This post was originally published in April 2022 and was updated with additional information in December 2024 to reflect emerging trends and technologies in accounts receivable management, accounts receivable challenges, and more.

Accounts receivable can be a significant issue for businesses if not managed properly.

Why are they so tricky?

A few things can cause problems with accounts receivable, such as invoicing errors, customers who don't pay on time or discrepancies between what was billed and what was received.

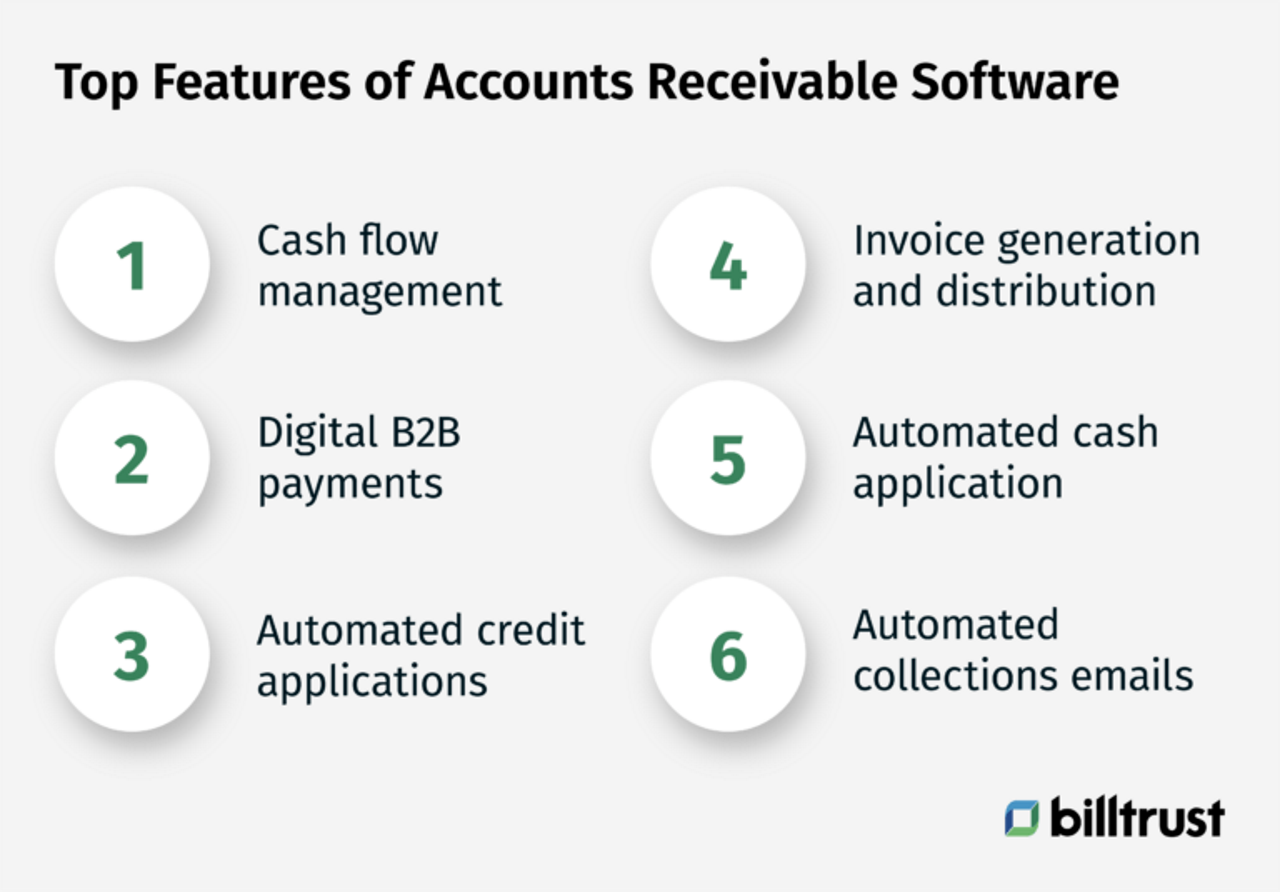

To avoid these accounting problems, it's essential to have a sound system for tracking and managing accounts receivable. This includes using accounting AR automation software to keep track of invoices and payments, setting up payment terms with customers and regularly reviewing your accounts receivable reports.

Read on to learn more about how you can conquer your accounts receivable challenges and empower your follow-up staff today.

Read the industry report → Best practices in receivables management

How do you solve for accounts receivable?

One of the most important aspects of running a business is managing accounts receivable. This can often be challenging for your AR team, as several potential issues can arise. However, by being aware of these problems and taking steps to avoid them (like bad debt), you can help ensure the smooth running of your business.

Below are several steps your AR teams can take to solve for accounts receivable:

- First, stay on top of invoices, and make sure they are paid promptly. You can do this by implementing an invoicing system and following up with customers.

- Send reminders for outstanding payments for goods or services.

- Offer discounts for early payment.

- Use a collection agency for overdue accounts.

- Negotiate with the customer to develop a payment plan.

- Consider using a collections agency if invoices are not paid promptly.

- Write it off as a bad debt.

- Review your credit policy regularly.

Regardless of the accounts receivable strategy you choose, the most important thing is to keep on top of your accounts receivable and take action quickly if there are any problems. By doing so, you can avoid major headaches down the road.

What are the basic problems that occur in the valuation of accounts receivable?

Some fundamental problems can occur when valuing accounts receivable including:

- Estimating uncollectible receivable value: First, there is the problem of estimating the value of uncollectible receivables. This can be difficult to do accurately, as it requires assessing the customer's ability to pay.

- Allowance for doubtful accounts: One of the most common problems in the valuation of accounts receivable is the allowance for doubtful accounts. This is when a business sets aside money to cover invoices that may not be paid.

- Late invoice payments: This can often be due to customers forgetting about the invoice or not having the funds available. Late payments on invoices can cause cash flow problems. In addition, if customers consistently fail to pay their invoices, this can damage your relationships.

- Receivables timing: Additionally, there is the issue of timing. Receivables must be valued when they are due, which may not always coincide with when they are collected. When there is a timing problem, payments may come in after the end of the accounting period. This can make it challenging to value accounts receivable properly.

- Bad debt allocation: The allocation problem of bad debts occurs when customers do not pay their invoices. This can lead to a loss for the company. But, again, this can be difficult to do fairly, as it often depends on subjective estimates.

- No accounts receivable management system: If you do not have an effective system for managing the accounts receivable process, it can be challenging to keep on top of payments and invoices.

- Invoice disputes: Customers may dispute invoices. In these cases, it is essential to work with the customer to come to a resolution.

- Identity theft: Finally, identity theft is another potential issue, which can result in fraudulent charges to your account.

Read the blog → Year-end accounts receivable tasks you don't want to skip

What are the five most frequent mistakes made by AR follow-up staff?

The five most common mistakes made by accounts receivable follow-up staff are:

1. Not following up promptly: It’s vital to regularly follow up with customers to pay their invoices on time.

2. No incentives: Offering incentives for early payment, such as discounts or extended payment terms, makes it worth the customer’s while to pay early.

3. Not maintaining good records: A system for better invoicing and payments will help you keep track of your customers, invoices and details.

4. Being inconsistent in payment policies: It’s vital to have an effective payment policy in place. This will help ensure customers know what they need to pay and what to expect.

5. Not communicating effectively: You should follow up with customers regularly to ensure that invoices are being paid promptly.

Download the ultimate guide to digital accounts receivable

How to avoid common accounts receivable challenges

Every business owner's worst nightmare is customers who don't pay their bills on time. It doesn't matter how good your product or service is. If you don't receive payments, you won't stay in business for long.

Customers might not pay their invoices on time for many reasons. Maybe they're waiting for approval from their boss, or they're just hoping you'll forget about the bill. Whatever the reason, late payments can seriously strain your business.

Avoid these AR nightmares with these tips

- Get organized. The first step is to get organized. Keep track of who owes you money and when the payments are due. Set up a system for sending reminders and following up with customers who are late.

- Use invoicing software. Invoicing software makes it easy to track who owes what and when payments are due. This can help you stay on top of your accounts receivable and avoid surprises.

- Get a deposit upfront. If possible, always get a deposit from your customer before starting work on a project. This will ensure that you at least get something if they decide not to pay the rest of their bill.

- Send invoices immediately. Another way to avoid late payments is to send your invoices as soon as the work is done. This will have a shorter time to pay the bill. You can also include late fees in your invoices.

- Offer discounts. Many businesses offer a discount if their customers pay their bills early. This can incentivize customers to pay on time (before 60 days) and help them avoid late payments.

- Have a straightforward payment policy. Make sure your customers know exactly when and how they are expected to pay their bills. This will help avoid any confusion and make it more likely that they will actually follow through with payment. Also, you may want to speak with your customers about the payment methods or options your company offers.

- Stay in communication with your customers. If you're having trouble collecting payment from a customer, reach out to them and try to work something out. The sooner you can resolve the issue, the better off you'll be.

- Be firm. If you've tried all of these tips and still have trouble getting paid, it's time to be firm with your customers.

- Stay informed. Keep track of changes in the law that could affect your accounts receivable process, such as new regulations governing debt collection.

- Reach out. Seek professional help from a collection agency if you are having trouble collecting payments from delinquent customers.

These tips can help you avoid accounts receivable nightmares and keep your business running smoothly.

What are the five steps to managing accounts receivable?

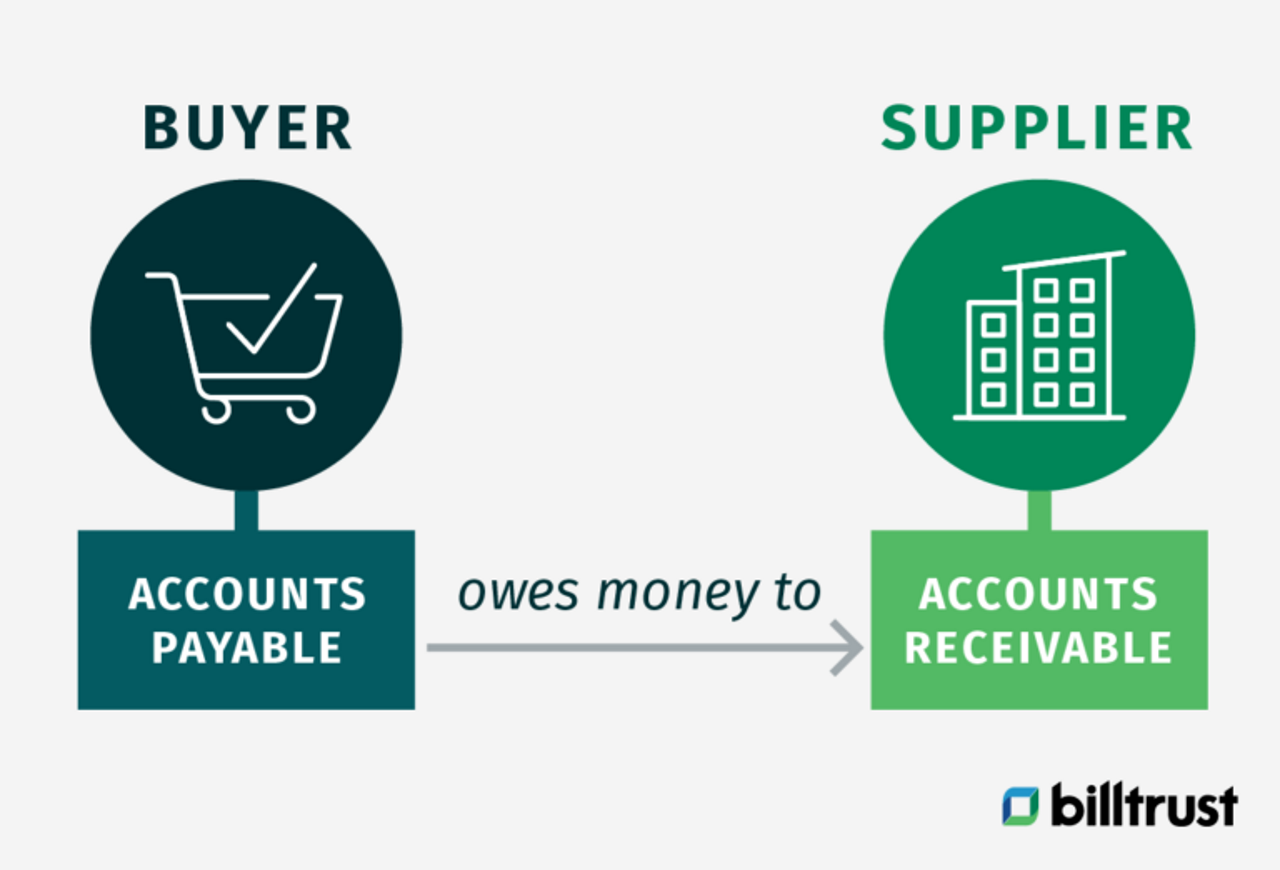

Accounts receivable management means collecting payments from customers who have purchased goods or services on credit. Accounts receivable management aims to collect payments promptly while maintaining good relationships with customers. Businesses can use several strategies to manage accounts receivable, including setting up payment plans, offering discounts for early payment and sending reminders for overdue invoices.

When it comes to collecting payments from customers, promptness is critical. The sooner you can get the money owed to you, the better off your business will be. That’s why it’s essential to have a system to manage accounts receivable. Below are a few additional steps for developing a strong accounts receivable management system:

1. Have a clear and concise credit policy and ensure that all employees know it.

2. Establish clear lines of communication between the sales, accounting, and collections departments.

3. Keep accurate records of all invoices and payments.

4. Follow up promptly on all outstanding invoices.

5. Offer incentives for prompt payment, such as discounts for early payment.

Accounts receivable management is an essential part of running a business. Using some or all of the strategies mentioned above, you can collect payments promptly while maintaining good relationships with your customers. You'll soon find that these few simple steps can help you avoid some significant common mistakes and effectively manage your accounts receivable process.

The future of accounts receivable Key trends shaping AR management

The accounts receivable landscape is rapidly evolving, with new technologies and approaches transforming how businesses handle their AR operations. From artificial intelligence to innovations in payment solutions, these changes are helping companies overcome traditional AR challenges while preparing them for future success.

How AI is transforming accounts receivable

AI-powered AR solutions can process thousands of transactions in minutes, automatically matching payments to invoices with unprecedented accuracy. Machine learning algorithms analyze payment patterns to predict which accounts might delay payment, allowing AR teams to take proactive steps before issues arise. For financial leaders, this means less time troubleshooting and more time focusing on strategic growth initiatives.

The digital payment revolution

The shift toward digital payments is dramatically reducing friction in the AR process. Modern platforms offer customers multiple ways to pay, from traditional ACH transfers to innovative digital wallet solutions. This flexibility isn't just about convenience – it's about getting paid faster. Companies implementing digital payment strategies are seeing reductions in DSO and improvements in customer satisfaction scores.

Tailored solutions for unique industry challenges

Every industry faces distinct AR hurdles. Manufacturing companies might struggle with complex pricing structures and volume-based discounts, while healthcare providers navigate insurance claims and patient payment plans. Modern AR solutions are increasingly offering industry-specific features that address these unique challenges. Whether it's specialized workflows for equipment dealers, streamlined solutions for distributors, or compliance tools for medical device manufacturers, these tailored approaches are making AR management more productive across sectors.

Building scalable AR operations

Today's AR solutions need to grow alongside your business. Cloud-based platforms are leading this charge, offering the flexibility to scale operations up or down as needed. These systems integrate with existing business tools while providing security features to protect sensitive financial data. For growing businesses, this means having an AR infrastructure that can handle increasing transaction volumes without requiring major overhauls or additional staffing.

Final thoughts

At the end of the day, remember that accounts receivable is just one part of running a business. So while it’s essential to keep on top of your receivables, don’t let them stress you out. With a little bit of organization and effort, you can get your accounts receivable under control.

Need a little extra help keeping your accounts receivable in order?

It can’t get simpler than automated AR software, particularly with a dedicated team behind you. Contact us to learn more about how you can leverage Billtrust, in conjunction with AR software automation, to help you get back to the most important thing – running your business.

Leading the future of accounts receivable

At Billtrust, we understand that modern accounts receivable challenges require modern solutions. As a trusted leader in AR automation, we help over 2,400 businesses worldwide transform their financial operations through intelligent technology. Our unified platform combines AI-powered automation with deep industry expertise to help you control costs, accelerate cash flow, and enhance customer satisfaction.

When you partner with Billtrust, you're choosing more than just software – you're gaining a dedicated team focused on your success. We combine cutting-edge technology with deep industry knowledge to help you overcome today's AR challenges and prepare for tomorrow's opportunities.

Frequently Asked Questions

Check out the FAQs for general questions. Find helpful answers quickly to get the information you need.

The most critical processes requiring attention are invoice delivery, payment capture, and cash application. Optimizing these core accounts receivable processes through automation can significantly reduce errors, and accelerate cash flow.

Establishing clear payment terms upfront is crucial for preventing AR challenges. Well-defined terms help set expectations, reduce payment delays, and provide a solid foundation for collections efforts when needed. They should clearly outline payment deadlines, accepted methods, and any early payment incentives.

Late payments, manual processing inefficiencies, and poor cash application accuracy most significantly impact cash flow. Addressing these challenges through automation and optimized processes can help accelerate collections, reduce DSO, and improve working capital management.