Finance professionals are no longer back office “number crunchers.” Finance leaders like you are instrumental in shaping the future success of your organizations. As the keeper of mission-critical data, you guide business decisions, influence growth strategies, and drive innovation. But this evolution isn’t without challenges.

Billtrust’s CFO, Bob Purcell sat down with Bryan Degraw, Associate Principal – Finance Market Intelligence at Hackett, to discuss these challenges in light of the findings from Hackett's “Finance Agenda, Key Issues Study.”

Watch the full video here or keep reading for a recap.

Moving beyond operations

For years, finance teams excelled at process efficiency—closing books quickly, managing compliance, and ensuring cash flow stability. While these skills remain critical, the need to go beyond the back office has never been greater. Organizations are relying on finance leaders to look beyond the books and provide data-driven insights for use in making crucial decisions.

Bob Purcell likened this transformation to moving from operating the engine room of a ship to standing on the bridge and setting the course. Finance professionals do more than ensure smooth operations. This role is helping shape the organization’s trajectory, identifying risks and opportunities before anyone else.

To achieve this, finance teams must be proactive, focusing on forward-looking measures. Historical data is important, but today’s top finance leaders also look to predictive analytics and real-time insights to inform their decisions.

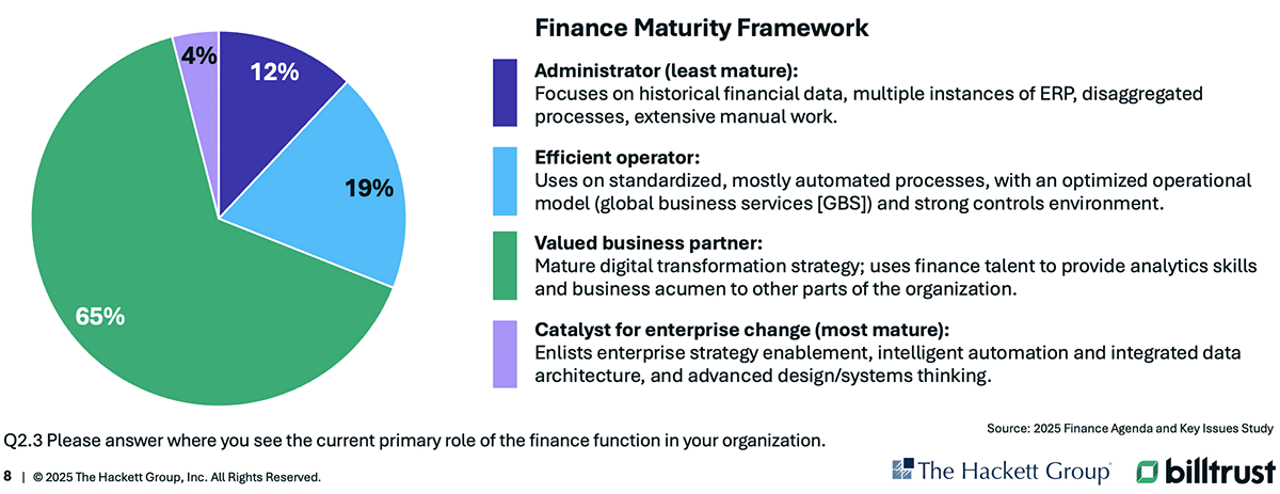

Finance maturity in 2025

The maturity of finance teams is accelerating quickly. According to the Hackett study, the number of finance teams identifying as valued business partners within their organizations increased significantly, rising from 41% in 2024 to 65% in 2025. This shift signifies how critical finance has become in shaping business strategies and outcomes.

“It is exciting to me that finance is taking the step from a partner in operations to being a navigator of the business,” says Bryan Degraw. “They’re using more and more cutting-edge technologies to analyze and get an idea of what’s on the horizon. The next step up, and the most mature position, is that of a catalyst for change, where finance teams are expected to evolve even more with a leadership role in data enhancement and adoption of AI.”

This evolution highlights the growing importance of finance teams as drivers of innovation and transformation. For finance leaders, the challenge lies not just in adopting advanced tools but also in steering their teams toward this more mature, catalytic role.

Building a strategic finance function

Becoming a strategic partner in business transformation starts with building a finance function that prioritizes collaboration and data-driven decision-making. A proactive approach helps organizations to stay ahead of challenges and take advantage of opportunities.

“One of the most important steps is getting the basics right,” says Purcell. “From spotting trends and identifying anomalies to forecasting cash flow, they all give you an edge to pull forward plans as an organization.”

Without reliable master data and processes in place, even the best financial insights will fail to drive meaningful action. Sharing accurate, timely data with other departments encourages cross-functional collaboration and ensures everyone is moving toward mutual objectives. Strategic alignment doesn’t stop within the finance unit; it must extend across the organization.

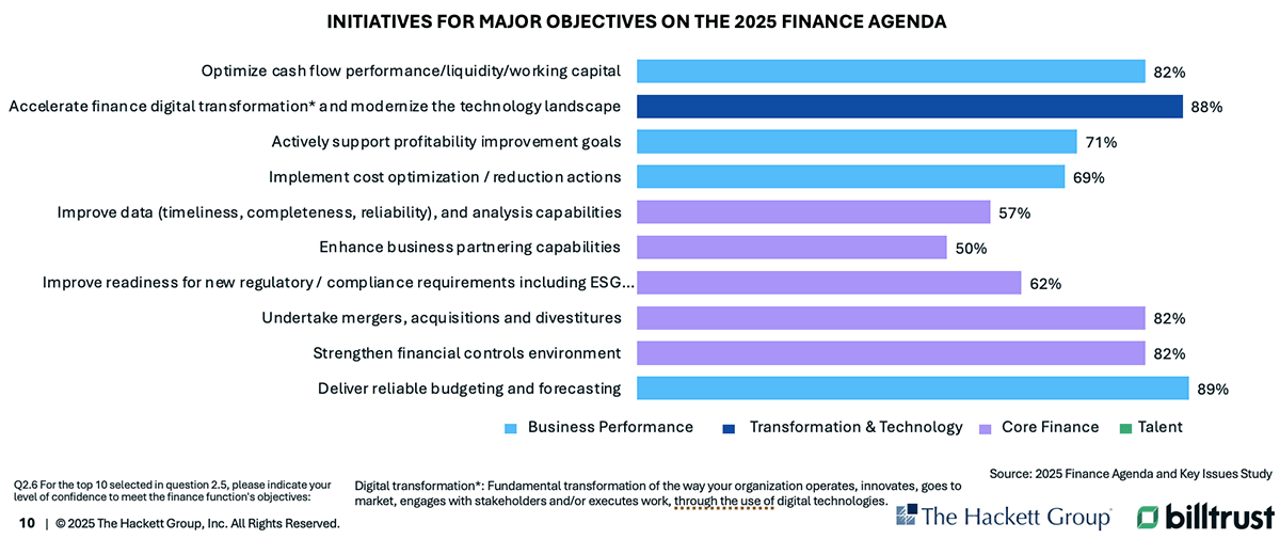

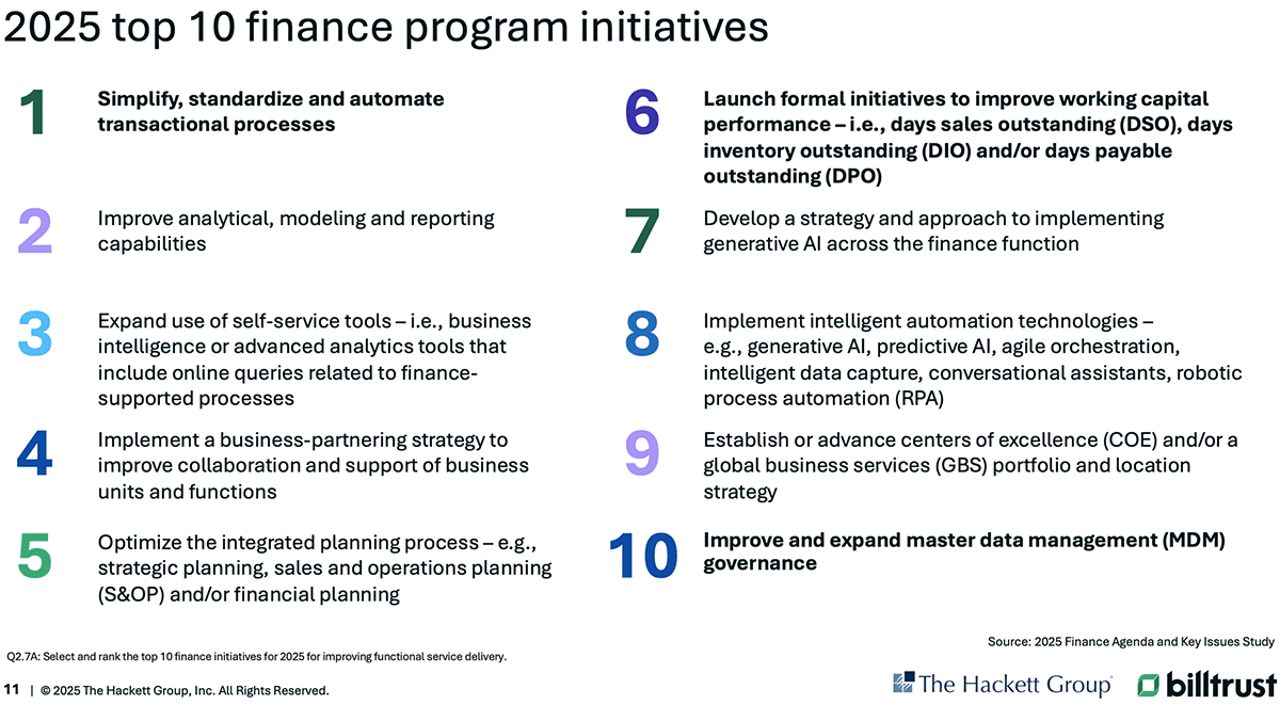

Top 10 strategic objectives and initiatives for 2025

The Hackett Group’s study identified ten key initiatives finance teams are pursuing in 2025 to meet their broader strategic goals. These include reliable forecasting, ramping up digital transformations, and improving data and analysis capabilities.

What stands out is the role of digital transformation. “Digital transformation is reshaping the finance function,” says Bob Purcell. “We should let technology do what it does best: automate repetitive tasks, so teams can focus on driving innovation and sharing insights. Finance professionals, with their strong understanding of numbers and processes, are uniquely positioned to champion technology investments and lead organizational change.”

Another critical initiative is data improvement; however, only 57% of finance teams are launching formal efforts to address this issue. Poor data quality undermines even the best tools, making it crucial for finance teams to prioritize master data management. As Degraw pointed out, “Great data and the right instruments are a must for using technology effectively.”

Additionally, organizations are emphasizing working capital performance. Days sales outstanding (DSO), for instance, often suffers when companies extend payment terms to boost market share but lack mechanisms to ensure on-time payments. Finance teams must find a better balance, adopting processes to manage late payments while leveraging tools to enhance liquidity planning.

Purcell adds, “Businesses can’t afford to lose sight of foundational finance practices. Simplifying, standardizing, and automating transactional processes lays the groundwork for successful forecasting and analysis. Without that foundation, it’s challenging to achieve broader objectives, no matter how ambitious.”

Embracing technology

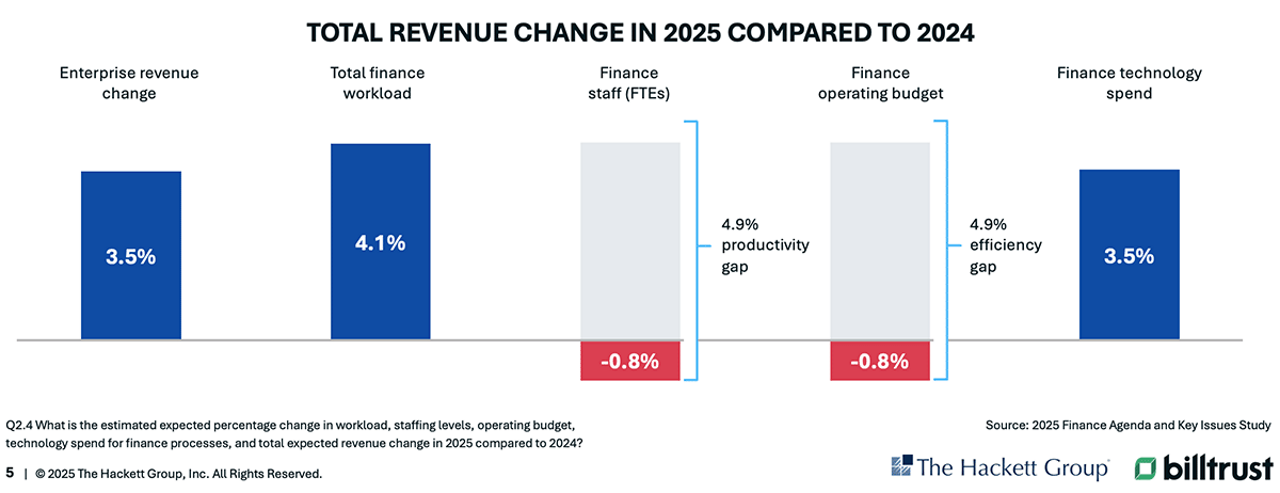

As finance evolves into a strategic function, technology plays an essential role. According to The Hackett Group’s study, finance workloads have been increasing but staffing and resource levels aren’t keeping pace.

2025 Projections:

- Revenue growth: +3.5%

- Workloads: +4.1%

- Staffing & Budgets: –0.8%

- Tech Investments: +3.5%

What does this mean for you as a finance leader? Quite simply, the time has come to lean on technology to work smarter, not harder.

“We’re being constantly asked to do more. Now is the time to learn and lean further into technology to automate manual tasks and free up resources for higher-value activities,” Purcell shared. “This includes AI and other automation tools to improve efficiency in areas like cash application and collections.”

The growing role of AI in shaping finance for 2025

AI is transforming how finance teams operate, allowing them to cover more ground, work efficiently, and provide actionable insights.

“At Billtrust, we embrace AI tools like ChatGPT and Microsoft Copilot within our finance team. We told ourselves, we’ll either be disrupted by this technology, or we’ll use it to disrupt,” said Purcell.

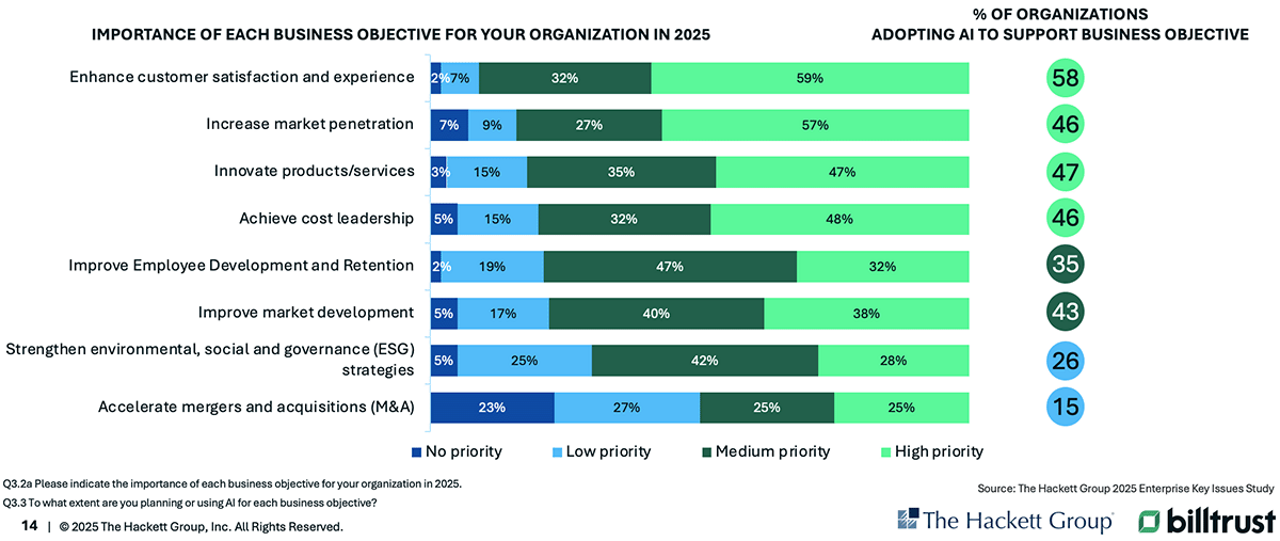

This aligns with research highlighting AI’s increasing role in driving key business objectives by 2025. Leading the charge, 58% of organizations plan to leverage AI to enhance customer satisfaction and experience.

AI is no longer just a tool—it's a catalyst for progress. “AI is on its way, and it’s essential to prepare for it and embrace its potential. From a competitive standpoint, you can’t afford to stand on the sidelines while your competitors move ahead. AI will be utilized across organizations of all sizes and industries, driving key objectives,” says Degraw.

Scaling AI for organization-wide impact

Maximizing the potential of AI requires a shift from isolated pilot programs to widespread adoption across the organization. To reach this level of operational sophistication, teams must focus on developing a scalable AI strategy.

This strategy begins with high-quality data. “Without clean, enriched master data,” explains Degraw, “even the most advanced AI tools won’t perform optimally.” AI systems rely on accurate inputs to deliver worthwhile outputs, so it's essential for finance teams to invest in data-enrichment initiatives.

Upskilling the workforce is another critical component. While AI brings incredible potential, finance professionals must know how to interpret its outputs and use them to ask better questions and deliver insights. By equipping teams with the skills to harness AI effectively, organizations can develop true enterprise-wide advantages.

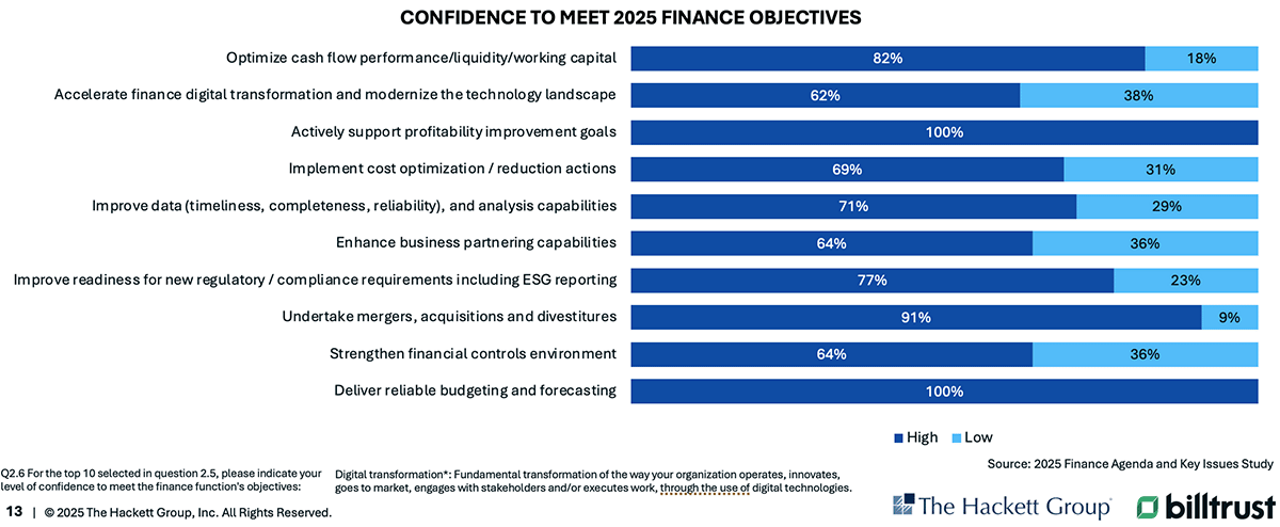

Confidence in achieving 2025 goals

Overall, finance leaders are optimistic about their ability to achieve 2025 finance objectives. Increased confidence in profitability initiatives and forecasting capabilities stems from the successful integration of advanced technologies like AI.

The opportunities to lead are endless. Consider your current manual processes and the sophistication of your tech stack. Is your roadmap robust enough to effectively address finance’s increasingly strategic role within the business? Do your teams have the tools and confidence needed to meet ambitious goals?

Finance leaders that embrace this mindset of continuous evolution, prioritize innovation and align their functions with organizational objectives are well-positioned to lead their organizations into a successful 2025 and beyond.