As businesses face a growing number of challenges and economic pressures, the responsibilities of financial management have shifted from sheer number-crunching to strategy-shaping. It’s no longer about just balancing the books. CFOs are expected to guide business decisions, influence growth strategies, and drive innovation – all while protecting the bottom line. This is where accounts receivable (AR) automation comes in.

Seventy-five percent of finance leaders now recognize accounts receivable as a strategic priority, no longer just a back-office function but a critical driver of financial strength and long-term success. A new study of 500 finance professionals using AR automation software demonstrates that AR automation software is a strategic investment proven to heighten business performance, financial agility, and competitive advantage. Conducted by Vanson Bourne, the research shows 100% of respondents reported measurable gains including faster payments, reduced costs, and accelerated cash flows. Here’s a look at key findings.

Study shows accounts receivable automation delivers expected returns

Overall, 93% of respondents confirmed that their AR automation software delivered the ROI they expected. The vast majority agree that their solution has helped accelerate cash flow and improve liquidity — two priorities that are often difficult to achieve. Solutions deliver by providing greater visibility and control over financial operations. Those who have fully embraced accounts receivable automation report the biggest gains, including a 40%+ reduction in Days to Pay (DTP).

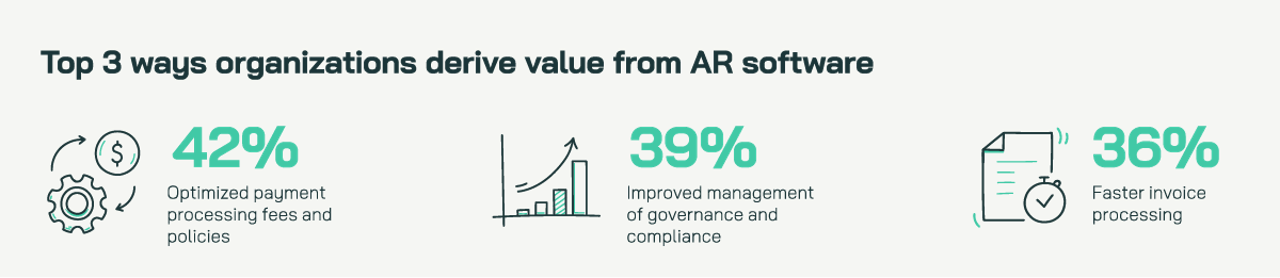

Accounts receivable automation goes beyond payment processing

More than 90% of respondents say their AR software has helped them effectively mitigate financial and compliance risks, giving them the tools they need to stay ahead of evolving regulations and maintain compliance across global invoicing operations. Automation has also helped improve their customer experience, offering more flexible payment options and faster, more accurate invoices and payment reminders. There are also significant productivity gains, with 95% reporting increases in efficiency through process automation.

While the masses recognize the value, nearly all still face these barriers

The biggest challenges include integrating AR systems with other platforms like CRM and ERP (55%), concerns about the accuracy of automated processes (39%), and issues with data quality (38%). The right AR software clears these hurdles by integrating with systems across the entire AR lifecycle, turning fragmented data into unified management and siloed reporting into actionable AI-driven insights at higher, holistic level.

AI can double or even triple results

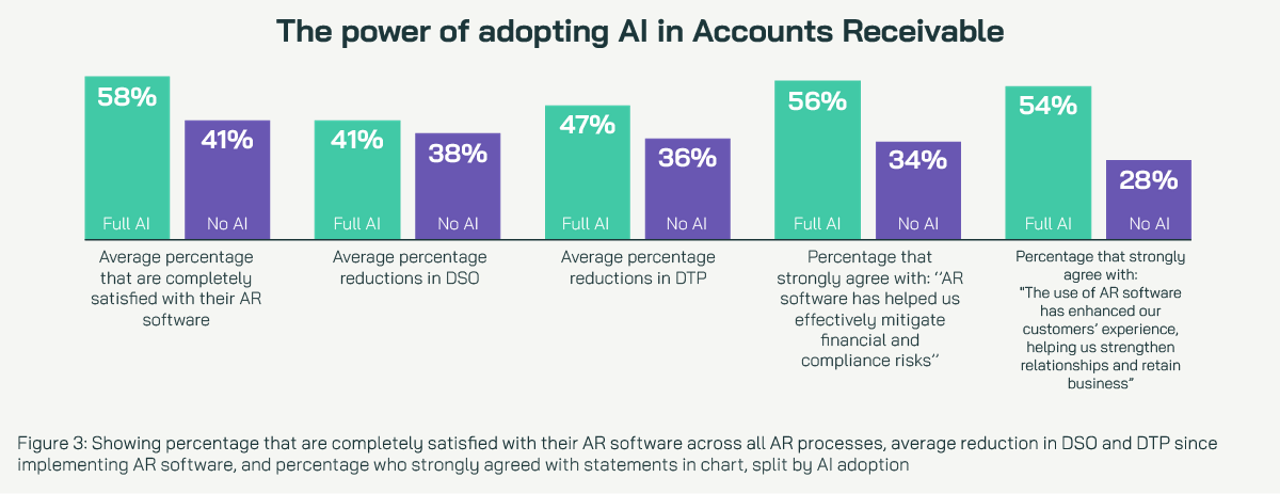

Accounts receivable automation has evolved from point solutions into an umbrella term for a broader ecosystem of AI-intelligent technologies that aid in managing cash availability, lowering risk, and enabling growth at scale. These technologies, such as predictive analytics (89%), advanced data analysis (89%), and Agentic AI (88%) are seen as critical components by most respondents that add meaningful value across the AR lifecycle.

When compared to companies that have not yet adopted AI, those that have embraced it report elevated AR performance metrics in the areas of DTP, Days Sales Outstanding, compliance, and customer experience. AI adopters typically doubled and sometimes tripled their results.

Agentic AI is a solution that CFOs should really be zeroing in on. This technology introduces AI-powered virtual assistants, or "agents,” that can act autonomously, collaborating across multiple systems and areas of responsibility to analyze data, solve problems, and drive efficiency.

- These AI agents bring a new level of visibility and control to the AR ecosystem, proactively identifying risks by detecting anomalies and patterns across the order-to-cash cycle and providing instant recommendations for optimization.

- By combining financial data with support content, they can resolve issues quickly and significantly improve the customer experience.

- By the end of this year, 25% of companies already using GenAI will be experimenting with Agentic AI. Deloitte predicts this number will double by 2027.

What the study says about the value of Billtrust’s AR automation

The study also evaluated the results recognized by Billtrust customers. 100% of Billtrust customers are satisfied with their AR software automation across every arena: order management, invoicing, payments, cash application, and credit and collections. Two out of three AR professionals that use Billtrust say they recognize a 50% increase in their productivity every week. At a time when 93% of companies face AR talent retention challenges, this value cannot be understated. Productivity gains can increase employee satisfaction, as automation elevates their work from mundane to meaningful.

100% of Billtrust customers are satisfied with their AR software automation.

For those still evaluating solutions, the data speaks for itself. As finance processes grow more complex and new technologies like GenAI and Agentic AI reshape the landscape, the impact of accounts receivable automation becomes explosive. CFOs who see the big picture will be better positioned to build a stronger, more resilient business ready for whatever comes next.

In a shifting financial market, action is the only option

To strengthen financial health and keep pace with growing demands, accounts receivable automation has become essential.

Explore the full research report to see how finance leaders are using AR automation software to unlock cash flow, reduce risk, and build a lasting foundation for their business.