This post was originally published in January 2022 and was updated in October 2024, with additional information on the different types of cash flow, how to achieve positive cash flow, and more.

Planning for cash flow is critical when starting a new business. Managing your startup cash flow can be a difficult task. However, as it involves a delicate balancing act of tracking expenses, invoices and sales. There are many different factors that affect your startup cash flow, and it’s crucial to know how to manage your cash. How can you get your startup’s cash flow off the ground? Read on to find out more about the importance of cash flow, how to maintain it, calculations and more.

Why is cash flow so important to a startup?

Cash flow is critical to a startup because it's one of the most important indicators of a company's health and viability. A company that lacks enough cash reserves could find itself unable to pay for necessary expenses, such as payroll or taxes, which can lead to bankruptcy, decreased creditworthiness or other serious consequences.

Cash flow includes all of the following:

Expenses

You’ll need to consider your expenses, or payments (money that goes out of your company) to ensure that you are paying for all of your necessities, such as payroll, rent, utilities and other miscellaneous expenses.

Profits

Secondly, you’ll want to look at your profits or cash receipts (money that comes into your company) to ensure that you have enough money coming in from your customers to cover expenses.

Net cash flow

Lastly, you’ll want to calculate your net startup cash flow (the difference between cash receipts and payments). Have an excess amount of money at the end of a month? Money that’s not needed to cover bills or expenses can be used for things like travel, charity or even just for fun.

Types of cash flow

Understanding the different types of cash flow can help you better manage your startup’s finances:

- Operating cash flow: This refers to the cash generated from your core business operations. It includes revenues from sales and expenses for running the business, such as rent, salaries, and utilities.

- Investing cash flow: This includes cash flows related to the acquisition and disposal of long-term assets, such as property, equipment, and investments.

- Financing cash flow: This involves cash flows from transactions with shareholders and creditors, including issuing shares, borrowing, and repaying debts.

Read now → Forecast your startup's growth with cash flow forecasting [ Blog ]

Calculating cash flow for a startup business

Cash flow (the net change in cash and cash equivalents) is one of the most important metrics for startups as it measures how much money is coming in versus how much is going out. This includes the money that a company has on hand, as well as its ability to take on new debt.

There are three ways to calculate startup cash flow:

1) Subtracting expenses from revenue (gross profit) for each month of the year

2) Adding up all costs incurred in a given year

3) Adding up all revenues received in a given year

It’s crucial to calculate your startup cash flow. Why? Because it will show you how much cash you have at any given time, identify areas where you might be spending too much or not enough and can determine whether or not your company can stay afloat.

How to achieve positive cash flow

Achieving positive cash flow is essential for startup survival. Here are some strategies:

- Increase sales: Focus on boosting your sales through marketing, promotions, or expanding your product line. Diversifying revenue streams can also help.

- Negotiate better terms: Negotiate favorable terms with suppliers and customers. For example, extended payment terms with suppliers or faster payment terms from customers can improve cash flow.

- Reduce costs: Identify areas where you can cut costs without compromising the quality of your product or service. This might involve renegotiating contracts or finding more cost-effective solutions.

- Improve inventory management: Excess inventory ties up cash. Optimize inventory levels to ensure you're not overstocked.

- Seek professional advice: Consult with a financial advisor or accountant who can provide insights and strategies tailored to your startup’s financial situation.

How do new businesses maintain cash flow

Startup companies constantly need to figure out ways to maintain cash flow because the success of a company is often dependent on how well it manages its cash. If a startup is not able to manage its cash flow, it will have a hard time paying its employees and meeting other obligations.

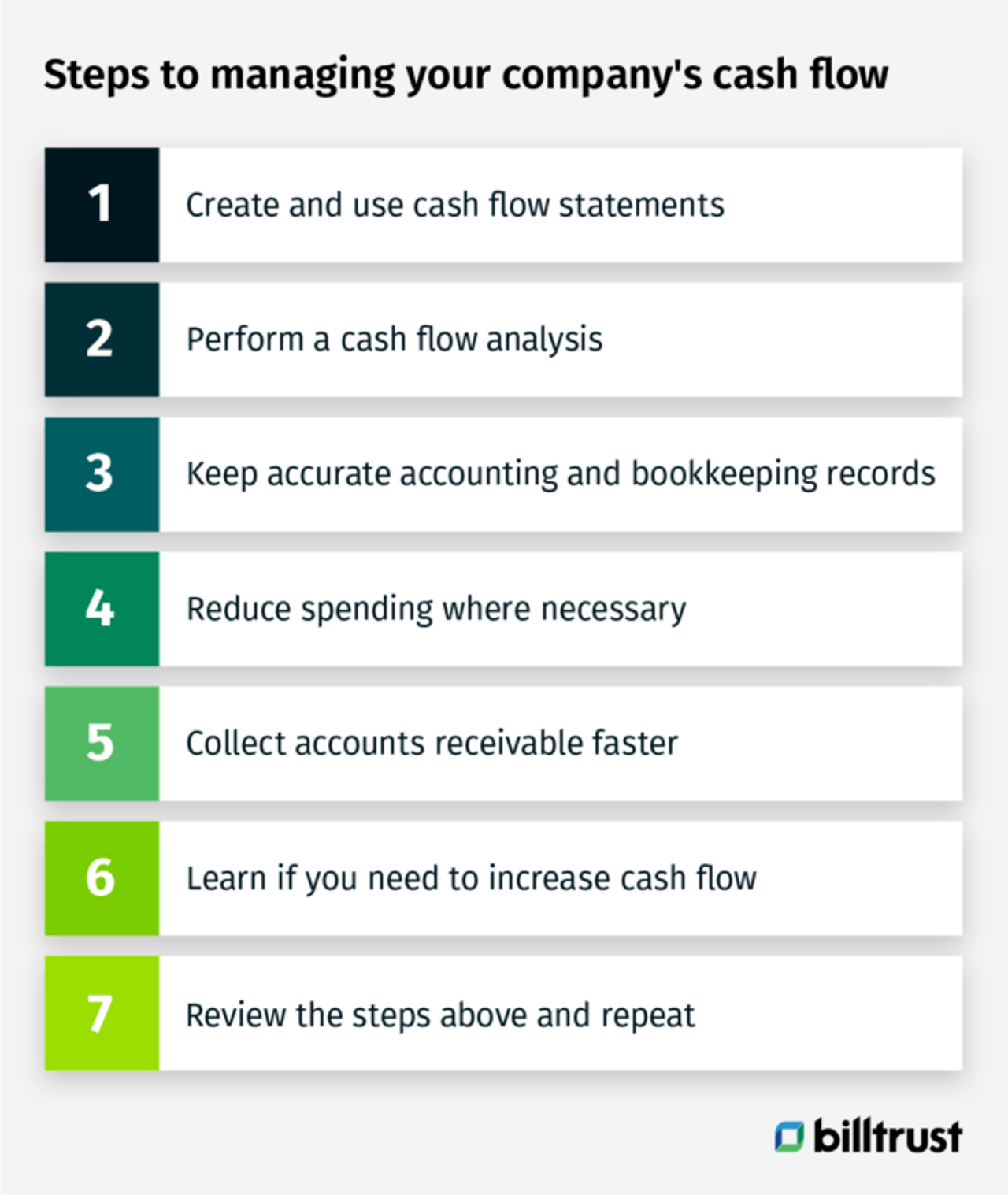

Below are a few tips for managing cash flow in your startup company:

- Calculate cash flow by looking at both incoming and outgoing cash. Understand how much money is coming in and how much money is leaving your business.

- Keep a close eye on expenses and make sure that they are as low as possible to maximize profits.

- Ensure that you have enough working capital to cover your expenditures for at least three months. Why? Because it can take that long for a new business to generate revenue from its operations.

- Don't forget about taxes, which can be a large expense for startups because they may not have been operating long enough to generate sufficient cash flow.

Now that you’ve considered the basics of maintaining your startup cash flow cycle, below are a few methods to ensure that your startup maintains its flow:

Bootstrapping

There are many ways that startups can maintain cash flow. And one of the most common ways is by bootstrapping their company. Bootstrapping is when a company uses its own capital to fund its operations. This method may take longer to get off the ground, but it does not require outside investment.

Debt financing

Another way to get startup cash flow is through debt financing. Debt financing is when a company borrows money from banks or other lending institutions to fund its operations and repay the loan with interest at a later date.

Equity financing

The final way that startups can maintain cash flow is through equity financing. This involves selling shares of ownership in exchange for funding or buying shares from investors to raise funds for the company’s operations and repay the loan with interest at a later date.

How to create a cash flow statement for a startup

A cash flow statement is a financial document that shows the cash inflows and outflows of a business over a specific time period. The cash flow statement breaks down where the company's money comes from, including:

- Cash on hand

- Loans taken out

- Revenue

- Expenses and payments to suppliers

- Payments to employees

- Payments to shareholders in dividends or reinvestment.

This helps entrepreneurs analyze the short-term stability of their company, as well as see how much money will be available to cover expenses for the next 12 months.

To create a cash flow statement for a startup, you need to know what revenue is currently coming in and what expenses are being paid out. The movement of cash in and out of an organization or company helps you to determine the company's liquidity. For that reason, a cash flow statement is one of the key financial statements that provide insight into the liquidity of a company.

There are three main components you’ll want to outline in your cash flow statement: operating activities, investing activities, and financing activities:

- Operating activities: include the day-to-day business operations.

- Investing activities: include buying or selling assets to generate income or turn assets into different assets.

- Financing activities: refer to the purchase of long-term assets by the issuing company, such as purchasing shares in other companies, issuing bonds and debentures.

The bottom line? Your cash flow statement of operating, investing and financing activities helps to measure the health of your company. It also provides information about the company's sources and uses of cash, the changes in its cash balance and its overall financial position.

Where do startup costs appear on the cash flow statement?

Startup costs are the costs that a company incurs in order to start up a business. Unlike other operating expenses, startup costs will not recur on future income statements. These costs can include the purchase of physical assets, intellectual property and other intangible assets including patents, trademarks, licenses and goodwill. A startup cost should be recognized as an expense when it is incurred, rather than when it is paid for. This is because the company does not receive any benefits until they have been incurred.

Startup costs can be classified as either direct or indirect:

Direct

Direct startup costs are those that have a clear impact on your startup cash flow and profitability. They also include items such as purchasing physical assets, intellectual property and other intangible assets.

Indirect

Indirect startup costs are those that have a less direct effect on these two things. These costs also includes items such as legal fees for setting up the business and marketing expenses.

The way to think about where startup costs appear on the cash flow statement is to think of them as expenses with no corresponding revenues. When a company has an expense without corresponding revenue, this means that the company is losing money. As startup costs are expenses that are incurred when the business is starting up. Startup costs should be reflected in the statement of cash flows as an operating or investing activity.

Final thoughts on managing your startup cash flow

Starting a company is no easy task and can be demanding, especially when you're trying to keep your new business afloat and looking for the light at the end of the tunnel. Yes, it's challenging. But there are some things that you can do to ensure that you’re managing your startup's cash flow properly.

One of the most important things that startups must do to be successful is to manage their cash flow. Cash flow management includes making sure that you have enough money in the bank to cover your expenses and that you're not spending more than what you're earning. This begins with realizing the importance of cash flow, then calculating it accurately, maintaining your startup cash flow and ensuring that it’s recorded correctly on your statements. Optimizing your cash flow is one of the most challenging aspects of running a successful company. But with a little forethought and planning, your startup will be well on its way to financial success!

Key takeaways

- Good financial hygiene and spending habits will strengthen your odds of success.

- No one said it’d be easy: Navigating cash flow requires diligence and adaptability.

- Know where your cash goes every day: Regularly monitor and review your cash flow to stay on top of your finances.

- Use credit cards — responsibly: Leverage credit wisely to manage cash flow, but avoid accumulating high-interest debt.

- Establish spending habits and rules: Create and adhere to spending guidelines to maintain financial control.

With a comprehensive approach to cash flow management and strategic planning, your startup can build a solid foundation for financial stability and growth.

Read now → Learn how cash application can support your startup's success [ Blog ]

FAQ

Project cash flow for a startup by estimating incoming revenues, outlining all expected expenses, and accounting for irregular costs over time.

Manage cash flow in a startup by monitoring expenses closely, maintaining a cash reserve, and ensuring timely receivables.

Yes, startups often have negative cash flow initially as they invest in product development, market entry, and customer acquisition before generating steady revenue.