From Security to Cryptocurrencies -- How Gen Z’s Views on Payments will Transform the Entire Ecosystem

As new generations enter society, we attempt to analyze them in order to understand how they will impact society and shape the world to come. Each generation brings a unique set of circumstances and attributes that enable them to leave their indelible mark. Generation Z (Gen Z), those born after 1995, is poised to be the largest and most influential generation to date.

Based on a recent analysis by Pew Research Center, this generation is expected to be the best-educated, most diverse and most tech-savvy generation in America. So it’s no wonder that companies and entire industries are placing an emphasis on decoding Gen Z in order to cater to them and harness all they have to offer.

As digital natives with an uncanny ability to adopt and adapt to the latest technologies, Gen Z has a very different view on almost everything, from the way they consume content to the way they shop. This digital lifestyle carries over to payments; where money is held in digital wallets and sent instantly across borders.

As the B2B payments space plays catch up to its digital B2C counterpart, Gen Z’s entrance in the workforce—including in accounts payable and receivable roles—will ultimately play a significant role in shaping the future of how businesses pay each other and their employees. With this and other factors, including the continued consumerization of IT and the massive check volumes that exist in the B2B payments space as a backdrop, we wanted to get an understanding of how these “Post-Millenials” will impact the space. To do so, Billtrust commissioned a research study encompassing responses from 750 Gen Z individuals from ages 18 to 23. The goal being to uncover the views, beliefs, and perceptions of the next wave of workers entering the job market, and how they will influence the way companies think about B2B payments.

Here’s what we found:

Digital Wallets Are the New Norm for Digital Natives

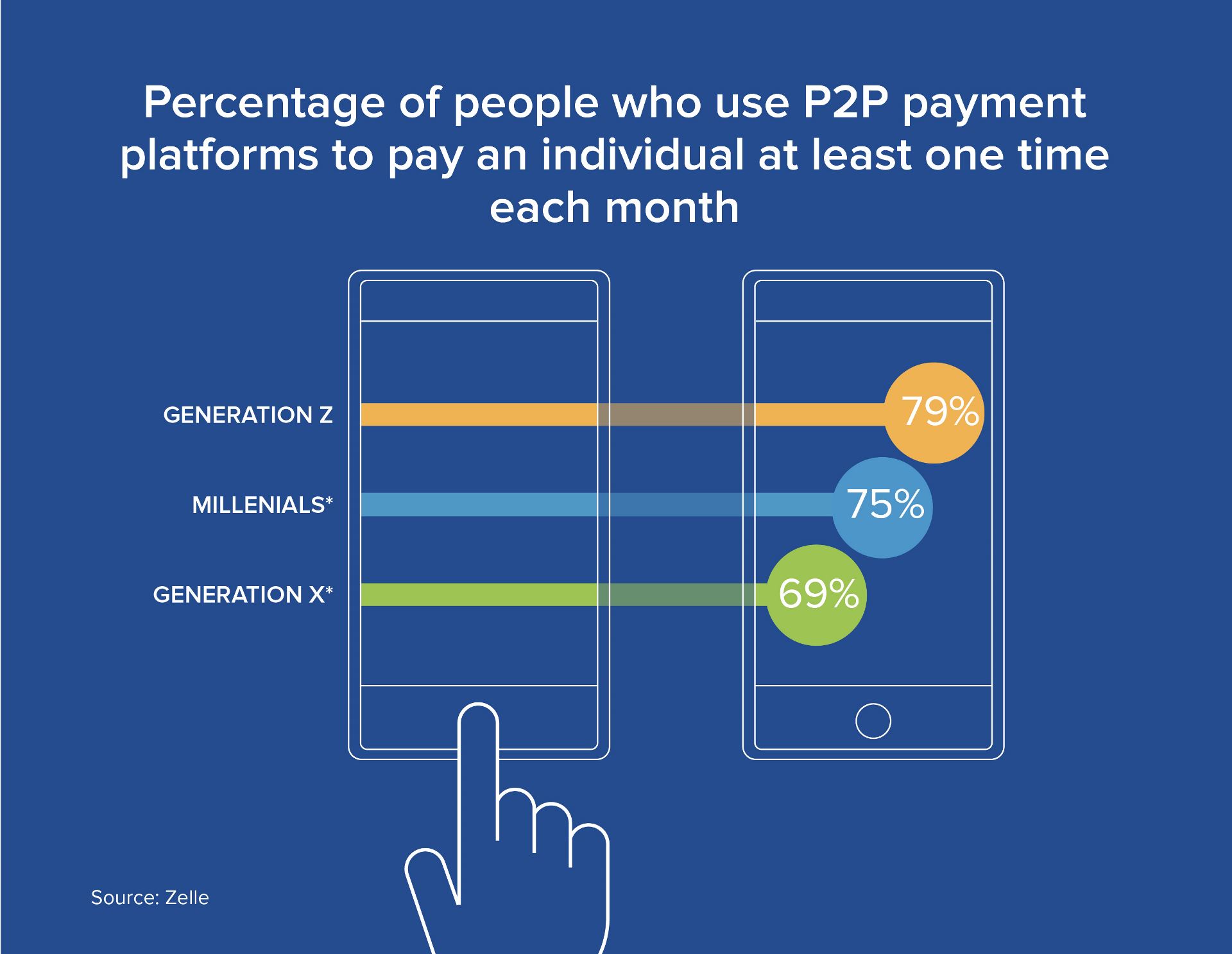

When it comes to paying individuals or doing business with companies, person-to-person (P2P) and B2C digital payments are the new ‘norm’ for Gen Z. When asked “How often do you use P2P payment platforms (Venmo, Paypal, Zelle, etc.) to pay an individual each month?,” 79% of Gen Z reported using at least once per month. Despite their youth, that means Gen Z is already using P2P payments more than Millennials (75%) and Gen Xers (69%), based on previous industry reports.

In fact, the majority of Gen Z respondents (47%) reported that they use these services 1-5 times a month and there is also a very large percentage (32%) of Gen Z using more than 6+ times per month! This is in line with a recent Accenture survey that found 68% of Gen Z consumers are interested in instant P2P payments — more than any other age group.

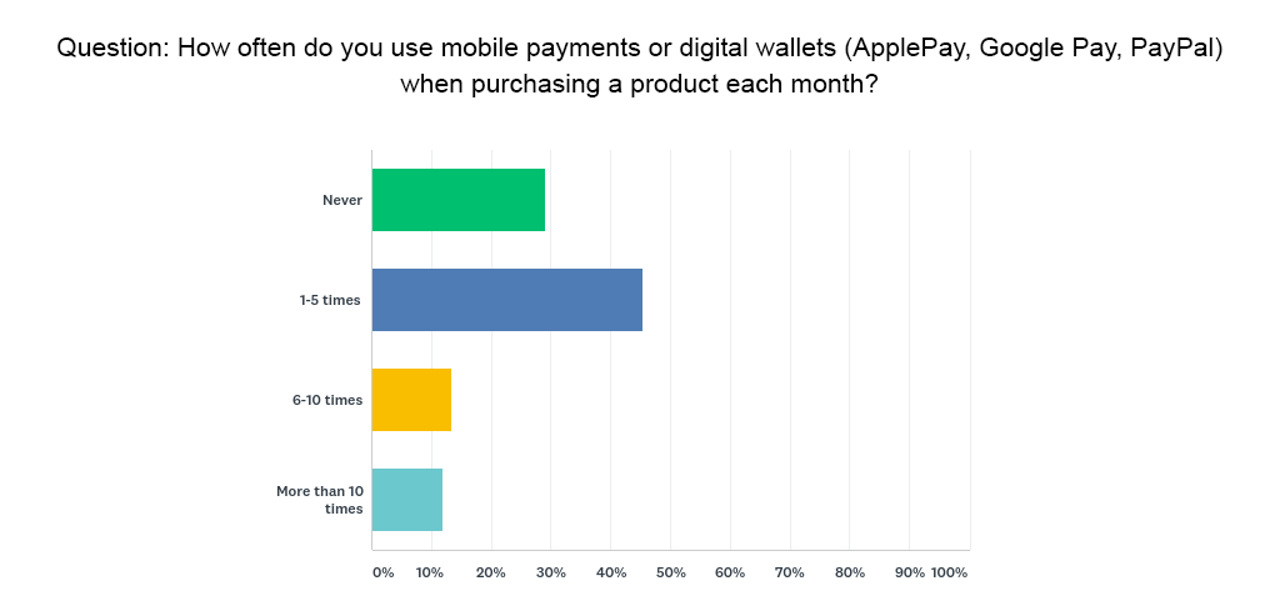

While services like Venmo have become popular for their convenience, perhaps more interesting is the fact that Gen Z is ditching credit cards and cash for digital wallets. When asked “How often do you use mobile payments or digital wallets (ApplePay, Google Pay, PayPal) when purchasing a product each month?,” the majority of respondents (46%) reported that they use digital wallets 1-5 times a month, while 13% are using them 6-10 times a month.

Only 30% of Gen Z respondents reported that they never use digital wallets to purchase a product. These findings coincide with a recent study from Javelin Strategies that found 51% of Gen Z members do not plan to apply for a credit card. The same study also found that only 18% of Gen Z prefers cash to make payments.

What’s a Check?

While the use of paper checks continues to see an incremental decline, 51% of B2B transactions—which double consumer payment volume at $13 Trillion annually—are still paid for by check. Taking a look at our Gen Z respondents, it’s safe to say that this decline may be heading towards a precipitous drop off to extinction, especially as members of Gen Z assimilate into the workforce.

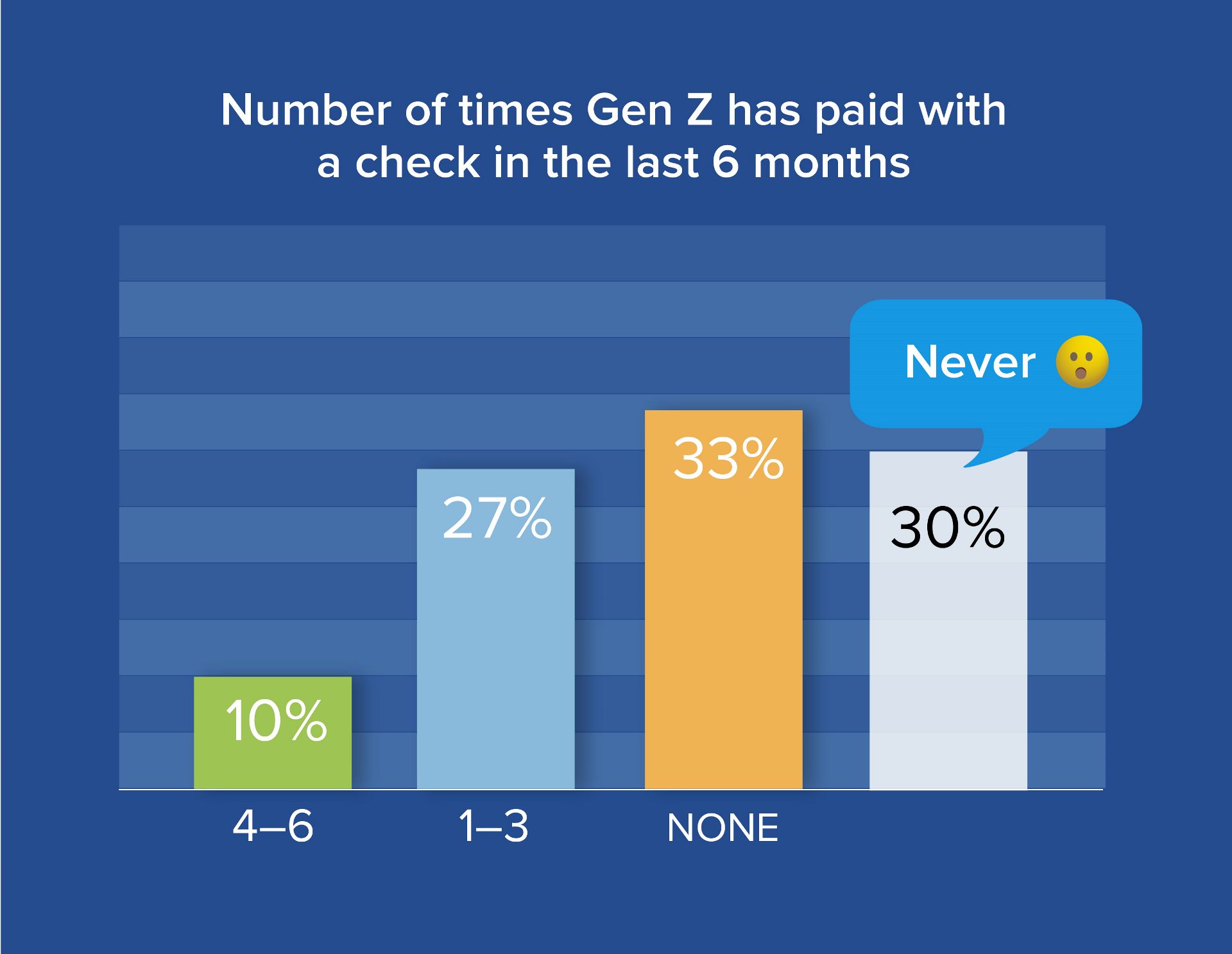

When asked “In the last six months, how many times have you used a paper check to pay for something?,” the majority of respondents (33%) reported that they have not used a paper check in the last six months. Most surprisingly, 30% of respondents reported that they have never used a paper check in their life! Again, this means Gen Z is further ahead of the digital curve than their slightly older peers. Previous research has found that 20% of millennials have not used a paper check in their life.

While 27% reported that they have used a check 1-3 times in the last six months, it’s important to note that the paper check is a required form of payment for many universities during back to school season.

Security Is Top of Mind for Gen Z

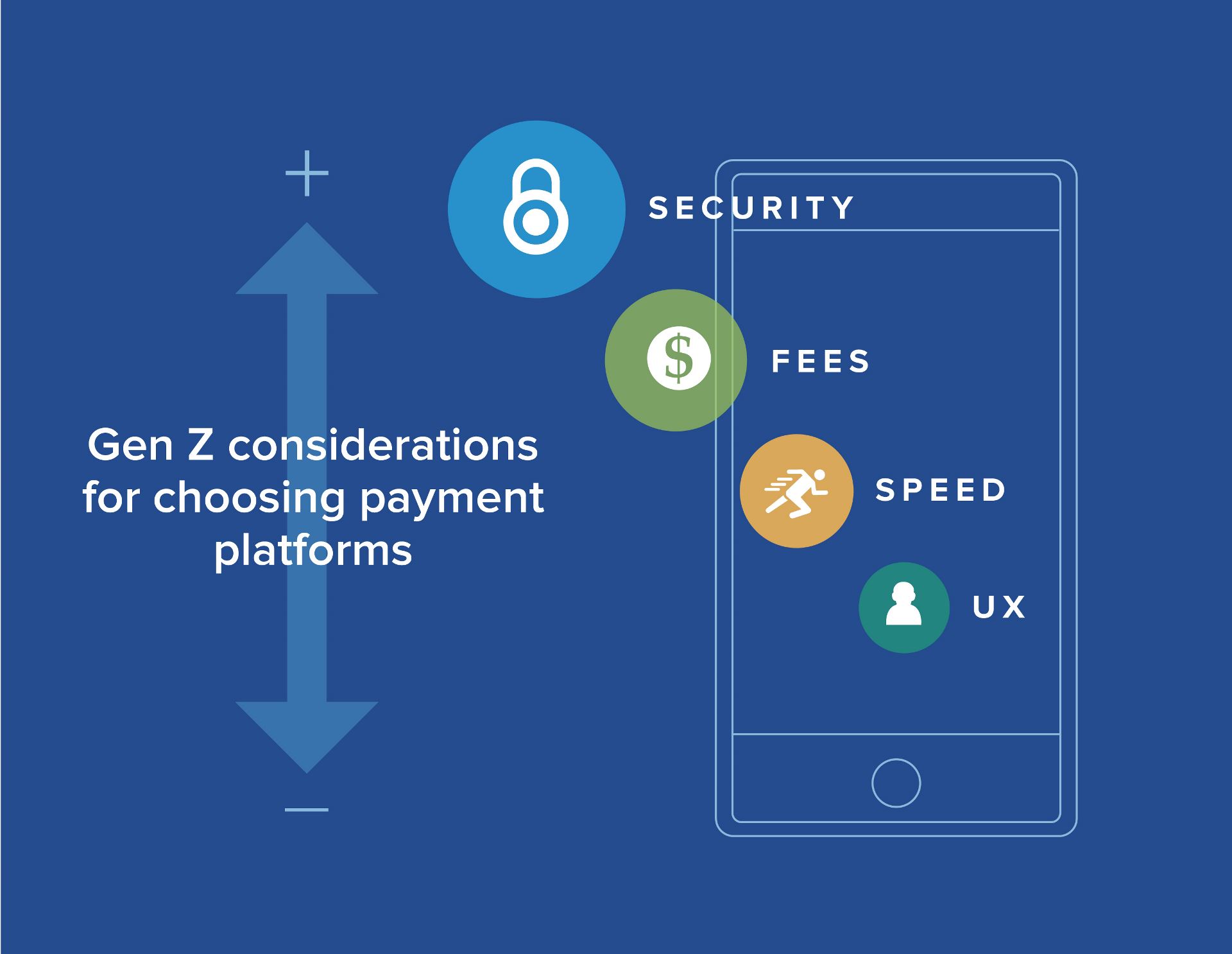

While one might expect a generation that has everything at their fingertips to value speed over anything else when it comes to sending and receiving money, but Gen Z actually, Gen Z has security top of mind. When asked to rank the importance of Speed, User Experience (UX), Security, and Fees as they pertain to the payments platforms they use, nearly half chose Security as the most important feature. Fees came in second, followed by Speed and UX.

Gen Z Loves Digital Payment/Banking, But They’re Still Weary of FinTechs When it Comes to Their Data

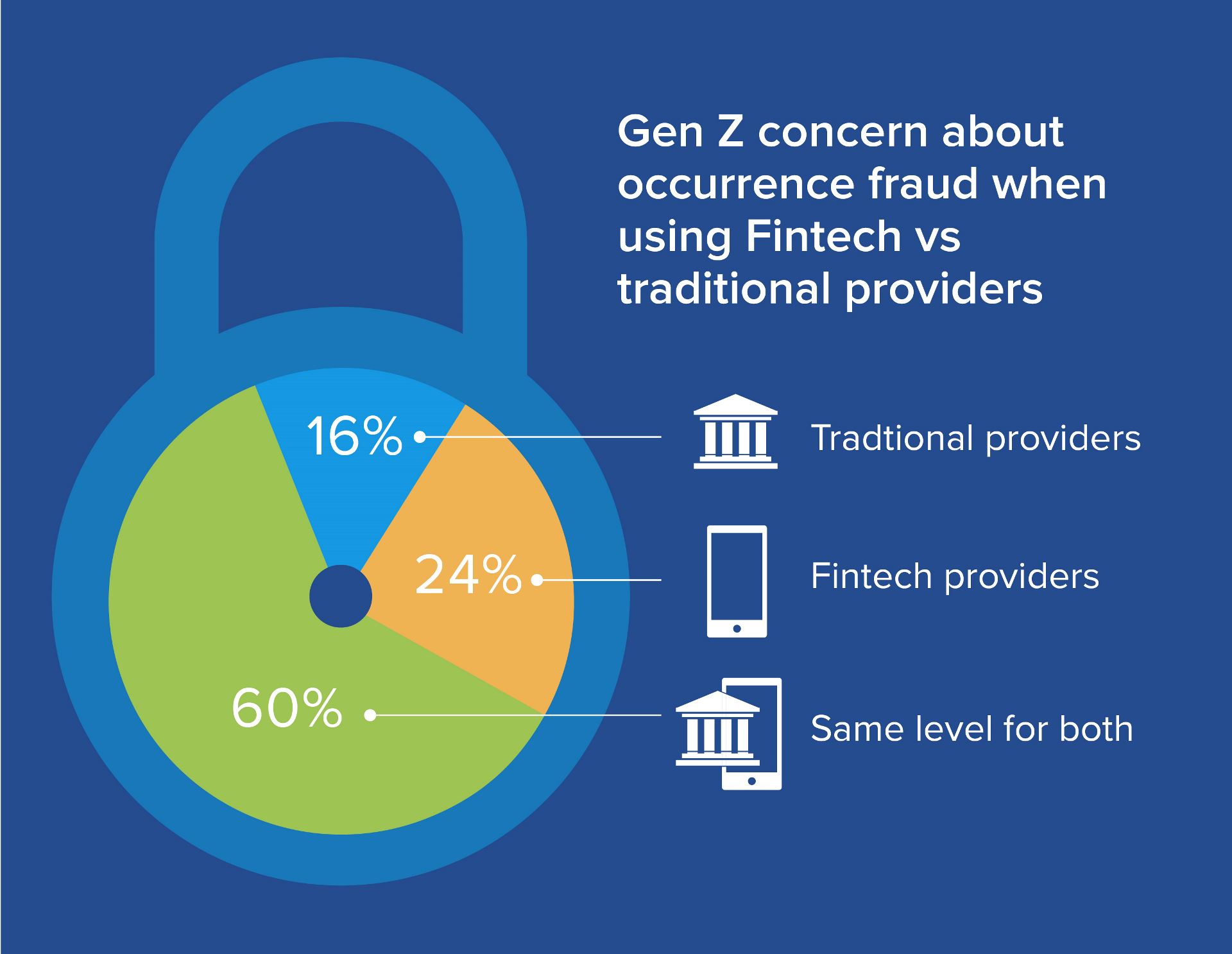

Gen Z is clearly happy using new digital payment and banking options rather than staying with the longstanding traditional providers. However, that doesn’t mean they necessarily trust newer Fintech solutions more with protecting their financial data. When we asked respondents whether they were more concerned about the occurrence of fraud when using payments or banking solutions from traditional providers or next generation Fintech providers, 60% said they are equally concerned about both.

However, 24% of Gen Z noted they were more concerned with the occurrence of fraud while using payment or banking services from Fintech providers versus 16% who said they were more concerned with the occurrence of fraud while using the same services from traditional providers.

When it Comes to Brands, Gen Z Values Options And Transparency

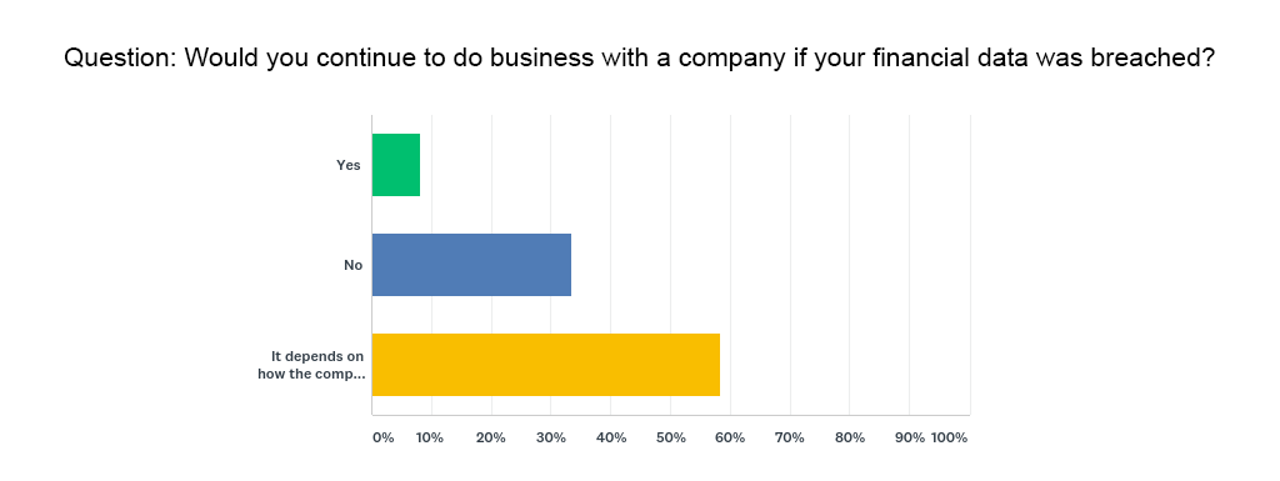

When asked “Would you continue to do business with a company if your financial data was breached?,” nearly 60% of respondents reported that it depends on how the affected company responds to the situation, while 33% reported that they would drop the company. Growing up in a time where hacks and breaches have become commonplace, these results could be a sign that Gen Z understands the reality of these threats in the digital age and is more concerned with how the brands they are trusting with their data responds to them.

We also asked respondents if they would be more likely to do business with a company that offered flexible payment options. The answer was almost a resounding “Yes” (76%).

Gen Z Expects Fast Payments But Aren't Quite Ready for Cryptocurrency

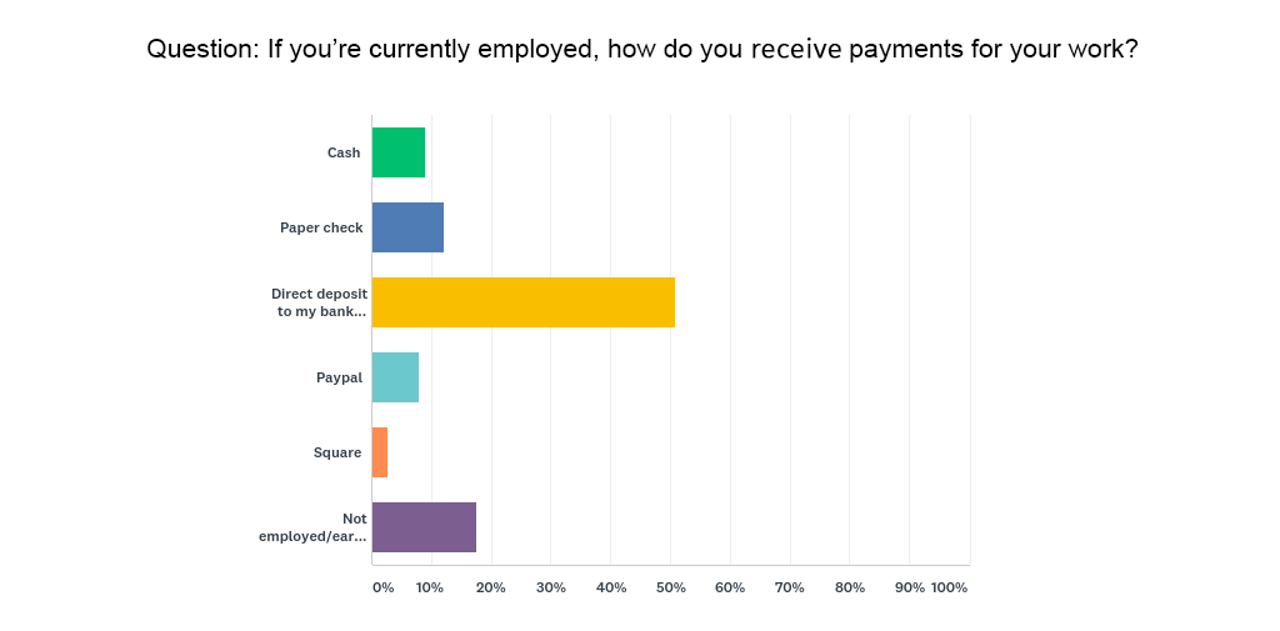

Gen Z likes the automated ability of digital payments, so it’s not a huge surprise that the majority of respondents (>50%) reported that they currently receive payment from their employer via direct deposit (ACH). This follows findings that during the fourth quarter of 2018, ACH Network volume saw more growth than it has in the last decade, including an 11.5% increase in B2B payments, according to the National Automated Clearing House Association (NACHA).

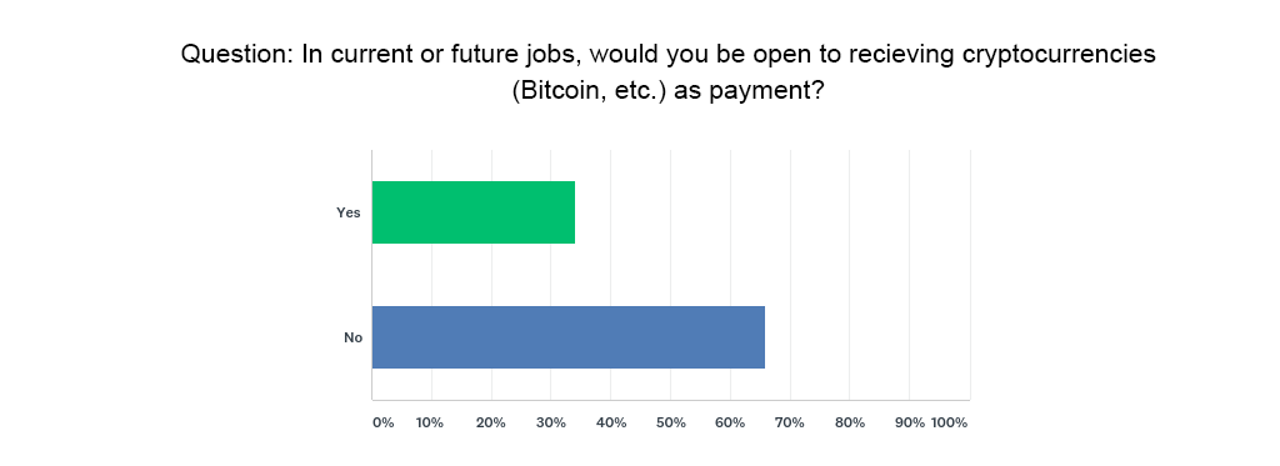

Does this mean they are open to receiving payments from their employer in the future via even newer payment methods such as alternative cryptocurrencies?

With the cryptocurrency market being heavily saturated by younger generations, one would expect them to be open to receiving Bitcoin and other cryptocurrencies as a form of payment. However, the majority of Gen Zers (66%) reported that they would not be open to this.

One might attribute this in part to the fact that many view cryptocurrency as a speculative investment, as well as the current state of the markets, where most cryptocurrencies have seen a significant drop in value over the last year. It could also be tied to the fact that Gen Z values security and stability — the latter which the crypto markets have not displayed recently.

Gen Z has grown up with unprecedented access to technology and innovation; access that has shaped their expectations on the products and services they interact with. However, while this generation clearly values things like convenience and speed, they aren’t necessarily willing to compromise more practical matters such as security and transparency. As companies continue to innovate in the payments space, they would do well to take this enormously influential generation's values and behaviors into consideration. Doing so now, will pay dividends in the future.