a business lower credit card processing fees?

A supplier can lower their credit card processing fees by pursuing lower interchange rates and processing fees.

Suppliers can lower their interchange rates by submitting Level 2 and Level 3 data with their transactions. Many suppliers look to outside vendors to help them achieve Level 2 and Level 3 data.

Suppliers can lower their processing fees (the additional fees paid to their payment processor) by negotiating their pricing structure or by using a membership-based model, wherein the supplier pays a monthly or annual membership fee to forgo additional fees beyond the interchange rate.

Are there other ways to lower the impact of credit card processing fees?

Suppliers can improve their margins on credit card payments by lowering the costs associated with applying the funds received from cards.

This is most easily achieved by automating their payment acceptance and cash application processes. Even though credit card payments come with remittance advice attached, most ERP systems cannot automatically apply the cash to open invoices. An automation vendor can help suppliers achieve straight-thru-processing of virtual credit card payments and save resources that would otherwise be diverted to the manual task of matching VCC payments to open invoices.

To learn how accounts receivable automation can help lower your costs to accept credit card payments, connect with Billtrust.