Cash management is the discipline of managing inflows and outflows of cash. It is a vital process for ensuring the viability of any business.

Businesses typically partner with banks and give them custody of their cash assets. Beyond simply holding cash for businesses, banks can help businesses receive cash from their accounts receivable and pay cash to both their accounts payable and other liabilities such as payroll.

Why is cash management important?

Cash is the primary vehicle that businesses use to pay their financial obligations. Cash is different from value. A company may be valued at $1 million when considering all of their assets, but they only may have $50K in cash. Companies need to make sure not to deplete their cash in expenditures more quickly than they receive cash from their receivables.

A company whose cash-on-hand dips below the level of their current financial obligations may need to liquidate assets to raise cash or take on a loan. Additionally, a company with insufficient cash-on-hand to build up inventory may miss out on potential sales.

Who are the players in cash management?

Chief financial officers, treasury managers and corporate treasurers are among the roles responsible for cash management. It is common for businesses to outsource all or part of their cash management responsibilities to service providers like banks. Those in charge of cash management rely on the cash flow statement.

The cash flow statement is a report on all inflows and outflows of cash within a company. The cash flow statement will be updated and analyzed daily, with quarterly versions shared with company stakeholders.

The cash flow statement will include cash received for accounts payable, cash paid to accounts payable, cash paid for investing and cash paid for financing. Cash-on-hand will be listed at the bottom of a cash flow statement.

What is working capital?

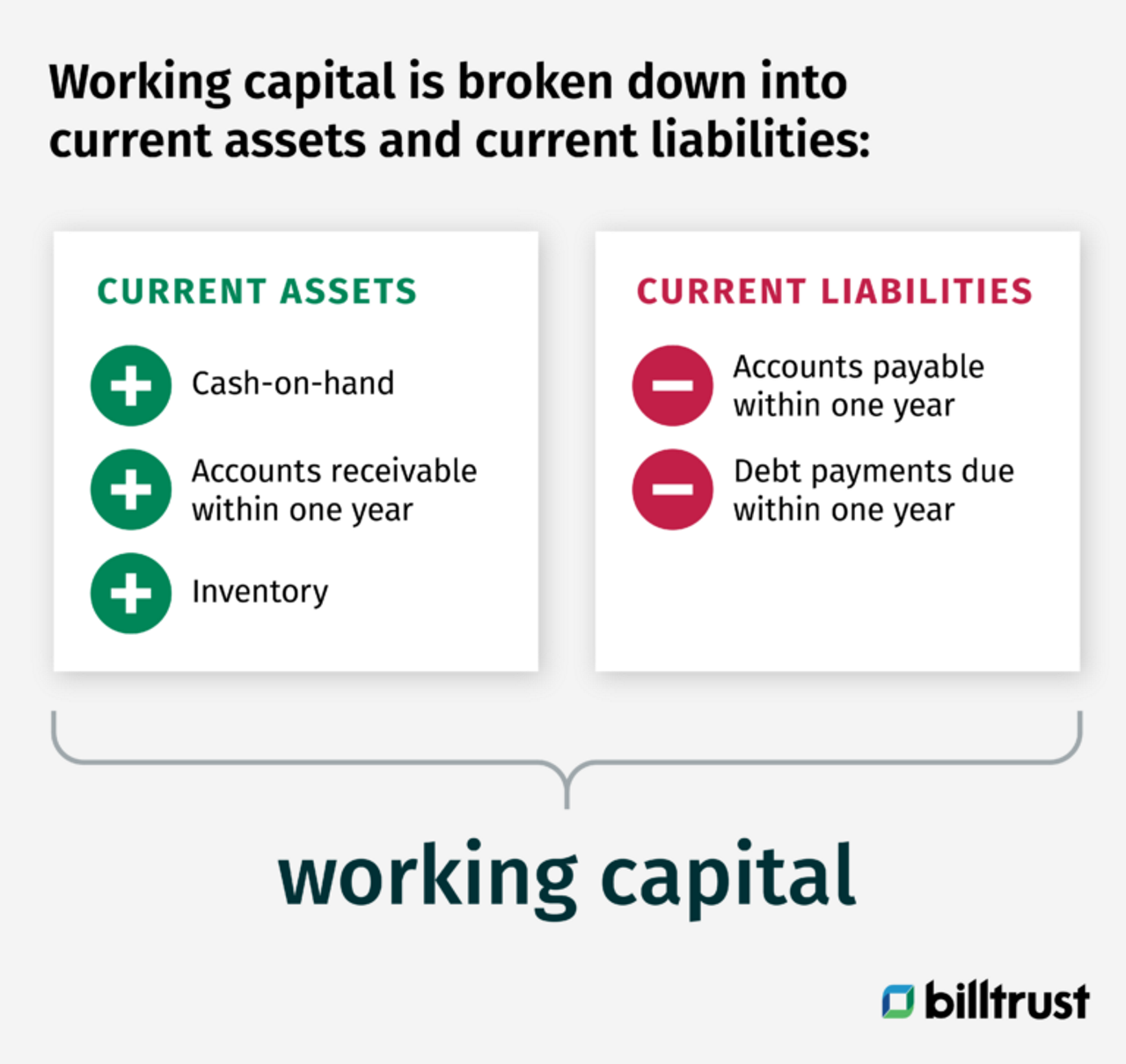

Working capital is broken down into current assets and current liabilities.

Current assets:

Cash-on-hand

Accounts receivable within one year

Inventory

Current liabilities:

Accounts payable within one year

Debt payments due within one year

Companies will endeavor to get their current assets above their current liabilities. When they do, they can be said to have sustainable cash flows. If their current liabilities exceed their current receivables they will need to access financing.

What are common problems in cash management?

Poor management of cash flow: Companies need to have a good understanding of the timing of both receipts and payments of cash. Companies must make sure they are receiving enough cash from their accounts receivable to pay their accounts payable in a timely fashion.

Not receiving cash from revenue quickly enough: Revenue is calculated at the moment of a sale, but cash may not be realized for 30 – 90 days. A company may report excellent profits based on revenue, but if they are not collecting their accounts receivable quickly enough (due to long payment terms, inefficient processes or delinquency) then they can run out of cash even though they are reporting profits.

How to improve cash management?

Regarding cash management support, there are many things companies can do to improve the efficiency of their cash inflows and outflows.

Encourage faster payment: Companies can pursue faster payment by reducing the days payable terms on their sales, or by incentivizing buyers to pay more quickly with discounts for early payment. Companies can also embrace faster payment channels such as business credit card payments. Electronic payments such as credit cards aren’t delayed by transit time like checks and the funds are also easier to quickly apply.

Automate invoicing and payment: Accounts receivable (AR) automation vendors can help businesses deliver their bills electronically and receive electronic payments. Electronic invoices aren’t slowed by transit times the way that paper bills are and, because the invoices are already digitized, they can be entered into the buyer’s ERP system nearly instantly. Payment process automation can help encourage buyers to pay with faster electronic payments and can speed the cash application process.

Improve collections activities: Companies can use best practices in combination with automation solutions to collect their coming due or delinquent receivables more quickly. Collection automation tools can generate automatic “payment coming due” reminder emails that help prevent accounts from becoming delinquent. Collections automation software can also help optimize the daily tasks of collectors and give managers greater insight into the process.

To learn how accounts receivable (AR) automation from Billtrust can improve and support your business cash management, connect with sales@billtrust.com.