This post was originally published in November 2021 and was updated in January 2025 with additional best practices and answers to common invoicing questions.

Invoices explained: Definition and components

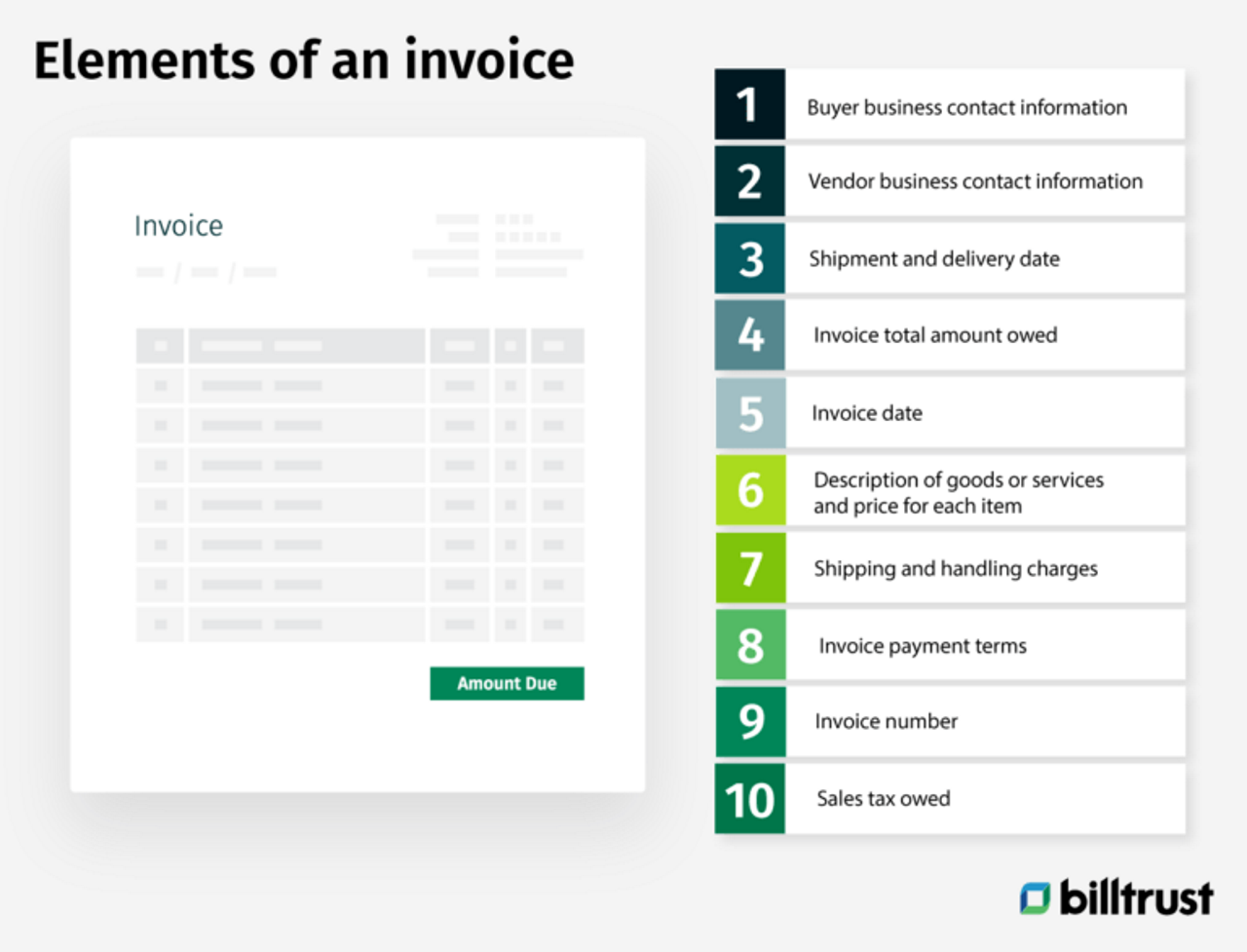

An invoice is a business document that itemizes and records a transaction between a buyer and a vendor (seller). A business sends an invoice to a customer after they’ve delivered a product or completed a service. Below are some features of an invoice, but keep in mind the documentation varies by business:

- Buyer business contact information

- Vendor business contact information

- Shipment and delivery date

- Invoice total amount owed

- Invoice date

- Description of goods or services and price for each item

- Shipping and handling charges

- Invoice payment terms

- Invoice number

- Sales tax owed

Invoices may be transmitted electronically or through paper. However, the latter may slow down cash flow because of changes to the USPS delivery schedule.

This post will explore the purpose of invoices, the difference between invoices and bills, the common types of invoices, best practices and why automating your invoices can save you time, money and errors in the long run. We’ll even provide you with a business invoice example. Let’s get started.

What is the purpose of an invoice?

Businesses use invoices to track what customers owe (creates accounts receivable for vendors and accounts payable for buyers) and as a way to monitor their cash flow. Invoices also help companies to receive payment on time and in full unless a payment arrangement has been made. Business-to-business invoices may also serve as sales records and as a way to track:

- The cost of a good or service.

- Outstanding balances buyers owe.

- The sell dates of goods and services.

- The accuracy of accounting records.

Invoices also benefit companies in the following ways:

Audit and taxes

Company invoices may protect the business if they receive an audit by creating a paper or electronic record and trail. Detailed business invoices will show the IRS where the company’s money came from should they question tax returns.

Legal protection

Business invoices may also serve as legal protection because the document can be viewed as proof of an agreement between the company and a buyer on a set price. Therefore, invoices may potentially protect the vendor from fraudulent lawsuits, but you should consult with your company’s legal counsel.

Business analytics

Analyzing invoices can help a company see their customers’ buying patterns, popular products or services, peak buying times, trends and more. The data may help the marketing department develop marketing plans, strategies, and campaigns to generate more revenue. The data analytics may also help the product team create new products or enhance existing ones.

Remember that a company that uses accrual accounting will record the number of invoices as accounts receivables. Customers owe you the money for goods or services, which means they have accounts payable.

Are invoices legal documents?

Invoices are not legal documents on their own because too much is left up to interpretation. Plus, there isn’t any proof that a company and its customer agreed to payment terms and conditions. However, when a company and its customer agree on terms and conditions in a legal contract, they can be held accountable for payment in exchange for goods or services. So, an invoice with a contract creates a legal agreement between a business and its customer. Again, you’ll want to consult with your company’s legal team to ensure that your business documents are current.

What is the difference between invoices, bills and receipts?

Invoices, bills and receipts are similar and different at the same time. For instance, invoices and bills are sales records showing how much a customer owes, and both are generated before a customer pays for the transaction. However, an invoice documents the sales transaction for payment at a later date. A bill is a document (or payment request) that a customer must pay immediately. It’s money owed to the vendor.

Receipts confirm that customers have received and paid for their goods or services. They prove that a customer paid and ownership was established for the product or service received.

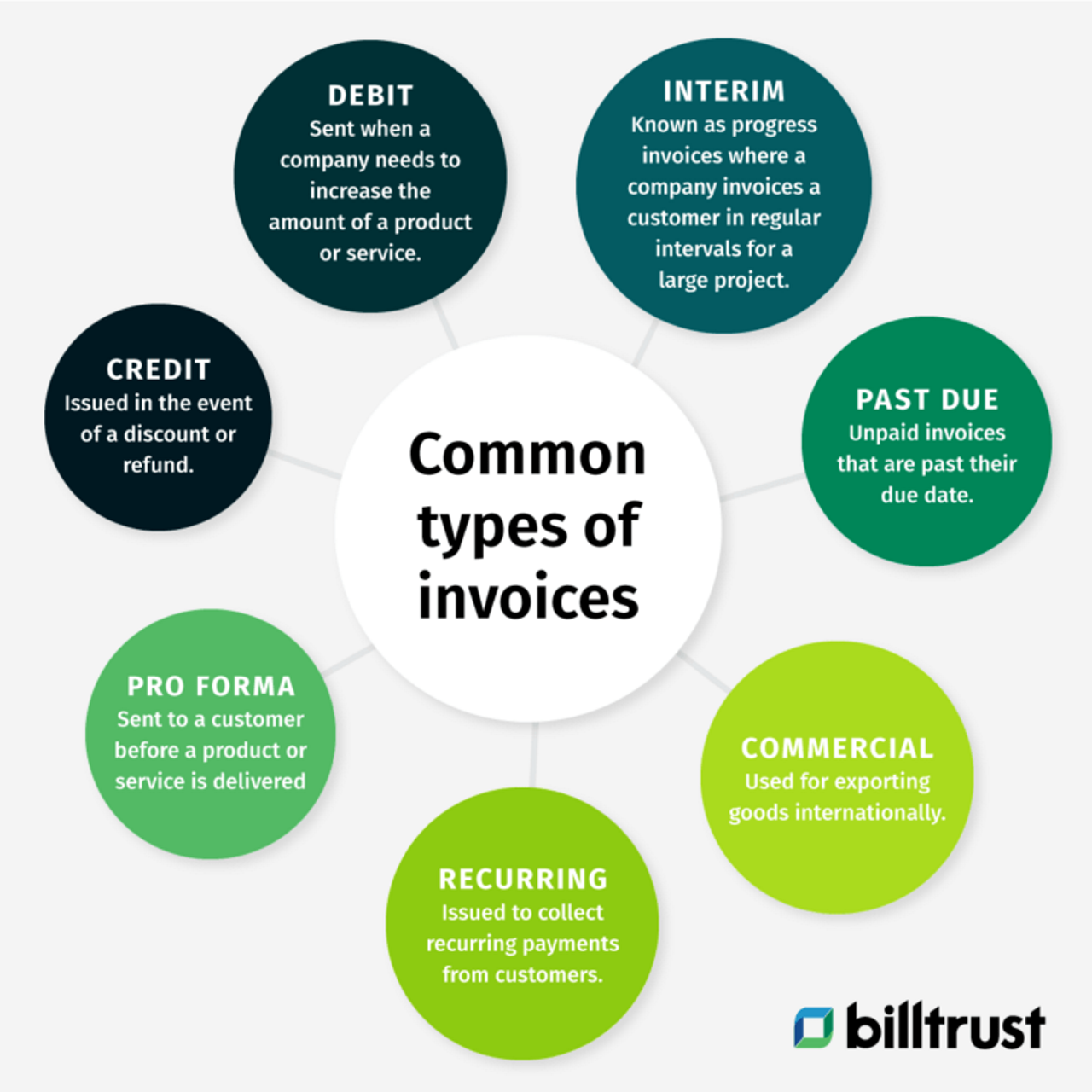

What are the common types of invoices?

The purpose of an invoice determines the type that’s generated. Here are some company invoices used during the payment process.

Credit invoice

A business issues a credit invoice to a customer in the event of a discount or refund. For instance, if you’ve overcharged a customer for products, you can issue them a credit invoice for the amount overbilled. This way, you and your customer have documentation (proof) that you’ve issued a refund.

Debit invoice

A debit invoice is issued when a company needs to increase the amount of a product or service. For example, you may have undercharged a customer, the project scope may have changed, or you provided additional hours on a project after sending an invoice. You may issue a debit invoice for the difference between the original invoice and the increased amount.

Interim invoice

Interim invoices, also known as progress invoices, are an accounting method where a company invoices a customer in regular intervals for a large project—the company bills for the percentage of the project completed at a given time. Interim invoices can help a company manage its cash flow by collecting B2B payments throughout the project. Cash can help a company cover costs associated with a project instead of waiting until its completion.

Past due invoice

Like interim invoices, past due invoices (unpaid invoices past their due dates) can negatively impact a company’s cash flow. Outstanding cash and collecting past due invoices can cost a business time and money. Electronic invoices that are easy to understand help reduce the risk of overdue payments.

Pro forma invoice

Pro forma invoices are sent to a customer before a product or service is delivered. These can help them understand the scope and cost of an upcoming project. Pro forma invoices are issued before a formal invoice goes out. It shows a customer how much a product or service will cost when delivered. Terms may need to be adjusted as a project progresses. However, like interim invoices, they can help ensure businesses and customers are on the same page regarding the project.

Recurring invoice

A company may issue recurring invoices by collecting regular customer payments and issuing them throughout the project. For example, a digital marketing agency may give monthly recurring invoices to customers for services provided. Invoicing software and automating invoices can reduce the extra work associated with processing them.

Commercial invoice

Companies use commercial invoices when they export goods internationally. The purpose is for customs declaration and calculating tariffs. Information you may find on commercial invoices includes:

- The goods exported and the reason for the shipment.

- A description of the goods, including the number of units, the value of the units and the usage of the items.

- The number of packages shipped and the total weight.

- The country or territory of origin.

- The contact information of both parties involved in the transaction.

- The shipper’s dated signature

- The Harmonized System code associated with the goods shipped.

What are the parts of an invoice?

Invoices aren’t standardized because companies may use invoicing automation software that allows for customization. Therefore, they vary by contractor or vendor. However, invoices should include these five major components:

- Business contact information

- Descriptions of products or services

- An invoice number

- An invoice date

- Payment terms

Business contact information

You must provide your business contact information, including your company name, address, phone number, email address and your customer’s contact information.

Description of products and services

Include every product or service on your invoice and the quantity and price for each item. At the bottom of your invoice, total up the line items and apply any tax charge.

Invoice number

All invoices should have an invoice number as part of your invoicing process. Otherwise, you and your customers won’t have a trail of information for your accounting records. Invoices are usually assigned sequentially, but you may use a chronological order, customer ID or project ID. Remember that invoices aren’t due immediately, so establish payment terms upfront.

Invoice date

The invoice date is essential because it indicates the time and date a company records a transaction and bills its customer. It also shows the credit duration and payment due date. Most invoices are ‘Net 30’ days but may be longer, depending on a company’s cash flow needs and agreement with a customer.

Payment terms

If you want to get paid quickly and avoid short pay, provide your customer with precise details about B2B payments. For instance, specify the amount of time your customer has to pay for their agreed-upon purchase. And keep in mind that it shows an accounts payable (AP) department when your company expects to receive its payment (Net 30 Days, Net 45 Days, etc.) and how it wants to get paid (ACH, bank transfer, etc.).

When you set your payment terms, establish how you’ll handle late B2B payments. You may consider a customer’s credit history and relationship with your company. Consider consulting with your credit management department.

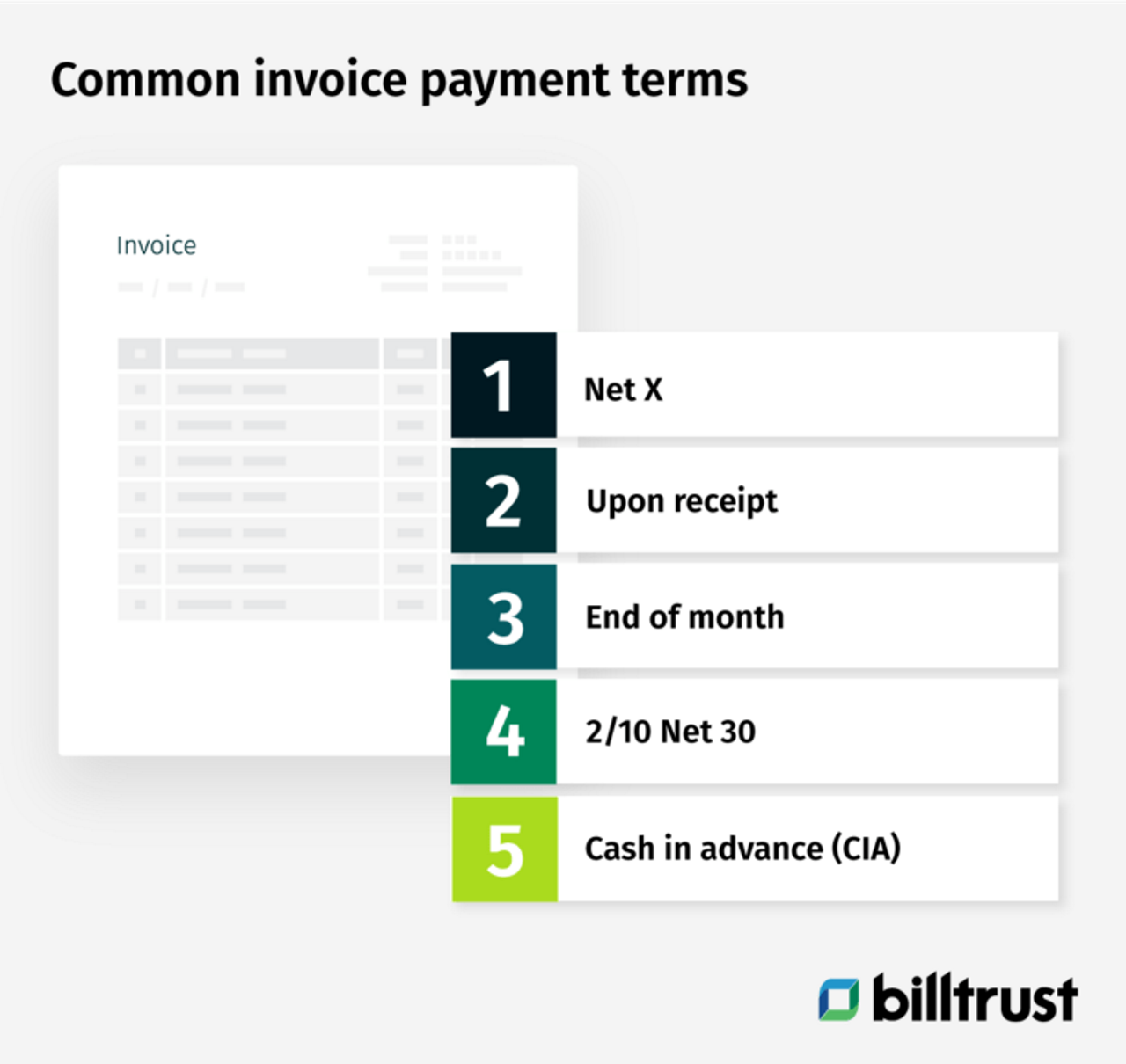

It’s up to your business to establish payment terms, so choose the right ones for your business. However, you may also want to honor your customers’ invoicing and payment preferences. Here are some common payment term examples:

Net X

When you indicate Net 30, Net 45, Net 60, etc., on your invoice, you’re asking customers to pay X number of days after the invoice date.

Upon receipt

Asking for payment upon receipt means you expect customers to pay when they receive your invoice.

End of month

Asking customers to pay EOM means you want them to pay by the end of the month indicated on the invoice date.

2/10 Net 30

Showing 2/10 Net 30 on your invoice indicates that you want customers to pay within 30 days of the invoice date. However, they'll receive a 2% discount on the total invoice amount if they pay within ten days.

Cash in advance (CIA)

When you ask customers for cash in advance, you're asking them to pay their invoices in full and in cash before you work. Remember that freelancers may use this type of payment instead of SMBs and enterprises.

Invoice example

Again, invoices may vary by company, but all usually follow the same structure and include the business and vendor contact information, invoice date, payment terms, etc.

Read the blog → The complete guide to B2B invoicing and payment processing

What is electronic invoicing?

Electronic invoicing, known as e-invoicing, is a form of electronic billing. It generates, stores and monitors transactions between your company and customers to ensure fulfillment of the terms. An e invoicing solution can help your company get paid sooner rather than later than sending paper invoices via the USPS, which is experiencing delivery delays and may slow down cash flow.

Electronic documents include invoices and receipts, purchase orders, debit and credit notes, payment terms and instructions and remittance slips. You may send digital invoices through email, web page or an app, which creates several advantages, including:

- Reduced paper use.*

- Increased cash flow due to quicker processing of invoices.

- Important data analytics and business intelligence.

- Increased auditability.

- Quicker searching and sorting of dates, names and terms.

- Printing or reproducing on demand.

*Most businesses have and continue to develop their sustainability practices, so electronic invoicing adoption is a step in the right direction.

Best practices for generating invoices

Keep these best practices in mind as you create invoices or implement an invoicing automation solution.

Write clear and concise product descriptions

If your company sells various products, you may want to include your SKU or product ID in your invoice. If you sell a service, include the title of your project and the description of activities performed.

Discern between purchase orders and invoices

Invoices and purchase orders are different—invoices are seller generated, while purchase orders (PO) are buyer generated. Purchase orders are purchase contracts between buyers and sellers. For instance, a golf course wants to purchase seven cases of golf balls from their favorite distributor. The buyer might sign a purchase order when they buy the golf balls. The distributor will issue an invoice upon receipt of the golf balls.

Offer online payment options

Get your invoices paid quicker by streamlining your payment process. After all, giving customers an easy way to pay your invoices ensures better cash flow and improves their experience with your company. And companies with complex customers could benefit from the Billtrust Business Payments Network (BPN) because it can handle large volumes of payments.

What do you do when a customer does not pay an invoice?

Unfortunately, a customer may not pay their invoice. To resolve the dispute, have a conversation with your customer to determine what they disagree with or why they can’t pay. Some conflicts will be resolved through discussions, while others may require legal action.

Some customers may not have a problem with their invoice but rather the payment terms. If this is the case, have someone from your collections team contact the customer. Determine if an extension is warranted and for how long. If your collections department isn't successful, you may take legal action or consider invoice factoring (also known as accounts receivable factoring and debt factoring). Some or all of a company’s outstanding invoices are “sold” to a third party to improve cash flow and revenue stability.

Modernizing your invoicing practice

As a critical touchpoint in your order-to-cash cycle, invoicing drives faster payments, strengthens customer relationships, and provides valuable business intelligence. Here are proven strategies to transform your invoicing process:

- Embrace real-time invoicing: Generate and send invoices immediately after service completion or product delivery. This accelerates your cash flow and demonstrates professionalism to your customers.

- Design for digital-first payment: Structure your invoices to facilitate electronic payments by including direct payment links, multiple payment options, and clear digital instructions.

- Implement smart automation: Leverage AI-powered invoicing solutions to eliminate manual errors, automate delivery based on customer preferences, and track invoice status in real-time.

- Create strategic payment terms: Design payment terms that balance your cash flow needs with customer relationships, incorporating early payment incentives and clear late payment policies.

This strategic approach turns invoicing from a basic business function into a powerful tool for financial efficiency and customer satisfaction.

Using invoicing automation software to get paid quickly and improve cash flow

Accounts receivable automation software makes it easier for companies to get paid, accelerating cash flow. Using an integrated, cloud-based AR solution can drive higher operational efficiency, grow revenue, increase profitability and minimize mistakes from manual activities such as invoicing.

Invoicing automation software makes it easier to send your invoices via email, fax, print, electronic presentment or AP delivery. But keep in mind that if you mail your invoices, they may take extra time to reach your customers because of USPS slowdowns. This is why many companies have encouraged their customers to accept electronic invoices.

Other advantages of invoicing software include:

- Accelerating your cash flow because of faster payments.

- Improving security and reducing fraud.

- Enhancing customer service through speedier error resolution.

- Tracking invoices and invoice account management are in a centralized location.

- Reducing manual input so that your staff can focus on more critical tasks.

If you want to improve your company’s cash and revenue, you may want to consider Billtrust’s invoicing automation software. It analyzes your customer base and determines which of your customers accept digital, electronic invoices from other suppliers so that they can be encouraged to receive e-invoices from your company.

Frequently Asked Questions

Check out the FAQs for general questions. Find helpful answers quickly to get the information you need.

Invoices are critical documents for financial reporting and accounting standards. They serve as primary source documents that validate revenue recognition, accounts receivable, and cash flow statements, ensuring accuracy in your company's financial statements.

Invoices are fundamental to basic accounting principles like revenue recognition and matching. They provide documentation needed for accrual-based accounting and help maintain accurate financial accounting records in compliance with generally accepted accounting standards.

Well-designed invoice processes are essential to internal controls and risk management. They create audit trails, help prevent fraud, and ensure proper documentation of financial transactions, which is crucial for both public accounting and corporate finance operations.