VP of Operations

Resources | Blog

Latest VP of Operations Blogs

-

The New ROI Playbook: Unpacking Research on the Impact of AR Automation

Is AR automation worth it? New research reveals stunning ROI and AI's game-changing role. See the numbers and transform your AR!

-

From Delays to Dollars: Smarter Collections Strategies for Transportation Companies

Struggling with managing cash flow in the transportation industry? Discover best practices to help you improve your collections.

-

AI in AR: How Generative and Agentic AI Are Transforming Accounts Receivable

Two types of AI are driving transformation in AR, and it’s important to understand their distinct capabilities.

-

Accounts Receivable Automation Boosts Efficiency and Collections in Healthcare and Life Sciences, Study Finds

The health and life sciences industry faces major cash flow pressure. This new study shows how companies reduce DSO by 12 days.

-

Accounts Receivable Automation: Emerging Trends, Strategic Opportunities, and Untapped ROI

Think accounts receivable automation is just faster processes? ROI research shows it’s a performance driver. Explore key findings.

-

Autonomous AI Assistants for Accounts Receivable: A Quick Guide

Learn how to tap into AI’s full potential with next-gen AI finance tools like Generative AI and autonomous AI assistants known as Agentic AI.

-

AI-Powered Accounts Receivable Solutions: The Future of Finance is Here

What does an expert say about AI-powered accounts receivable solutions? Glenn Hopper explores misconceptions and the best software.

-

E-invoicing compliance update, April 2025

Stay updated with the latest global e-invoicing compliance news for Q1 2025.

-

U.S. Government Now Requires Electronic Payments – Here’s What it Takes to Go Digital

The U.S. Government is mandating electronic payments for all Federal transactions. Discover how to transition seamlessly and unlock the full benefits of e-payments.

-

What is Agentic AI and How does Billtrust Stand Apart from AI-Startups?

Understand Agentic AI and its reality versus hype. Explore how Billtrust’s strategy to AI innovation differs from others.

-

How Billtrust ensures data security with AI

Learn how Billtrust navigates the AI revolution, securing financial data and transforming O2C with cutting-edge AI solutions.

-

How to Optimize Cash Flow by Defining Your Payment Policies

Are your payment policies driving sufficient cash reserves? Capture funds faster with these optimization tips.

-

The Digital Shift in AR: Smarter Strategies, Better Outcomes

Explore AI-driven AR automation and process improvements. Learn firsthand from financial leaders who have jumped hurdles and turned challenges into opportunities.

-

The ROI of Generative and Agentic AI in Accounts Receivable

What if your AR team had a genius sidekick? See how Generative and Agentic AI keep cash flow flowing with automation and autonomous agents.

-

Tariffs & Economic Turmoil: Enhancing Financial Liquidity to Remain Resilient in Challenging Times

Financial liquidity is critical in counteracting macro-level trends. Unpack the top risk reducing tactics and see the role AR plays in them.

-

Take Control of Your Cash Flow: Proven Strategies for AR Leaders

Optimize cash flow strategies with these 8 proven steps. Get actionable tips and advice from Billtrust clients.

-

8 Ways to Turn Cash Application into a Competitive Advantage

Struggling with cash application? Learn 8 best practices to streamline AR, enhance automation, and optimize efficiency.

-

Gen Z is Forcing a B2B Payments Revolution: Is Your Business Ready?

Discover how Gen Z is transforming B2B payments. Download our infographic and read the full study to stay ahead in the evolving market.

-

Streamline global order-to-cash processes with the power of SEPA B2B Direct Debit

See why SEPA B2B Direct Debit is gaining traction for automating payments and improving cash flow in AR.

-

Modernizing Accounts Receivable Processes to Fuel Growth

Drive growth with a phased approach to modernizing your accounts receivable function – we’ll show you how.

-

Optimizing Your Accounts Receivable in 2025: A Strategic Guide for Success

Discover strategies for optimizing accounts receivable in 2025. Learn more about the evolving AR landscape.

-

From operators to strategic business navigators: the changing role of finance in 2025

Explore the strategic role of finance in 2025. Learn how finance leaders are shaping business success.

-

How to improve your cash application process

Discover practical steps to enhance your cash application process, boost cash flow, and delight customers.

-

Exception to the rule: confidence-based matching for smarter cash application

Understanding the key difference between rules-based and confidence-based cash application can save you time and money.

-

The view from the high road is so much better

Learn about Billtrust's response to competitor claims and our commitment to transparency.

-

Benefits of cash application automation for businesses: Complete analysis

Discover how cash application automation streamlines AR processes, enhances accuracy & accelerates cash flow for businesses that can profit you.

-

3 ways AR process automation can boost your bottom line

Time-consuming AR processes can be a thing of the past, thanks to automation. See how it can unlock cost savings for your company. edge—and it’s just one seamless integration away.

-

Why real-time payments reign supreme in retail

In retail, B2B real-time payments can sharpen your competitive edge—and it’s just one seamless integration away.

-

Data residency for international companies in Europe

Understand data residency requirements for international firms in Europe.

-

Why it pays to accept multiple payment methods

What’s stopping you from offering multiple payment methods? There are ways to ease the complexity of this customer-friendly option.

-

Why data analytics tools beat Excel every time

Are you still using an Excel spreadsheet to track data? Go beyond time-intensive manual processes to maximize your data analytics.

-

E-invoicing in Belgium: the complete guide for 2026

Prepare for Belgium's 2026 e-invoicing mandate and requirements with our complete guide.

-

How better invoicing and cash application leads to faster collections

Improve your order-to-cash cycle with invoicing and cash application solutions that can lead to faster collections.

-

Ease healthcare processes with unified and automated AR solutions

DSO in healthcare is one of the worst across industries—47 days! Unified AR can speed that up. Let us explain.

-

4 ways unified AR beats ERP systems alone

ERP systems aren’t the be-all and end-all for finance teams. Discover how a unified AR lifts ERP to the next level.

-

EU approves VAT in the Digital Age (ViDA) package

EU Member States reached agreement to adopt the final text on ViDA. VAT in the Digital Age includes mandatory e-invoicing.

-

The Power of Many: How Multi-Agent AI Systems Transform AR into an Advisor

How multi-agent AI offers valuable insights, guidance, and works as a collaborative partner in the future finance organization.

-

How to detect an accounts receivable scam in 2025

No matter how much finance teams fight fraud, bad actors always devise new ways to scam people. But is it a losing battle? It doesn’t have to be.

-

AI is Pushing the Boundaries of What’s Possible for B2B Order-to-Cash Operations

Uncover how AI is pushing the boundaries of B2B order-to-cash operations in this must-read for finance leaders.

-

Enhance AR process efficiency with analytics and AI: Top strategies

Explore how AI and analytics can improve AR efficiency and help you manage your accounts receivable better.

-

Four ways AI will simplify global payments

Unlock the future of global payments with AI! From fraud prevention to efficiency, explore game-changing possibilities.

-

How to improve cash flow management in the construction industry

With a low adoption rate of AR automation software, Billtrust boasts solutions to help construction firms with their financial challenges.

-

Laying the foundations for future AR insights with AI

Unlock the future of AR. See how Billtrust unifies AR leads to better AI-powered insights.

-

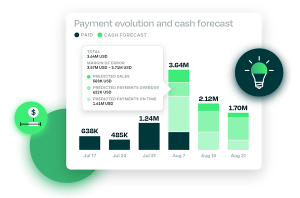

Make data-driven decisions with Billtrust analytics

Why analytics is indispensable for data-driven CFOs and their shift to a future-oriented and unified order-to-cash mindset.

-

Reducing Recessionary Risks

It’s critical to automate your organization's system and reduce cycle times so that you get paid faster.

-

Largest customer marketplace ranks Billtrust Overall Leader in AR software

G2.com names Billtrust as the overall leader in accounts receivable automation.

-

10 strategies for optimizing your accounts receivable to maximize your ROI

Discover 10 strategies for optimizing accounts receivable to get the most out of your AR operations.

-

Your complete guide to creating a crisis continuity plan

If you're not prepared for the unexpected, your business could be in serious trouble. A crisis continuity plan can help keep your customers' payments coming into your business.

-

Collaborative accounts receivable and your business

Leveraging a collaborative accounts receivable management service can improve your organization's cash flow and support its growth.

-

Accounts Receivable Fraud: How To Detect And Deal With It

Many businesses are adopting automated accounts receivable solutions now more than ever. Get tips on how to detect, prevent and eliminate AR fraud.

-

How the pandemic helped firms digitize internal processes

Many businesses have turned to digitalization during the pandemic to keep their operations running smoothly. Learn what they’re doing and how you can adapt!

-

Everything You Need to Know About Startup Cash Flow

See our guide to managing, calculating and documenting your startup’s cash flow with tips and more!

-

Making AR relevant to the C-suite

Billtrust commissioned a 2021 study where over 350 accounting/finance senior leaders shared how they believe the C-suite perceives them.

-

Cash Flow: The components, analysis, statement and more

Learn how cash flow impacts your business, the importance of managing and analyzing cash flow, the statement and more.

-

What is cash management?

Managing the inflows and outflows of your organization's cash is vital to ensuring its viability within a competitive marketplace.

-

Emergencies are inevitable. Is your business prepared?

Does your organization have a plan for when a crisis strikes? Creating a disaster plan recovery now can save you time and money in the long run.

-

Use Data to Drive Your Business in the Right Direction

Data can make your organization more efficient, transparent and help you identify trends to automate and accelerate the invoice-to-cash process.

View blogs by topic

Browse blogs by your unique role

Read blogs focused on your industry

Explore blogs by Billtrust solutions

Billtrust Blog: AR management, cash application and more

The Billtrust Blog provides valuable accounting insights, expert advice on automated AR best practices, and practical tips and strategies to enhance your AR processes. Stay updated with regularly published articles.