This post was originally published in September 2021 and was updated in January 2025 with additional information on why AR turnover ratio matters to your business.

What is Accounts Receivable (AR) turnover ratio?

The accounts receivable turnover ratio shows you the number of times per year your business collects its average accounts receivable. It helps you evaluate your company’s ability to issue a credit to your customers and collect monies from them promptly. A high accounts receivable turnover ratio indicates that your business is more efficient at collecting from your customers.

In business accounting, many formulas and calculations can provide you with valuable insights into your company’s financials and operations. The accounts receivable turnover ratio can help you analyze the effectiveness of extending credit and collecting funds from your customers.

This post will break down the receivable turnover ratio, calculate it, the difference between a high and low ratio and more.

Read the blog → 10 strategies for optimizing your accounts receivable to maximize your ROI

Why your AR turnover ratio matters

The accounts receivable turnover ratio reveals far more than just your collection speed—it's a critical indicator of your company's overall financial health. This metric helps you evaluate multiple aspects of your business:

Liquidity and cash flow

A higher ratio shows you're converting credit sales to cash efficiently, giving you the funds needed for daily operations, from payroll to inventory. Strong liquidity through efficient collections positions you better for both stable operations and growth opportunities.

Credit policy effectiveness

Your turnover ratio helps evaluate if your credit policies are serving your business well. Regular monitoring helps you balance customer-friendly credit terms with healthy cash flow. If your ratio drops below industry standards, you may need to adjust your policies or strengthen collection processes.

Financial planning insights

Think of your AR turnover ratio as an early warning system. Changes in this metric can signal potential issues before they impact your bottom line. A declining ratio might indicate customer payment delays or process inefficiencies that need addressing.

Competitive positioning

Understanding how your ratio compares to industry standards helps you stay competitive. A higher-than-average ratio often indicates more effective credit and collection processes. If you're behind competitors, you can identify specific areas for improvement in your order-to-cash cycle.

Read the blog → What is accounts receivable automation software?

How to calculate accounts receivable turnover ratio

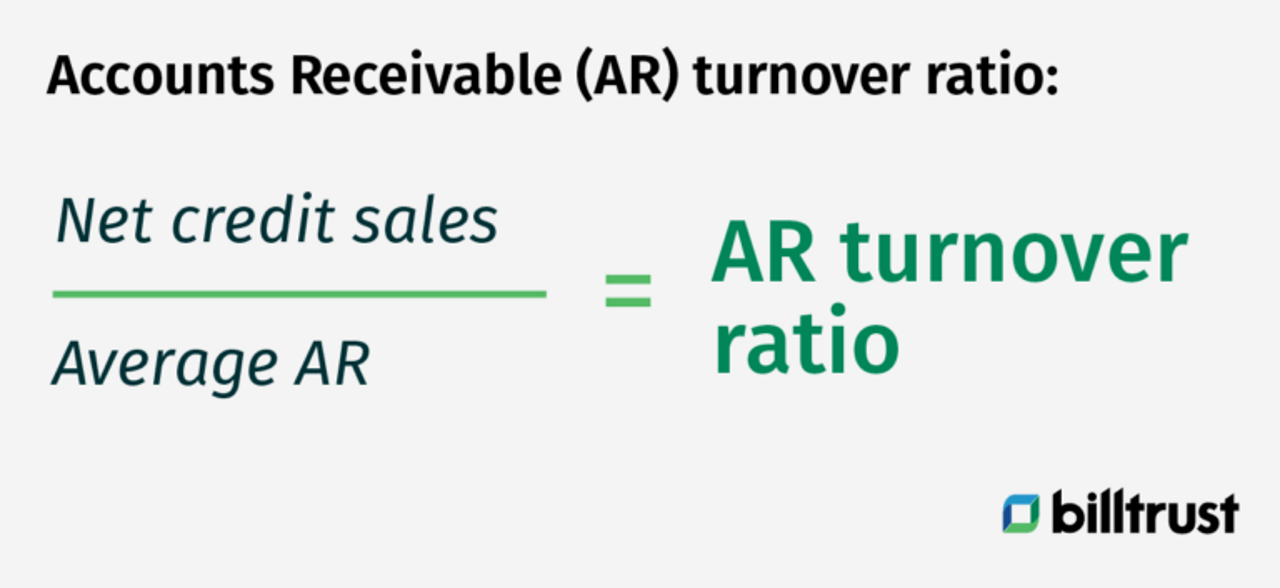

To calculate the accounts receivable turnover ratio, you use the formula below:

Let’s take a closer look at how to determine the receivable turnover ratio by following the three steps below:

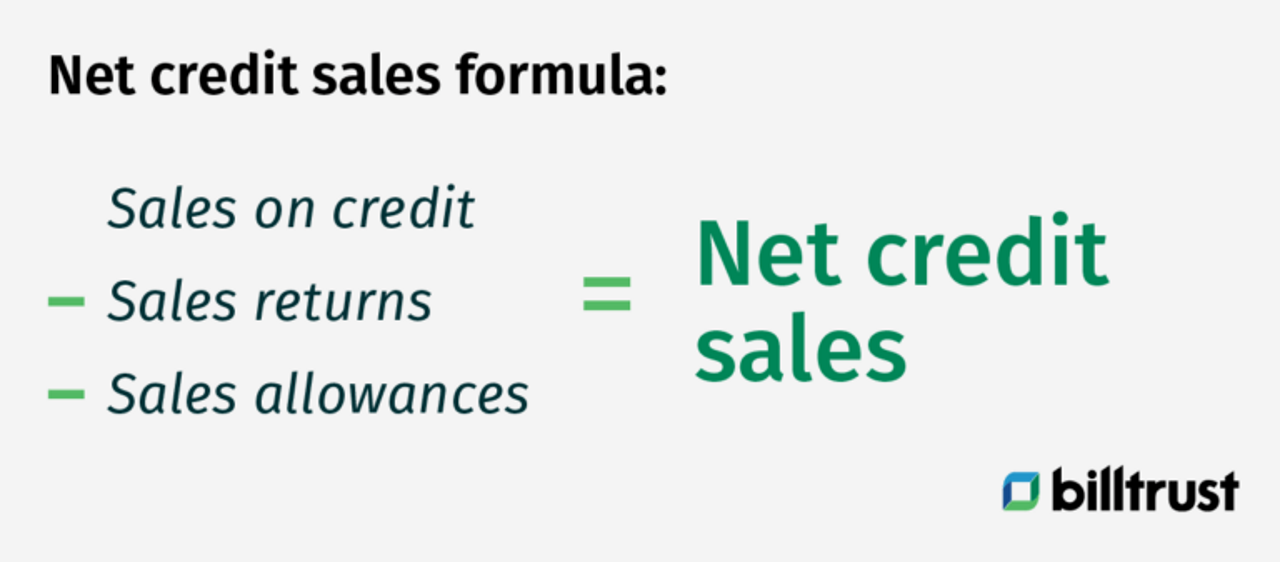

Calculate your net credit sales

The first step of the account receivable turnover begins with calculating your net credit sales or total sales for the year made on credit instead of cash. The number must include your total credit sales, minus returns or allowances. You can find it on your annual income statement or your balance sheet. See the formula below on how to calculate your net credit sales.

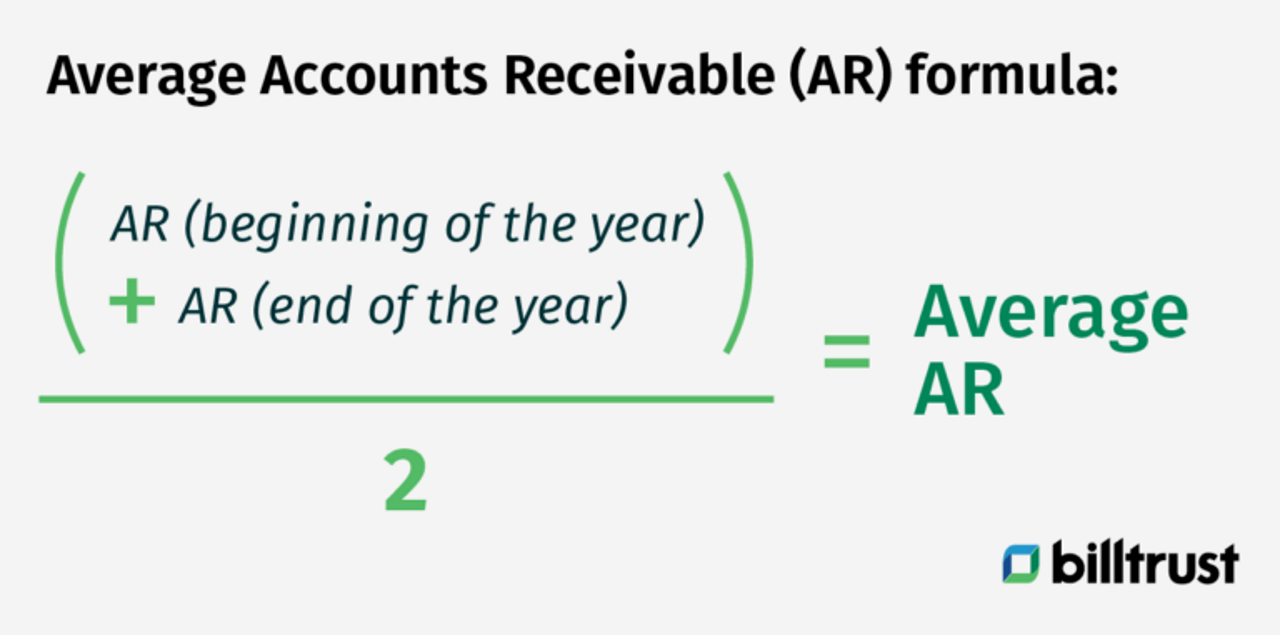

Determine your average accounts receivable

After you’ve pinpointed your net credit sales, the next step of the accounts receivable turnover ratio is to find your average accounts receivable (money owed to you by your customers). To determine your average receivables, find your accounts receivable at the beginning of the year, add it to the value of your receivables at the end of the year, and then divide it by two to get the average. The formula to calculate your average accounts receivable is:

Divide to find the AR turnover ratio

Now that you have these two values, you can apply the account receivable turnover ratio. You divide your net credit sales by your average receivables to calculate your receivables turnover ratio.

Accounts receivable turnover ratio formula example

Let’s review an example of the accounts receivables turnover ratio:

Perhaps your company had $2,500,000 in net credit sales for the year, with an average accounts receivable of $500,000. To calculate your accounts receivable turnover ratio, you would divide your net credit sales, $2,500,000, by the average accounts receivable, $500,000, and get four.

$2,500,000 (net credit sales)

/ $500,000 (average accounts receivable)

= 5 (accounts receivable turnover ratio)

So, your receivables turnover ratio of five turned over five times during the past year, which means you collected your average accounts receivable in 73 days (365 (days) / 5 (ratio)), which is more than 30-45 days.

Keep in mind that the receivables turnover ratio helps you to evaluate the effectiveness of your credit. A low number of collections from your customers signals a more insufficient account receivable turnover ratio. Likewise, if you have a higher number of payment collections, you’ll have a higher ratio.

Key AR turnover takeaways

- Accounts receivable turnover definition: Indicates the number of times per year your business collects its average accounts receivable. It helps evaluate your company’s ability to issue credit extensions to your customers and collect monies from them promptly.

- High ratio: A high accounts receivable turnover ratio indicates that your business is more efficient at collecting from your customers.

- Low ratio: A low accounts receivable turnover ratio can indicate inefficiency in collecting debts.

- High vs. low ratio: While considered better, a high ratio may signal that you have a conservative credit policy or that you have higher quality customers. A low ratio may show poor management or a riskier customer base.

- Improving your AR ratio: You may improve your ratio by stating your payments terms clearly, implementing AR automation software, invoicing accurately and timely, building and nurturing customer relationships and making accepting payments easy.

How do you interpret accounts receivable turnover ratio?

Now that you know what the receivables turnover ratio is, what can it mean for your company? Since you use the number to measure the effectiveness of how you may extend credit and collect debts, you must pay attention to whether or not you have a low or high ratio. Remember, the higher your ratio, the higher the likelihood that your customers will pay you quickly.

What do high accounts receivable turnover ratios indicate?

The general rule of thumb for businesses is that the higher the accounts receivable ratio, the better. If your company has a high turnover ratio, it may indicate the following:

- Your customers are first-rate and pay their invoices on time, which improves your cash flow so that you can support your day-to-day operations.

- You have an effective collections department that collects payments quickly.

- You extend credit to customers but avoid taking on too much bad debt, indicating that your company is financially healthy.

- Your customers pay their invoices sooner than most, which opens credit lines for later purchases.

In most cases, a higher receivables turnover is preferable. But there may be situations where it’s too high. For example, your credit policies may be too stringent. Customers may become upset, or you may lose the opportunity to work with customers who may have lower credit limits. Because of these, you may want to revisit your credit policies.

What do low accounts receivable turnover ratios indicate?

A low accounts receivable turnover ratio can indicate inefficiency in collecting debts. Some reasons for a low ratio may include:

- Lenient credit policy.

- Tendency to extend credit too quickly.

- Limited collections team or customers that may have financial difficulties.

- Considerable amount of bad debt.

Tracking your receivables can reveal trends if your turnover has slowed down. If this is the case, you may need to hire additional collection staff or analyze why your receivables turnover ratio worsened.

Is it better to have a higher or lower AR ratio?

Remember, if your company has a high accounts receivable ratio, it may indicate that you err on the conservative side when extending credit to its customers. It also may show a more aggressive and efficient collection process. It may also mean customers are high quality, or a company may use a cash basis.

If your company is too conservative with its credit management, you may lose customers to competitors or experience a quick drop in sales during a slow economic period. On the other hand, a low ratio may imply that your company has poor management, gives credit too easily, has a riskier customer base or spends too much on operating expenses.

Leadership must determine what an acceptable ratio is for their company while keeping in mind that a lower ratio may indicate trouble.

What indicates a good accounts receivable turnover?

The higher the receivable turnover ratio, the better because it means your customers pay their invoices on time, and your company collects debts efficiently. A higher turnover ratio also illustrates a better cash flow and a more robust balance sheet or income statement. Your company’s creditworthiness appears firmer, which may help you to obtain funding or loans quicker.

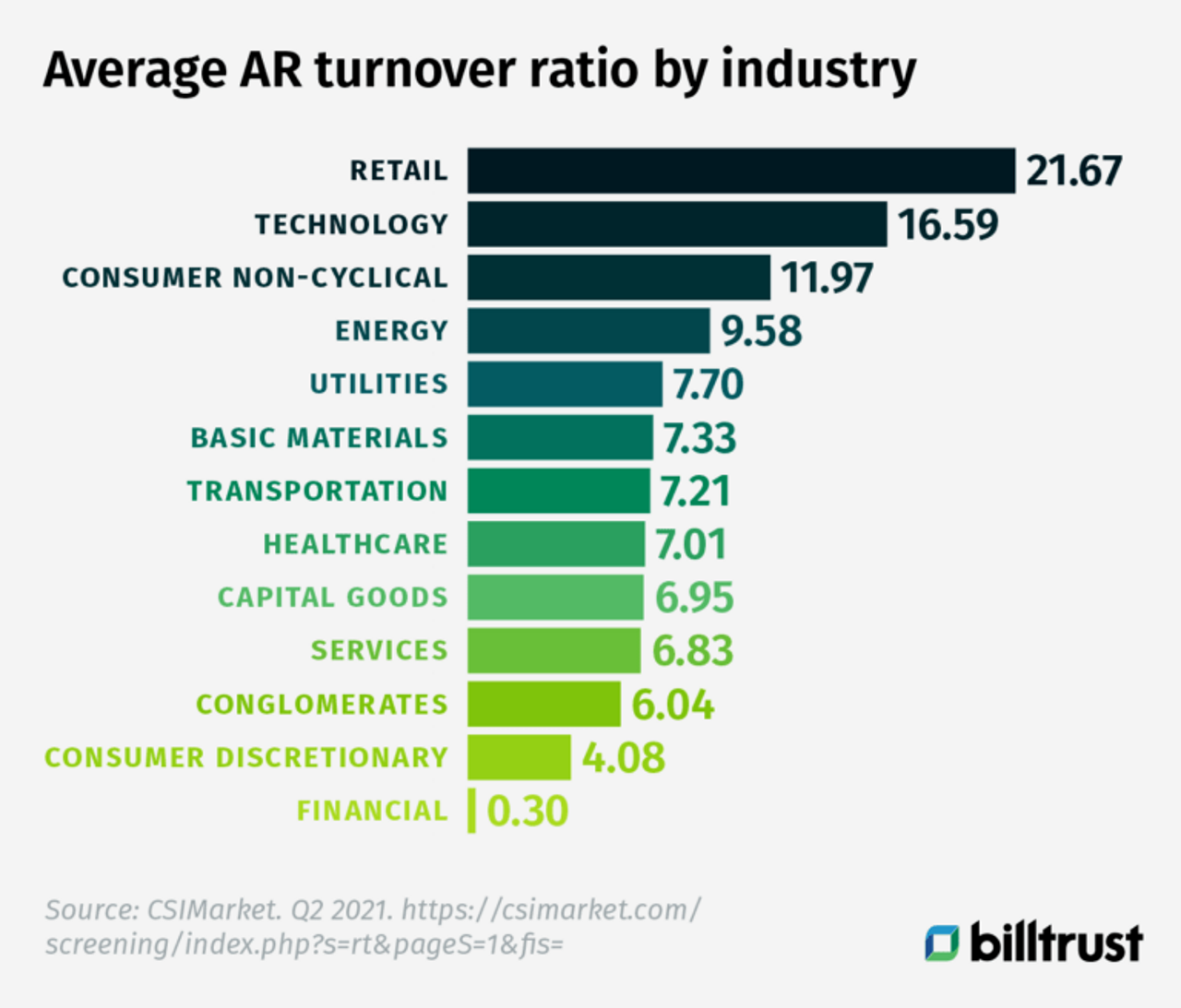

Is there an average accounts receivable turnover?

Here’s a breakdown of the average account receivable turnover ratio by industry as of Q2 2021:

You can use the above data to guide your company’s receivables turnover ratio to see if your number is above or below the industry average.

Improving your accounts receivable turnover ratio

Why is it important to track your accounts receivable turnover? Because as a business owner, your receivables ensure a positive cash flow. Excellent customer service and strong sales are essential. But you can’t run a deficit. And even if your company’s ratio is within industry norms, there’s always room for improvement.

How to improve your accounts receivable turnover ratio

If your company’s cash flow cycle isn’t strong, you may want to review your AR ratio. Here are a few tips you may use to improve your turnover ratio.

1. Invest in accounts receivable automation software

Think about investing in AR automation software to make your invoicing and receivables process easier. For instance, Billtrust focuses on helping companies to accelerate cash flow by getting paid faster. Using a fully integrated, cloud-based accounting software can help with improving operating efficiency, growing revenue and increasing profitability.

2. Build and nurture customer relationships

Having a good relationship with your customers will help you get paid in a more timely manner. Satisfied customers pay on time for the goods and services they’ve purchased. Small and mid-sized businesses (SMBs) can benefit from professional, friendly action like an email or phone call to follow up. These may improve your average collection period.

3. Invoice accurately and in a timely fashion

Using automated AR software can make it easier to invoice your customers and ensure they pay on time. Clean and detailed invoices are more manageable for your customers to read and understand. Creating and sticking to a billing schedule makes it easier for your company to collect receivables quicker. Plus, automation can reduce errors caused by a manual process.

4. Make accepting payments easy

Giving your customers the flexibility to pay their invoices through various channels makes it easier for you to collect payments quicker; AR software makes this easy to do. An automated, fully-branded payment system provides a convenient and seamless experience for your customers.

5. State your payment terms

You can’t expect your customers to pay their invoices on or ahead of time if you don’t state your payment terms clearly. Ensure that your agreements, contracts, invoices and other customer communications cover your payment terms. Do this, and there won’t be any surprises, and your collections team can collect payments on time.

Accounts receivable turnover ratio limitations

Even though the accounts receivable turnover ratio is crucial to your business, it has limitations. For instance, certain businesses (grocery stores) may have high ratios because they’re cash-heavy, so the AR turnover ratio may not be a good indicator.

Manufacturers usually have low ratios because they have longer payment terms. They should take the receivables turnover ratio into account to determine a helpful meaning.

The turnover ratio shows your customer payment trends, but it doesn’t indicate which customers may be in financial trouble or switching to your competitor. On the other hand, it may skew your customers who pay quicker than most or even those who pay slowly, which lessens their credit effectiveness.

If your business is cyclical, you may have a skewed ratio by the beginning and end of your average AR. You’ll want to compare it to your accounts receivable aging report to see if your receivables turnover ratio is accurate.

Finally, when comparing your receivables ratio, look at companies in your industry that may have similar business models. And use discernment when comparing your ratio. If you look at businesses of different sizes or capital structures, it may not be helpful to analyze.

Take control of your AR turnover ratio with Billtrust

Improve your collections efficiency, accelerate cash flow, and optimize credit decisions with Billtrust's unified AR platform. Our AI-powered solutions help you automate manual processes, reduce DSO, and gain real-time insights into your accounts receivable performance.

Frequently Asked Questions

Check out the FAQs for general questions. Find helpful answers quickly to get the information you need.

A good accounts receivable turnover ratio typically ranges from 2 to 10, though this varies by industry. Manufacturing companies often have lower ratios due to longer payment terms, while retail businesses tend to have higher ratios. The key is comparing your ratio to your industry average to gauge performance.

To calculate your accounts receivable turnover ratio, divide your annual net credit sales by your average accounts receivable. For example, if your net credit sales are $2,000,000 and your average accounts receivable is $400,000, your ratio would be 5, meaning you collect your average receivables five times per year.

To find your average accounts receivable, add your beginning and ending AR balances for the period and divide by two. For example, if you started the year with $300,000 in receivables and ended with $500,000, your average accounts receivable would be $400,000.