Payment Services

Resources | Blog

Latest Payment Services blogs

-

U.S. Government Now Requires Electronic Payments – Here’s What it Takes to Go Digital

The U.S. Government is mandating electronic payments for all Federal transactions. Discover how to transition seamlessly and unlock the full benefits of e-payments.

-

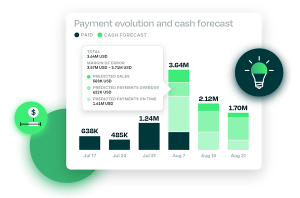

How to Optimize Cash Flow by Defining Your Payment Policies

Are your payment policies driving sufficient cash reserves? Capture funds faster with these optimization tips.

-

Gen Z is Forcing a B2B Payments Revolution: Is Your Business Ready?

Discover how Gen Z is transforming B2B payments. Download our infographic and read the full study to stay ahead in the evolving market.

-

Construction invoice software: How to modernize your payment processing

Streamline your construction invoicing with modern software solutions. Automate payments, reduce errors, and improve cash flow effortlessly.

-

Accounts receivable services healthcare & life sciences companies need for better finance

Streamline healthcare AR with automation and AI. Improve cash flow, compliance, and efficiency with modern accounts receivable solutions.

-

B2B payment processing: Simplifying payments for your business

Simplify B2B payment processing with advanced digital solutions. Optimize cash flow, strengthen relationships, and drive business growth.

-

What is cash on delivery (COD) and how does it work?

Cash on delivery means the customer pays for goods upon delivery but it has drawbacks for both the buyer and the seller, like delays & risk.

-

Enterprise guide to payments automation

Streamline your financial operations with payment automation. Discover how to optimize cash flow, reduce errors, and improve efficiency.

-

The complete guide to B2B invoicing and payment processing

Simplify your B2B invoicing process. Learn best practices, advanced strategies, and how automation can optimize financial operations.

-

What happens when a company collects cash from accounts receivable?

Discover the critical process of collecting cash from accounts receivable and how automation transforms AR operations for better cash flow.

-

Discover the value of Billtrust's EIPP solutions with Hackett Group's latest study

Explore Hackett Group’s findings on Billtrust EIPP solutions. Download the infographic now.

-

What you need to know about Virtual Credit Cards?

Improve B2B transactions with virtual credit cards, which offer enhanced security, cost savings, and seamless integration.

-

E-invoicing compliance update, June 2024

Navigate the latest e-invoicing compliance updates for Q2 2024 around the globe.

-

The untapped potential of payments analytics in advancing payment policy strategies

Streamline your O2C process and gain deeper customer insights with next-generation payment analytics.

-

E-invoicing compliance update, January 2024

Navigate the latest e-invoicing compliance updates for Q4 2023 around the globe.

-

Insights into the evolving role of the CFO

Unlock insights from an IDC survey: CFOs navigating disruptions, data, and transforming the order-to-cash process.

-

How to get paid faster: 10 pro tips to optimize payments

Get paid faster with these 10 tips for optimizing your payments process: automating approvals, paying suppliers sooner and more.

-

Stress-free accounts receivable solutions for smoother cash flow

Reduce the time spent on accounts receivable and invoice collection and eliminate the headaches that come with waiting for payment.

-

Why are B2B AP portals on the rise?

Learn what’s driving more buyers to mandate sellers use these portals.

-

A guide to selecting the best B2B payments network solution

How to find the right solution that checks all the boxes for your business.

-

5 ways to manage the cost of credit card acceptance

You can receive payments faster by accepting credit cards. But the cost of credit card acceptance is significant, so learn how to manage it.

-

Innovative B2B payments technology for your business

B2B payments technology can help you to streamline your business with faster, more cost-effective processing.

-

Debunking AR myths: Accounts receivable explanation

Accounts receivable is a critical part of any business, but it can be difficult to understand. This article will debunk some common myths about AR in plain English.

-

B2B payments trends – and solutions – in medical equipment & supplies

Discover how medical suppliers can have better cash flow through accounts receivable automation solutions.

-

How AR solutions equal faster payments for transportation firms

See how AR automation solves multiple challenges for transportation firms– some old, some new.

-

Everything you need to know about AR best practices

Is managing your AR process challenging? This Billtrust AR best practices resource will help you learn how to keep the cash and your business growing.

-

Navigating the web of accounts payable fraud

AP fraud is a significant contributor to businesses experiencing losses, and it can be challenging to detect. Billtrust can help you protect yourself from AP fraud.

-

How the pandemic helped firms digitize internal processes

Many businesses have turned to digitalization during the pandemic to keep their operations running smoothly. Learn what they’re doing and how you can adapt!

-

The AP portal solution

Billtrust's Business Payment Network, the integrated solution to capture, analyze, and view the entire cash flow, transforms the way you invoice and work with AP portals.

-

Top 5 best practices to accelerate digital payments & maximize team efficiency

Get the five best practices to drive digital payments in your business and find out how to maximize your accounts receivable team’s efficiency.

-

Warning: Payment fraud can destroy your accounts receivable

Even with fraud detection best practices in place, accounts receivable (AR) payment fraud may still happen and affect cash flow.

-

Working capital management: Components, the top three approaches and more

Working capital determines whether or not an organization can pay its current liabilities with its current assets.

-

What is cash on delivery and how does it work

Cash on delivery means that a customer doesn't pay for the goods they've ordered until they are delivered. However, there are disadvantages of this to the buyer and seller.

-

What is an ACH Payment & How Does It Work?

An ACH is a domestic transfer of a single currency—funds don’t cross borders, and the currency doesn’t change.

-

B2B Payment Insights from ATM interoperability

Like ATM interoperability, B2B payments networks have formed and are constantly growing and adding partners to streamline digital payments.

-

The cloud revolution is just the start for B2B payments

The cloud revolution is just the beginning of B2B payments. Technology will be a major focus of organizations as they work to maintain cash flow.

-

Managing your O2C process through employee absences

Your order-to-cash (O2C) process doesn’t need to stop when someone is sick or on vacation. You can keep your accounts receivable team on track.

-

Putting touchless payments in reach with BPN and Cash Application

Manual payment acceptance processes add days to DSO, limit cash flow and reduce working capital. The truth is that the status quo is slow. But until recently, there hasn’t been an alternative.

-

The AP vs. AR tug-of-war: Ending the struggle to manage multiple AP platforms

Learn what you can do to make the best of the AP vs. AR tug-of-war game.

-

The coronavirus has vaulted B2B innovation ahead of consumer payments

The disruptions caused by COVID-19 prompted B2B innovation and payments to catch up to consumer payments.

-

Payments processing strategy: Calculating the costs of payment acceptance

Guiding buyers towards specific payment channels requires a great strategy.

-

Why Your Customers’ Payment Preferences Matter

Customer experience has become a competitive advantage and organizations must recognize that no two customers are the same and each requires different payment options.

-

The B2B Payment Evolution

The B2B payment landscape is changing and will continue to evolve in the future. Will your company be prepared to meet the challenges?

-

The Future of Global Payments: What AR Teams Can Expect

It’s imperative for companies to seek new and emerging markets and technologies to survive.

-

Why I Love Billtrust – Crescent Parts & Equipment

Crescent Parts has been working with Billtrust for over 10 years. The benefit of using Billtrust at first was to automate the invoice processing portion of order to cash.

-

Your Customer Portal Automation Questions Answered

What pressures drive accounts payable teams to automate, and how can Customer Portal Automation help both AP and accounts receivable teams stay sane?

-

Top 5 Benefits of Accounts Receivable Automation

The top benefits of accounts receivable automation include reducing DSO, improving order-to-cash cycle times and more.

-

B2B Payment Challenges: Why is payment acceptance so complicated?

Today, customers pay their bills in a number of ways through a variety of payment channels. However, suppliers must determine how to accommodate the various payment preferences.

-

PART 2 - Understanding the Impact of Technology on Customer Experience for Staffing Firms

Get a technology framework that will help your staffing firm evaluate its current process needs.

-

B2B Payment Challenges Part 3: Cost-Effective & Efficient Payments

Businesses that make small changes by adopting accounts receivable technology now can see a huge impact later.

-

B2B Payment Challenges Part 2: Demystifying Virtual Cards

Virtual cards are on the rise and so are payments, which poses new cash application challenges for integrated accounts receivables processing.

-

5 Best Reasons to Move Your Invoicing and Payments Online

Electronic invoicing is a brilliant way to save money, increase your cash flow and improve accounts receivable (AR) team efficiency, all while making your customers happier.\r\n

-

5 ways to make your customers LOVE paying you

By accepting ACH payments and electronic payments, you may convince your late paying customers to pay on time.

-

Short Pays: Why They Happen and What You Can Do About Them

Short pays wreak havoc on your cash flow. Discover why they occur and how to handle them effectively to safeguard your business.

-

Will Electronic Transactions Continue to Grow at a Fast Clip?

Some U.S. customers may still pay by paper check, but electronic invoicing and payments are becoming the norm around the world.

View blogs by topic

Browse blogs by your unique role

Read blogs focused on your industry

Explore blogs by Billtrust solutions

Billtrust Blog: AR management, cash application and more

The Billtrust Blog provides valuable accounting insights, expert advice on automated AR best practices, and practical tips and strategies to enhance your AR processes. Stay updated with regularly published articles.