Accepting credit cards can be a competitive advantage. You’ll make customers happy and receive payments faster than with ACH or check. You’ll also have the digitized remittance that you need for fast cash application.

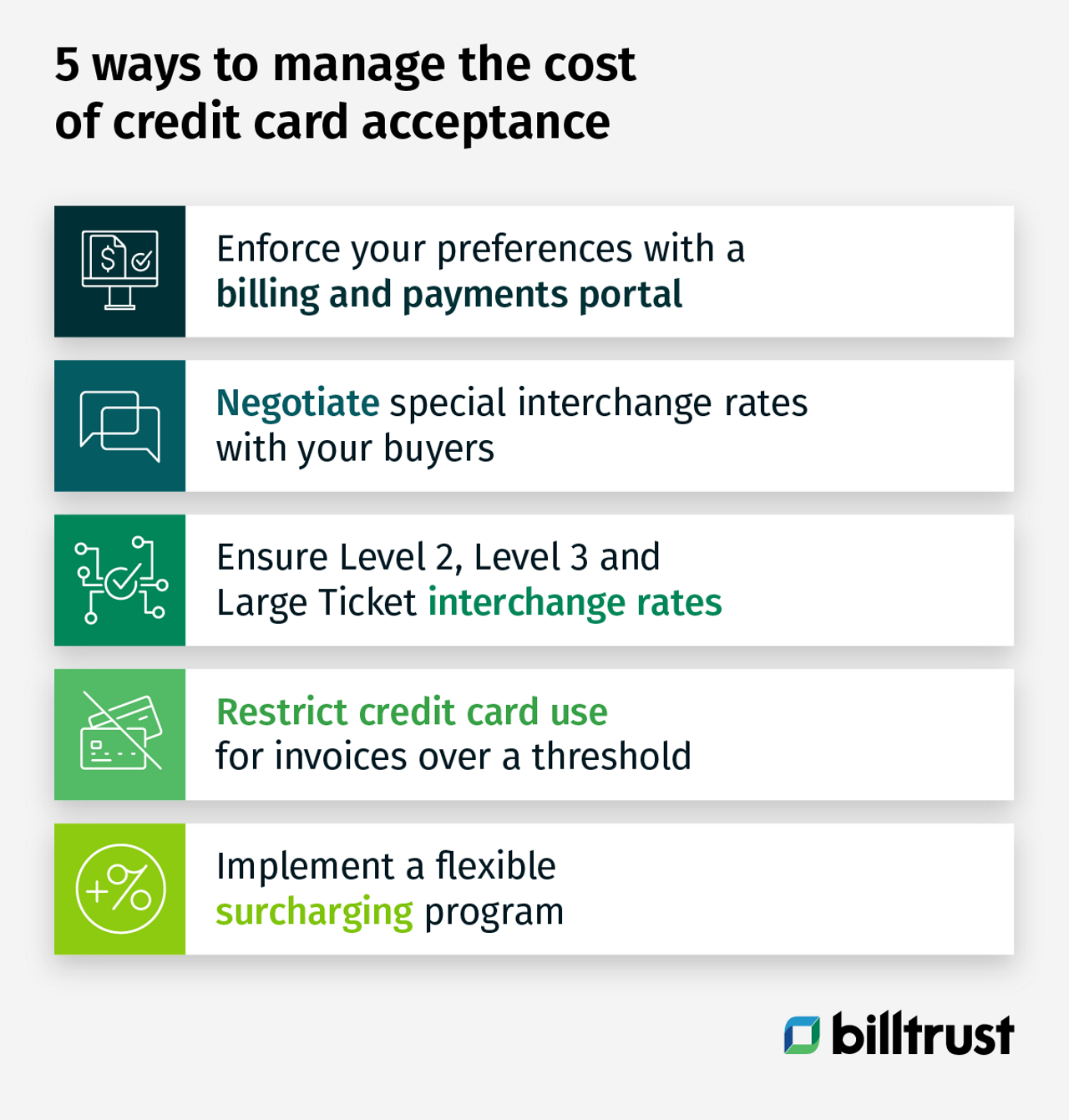

But there are significant costs associated with credit cards. Here are 5 ways to manage them.

How to manage the cost of accepting credit cards

1. Enforce your preferences with a billing and payments portal

When you establish a billing and payments portal, you’re not only giving your customers the ability to easily view and pay their invoices, you’re also creating a system where you control how your buyers pay.

You can create payment rules that reward faster payment. For example, you can make it a rule to accept credit card payments within ten days of invoice delivery. Your buyers that want to use credit cards will be incentivized to pay faster and you’ll realize benefits that offset the cost of credit card acceptance.

2. Negotiate special interchange rates with your buyers

This is a unique proposition and it’s not easy to scale. But if you have a good relationship with one or more of your buyers and high payment volume, Billtrust can help you negotiate a special interchange rate between your business and their payments vendor.

3. Ensure Level 2, Level 3 and Large Ticket interchange rates

Make sure that your payment processor is set up to constantly monitor your payment rates and get you the advantageous rates associated with higher levels of data when processing.

4. Restrict credit card use for invoices over a threshold

Credit cards payments require less manual work to process and apply than ACH or check, but for invoices above a certain dollar amount, the saved time and energy may not be worth the interchange rates.

5. Implement a flexible surcharging program

Surcharging can eliminate the costs associated with accepting credit cards completely. But until recently, it’s been a major challenge to implement surcharging at scale. Differing rules between states and card brands are tough to navigate while maintaining compliance. But now, Billtrust is offering surcharging-as-a-service.

We handle the calculation, compliance and customer communication for you, so surcharging can be simply “turned on” for some or all of your buyers.

We can even help you partially surcharge and “split the fee” with price-sensitive customers. To learn more, read Surcharging: the key to unlocking credit card payments.

Download the ultimate guide to digital accounts receivable

Get help with managing the cost of accepting credit cards

If you’d like to learn more about how Billtrust can help you manage the cost of accepting credit cards, please fill out the form and a payments expert will be in touch with you shortly.