This post was originally published in June 2024 and was updated in February 2025.

You don’t have a lot of control over when you get paid by your customers – but once payment is received, it’s all on you. The clock starts now, and the efficiency and speed of your cash application process will determine both your business’s cash flow and your customer’s ability to refresh its credit.

Let’s review some practical steps that you can take to enhance your cash application process and turn cash application into a competitive advantage.

Move more of your customers to digital payments

One of the core objectives of any payment acceptance strategy should be automation, and digital payments make this goal far more achievable. Why? Because digital transactions provide more reliable remittance information, making them easier to process and reconcile. Encouraging the adoption of electronic payments improves your match rates, simplifies the reconciliation process, and provides customers with faster, more dependable payment experiences.

While some level of automation is possible with paper checks through technologies like Optical Character Recognition (OCR), the process still involves manually opening envelopes and scanning checks to digitize them. This outdated method feels unnecessarily cumbersome, especially when payments could be fully digital from start to finish.

Benefits of digital payments:

- Speed: Digital transactions are processed faster than physical checks, reducing the time it takes for funds to clear.

- Accuracy: Electronic payments minimize errors often associated with manual data entry.

- Security: Digital transactions offer robust security features, reducing the risk of fraud.

By moving more customers to digital payments, you’ve set yourself up for a more easily automated cash application process.

How to encourage digital payments

Even though digital payments are ultimately more convenient for you and your customer, some customers’ AP processes are overwhelmed with work and stuck in their old ways. They’re not trying to reinvent how they do things – they’re just trying to get through the day. However, you can encourage your customers toward digital payments.

- Simplify the process: Make it easy for customers to set up and use digital payment methods by hosting a billing and payments portal.

- Educate your customers: Communicate the advantages of digital payments through newsletters, emails, and webinars. Billtrust can even run email and phone campaigns to sign customers up to use your portal.

- Incentivize transition: Offer discounts or other incentives to customers who switch to digital payments. This can include accepting credit card payments.

Leverage data analytics and AI

Your data is a valuable asset. By identifying trends and areas for improvement, you can make informed, data-driven decisions that enhance efficiency and accuracy over time. Monitor match rate performance by customer, payment method, or time period to spot trends and gaps. For example, if certain customers consistently show lower match rates, targeted outreach can address their specific issues and improve outcomes.

Additionally, artificial intelligence (AI) is revolutionizing the cash application process with unprecedented levels of automation. Integrating AI into your solution can unlock powerful benefits and transform the way you manage receivables.

Benefits of AI in cash application:

- Predictive matching: AI algorithms can predict and match payments to invoices with high accuracy, even when data is incomplete or ambiguous.

- Anomaly detection: AI can identify anomalies and flag potential errors or fraudulent activities, improving security and compliance.

- Continuous improvement: AI systems learn and adapt over time, continually improving their performance and accuracy.

Capture emailed remittance from ACH and credit cards automatically

One of the challenges accounts receivable (AR) professionals face is manually capturing emailed remittance information — a task that is both time-consuming and prone to errors. Automating this process can drastically improve efficiency and accuracy.

Keys to automating remittance capture:

- Use OCR technology: Optical Character Recognition (OCR) technology can automatically read and extract relevant payment information from emailed remittances, including PDFs and scanned checks.

- Direct payments to an automated inbox: Billtrust can open emailed payments automatically. We can process emailed credit card payments and capture remittance from emailed ACH payments as soon as they’re sent.

Keep an eye out for intelligent matching and exception-handling

Modern cash application solutions use AI-powered matching engines to match payments with remittances. Two primary approaches drive this process: rule-based matching and confidence-based matching. Rule-based systems operate on strict, predefined rules, while confidence-based systems utilize machine learning to evolve and improve over time.

In confidence-based matching, payments exceeding a predefined confidence score are automatically processed, while those falling below it are routed to an exception-handling interface. This workspace should be designed to offer intelligent suggestions, allowing most exceptions to be resolved with just a few clicks, thereby minimizing manual effort.

Struggling with manual reconciliations in your cash application process? Discover actionable strategies in our eBook, The Cash Application Advantage.

Maintain strong communication with customers

Set your customers - and your AR team - up for success from day one. Use the onboarding process to clearly outline your payment and remittance requirements, preferred payment methods, and tips for avoiding common mistakes. Providing a little extra guidance up front can save significant time and prevent major issues later.

But also later, open lines of communication with customers are crucial to ensure they provide the necessary remittance details with their payments, reducing mismatches and discrepancies.

Implement a solution with a high match rate in your industry

The match rate refers to the percentage of payments that can be correctly matched to open invoices without manual intervention. Implementing a solution that has proven a high match rate for peers in your industry can significantly reduce the workload on your AR team.

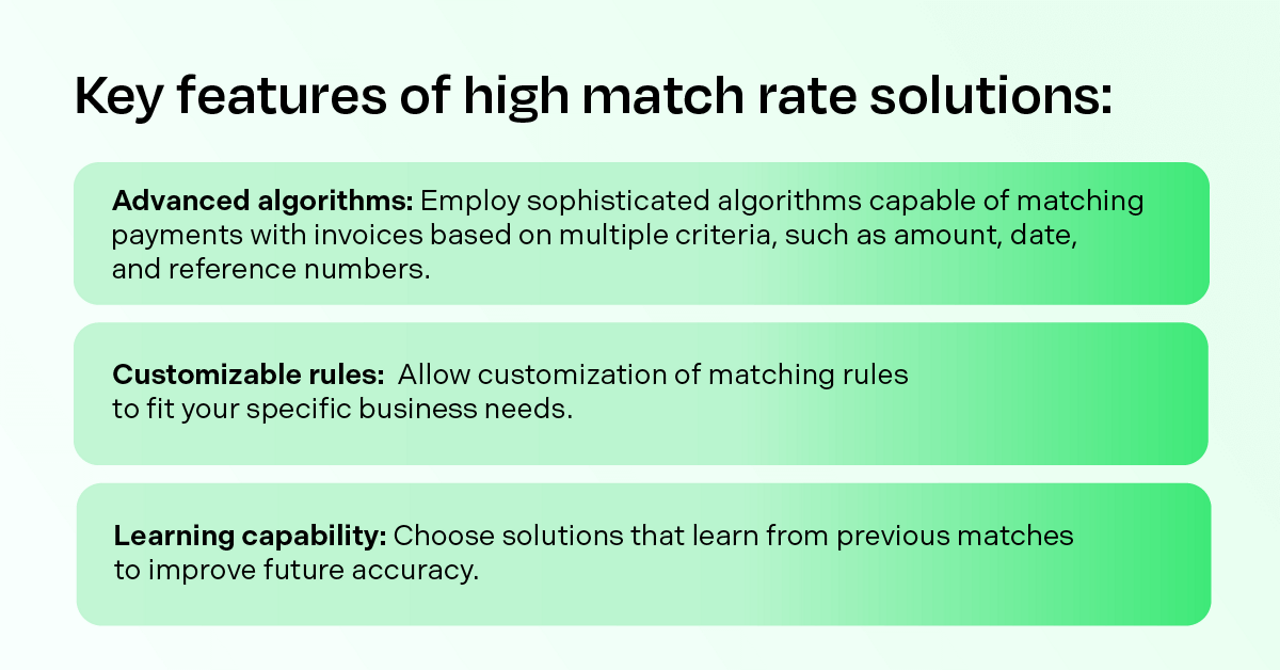

Key features of high match rate solutions:

- Advanced algorithms: Employ sophisticated algorithms capable of matching payments with invoices based on multiple criteria, such as amount, date, and reference numbers.

- Customizable rules: Allow customization of matching rules to fit your specific business needs.

- Learning capability: Choose solutions that learn from previous matches to improve future accuracy.

Tips for selecting the right solution:

- Evaluate vendors: Conduct thorough evaluations of different vendors to identify the ones that offer the highest match rates for your industry.

- Feedback loop: Establish a feedback loop with your vendor to continuously improve the match rate based on real-world usage.

- Performance metrics: Make sure you’ll have the stats at your fingertips that allow you to improve match rates over time.

Establish a feedback loop

The best cash application processes are not static. Regularly revisit and refine your payment workflows, remittance requirements, matching rules and exceptions to keep pace with changing customer behaviors and technological advancements.

This allows you to spot trends or recurring issues, whether they stem from internal processes or customer behavior. Use these insights to refine your matching rules and remittance guidelines, driving long-term improvement.

Emphasize collaboration across departments

Cash application isn’t just an AR issue, it’s a company-wide effort. Bring together your AR, sales, and customer service teams to ensure consistent communication with customers about payment processes. This alignment can resolve disputes faster and prevent mismatches before they happen.

The cash application processes' next evolution

Digitization and automation of the cash application process has opened new opportunities for AR professionals. With radically less time spent on manual processes, AR teams can focus on strategic tasks that support the rest of the company.

And with a cash application process that is fast, efficient, and accurate – you can deliver free cash flow and working capital at levels that move businesses out and ahead of the competition.