Originally published in January 2022 and updated in January 2025 to include a new FAQ section.

Accounts receivable outstanding is the amount that your customers owe for products or services that they have purchased but have not yet paid for. Accounts receivable outstanding, also called "ARO" or "AR," is an important metric used in financial analysis for calculating a company's liquidity. If the number of accounts receivable outstanding becomes too high, it can put your business at risk for a host of negative outcomes. Read on to discover more about what accounts receivable (AR) outstanding means, how to reduce these outstanding balances and more.

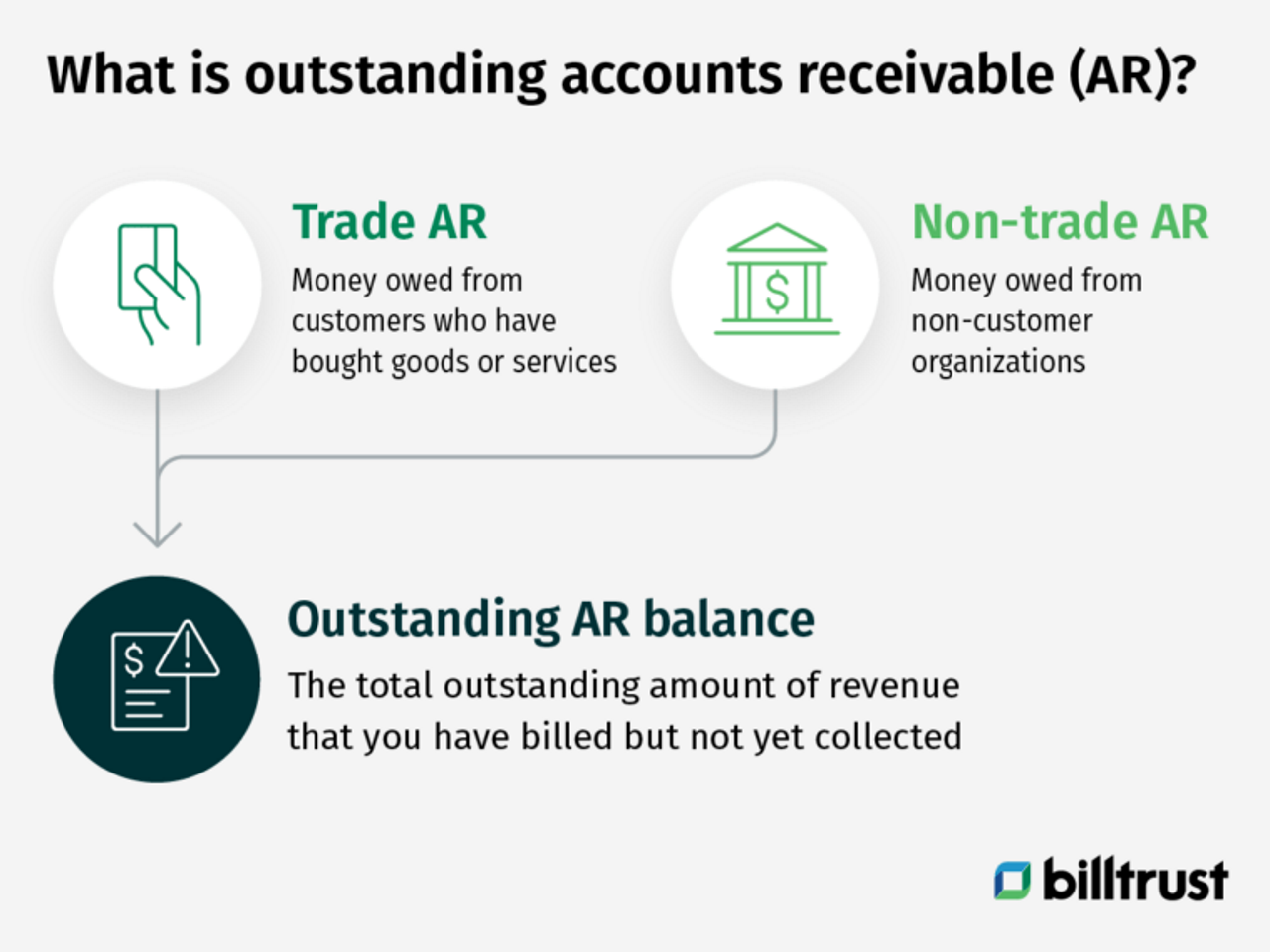

What is outstanding accounts receivable?

Receivables are an important part of the accounting cycle. If you were to combine the two words, "account" and "receivable,” you would get the accounting concept of receivables – a term used to describe money owed by a company to its creditors (often referred to as outstanding accounts receivable).

The receivable balance is the total outstanding amount of revenue that you have billed to customers but not yet collected. This is referred to as AR.

There are two main types of accounts receivable: trade accounts receivable and non-trade accounts receivable. Trade accounts receivable are money owed to the company from customers who have bought goods or services. In contrast, non-trade accounts receivable are money owed to the company from other organizations that owe it money for goods or services provided.

In short, outstanding account receivables is the money or value that is owed to a business that the company has not yet received.

How do you find outstanding accounts receivable?

Finding outstanding accounts receivable can be a tedious task, time-consuming and frustrating to try to track down all of the different people, phone numbers, emails and addresses that are owed money. Some companies have difficulty finding out who owes them money because of outdated contact information or missing data.

With the rise of automated AR services, however, finding outstanding accounts receivable doesn’t have to be complicated. Accounts receivable outstanding can be found instantly by accessing your accounting records and looking at the outstanding balance of invoices and customer payments. AR outstanding debts are the easiest to track if you have a billing system that is integrated with accounting software. This will be listed under accounts receivable, or sometimes called accounts unpaid.

Searching for alternative methods?

Accountants who want to take advantage of the outstanding accounts receivable formulas and functionalities can do so with a few different methods.

To generate a list of unpaid accounts:

Review your list of customers to see who has not paid their invoice in the past 30-60 days. Alternatively, you can also use a credit monitoring service or an outstanding AR software program to automatically find these delinquent customers.

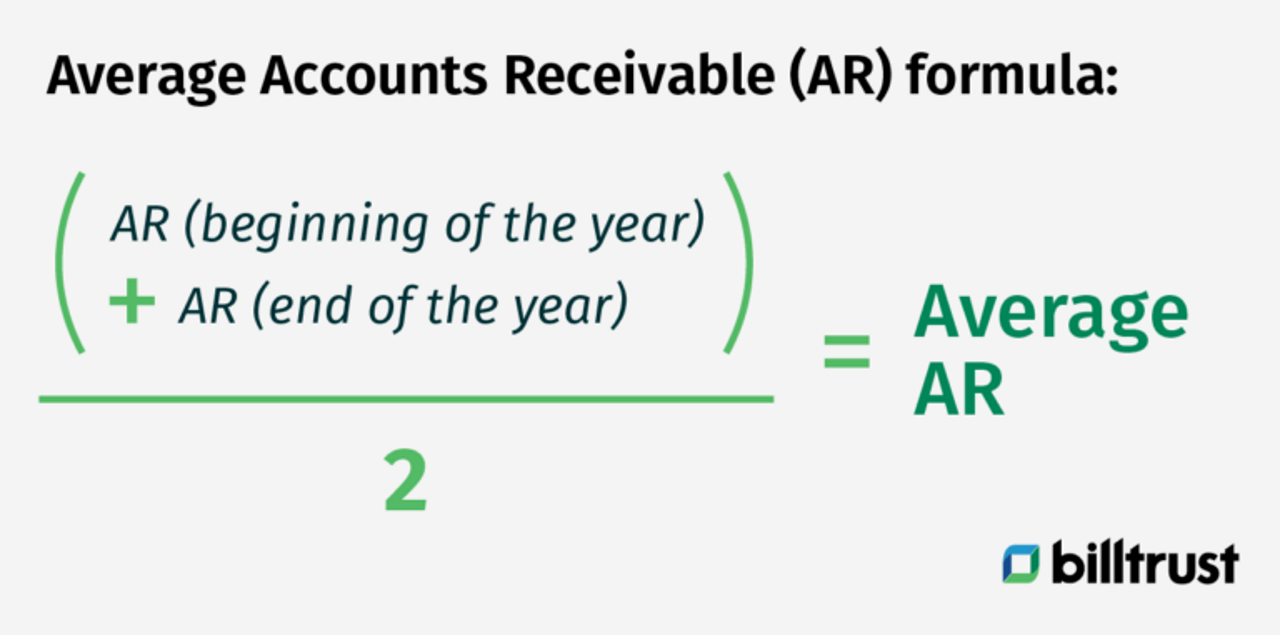

To calculate average accounts receivable:

To calculate average accounts receivable, use the starting and ending accounts receivable sums over a set period (such as quarterly or monthly) and divide by 2.

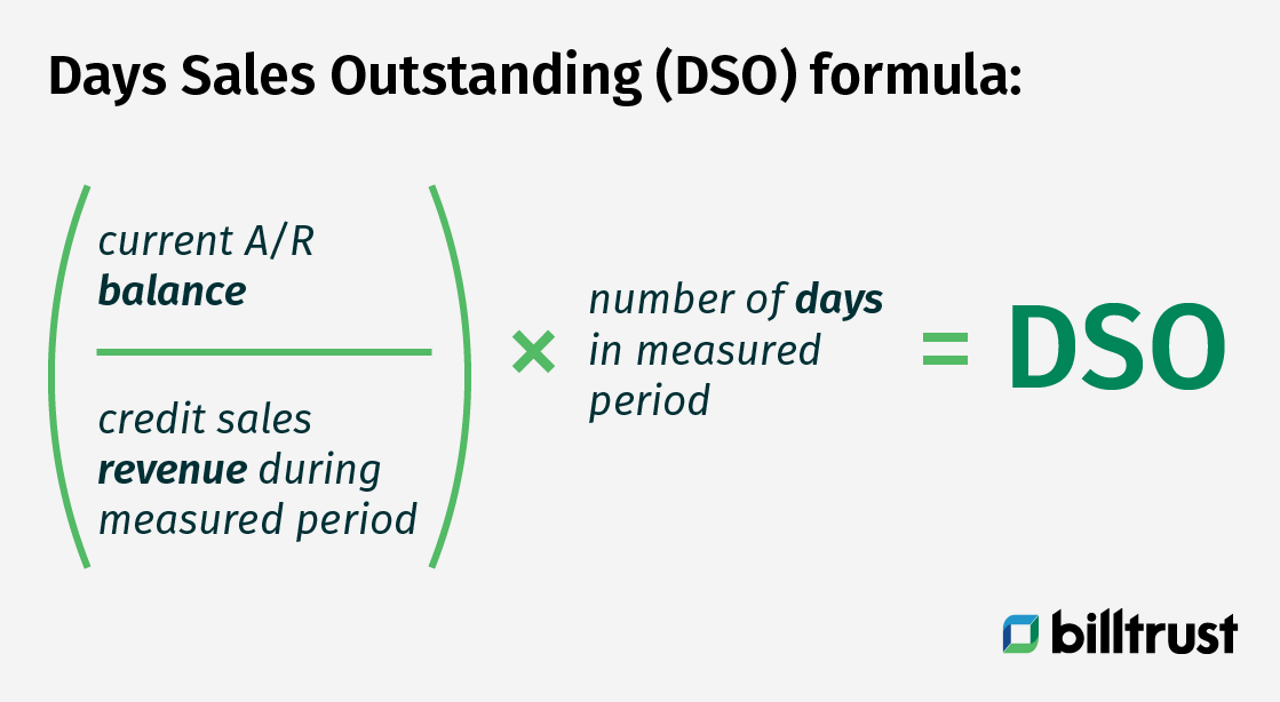

To calculate days sales outstanding:

Calculate DSO (days sales outstanding) by beginning with your Current AR Balance, dividing it by your Credit Sales Revenue During Measured Period, then multiplying that figure by the Number of Days in Measured Period.

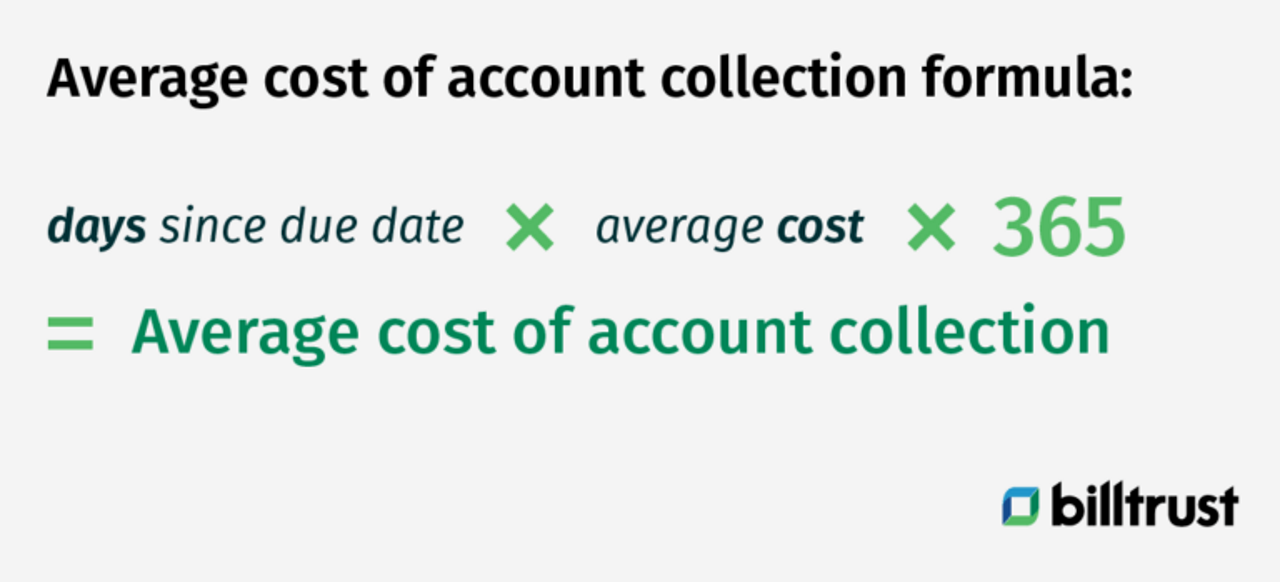

To find the average cost of account collection:

To calculate the average cost of collecting an account, calculate the number of days since the due date, multiply that by the average cost, and multiply that by 365. This will show how much it would cost them to recover all outstanding accounts receivable.

Average cost of account collection = days since due date * average cost * 365

To find the total unpaid invoice balance:

The total balance of all unpaid invoices is divided by the total invoices issued to arrive at an average balance per invoice. This can be calculated for each customer, giving insight on which customers are not paying their bills on time.

To calculate credit terms, invoice balances and days in accounts receivable in Excel:

Outstanding accounts receivable formula is the only Excel-based formula that will calculate the outstanding receivables. It will automatically calculate your credit terms, invoice balances and days in accounts receivable.

In the world of business, it is essential to have a reliable method for determining how much money you can expect from outstanding accounts receivable. The more knowledge you have about the accounts receivable process, the better you can estimate your potential profit.

What is accounts receivable on a balance sheet?

Accounts receivable is a crucial accounting concept and represents a potential source of financing for your organization. When your company provides goods or services, you record how much was owed for them on its receivables account. When it's actually paid, that amount is then transferred from accounts receivable to cash.

As accounts receivable represents money owed to the company by customers and suppliers, it’s the company's obligation to pay these debts. On a company's balance sheet, accounts receivable appears as an asset to indicate that the company is owed money and might receive that money in the future.

How do you reduce accounts receivable outstanding?

Effective accounts receivables management is the key to reducing outstanding balances. The first step is to create a system (you can use AR software) that enables you to accurately track and report on account balances as they arise. The next step is to implement a process for following up with your customers and clients to make sure they pay on time, every time.

There are two main reasons why there might be unpaid accounts:

1) The customer hasn't paid. Customers might be delaying payments because they don’t have the funds, may have forgotten or because of a lack of trust in your company.

2) The company hasn't billed the customer yet. This means that either your company never received payment for goods and services it sold, or it's waiting to collect payment on services rendered before sending out an invoice.

Looking to reduce outstanding accounts receivable? There are several steps you can take, including:

Track outstanding accounts

The first step is to keep track of which customers owe money. You have to know who owes you cash so that you can follow up.

Offer discounts

Offer discounts to encourage immediate payment. You can also offer discounts for early payment on invoices.

Obtain legally-binding guarantees

Another way is by getting guarantees from your customers before they buy your product or service. This way, if they don't pay, they will be legally required to make good on their debt and repay your business the amount owed plus interest and penalties.

Use automated billing

One of the best ways to reduce your accounts receivable outstanding is to set up an automated billing process using AR software. This will ensure that people are invoiced regularly and help you avoid trying to collect from customers who refuse to pay.

Read the solution guide → 5 tips to collect outstanding receivables

Final thoughts on accounts receivable outstanding

The purpose of accounts receivable outstanding is to represent the total amount of money that a company is owed by its customers. This includes all customer balances for which payments have not been received from the customer or for which credit has been extended. Tracking outstanding AR is crucial and this information will allow you to spot trends and address problems proactively.

Looking to make the accounts receivable (AR) process easier? Consider using an automated invoicing system, such as Billtrust's AR software, to streamline your accounts receivable payments today!

Frequently Asked Questions

Check out the FAQs for general questions. Find helpful answers quickly to get the information you need.

Your total accounts receivable outstanding is the sum of all unpaid customer invoices. While you can calculate this manually by adding up unpaid invoices, automated AR solutions can track this in real-time, giving you instant visibility into your outstanding receivables.

Payment terms vary widely by industry, company size, and business relationships. While some businesses operate on shorter payment cycles, others may extend longer terms for enterprise clients or specific sectors. The key is establishing clear payment terms aligned with your business goals and using automated reminders to encourage timely payments. Modern AR solutions like Billtrust can help you track aging receivables and optimize your payment cycles based on your business needs.

Best practices for recording AR outstanding include maintaining detailed documentation in your sales ledger, properly categorizing unpaid credit sales, and ensuring accurate debits and credits. While traditional manual methods work, automated AR platforms can streamline this process, reducing errors and providing real-time updates to your financial records.