The B2B payments landscape is undergoing its biggest disruption in decades—not just from technology, but from a generation reshaping expectations. As Gen Z rapidly advances into decision-making roles, comprising 27% of global workers in 2025, they're not just requesting change – they're demanding it. New research from Billtrust reveals a seismic shift that's reshaping how business transactions happen.

Gen Z's digital mandate: The B2B payment revolution [Download the infographic]

Our comprehensive study of 1,000 US-based Gen Z professionals has uncovered trends that should be setting off alarm bells in every B2B organization:

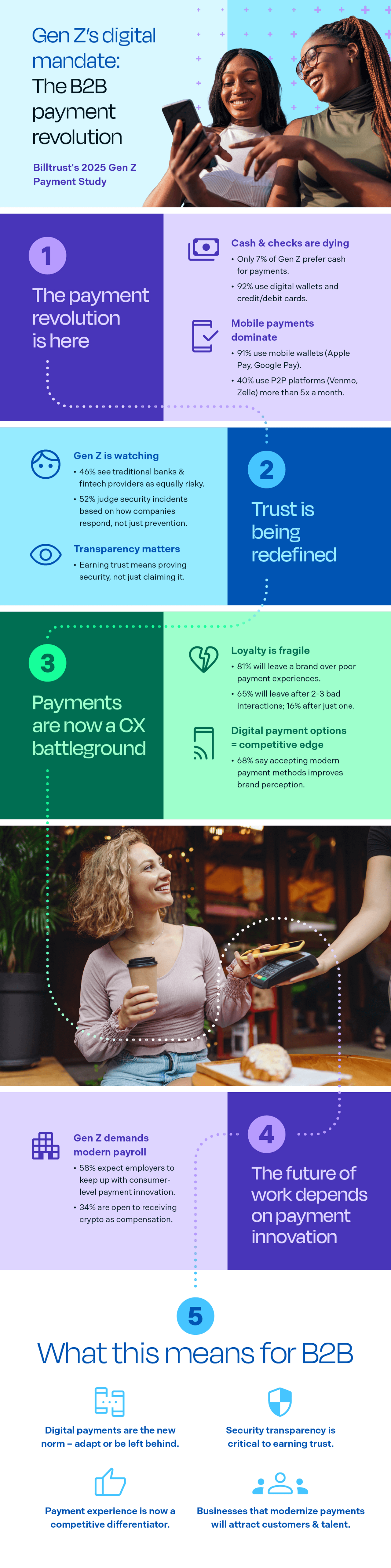

The Digital Payment Revolution is Non-Negotiable

Forget evolution – we're witnessing a revolution. Traditional payment methods like cash and checks aren't just declining; they're becoming extinct in Gen Z's world, with cash representing just 7% of their preferred payment methods. Our data shows an overwhelming shift to digital payments, with mobile/digital wallets (42%) and credit/debit cards (50%) dominating transactions. If your business isn't ready, you're already behind.

Trust is Being Redefined

Think Gen Z is naive about financial security? Think again. Our research reveals a sophisticated approach to trust, with 46% now expressing equal concern for both traditional and fintech providers. This generation isn't just accepting what traditional financial institutions say. They're demanding proof through actions, especially during security incidents. Their trust must be earned, and they're watching closely.

Experience: Your New Competitive Battlefield

Here's a wake-up call: payment capabilities have become make-or-break for business relationships. Our data shows that 65% of Gen Z will abandon brands after just 2-3 negative service interactions, and 94% consider payment capabilities important when choosing between similar services. The message? Adapt or watch your customers leave for competitors who will.

The Future of Work Depends on Your Payment Strategy

The implications extend far beyond customer transactions. Gen Z employees are bringing their consumer payment expectations into the workplace, and they're voting with their feet. Organizations clinging to outdated payment systems aren't just risking their customer relationships – they're jeopardizing their ability to attract and retain top talent.

The Stakes Have Never Been Higher

The writing is on the wall: businesses that fail to modernize their payment infrastructure risk more than market share—they risk their future. In a rapidly evolving business landscape, keeping up with trends isn’t optional but essential for survival.

Want to know exactly how dramatic these shifts are and what specific actions your business needs to take? Our report dives deep into the data, revealing:

- The shocking decline of traditional payment methods (the numbers will surprise you)

- Critical security insights that challenge conventional wisdom

- The exact payment capabilities Gen Z demands from employers

- Strategic recommendations to future-proof your payment infrastructure

Download the full report now to ensure your business isn't left behind in the payment revolution.