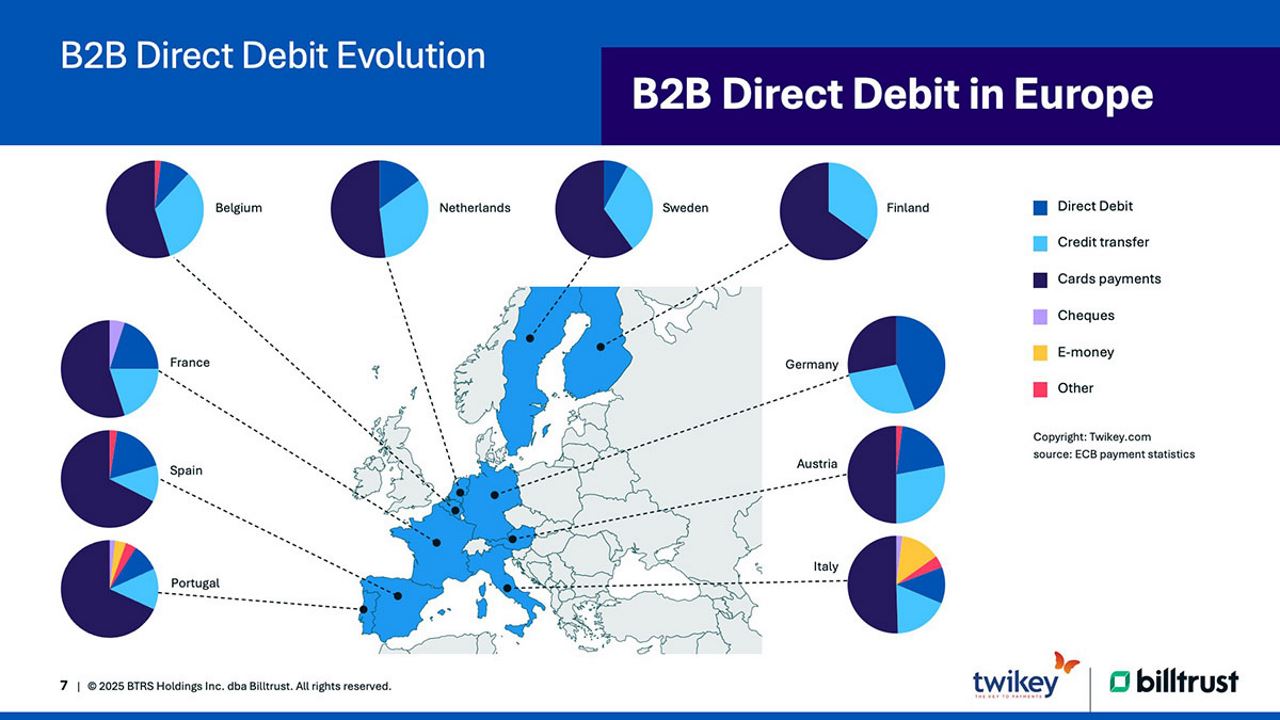

If there’s one thing that finance leaders agree on, it’s that managing payments efficiently can streamline operations, drive predictable cash flow, and build stronger customer relationships. SEPA B2B Direct Debit is emerging as a powerful tool in Europe and the UK to achieve these goals, offering reliability, speed, and cost efficiency that meet the needs of modern finance teams.

Industry experts Ruud Stechweij, Presales Manager at Billtrust, and Dominique Adriansens, Founder and Managing Director of Twikey, teamed up to discuss why SEPA B2B Direct Debit is quickly becoming a great option for CFOs and international AR teams aiming to streamline their Order-to-Cash (O2C) processes.

Missed the session? Don’t worry—here’s everything you need to know, including the full video and key takeaways.

Direct Debit reinvented for B2B transactions

SEPA B2B Direct Debit, an automated payment method that enables businesses to collect payments directly from their customers' bank accounts through pre-approved mandates, is no longer confined to consumer transactions. It’s rapidly evolving into a valuable tool for businesses.

“Businesses are beginning to recognize the scalability of Direct Debit,” explains Dominique Adriansens. “It’s not just for recurring B2C payments. We’ve seen transactions as large as €80 million processed through Direct Debit.” This demonstrates its capacity to handle not only recurring payments but also significant, one-off transfers.

The reason for its growing popularity? The reliability of Direct Debit is a key driver. With a remarkable 99% completion rate on the first attempt and 99.9% following retries, it offers businesses a predictable and secure payment method that accelerates cash flow and frees up resources for finance teams. This reliability is backed by the strength of the banking infrastructure in Europe, where Direct Debit reaches over 3,600 banks and 600 million accounts.

The DSO reduction advantage

One of the most significant benefits of SEPA B2B Direct Debit lies in its ability to reduce Days Sales Outstanding (DSO). Late payments continue to be a challenge for many businesses, creating cash flow unpredictability and straining AR teams. By aligning payments with invoice due dates, SEPA B2B Direct Debit minimizes delays.

“When businesses adopt this payment method, invoices get paid on time—no more waiting for customers to initiate payments,” explains Adriansens.

SEPA B2B Direct Debit at a glance

What is it?

- An automated payment method where businesses collect payments directly from their customers’ bank accounts based on pre-approved mandates.

- Ideal for recurring or large one-off payments in the B2B space.

Key Benefits:

- Cash flow predictability

- Efficiency

- High success rates

- Improved customer experience

- Cost savings

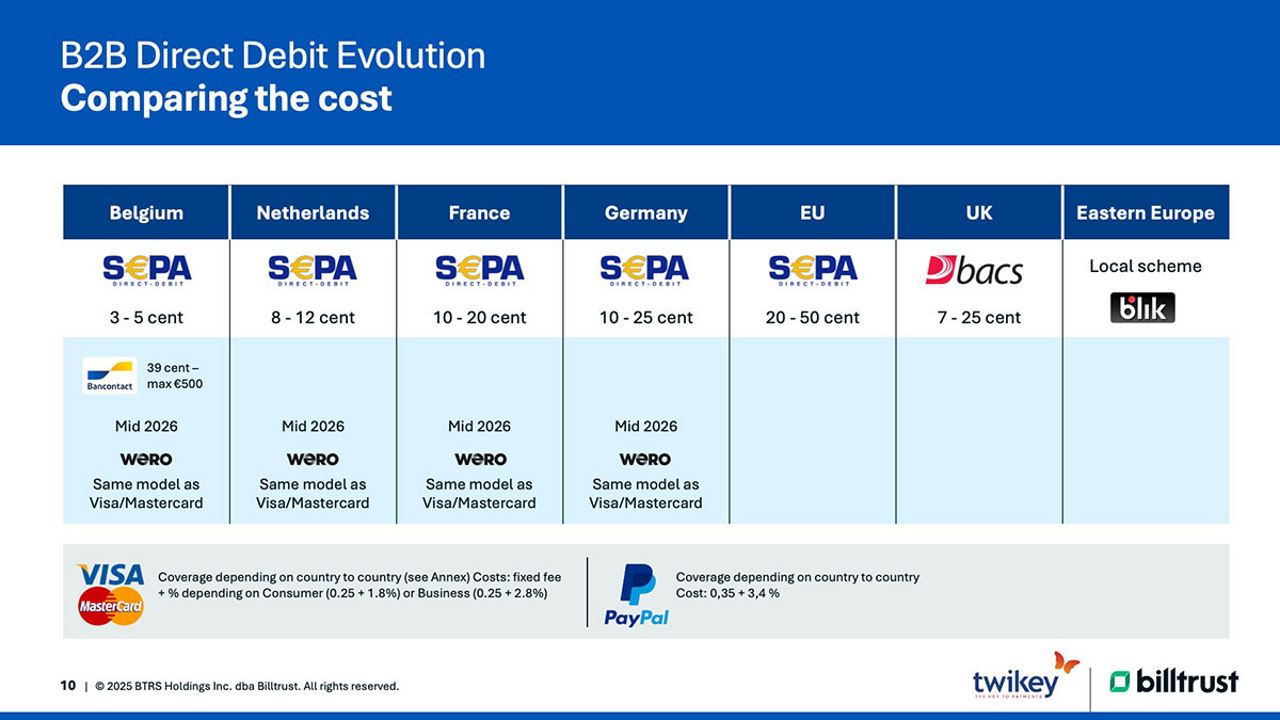

Costs:

- Direct Debit fees: Only starting from €0.03-€0.05 per transaction (depending on country), significantly lower than credit cards (2.8%+) or PayPal (3.4%).

- Infrastructure savings: Reduces time and resources spent on manual payment processes.

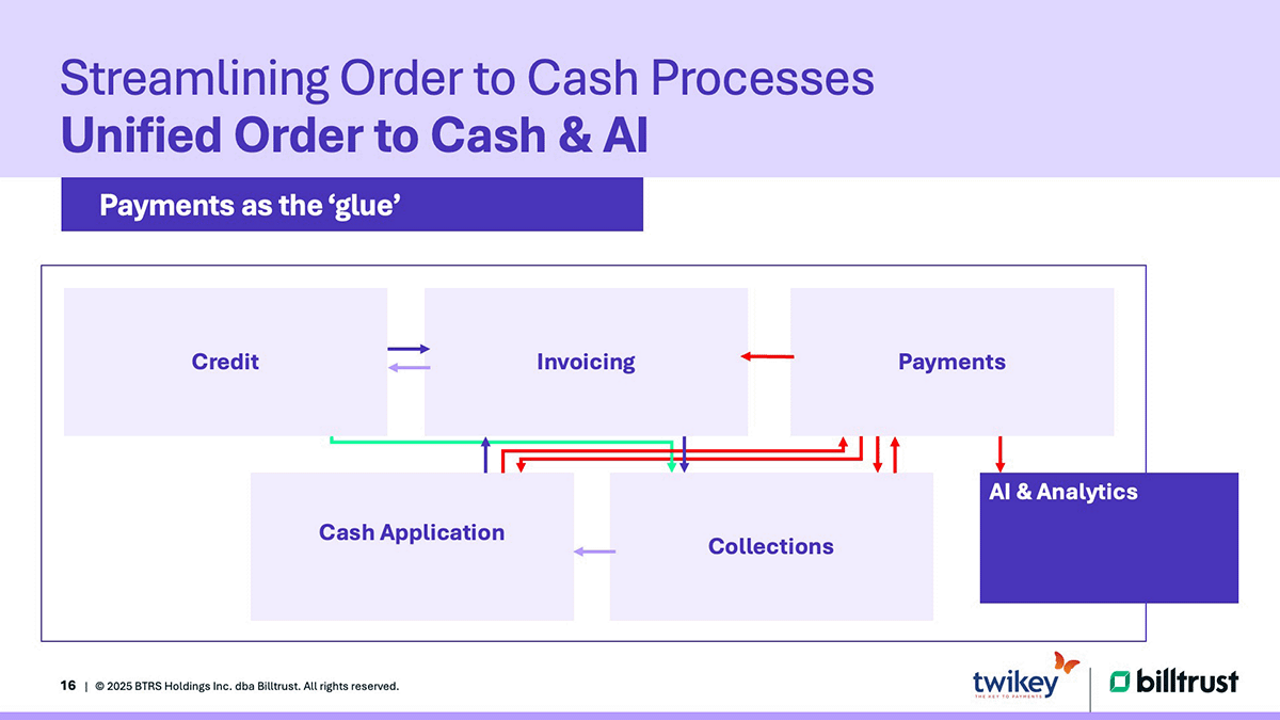

Efficiency at every stage of the O2C cycle

SEPA B2B Direct Debit doesn’t just simplify the payment process—it brings efficiency to the entire Order-to-Cash (O2C) cycle. Ruud Stechweij explains, “Traditionally, AR teams handle manual uploads and downloads in ERP systems to process payments. But by integrating B2B Direct Debit, that entire workflow can be automated.”

-

Automating payment workflows

With B2B Direct Debit in place, invoices align with mandates, and payments occur automatically on the due date. This eliminates the need for manual intervention at multiple points in the O2C cycle. By removing these touchpoints, businesses can cut down on errors, save time, and improve operational efficiency. -

Rejection management becomes proactive instead of reactive

Payment rejections—such as insufficient funds or account errors—can cause bottlenecks in cash flow if not addressed quickly. B2B Direct Debit enables businesses to automate rejection handling using predefined workflows. For example, an AR team can initiate a retry for insufficient funds after a specified period or follow up with a tailored communication offering alternative payment methods. “Acting promptly on rejections keeps the momentum going and avoids prolonged delays in collections processes,” Stechweij confirms. -

Transparency in cash application

When payments are made through B2B Direct Debit, businesses benefit from a higher degree of visibility. Instead of reconciling multiple bank transfers with invoices, B2B Direct Debit consolidates transactions, enabling cash application teams to match payments with outstanding invoices automatically. This reduces the risk of missing payments, improves match rates, and helps AR teams close their books faster.

Enhancing customer experiences

Beyond the operational benefits, SEPA B2B Direct Debit is also a customer pleaser. “Customers often look for convenience when it comes to payments,” Adriansens explains. “They don’t want to be bothered with extra steps. The more invisible the payment process, the better their experience. By embedding B2B Direct Debit into your process and making it easy for customers to opt-in, you’re not just solving your cash flow problems—you’re simplifying life for your customers.”

Addressing customer adoption challenges

One question businesses may ask when considering B2B Direct Debit is, “How do we encourage customers to adopt it?”

Integrating this payment method into your O2C process doesn’t have to disrupt existing customer relationships—in fact, it can deepen them if implemented thoughtfully.

Here are three actionable strategies to drive customer adoption successfully:

-

Make it easy to sign up

The mandate is the foundation of SEPA B2B Direct Debit success. Getting this agreement from customers becomes simple when you embed sign-up options into your process. For instance, include links or QR codes for mandate sign-up in invoicing emails, reminders, and even account statements. “If a customer pauses or cancels the process, treat it as an opportunity to engage,” suggests Stechweij. “Following up personally can often convert hesitant customers into advocates.” -

Offer flexibility with payment options

SEPA B2B Direct Debit is a fantastic tool, but some customers may prefer alternate payment methods. Providing additional choices—like one-time payment links—ensures flexibility while still meeting your business’s cash flow goals. Adriansens adds, “Flexibility is key. It shows customers that you understand their unique needs—and creates a smoother transition to more automated processes.” -

Build trust throughout the process

Transparency is critical to driving adoption. Customers need to feel confident that payments initiated through SEPA B2B Direct Debit align with their agreed terms. Sharing clear schedules, payment confirmations, and detailed reconciliations increases trust. “The trust established through an efficient B2B Direct Debit process often leads to deeper, long-term customer relationships,” says Adriansens.

Looking to digitally transform your AR processes? Read the eBook ‘From Manual to Modern’ here.

Actionable insights for finance leaders

SEPA B2B Direct Debit transforms the O2C cycle by allowing teams to integrate payments seamlessly into every stage, delivering immediate and long-lasting benefits. Key strategies include segmenting accounts based on payment behaviors, identifying customers in need of intervention early, and using analytics for real-time insights.

“Dashboards and AI tools provide insights into key metrics like match rates, payment trends, and customer behavior,” says Stechweij. “This data allows you to make smarter decisions, such as identifying customers who might benefit from B2B Direct Debit or tailoring your collections workflow to improve outcomes.”

Seizing the benefits of Direct Debit

SEPA B2B Direct Debit is far more than just a payment tool—it’s a strategic enabler that helps finance teams reduce costs, improve customer satisfaction, and focus on value-added activities. For organizations juggling large transaction volumes or struggling with long DSO cycles, exploring the capabilities of B2B Direct Debit can lead to significant efficiency gains.

“Payments are the glue that holds the entire O2C process together,” Stechweij highlights. “When you streamline this part of the equation, every other step—from invoicing to analytics—operates more effectively.”

Making the shift to Direct Debit

The steps to integrate B2B Direct Debit into current processes are straightforward. Begin by understanding your customers’ payment preferences, identify where manual intervention can be reduced, and assess your ERP and payment platform’s compatibility with automated workflows.

Adopting B2B Direct Debit is an investment in both operational excellence and customer satisfaction. Its proven track record—99% success rates, near-universal accessibility across European banks, and significant cost savings—makes it an indispensable tool for AR departments looking to evolve.