The need to move toward automated accounts receivable processes becomes more urgent every day. Manual processes throughout the order-to-cash (O2C) cycle have found themselves under extra scrutiny as suppliers and customers come to terms with new post-pandemic norms, and the cost of inefficiency can be fatal for business.

Online payment portals, billing via email and even payment by SMS or apps on smartphones are the future, and the future is closer than you think.

Why accounts receivables needs to move toward digital processing

The first thing to mention here is that accounts payable teams have been automating their processes for a long time now, and according to a Forrester forecast, spending on AP automation is set to double from 2020 to 2021. The numbers are compelling, and failure to keep up with how customers want to pay is a sure way to lose them. So let’s start with the customers you’re most at risk of losing: Millennials.

Digital natives aren't using checks

The generations entering the workforce between 2000 and 2040 are digital natives and think digital first. Early Millennials are already in their 40s and occupy leadership roles — which means they’re involved in their organizations’ vendor selection processes. And just like all humans, they’re likely to prefer tools they can master quickly and which make sense to them.

In a recent Billtrust Survey of Gen-Z payments preferences, 63 percent of respondents said they hadn’t written a check in the last six months or that they’d never written a check. Ever. So the best way to lose customers, especially those with a number of under-40s in accounts payable leadership positions, is to give them fewer options to pay, and don’t offer a way to pay digitally.

The postal service takes too long to deliver invoices and payments

The most effective way to control the delivery of bills is to minimize the amount of time your bills are in transit. Switching to electronic delivery should be a top priority so you can stop worrying about when the bills will get there and can instead focus on those other actions that help speed up payment.

A lot of things went sideways in 2020. Accounts receivable and payable teams had to contend with increased demands on the postal service that led to delays in the delivery of paper invoices and the timely return of remittance and checks.

Those delays can transfer to an upward trend in days sales outstanding for suppliers, and extra time before payments are applied to customer accounts.

Increasing days sales outstanding (DSO) translates to cash flow constriction which affects all parts of the supplier organization. It impacts everything from hiring to whether enough cash is available to pay wages. Tighter cash flow, even temporarily, can prompt budget cuts or have longer-term effects when it comes to securing financing for growth.

When customers’ payments don’t enter the cash application process in a timely way, the amount of credit they’re able to use for new purchases is also impacted. And in those cases, smart customers diversify their supply chain so they don’t run out of product before they’re able to restock.

Remote work is already forcing changes for accounts receivable teams

When the pandemic took hold in the spring of 2020, companies had to quickly figure out ways to work remotely — if remote work was even an option for them.

Throughout the order-to-cash process new ways of working were discovered or innovated. Invoice stuffing parties had to stop as the job of printing and sending invoices was quickly outsourced or automated. For some businesses, that transfer of a simple, repetitive task provided unexpected savings as the value of the regained productivity for taking employees out of the bill-mailing process outweighed the cost of automation.

But on the back end, when payments are sent to suppliers, there were pitfalls to avoid. Customers may have mailed their remittance and check to the supplier’s company address like they had done for years, unaware that nobody was in the office to receive the payment. Suppliers needed to update their remittance address for in-house processing or adopt a lockbox. And even then, they’d need a plan to recover incoming mail from the previous address.

And the challenges weren’t limited to sending invoices and receiving payments. The people performing all the tasks in the accounts payable and receivable process needed infrastructure to do their work remotely. Not least of these concerns was…

How to be PCI compliant while working remotely

Data security is a huge concern when transferring to a fully-remote workforce for processing invoices and payments. Controls may be difficult to implement and monitor off-site, and additional risks of unauthorized access to paper records need to be mitigated in accordance with payment card industry security standards.

Virtual credit cards had a banner year in 2020, precisely because the extra layer of security provided by a single-use or single-vendor card number means hacking them and clearing out the account is virtually impossible and makes PCI-DSS compliance easier to demonstrate.

Customer relationships still matter, and buyers have all the power

Everything we’ve discussed so far is important, but ultimately it’s how your customers feel about your relationship that’s most important. If your customers are telling you they want to be able to receive and pay bills online, you’re going to have to provide it sooner or later because there are other vendors who already do.

If you offer early-payment discounts that require customers to make a payment within a short window of opportunity, sending everything through the mail reduces the time your customers have to return their payment and earn the discount — which could result in less-than-happy customers. But what would make them more unhappy is getting a collections call about an invoice they’ve already sent payment for, which is stuck in the mail because you insist on paper payments.

The cost of fixing customer perception of your brand, or acquiring new customers as your turnover increases, is likely more than the cost of bringing your billing and cash application processes in line with what customers expect.

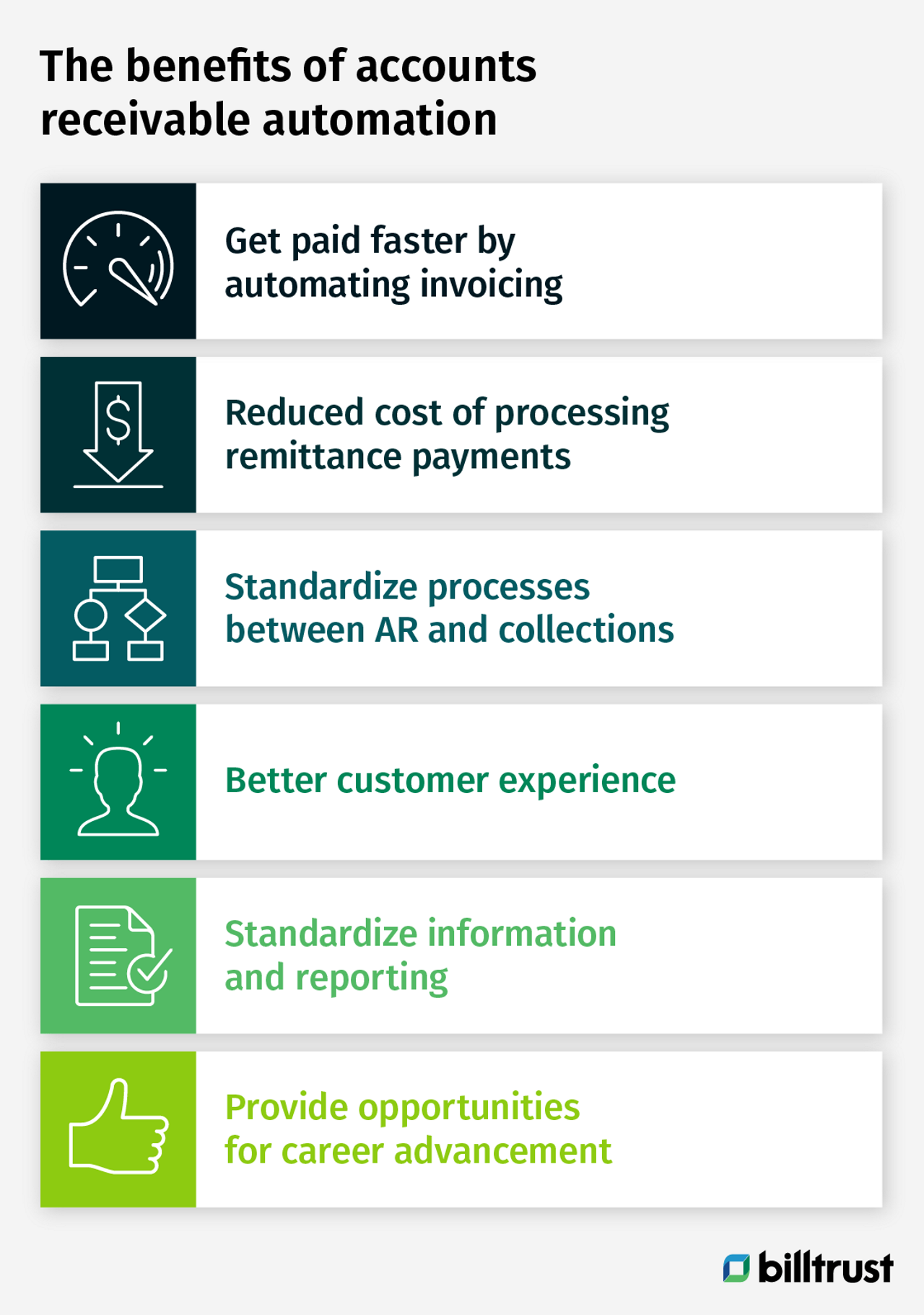

What are the benefits of accounts receivable automation?

As with most things in business, what gets measured is what gets done. When accounts receivables team members use esoteric processes and create their own spreadsheets to build reports, there’s a potential for mismeasurement, leading to the possible misreporting of progress.

Get paid faster by automating invoicing

The steps in sending an invoice are manual, time-consuming, occur with high frequency, involve multiple data files across multiple systems and have a high cost if they go wrong. Coincidentally, these are also some of the criteria for identifying processes to automate.

By automating or outsourcing compiling, printing and mailing invoices, you can reduce errors, increase efficiency and allow your team to focus on more strategic or business-critical work that can’t be automated.

Reduced cost of processing remittance payments

Since 2000 there’s been a 3X increase in remittance volume. And while that hasn’t seen a correlating 3X growth in expenditure on remittance processing, the cost of processing individual invoices hasn’t reduced significantly.

How much would it be worth to your business to cut remittance processing expenses by 20 or even 50 percent? What if you could reduce it by 80 percent? Where would you invest those savings? How much growth would that support?

Standardize processes between AR and collections

Some of the most valuable process information companies have isn’t found in procedure manuals, it’s in the gray matter of employees who have been there for years. They know the process and while they could explain it, it’s just easier for them to do it.

Those people are amazing to have on your team right up until they retire or win the lottery. And then you lose all that institutional knowledge and those personal relationships that smoothed bumps in the road before they became a problem.

Having a properly documented process for handling accounts receivable and handing off delinquent accounts to collections is one of the prerequisites and benefits of automation. Automated processes, without an artificial intelligence or machine learning layer, do the same thing over and over again. To understand how to repeat a process, the software needs to know what the process is, which means you have to standardize and document it.

Bringing stakeholders together to create the procedure document pushes them to align on what processing occurs at each step, and what information is handed off at each interface point. That alignment across functions provides a basis for healthy accountability when the process isn’t followed, and a guide to putting errant processes back on track.

Better customer experience

Customers want to pay in the way that’s most convenient for them. Or that gives them reward points or cashback on their credit card — which is like getting a discount when they pay. But if you only offer payment by check, your customers are going to miss out on the benefits they’d experience paying how they want to.

And it’s not just air miles at stake, paying you by check means the funds come out of the customer’s business bank account within a week. Paying by credit card allows them to float up to an extra month before they begin paying interest charges or making payments, which allows them flexibility in managing their cash flow.

But mostly, offering a variety of ways to receive invoices and make payments tells your customers that you care about their experience, and that making their life easier is important to you. That’s the kind of goodwill you just can’t buy.

Standardize information and reporting

Remember how what gets measured is what gets done? Well making sure everyone is measuring the same things in the same way is just as important. The output from one process should become the input of the next. Exceptions need to be organized by error code, aging reports by days and dollar amounts.

The same process you go through to standardize processes can be used to define reporting requirements, which are then incorporated into the reporting suite of your automation software. Consistent reporting puts everyone on the same page because everything is being extracted from the same data sets rather than extracts on individuals’ computers that might have been pulled at different times and manipulated in inappropriate ways.

Provide opportunities for accounts receivable career advancement

Utilization isn’t just a fancy word for “use,” it’s a productivity metric that measures the efficiency of production output compared to maximum capacity: How much output was generated versus how much could have been.

It’s a great measure for machinery, but it’s less helpful when measuring human performance because humans cannot sustain 100 percent utilization — even over relatively short periods of time. Operating at 100 percent efficiency means you’re only doing the same thing over and over again. It means time isn’t available to learn new skills that would help you reach the next level of your career.

By taking those repetitive tasks and automating them, your accounts receivable team gets to have some time on its hands to create strategy, innovate new processes and do the things that only humans can do: create great relationships with your customers and invest in growing their careers.

Improve your order-to-cash process

If you’d like to learn how Billtrust can help improve your order-to-cash process, please fill out the contact form.