Are you prepared for the new frontier of AI technologies? Do you know how they will fit into your accounts receivable (AR) operations? Over 70% of finance leaders are already using AI to streamline collections and speed up cash flow. But what about next-gen AI finance tools like Generative AI (GenAI) and autonomous AI assistants known as Agentic AI? In 2025, 25% of companies using GenAI will experiment with Agentic AI, and by 2027 that number will rise to 50%, according to Deloitte. The next wave of transformation is here – Agentic AI – and it’s the most powerful evolution yet. It has the potential to make AR “self-driving.”

You may not be familiar with Agentic AI, but you soon will be. By 2028, Gartner expects that 15% of all daily work decisions will be made autonomously by Agentic AI. That means in a few short years, today’s early adopters won’t just be making progress – they’ll be measurably ahead. The gap will widen so quickly that latecomers may struggle to catch up at all. Where will you stand, and how will that affect your AR success?

If you’ve been hesitant to tap into AI’s full potential, there’s still a chance to get ahead. We’re sure you have a lot of questions, and we have the answers. Billtrust’s new eBook “AI Assistants are Autonomous: The New Era of AR is Here” offers a deep dive into how Agentic is driving the “Autonomous AR” revolution and the actions accounting leaders should take to overcome challenges and get ahead. Here’s a quick summary.

What Exactly is Agentic AI?

Traditional AI operates within fixed rules, like automatically applying payments when invoice data matches. GenAI analyzes patterns to create new content, such as drafting personalized payment reminders based on customer history. Agentic AI uses traditional AI and GenAI’s large language models (LLMs) to go beyond both -- observing, deciding, and acting alone. Simply put, these autonomous agents are the cumulative benefit of previous AI models. LLMs, data analytics, and reasoning tools are the building blocks of Agentic AI, allowing it to “think” and act alone on the human’s behalf.

Forbes calls Agentic AI “not just another industry buzzword but a paradigm shift,” while leading futurists predict it will unlock multi-trillion-dollar opportunities.

How We Got Here: The Road to Agentic AI

- 2023: AI takes a quantum leap as OpenAI launches GPT-4, introducing multimodal capabilities (text + images), while Google rolls out Gemini, its most advanced conversational AI yet.

- 2024: Businesses rush to integrate GenAI into workflows while the EU implements landmark AI regulations, setting the stage for global compliance.

- 2025: Agentic AI takes center stage. Companies begin deploying autonomous AI agents to make real-time decisions, automate workflows, and push efficiency to unforeseen levels.

How Does Agentic AI Work?

Data Synthesis in Real-Time

Agentic AI doesn’t just gather data. It continuously pulls from ERPs, payment histories, customer communications, and third-party sources to create a dynamic, real-time picture of each customer. Traditional AI analyzes static datasets, whereas Agentic AI keeps evolving with every new input.

From Insight to Action

While traditional AI stops at identifying patterns, Agentic AI takes the next step by deciding what to do with that information and executing it. For example, the “agent” can respond to late payment trends by adjusting outreach or terms automatically.

True Autonomy

Agentic AI operates independently within defined guardrails, making decisions and carrying out tasks across the entire AR lifecycle. Unlike traditional AI, which relies on users to interpret and act autonomously on insights, the “agent” owns the process end-to-end. But don’t worry – it doesn’t go rogue. Humans stay in control, with full visibility and approval options whenever needed.

Built-in Learning and Adaptation

Every action taken by Agentic AI feeds back into the system, allowing it to learn what works and refine its strategies over time. Traditional AI models require manual retraining, whereas Agentic AI improves continuously in the background.

Where to Start: Laying the Groundwork for Agentic AI

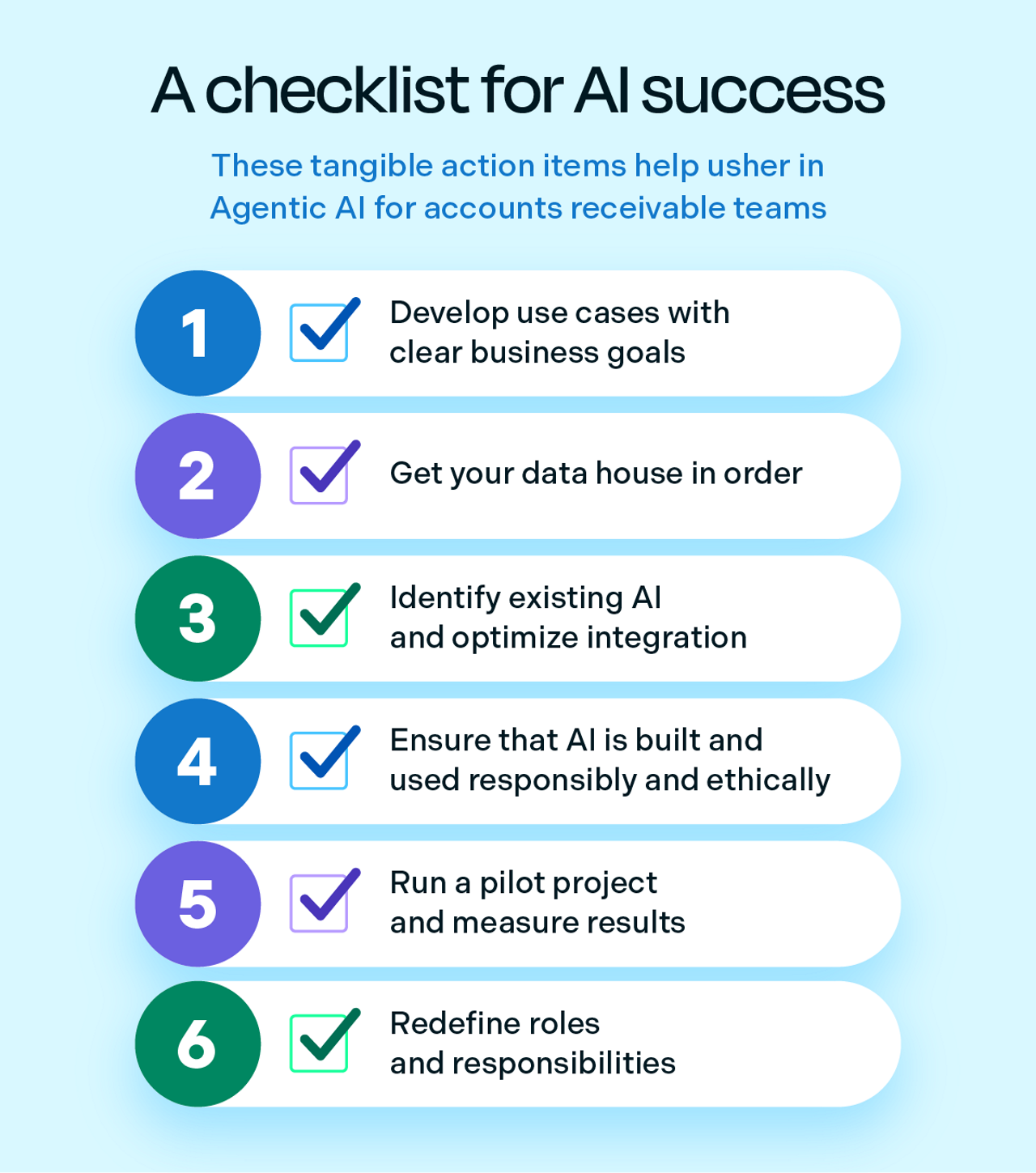

Full-fledged Agentic AI doesn’t happen overnight. It requires a strategic approach, the right foundation, and a clear vision. As a leader in AI-driven financial transformation, here are the first two steps Billtrust recommends:

- Get your (data) house in order. Better data leads to better decisions. Leading companies are building centralized AI and data hubs to ensure clean, structured, and accessible information because they know AI is only as good as the data it’s trained on.

- Develop use cases with clear business goals. The greatest AI successes start with well-defined objectives. What specific challenges in AR can AI solve? How will success be measured? Finance teams that set clear KPIs and financial impact assessments from the start see real ROI faster.

Explore all six steps below.

Leading order-to-cash (O2C) software automation platforms like Billtrust come equipped with autonomous workflows and virtual assistants, trained on the industry’s largest financial data network and perfected by experts who deliver thousands of AI finance transformations each year. As a baseline, our clients recognize up to 95% cash application match rates, up to 50% improvement in Days-Sales-Outstanding, up to 80% increase in productivity, and up to 25% improvement in cash flow.

Get the full picture of autonomous AR, plus all six steps to successful adoption, in Billtrust’s complete guide to Agentic AI.