Sometimes a customer not paying happens. It's one of the risks of the business.

But what do you do when customers are delinquent? What's the best way to receive your money from a customer not paying?

Depending on how long they've been delinquent, you have a few different tactics to help get them to pay. Read on to discover the strategies and solutions that work to motivate your non-paying customers.

Non-paying customers and the order-to-cash cycle

Billtrust defines the order-to-cash cycle as "the process of generating invoices and collecting payments for goods or services." In other words, it's what businesses do to make money. But unfortunately, not all customers pay on time. Some are great at paying their bills on time, while others are not so much. We like to call the latter group "non-paying customers."

So what's the big deal with a customer not paying?

Imagine spending hours putting the finishing touches on your latest product. Then, finally, you're ready to ship it to your customer and get paid, only to find out they haven't paid their last invoice. So now you're stuck in the order-to-cash cycle with a non-paying customer.

A healthy order-to-cash-cycle is how your business stays afloat. However, when forgetful or dissatisfied customers don't pay their invoices, it throws a wrench into the health of your entire business. This means spending more time and resources chasing down payments, which means you have less money to invest in new products and growth. This can eventually lead to layoffs and other difficult decisions. In other words, non-paying customers are bad news for business.

Leveraging BPN for more manageable payments

Chasing your accounts receivable is often a headache. If you use manual accounts receivable systems, or even automated systems that do not fit your unique needs, you manually keep track of invoices, make sure your receive payments on time and chase down late unpaid money. It can be a lot to track.

But what if there was an easier way?

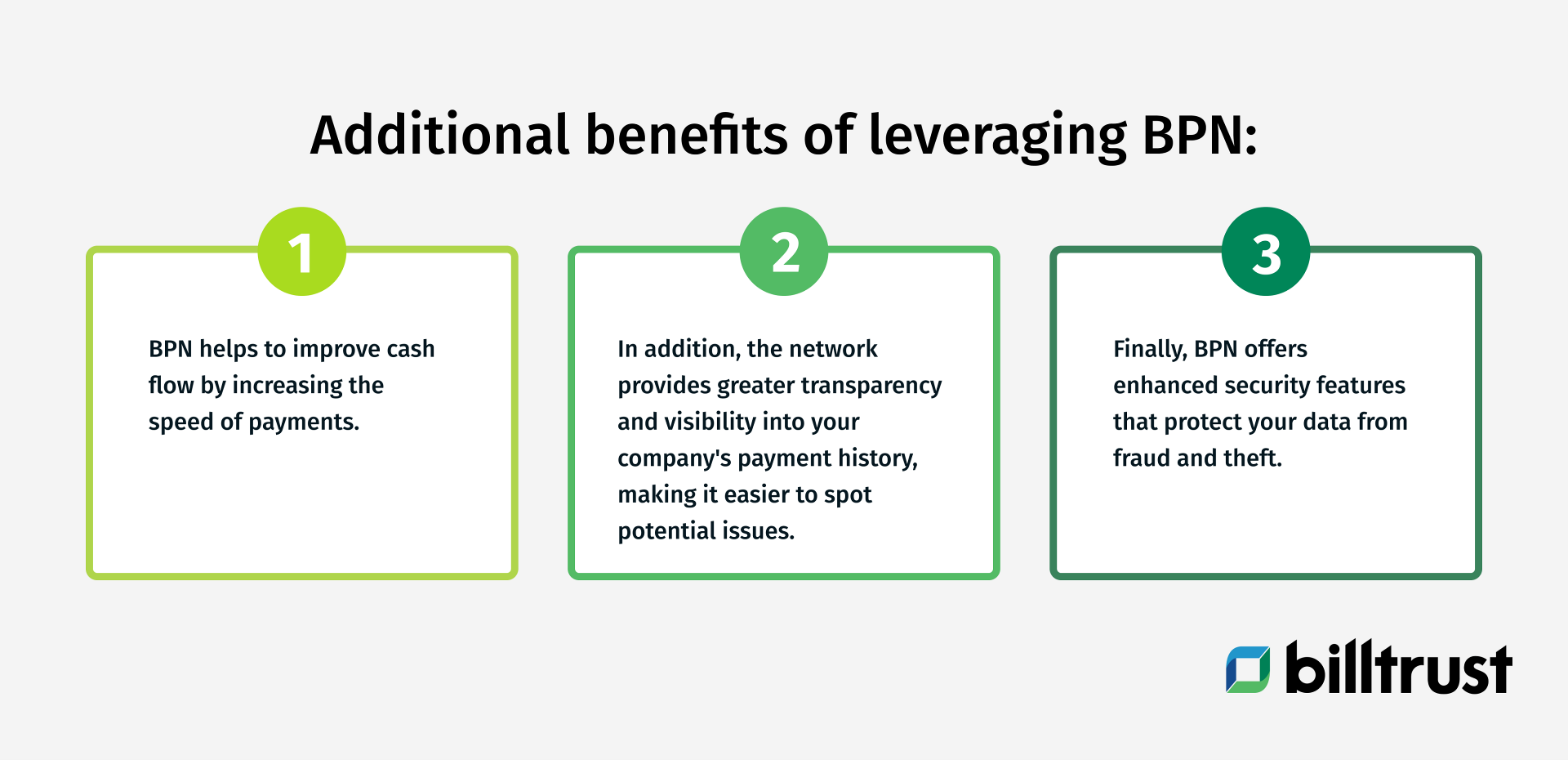

Leveraging Billtrust's Business Payment Network (BPN) can help make payments easier for you and your customers. With BPN, you can send invoices electronically, and customers can view them online. This means no more paper invoices getting lost in the shuffle. Below are a few additional benefits of leveraging BPN:

- BPN helps to improve cash flow by increasing the speed of payments. And if a customer needs to make a payment, they can do so quickly and easily online. No more missed or late payments – everybody wins.

- In addition, the network provides greater transparency and visibility into your company's payment history, making it easier to spot potential issues. Streamlining payments in a transparent one-stop-shop platform makes it easier to align all the aspects of your bottom line so that you have more control over your finances and more time for what matters most.

- Finally, BPN offers enhanced security features that protect your data from fraud and theft. These include:

- Two-factor authentication

- Fraud monitoring and prevention

- Data encryption

With these features in place, you can rest assured that your customer's payment information is safe and secure. So it's no wonder that more and more businesses are switching to BPN.

How to handle a customer not paying

As a business owner, you're undoubtedly familiar with the occasional customer who doesn't pay their bill. While it can be frustrating, there are a few things you can do to collect payment:

- First, reach out to the customer and try to work out a payment plan. If they cannot pay the total amount right away, they may be willing to agree to a payment plan that allows you to recoup your losses over time.

- Next, you can always hire a collections agency. While you won't get back all the money a customer owes you this way, it's better than getting nothing.

- Finally, if the customer is uncooperative or refuses to pay, your next step may be to take them to small claims court. Use this as a last resort. But if you win your case, the court will order the customer to pay you the money they owe.

The bottom line?

No business owner likes dealing with a customer not paying. By following the tips above, however, you can receive payments and avoid any lasting damage to your business.

Streamlining your accounts with AR automation

Are you tired of dealing with several manual accounts receivable (AR) programs? If so, you're not alone. Many businesses find that managing multiple manual AR systems is inefficient and time-consuming. Fortunately, there's a solution: AR automation.

Why AR automation?

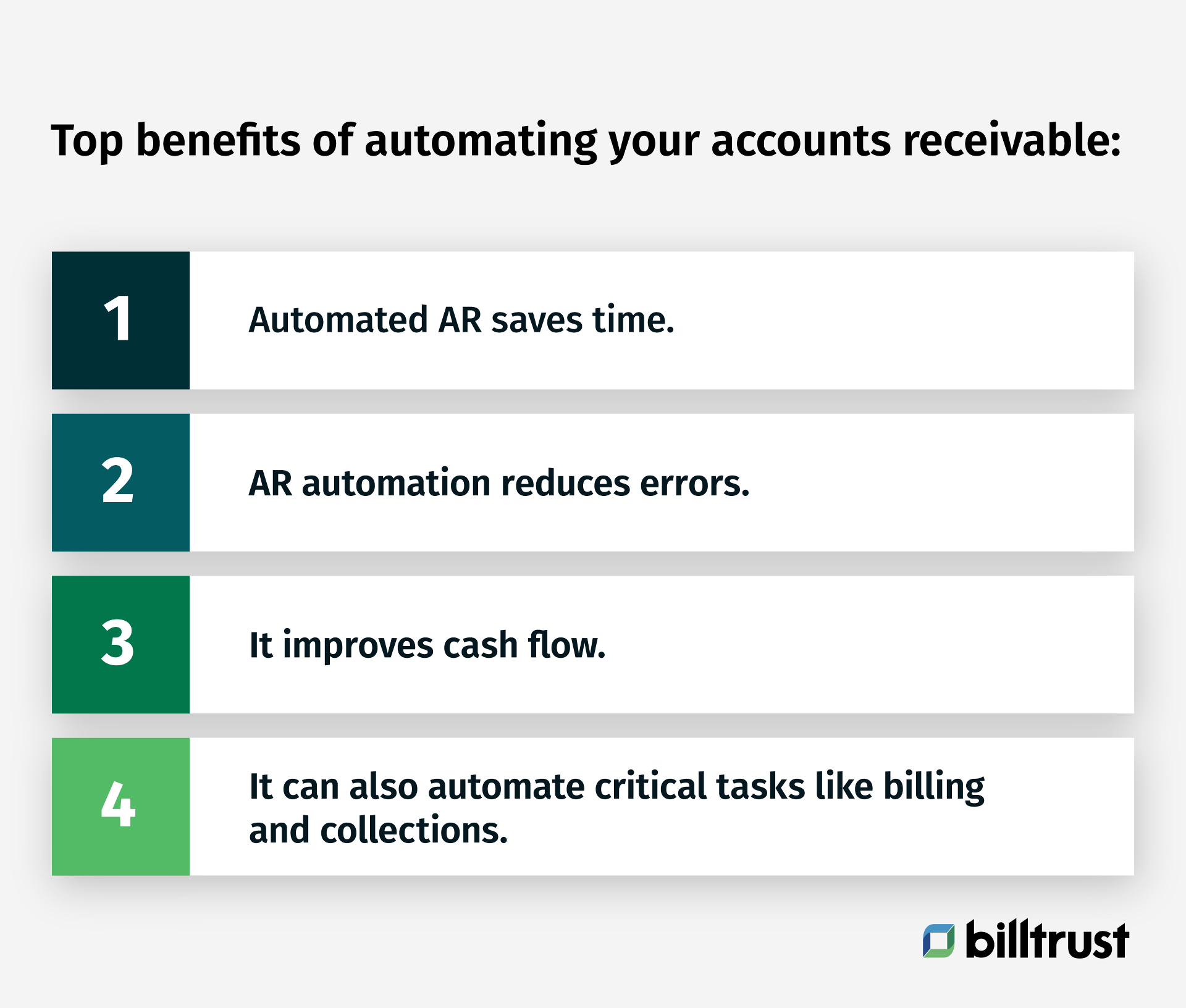

An automated AR system can help you keep track of invoices, payments, and customer information. Below are a few of the top benefits of automating your accounts receivable:

- Automated AR saves time. With automation, you can eliminate the need to enter data into your accounting system manually. This can save you hours each week and your AR team can spend them on more productive activities.

- AR automation reduces errors. With manual data entry, there is always the potential for errors. Automation can help to reduce these errors, ensuring that your financial reports are accurate.

- It improves cash flow. You can ensure that invoices are paid promptly by automating your accounts receivable. This can help to improve your business's cash flow and keep your finances healthy.

- It can also automate critical tasks like billing and collections. As a result, you'll be able to free up your staff to focus on more important things.

If you’re looking for a way to streamline your accounts receivable (AR) management, consider investing in an automated system. It could be just what you need to take your business to the next level.

Take legal action as a last resort

As a business owner, you always hope your customers will promptly pay their invoices. Unfortunately, however, there are always a few who don't. You might send them a reminder letter, but eventually, you'll have to decide whether to take legal action against them. It's not a decision to be made lightly - after all, taking someone to court can be expensive and time-consuming. But it might be your only recourse if you've exhausted all other options and still have not received payment.

If you're tired of waiting for a customer to pay up, you may be wondering what legal options are available to you. Here are a few tips to help you begin the legal process:

- Research your state's laws on collections. Each state has its laws and procedures, so it's essential to know your rights before taking action.

- Send a demand letter. This is simply a formal notice that you are owed money and intend to take legal action if the debt is not paid within a certain period e (typically 30 days). You can hire a lawyer to draft the letter for you or use one of the many template letters available online.

- File a lawsuit. If the demand letter doesn't get results, your next step is to file a lawsuit in small claims court. This is usually a relatively straightforward process, but you'll want to ensure you have all your documentation in order before going to court.

- Garnish wages or freeze assets. If the debtor is employed, you may be able to garnish their wages to collect the debt. You can also freeze their bank accounts or put a lien on their property. These measures should only be used as a last resort, as they can have significant financial repercussions for the debtor.

- Hire a collection agency. If you're not interested in dealing with the debt, you can hire a collection agency to handle it. A fee will be involved, but it may be worth it to avoid the hassle of pursuing legal action yourself.

Ultimately, you have to decide what's best for your business. However, if you think taking legal action will help you to receive payment, you may want to pursue it.

Download the ultimate guide to digital accounts receivable

Accelerate your cash flow with collections automation software

Non-paying customers can be a significant drain on your resources, but with the right attitude and approach, you can turn them into paying customers. Remember that every interaction with a customer may create a positive or negative impression of your business. Remain calm, be polite and implement accounts receivable automation software for faster collections. And if all else fails, remember: there are plenty of other companies you can do business with.