The goal of every business is to make their customers happy. And, by extension, the goal of every accounts receivable (AR) team should be to honor their customers' invoicing and payment preferences by offering multiple channels of presentment and payment acceptance.

Your customers are all unique, but they can be generally defined by the size of their business. These general groupings will often share a set of preferences.

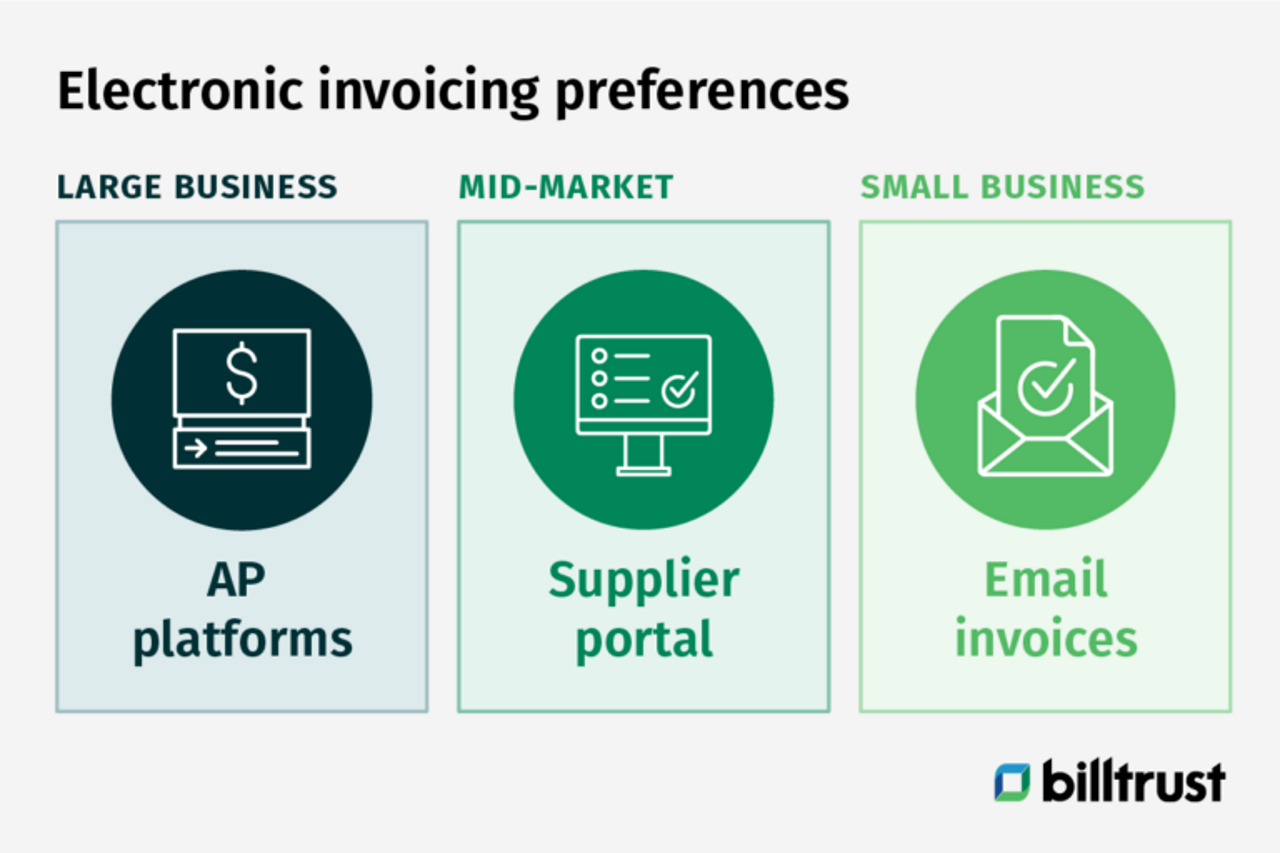

How do large businesses prefer to be invoiced?

Large businesses receiving thousands of invoices a month have shown a growing preference for accounts payable (AP) platforms. These AP platforms are usually outside vendors that create AP payment portals that suppliers must use to key in invoice data and receive payment.

Suppliers are often challenged by the manual keying required to invoice into these portals. It is possible for a supplier’s IT department to create connections to their customers’ AP portals, but with dozens of different AP portals in the market, it is often not feasible.

A wise alternative is to invest in AR automation solutions that already have connections created with most of the major AP portals. Solutions like Billtrust’s AP Portal Automation can take data from open AR files in a supplier’s ERP and automatically input invoicing data into customer AP portals.

AR automation can also be used to automate payments from AP providers, making cash application quick and easy.

How do mid-market businesses prefer to be invoiced?

Mid-market businesses may be receiving hundreds of invoices a month, but their AP teams and budgets may not be large enough to justify investments into AP platform providers. Mid-market businesses like to simplify their AP processes, and often prefer to receive electronic invoices via a supplier-hosted invoicing and payments portal.

Mid-market AP teams love these supplier-hosted portals because they can login to view their current invoices, easily track past paid invoices, keep records of deductions and disputes and easily pay their bills electronically.

How do small and medium-sized businesses prefer to be invoiced?

Small and medium-sized businesses may be making less than one hundred payments a month. They also may be ordering from their suppliers infrequently. Because of their low volumes of payments and infrequent ordering, they generally do not like being required to create and maintain supplier-hosted portal credentials for all of their suppliers.

They are your customers who may be most hesitant to accept electronic invoices because they lack the resources to update their AP processes. It is always advantageous to attempt to gain electronic invoicing adoption from your customers, but if they are unwilling, utilizing an outside vendor for your paper invoices can make your AR process more efficient.

For your small and medium-sized business customers that are accepting electronic invoices, they will often prefer to be invoiced via email. This can be an excellent opportunity to convert them to electronic payment.

With Pay on Email from Billtrust, your customers can make electronic payments directly from their emailed invoices, securely, on their PC or mobile device.

Why do customers have diverse invoicing and payment preferences?

The answer is that your customers are diverse. You have VIP customers who purchase large volumes, customers in mature industries and others in emerging ones, small to medium sized customers who may not be your biggest purchasers but are incredibly loyal, and everyone in between. This level of customer diversity leads to diverse invoicing preferences and payment behaviors. This is significant because for many organizations, the payment experience is a big part of the customer experience, and both have become a competitive advantage in today’s world of doing business.

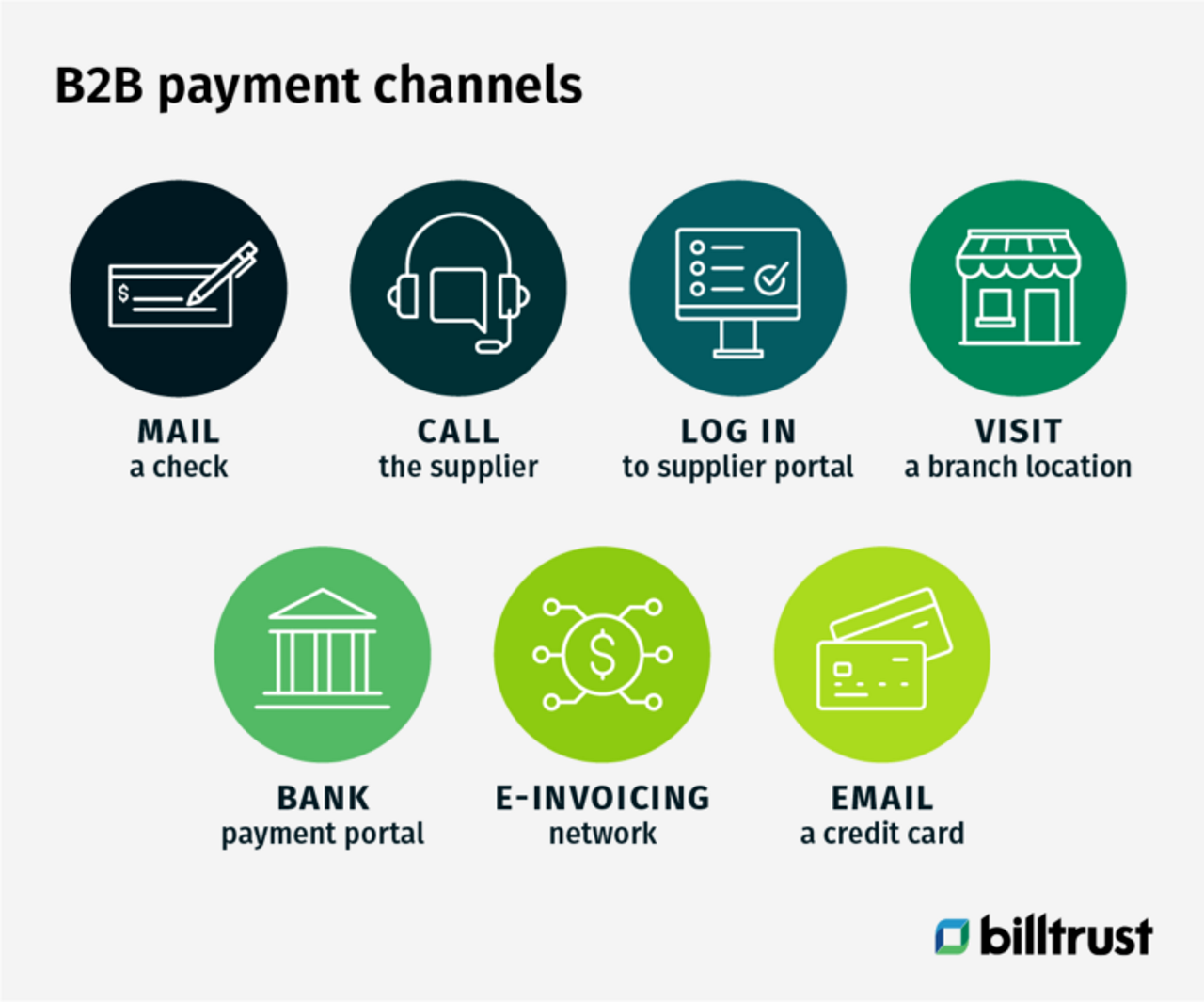

Why should you honor customer payment preferences?

Giving your customers the ability to pay you their way not only makes them happy, it helps you get paid faster, too. Some customers may still prefer to pay you via paper check, while others may have adopted AP automation with a portal. The key here is to meet them where they want to be and offer that flexibility in a multi-channel approach.

What are the trends in payment preferences by company size?

The B2B payments market has been going through an incredible digital transformation affecting all players including AR and AP departments, banks, credit card brands and payment processors.

At Billtrust, we spend a lot of time talking to our customers, and we’ve heard from them about how this changing payments landscape is affecting them. What we’ve learned is that businesses are continuing to feel increased pressure from customers to broaden acceptance of digital forms of payments like ACH and credit cards, including emailed virtual cards.

Below are some of the general payment trends that have stuck out to us amongst our customer base, and the different buying behaviors seen across specific customer segments.

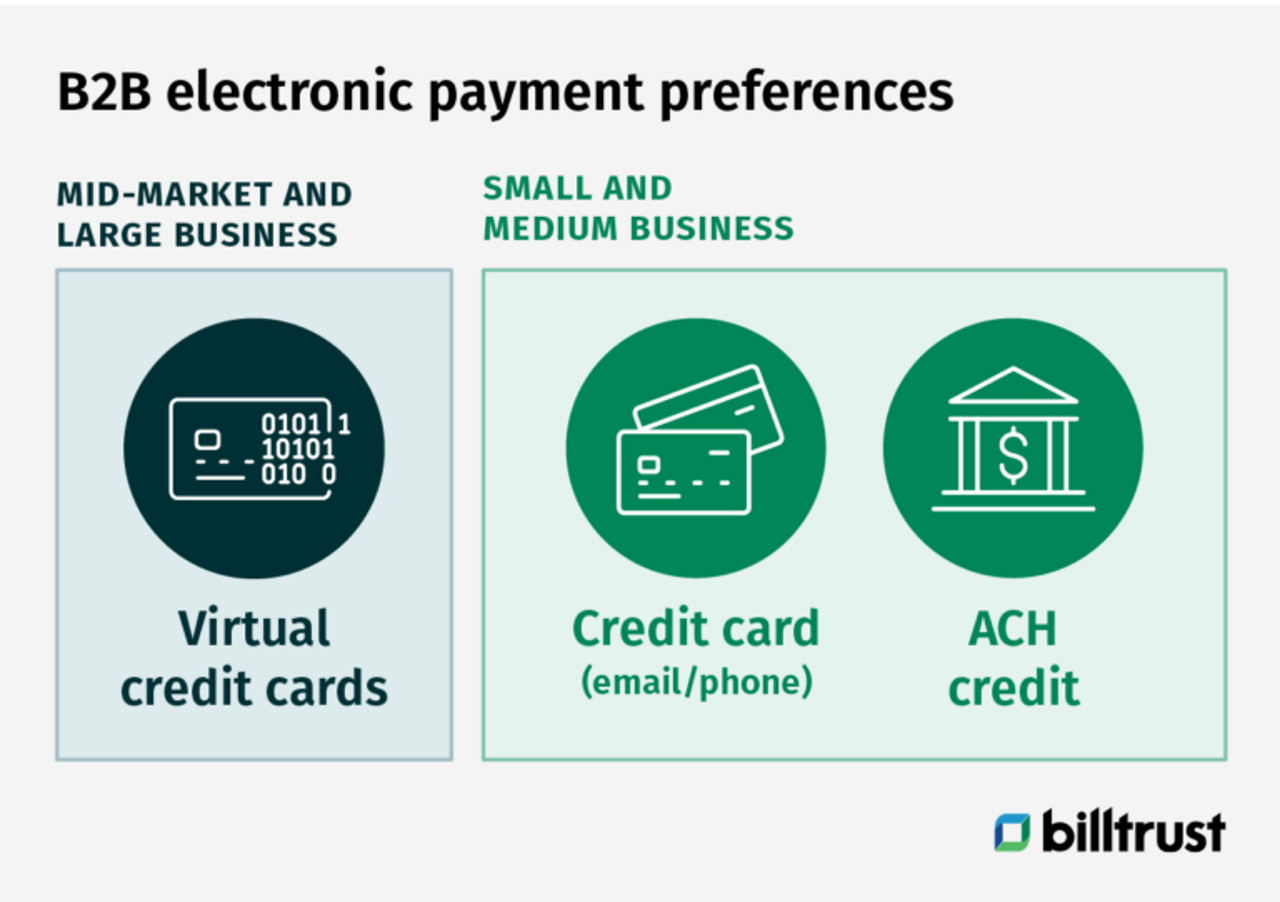

How do small and medium-sized businesses prefer to pay?

Historically, SMB companies have relied heavily on analog payment methods like checks. The complexity of B2B payments and inertia has kept SMB suppliers from moving away from checks.

But recent years have seen a shift to electronic invoicing and payment methods. Our Billtrust customers have seen their small business buyers’ payment behaviors change in two areas: paying by credit card (both online and via phone), as well as buyer-initiated ACH transactions. This is no surprise as B2B commercial credit card usage is increasing at a rate of 10% annually and is expected to continue growing rapidly.

How do mid-market and large businesses prefer to pay?

Billtrust customers have seen their mid-market and large buyers’ payment behaviors shift in one critical area: an increase in the use of virtual cards, or one-time use cards. In fact, research from Mercator Advisory Group projects that by 2021, there will be $315.1 billion dollars a year in commercial purchasing with virtual cards.

How do payment preferences impact your business?

While digital payment methods drive customer retention and speed up and improve the payment process, managing that process and reconciling all types of payments (from manual keying to security) can be complicated. As AP methods have advanced over the years, these innovations have pushed new manual processes onto already overburdened and overextended AR teams. In fact, accepting certain electronic payments can be so burdensome that businesses have to say no to accepting new customers because their team is unable to scale.

Fortunately, accounts receivable automation technology can empower AR teams with electronic invoicing and payment capabilities, ways to extract virtual credit card information automatically, and faster, more accurate cash application solutions. As a result, organizations can more easily meet buyers’ extremely high vendor expectations, take on new business, and scale their operations efficiently.

Learn more about touchless B2B payments

BPN has put truly touchless B2B payments in reach. If you’d like to learn more about how your company can benefit from BPN, please fill out the contact form.