The current economic climate poses a particular challenge for transportation companies—where cash flow delays can threaten operations practically overnight. Melanie Morcelle, the EVP of the Creditors Adjustment Bureau, knows how to mitigate today’s threats. In a recent Billtrust webinar, she explained how she leverages 25 years of credit and collections experience to scale collections success. If you missed the event, here’s a quick summary of our discussion and key learnings.

Key Collection Objectives

Modern collections is more than maximizing cash collection, explained Morcelle. It’s about preserving positive customer relationships and safeguarding brand reputation. In her view, effective collections start with two core scenarios:

- Either a customer truly can’t pay (cash flow issue)

- They choose not to pay (dispute)

According to Morcelle, "The fresher the paper, the higher the probability of collection. At due date, you have a 92% chance of full recovery. By 60 days, it drops significantly, and by 6 months, it's under 50%.”

These statistics highlight the importance of taking a proactive approach to outreach. Early intervention not only protects cash flow but also fosters trust. If you wait until 60 days past due, you’re already fighting diminishing odds—and risking customer dissatisfaction.

From Valued Customer to Concerning Debtor: Recognizing the 3 Stages of Buyer Behavior

A key skill in collections is recognizing when a reliable customer is on the verge of becoming a potential debtor. Morcelle divided this journey into three stages, each with distinct warning signs and dramatically different recovery odds.

The fresher the paper, the higher the probability of collection. At due date, you have a 92% chance of full recovery.

Melanie Morcelle, Executive VP, Creditors Adjustment Bureau

Stage One: The Highest Potential for Recovery

At this initial stage, the customer is typically still wishing to remain in good grace. They might be experiencing temporary cash flow hiccups but genuinely intend to pay.

- Signals: Watch for late checks, an uptick in insufficient funds notices, or service issues emerging only at invoice time. Buyers may proactively offer partial payments or make sincere promises to pay.

- Mindset: Willing to cooperate; they just need a short-term bridge.

- Recovery Odds: 90%

Stage Two: The Turning Tide

Payment promises are broken. Cash is truly tight at this stage. Invoices decrease in priority, and suppliers might see operational shifts on the buyer side (e.g., new ownership or changing banks).

- Signals: Communication often goes cold—receptionists screen calls, emails go unanswered.

- Mindset: Evasive; buyers are scrambling to pay critical vendors first.

- Recovery Odds: Average 50%

Stage Three: The Critical Point

This is the most precarious stage, where the likelihood of recovering the full amount plummets. The customer may be insolvent or already in bankruptcy.

- Signals: Expect disconnected phones, returned mail, or an attorney referral.

- Mindset: Unresponsive or shutdown. At this point, the role of your AR team shifts from collection to bad debt, loss mitigation, and legal follow-up.

- Recovery Odds: Minimal

A Playbook for Learning the Art of Negotiation

When faced with a customer struggling to pay, negotiation becomes an indispensable tool. Morcelle described negotiation as a learned art, outlining 12 crucial steps to navigate these often-delicate conversations. Five principles capture the heart of Morcelle’s negotiation playbook:

- Listen First: Let the customer fully explain their situation—defuse tension and gather vital intel before you ever speak.

- Reframe Objections as Shared Goals: Don’t dismiss concerns. Acknowledge their cash constraints, then reorient the conversation to “How can we build a feasible payment plan?”

- Use Specifics to Lock in Commitment: Ask for exact dates and odd-dollar amounts (e.g., $5,275 instead of $5,000). This signals that you’ve calculated your bottom line and expect them to do likewise.

- Trade Concessions Strategically: If you offer a partial discount or extended term, require something measurable in return—don’t “give away” flexibility without getting a comparable commitment.

- Stay Firm, Yet Empathetic: Once you agree on a plan, don’t renegotiate unless absolutely necessary. Maintain a respectful, professional tone—your goal is a sustainable resolution, not a short-lived band-aid.

Cash Flow Challenges in the Transportation Industry

Transportation companies are feeling the squeeze more than most. Industry data shows that 47% of transport invoices arrive past their terms—well above the 35% average found across other industries. Transport companies are waiting, on average, 37 days longer than standard 30-day terms, and this figure is subject to constant fluctuation.

Most transportation invoices are paid 37 days late.

As outstanding invoices and delinquency extend from a normal 30 days past due to 60 or 90 days, roughly one-fifth of annual revenue can become tied up. For a mid-sized company with $5M in revenue, that’s over $1M in inaccessible cash flow – funds unavailable for maintenance, payroll, or growth. This creates a devastating cascade effect, Melanie explained.

With less working capital, transportation companies have fewer opportunities for maintenance and growth.

Companies find themselves struggling to fund upcoming jobs, maintain essential equipment or pay their staff on time. When confronted with a cash crunch, carriers turn to high-interest, short-term loans to cover fuel and wages. This erodes already thin profit margins. Even worse, unpredictable cash inflows make budgeting impossible. If you can’t forecast cash, you can’t invest in new routes, maintain fleets, or hire drivers.

Tariff Challenges in the Transportation Industry

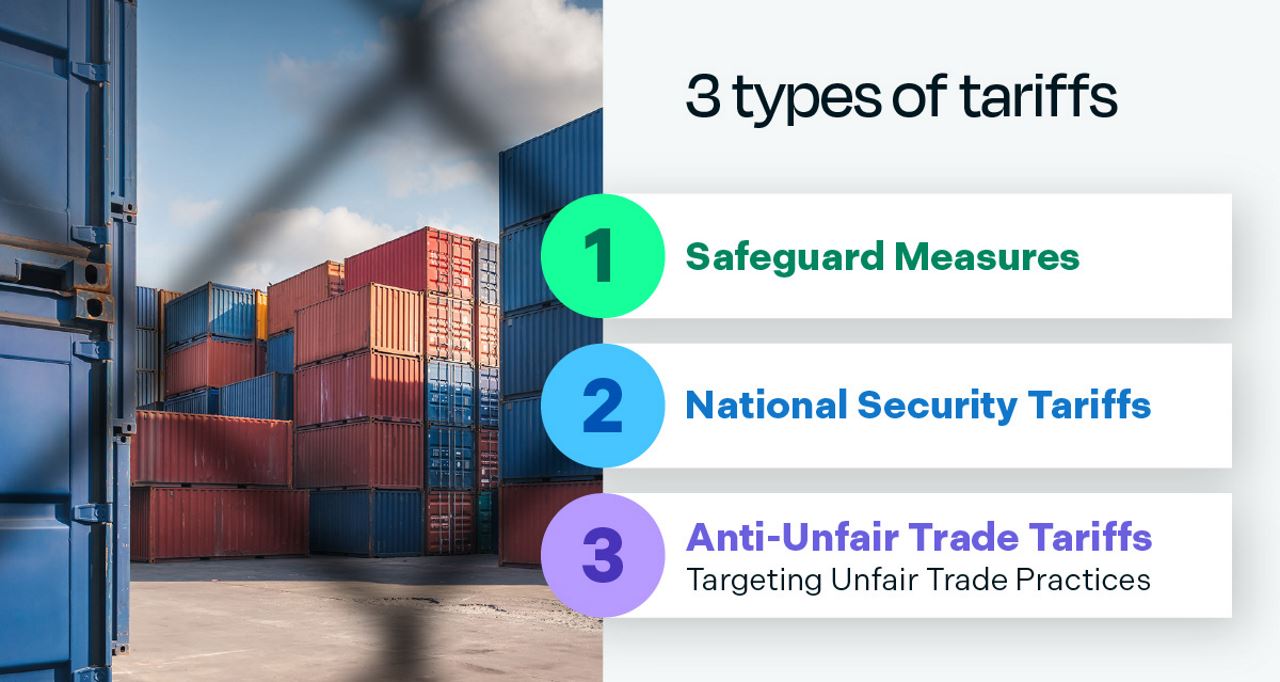

Geopolitical shocks and new tariffs add another layer of stress for transport providers. Below are the three major tariff categories to watch—and why each matter in the fight to preserve cash flow.

- Safeguard Measures: Tariffs designed to protect domestic industries from serious injury due to surges in retail imports. They can be long-lasting, often for 4-8 years.

- National Security Tariffs: Imposed without Congress. These can pop up unexpectedly, instantly raising freight costs for affected goods. A recent example cited was a 25% duty on steel from many foreign sources.

- Anti-Unfair Trade Tariffs Targeting Unfair Trade Practices: Target specific countries, most notably China, for issues like intellectual property theft or forced technology transfers. If negotiations fail, tariffs on billions of dollars of imports can be imposed, with rates often hitting 25%, and in some recent measures, climbing as high as 50% or even 100% on certain items.

Tariffs typically lead to a lower volume of shipments.

How does this directly impact the transportation sector? The most direct consequence is that higher tariffs can lead to a lower volume of shipments, said Morcelle. Rail carriers and parcel services feel the pinch most: around 10–15 % of their revenues come from cross-border flows. Trucking less-than-truckload (LTL) carriers see a smaller immediate hit, but anyone serving cross-border lanes should revisit contracts and fuel-surcharge clauses.

Tariff Survival Tip

Reevaluate freight agreements quarterly, incorporating clauses that address sudden tariff changes and higher border-inspection fees.

Melanie Morcelle, Executive VP, Creditors Adjustment Bureau

Proactive Defense: Collections Best Practices

In such a volatile environment, reactive measures are insufficient. Morcelle emphasized that to survive and thrive, transportation companies must adopt proactive collections strategies. She also highlighted best practices for more effective collections efforts.

- Tighten Credit Policies: Establish stricter credit terms for new customers. Routinely evaluate existing customers – don't assume past good behavior guarantees future performance. Shorten payment windows wherever feasible.

- Leverage Business Credit Reports: Understand your customer’s ability to pay to avoid extending credit where repayment risk is high. These reports are crucial for evaluating both prospective and existing customers. Review and adjust credit policies regularly to reflect current market conditions and customer behaviors.

- Monitor AR Aging Reports: These reports are critical for quickly identifying overdue accounts before delinquency escalates.

- Streamline Internal Collections: Invest in internal processes and collections automation technologies. Consider outsourcing partners to augment your team, especially during periods of high AR backlogs.

- Define Payment Terms Clearly: This includes due dates, policies on interest for overdue accounts, and precise criteria for extending credit. Communicate these terms clearly at the outset of any relationship. Involve the sales team in this process. Each missing document extends payment cycles by approximately 7 days on average.

- Offer Incentives for Early Payments: Encourage early payment directly, for example through tangible discounts, such as a 2% discount if paid within 10 days.

- Monitor Key Performance Indicators (KPIs): "Tracking specific KPIs is essential for assessing the effectiveness of AR processes and identifying areas for improvement," Morcelle asserted. Examples of great KPIs are Days Sales Outstanding (DSO), Accounts Receivable Turnover Ratio and Collections Effectiveness Index.

Why Effective AR Matters: Operational Payoffs

The impact of effective AR management on operational capabilities and financial stability cannot be overstated, stated Melanie. It allows transport companies to:

-

Preserve Cash Reserves

Ensures both planned and unexpected expenses (repairs, payroll) are covered. -

Deliver Reliable Service

On-time cash means on-time shipments, strengthening customer relationships. -

Maintain Assets & Workforce

Keep equipment maintenance schedules intact and ensure timely driver compensation. -

Seize Growth Opportunities

When cash is predictable, you can expand lanes or invest in new tech without drilling for financing. -

Weather Commodity Shocks

Did You Know? When diesel spiked 22% in early 2022, carriers with disciplined AR execution applied surcharges immediately—while those lagging faced crippling margin erosion.

Clarity, Consistency, and Control: Keys to Credit Management Resilience

Proactive credit management is crucial, emphasized Morcelle, supporting her point with a striking statistic: "Transport companies that conduct monthly credit assessments see 67% fewer payment defaults compared to those relying on informal practices."

Monthly credit assessments can lower payment defaults by 67%

That kind of success starts with structure. Develop a formal, tiered credit policy based on customer history, financial stability, and industry reputation. Just as important: create a process your team can realistically maintain. A well-written policy is useless if it’s not consistently applied.

Develop a process that your organization can adhere to. A shiny new policy is useless if it's not consistently applied.

Melanie Morcelle, Executive VP, Creditors Adjustment Bureau

Don’t underestimate the value of transparency. “It’s best to communicate these changes at least 30 days before implementation and be clear about the cause,” Morcelle advised. “This is a goodwill gesture that works. Try to explain the business rationale and benefits, turning potential friction points into opportunities for relationship building.”

A clear policy is more than a document—it’s a promise to your customers and a compass for your team. When backed by timely, transparent communication, it becomes a powerful tool for reducing disputes and reinforcing relationships.

In uncertain times, transportation AR teams can’t afford to be reactive. By refining policies, monitoring KPIs, leveraging technology such as Billtrust’s automated Collections software, and leaning into clarity at every step—collections become less about chasing and more about collaborating with your clients.

The most resilient transportation companies replace friction with follow-through and late payments with lasting partnerships.