Accounts receivable (AR) directly impacts an organization's ability to drive sustainable growth. If you're like most finance leaders we work with, you know that AR can make or break your cash flow. And in today's business environment, getting AR right isn't just about keeping the lights on—it's about giving your organization the financial agility it needs to grow and compete.

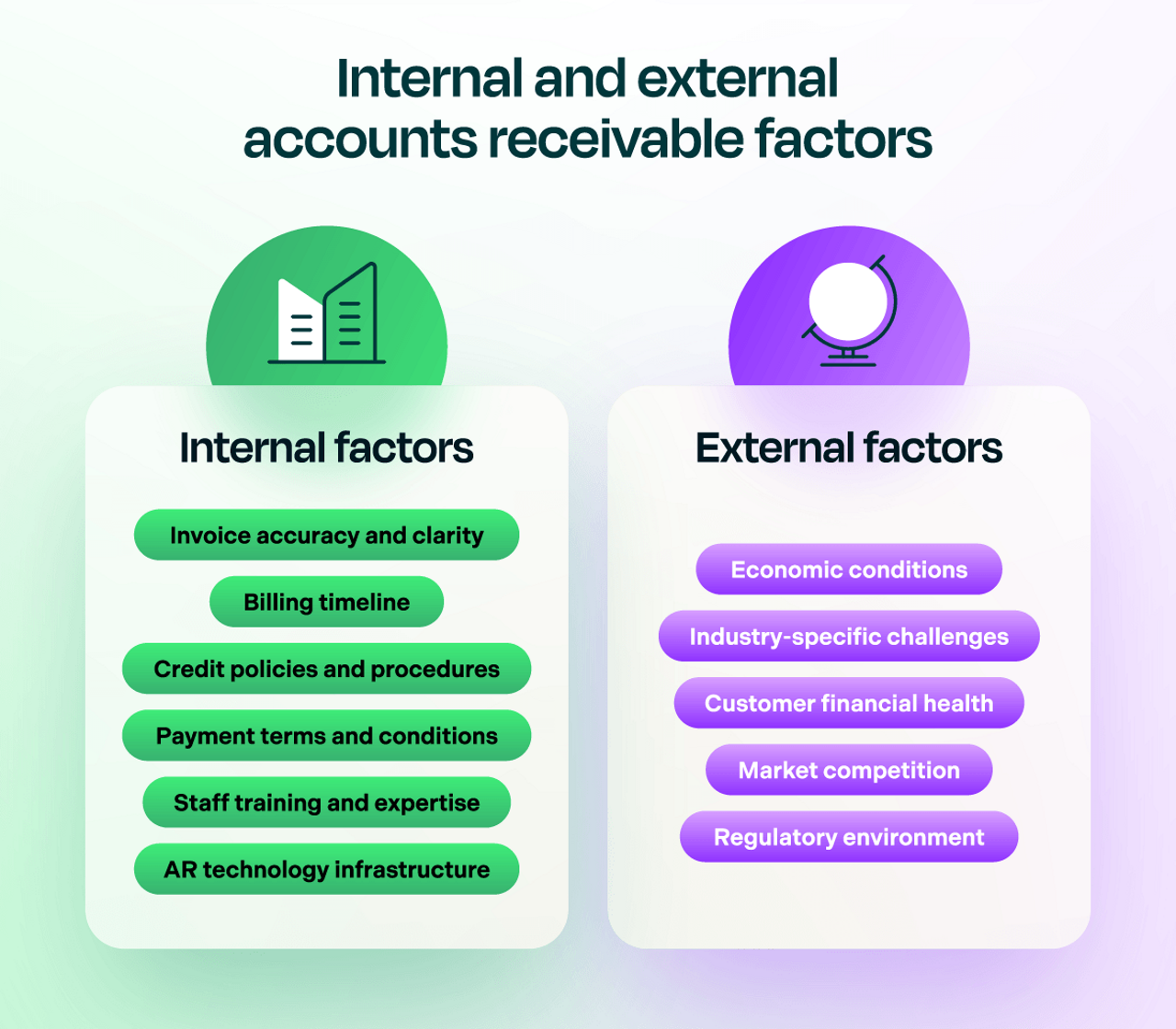

These accounts receivable factors encompass every aspect that influences how quickly and reliably a company converts sales into cash. From internal processes to external market conditions, each factor plays a vital role in determining AR performance. When properly managed, these factors can improve cash flow, reduce operational costs, and enhance customer satisfaction.

Internal accounts receivable factors

The foundation of capable AR management lies in the elements directly under an organization's control. Finance leaders can actively optimize these internal factors to drive performance improvements. Understanding and fine-tuning these components creates a strong foundation for AR success.

- Invoice accuracy and clarity: Invoices are your first opportunity to get paid faster. When your customers receive clear, accurate invoices with all the details they need, from PO numbers to payment terms, they're much more likely to process and pay them quickly.

- Billing timeline: The timing of invoice generation and delivery impacts cash flow performance. Consistent billing cycles that align with customer preferences and business needs can create predictable cash flow patterns and reduce processing delays. Finance teams should regularly analyze billing patterns to optimize timelines based on customer payment behaviors.

- Credit policies and procedures: Well-designed credit policies balance growth opportunities with risk management. These policies establish the framework for customer relationships and risk assessment, creating guidelines for credit approval, monitoring, and management. Regular reviews ensure policies stay relevant to current market conditions and protect the organization's financial interests.

- Payment terms and conditions: Strategic payment terms balance customer relationships with cash flow needs. Organizations must consider competitive pressures, industry standards, and working capital requirements when establishing payment terms. Regular reviews of payment terms help maintain competitiveness and support financial goals. This includes evaluating early payment incentives, late payment penalties, and standard payment windows to optimize cash flow without compromising customer satisfaction.

- Staff training and expertise: The expertise of AR team members directly impacts operations. Training programs help staff use systems, follow procedures, and handle complex situations. Regular professional development keeps teams updated on industry best practices and technological advances. Investment in staff development pays dividends through improved accuracy, faster processing times, and better AR services.

- AR technology infrastructure: Modern AR operations require technological support to maintain accuracy. A well-designed technology infrastructure enables accounts receivable automation, improves accuracy, and provides valuable insights for decision-making. Regular evaluation and updates ensure systems remain current and capable of supporting evolving business needs. Integration capabilities, security measures, and scalability should be key considerations in technology planning.

Read our blog → Are your accounts receivable (AR) processes modernized?

External accounts receivable factors

Although you can't directly control external factors, their impact on AR performance requires management and planning. While you can't change the economy or your industry's dynamics, you can develop strategies to handle these external challenges. Here's how to stay ahead of the game:

- Economic conditions: Broader economic factors influence payment behavior and risk levels. Organizations must monitor economic indicators and adjust strategies accordingly. This includes considering interest rate changes, market stability, and industry trends affecting customer payment capability. Proactively adjusting credit policies and collection strategies in response to economic conditions helps maintain healthy cash flow during challenging times.

- Industry-specific challenges: Each industry faces unique AR challenges that require specialized approaches. Understanding sector-specific payment norms, seasonal patterns, and competitive pressures enables better AR management. Organizations must adapt their AR strategies to address industry-specific factors. This includes considering unique documentation requirements, compliance needs, and payment practices common to their industry.

- Customer financial health: Customers' financial stability directly impacts payment reliability. Proactively managing customer financial risk helps prevent payment delays and reduce bad debt exposure. This includes tracking payment history, market position, and other indicators of financial stability.

- Market competition: Competitive pressures influence AR policies and customer expectations. Organizations must balance competitive necessity with sound financial management when establishing payment terms and service levels. Understanding competitive offerings helps finance leaders develop AR strategies that maintain market competitiveness while protecting financial interests. Regular review of competitive practices ensures AR policies remain appropriate for market conditions.

- Regulatory environment: Compliance requirements significantly impact AR processes and policies. Organizations must stay current with changing regulations while maintaining efficient operations. This includes adapting to new payment standards, ensuring data protection compliance, and meeting industry-specific regulatory obligations. Regular review of regulatory requirements helps prevent compliance issues.

Process-related accounts receivable factors

Your AR processes can either make your life easier or create daily headaches. When you get these accounts receivable processes right, you'll not only see better financial results, but you'll also have happier customers and a more productive team. Let's look at what makes the difference:

- Invoice delivery methods: How organizations deliver invoices impacts payment speed and customer satisfaction. Modern AR operations typically employ multiple delivery channels to meet diverse customer needs. Electronic delivery methods reduce costs while maintaining traditional options ensures all customer preferences are met.

- Payment processing systems: Payment processing systems form the backbone of AR operations. These systems must handle multiple payment methods while maintaining accuracy and security. Integration with other business systems ensures smooth data flow and reduces manual processing requirements.

- Collection procedures: Well-designed collection procedures balance payment acceleration with customer relationship management. This includes implementing automated reminders, establishing clear escalation protocols, and maintaining consistent communication throughout the collection process.

- Dispute resolution protocols: Dispute management processes protect customer relationships while minimizing impact on cash flow. Clear procedures for identifying, tracking, and resolving disputes help maintain customer satisfaction and prevent payment delays. This includes establishing service-level agreements for dispute resolution and maintaining documentation.

- Cash application: Rapid and accurate cash application directly impacts working capital and resource utilization. Modern AR operations leverage automation to match payments with invoices and handle exceptions. This includes implementing intelligent matching algorithms and maintaining clear procedures for complex scenarios.

Technology accounts receivable factors

The right technology stack can transform how your entire AR operation functions. When implemented strategically, technology becomes your competitive advantage, helping your team work smarter, not harder.

- AR automation impact: Automation transforms AR operations by reducing manual effort and improving accuracy. Modern automation tools streamline processes across the order-to-cash cycle, from invoice generation to cash application. This includes automated workflow management, payment processing, and exception handling.

- Integration capabilities: System integration enables data flow and process automation. AR systems must communicate with ERP systems, banking platforms, and customer portals. This includes maintaining reliable data connections and ensuring consistent information across systems.

- Digital payment adoption: Electronic payment methods accelerate cash flow and reduce processing costs. Organizations must support various digital payment options while encouraging customer adoption. This includes providing secure online payment portals and tools to help customers transition from paper-based methods.

- AI and machine learning utilization: Advanced technologies improve decision-making and process efficiency. AI-powered solutions help predict payment behavior, optimize collection strategies, and automate complex tasks. This includes implementing intelligent cash application and predictive analytics capabilities.

- Real-time reporting abilities: Immediate visibility into AR performance enables proactive management and faster decision-making. Modern systems must provide customizable dashboards and detailed reporting capabilities. This includes tracking key metrics, identifying trends, and highlighting exceptions requiring attention.

Read our blog → Accelerating financial operations: The power of AR automation

Financial accounts receivable factors

Numbers tell the story of your AR performance. These financial metrics aren't just data points; they're your early warning system and your roadmap to improvement. Let's explore the key indicators that should be on every finance leader's dashboard:

- Days Sales Outstanding (DSO): This key metric indicates how quickly organizations convert sales into cash. Finance leaders must regularly monitor DSO trends and implement strategies for reduction. This includes analyzing the root causes of payment delays and developing targeted solutions. Regular DSO analysis helps identify opportunities for process improvement and policy adjustments.

- Bad debt ratios: Managing potential losses while supporting growth requires careful balance. Organizations must maintain appropriate reserves while implementing credit assessment procedures. This includes regular review of bad debt trends and adjustment of credit policies. Analysis of bad debt patterns helps improve risk assessment and collection strategies.

- Cash flow implications: AR performance directly impacts organizational liquidity and working capital. Finance leaders must understand and optimize the relationship between AR practices and cash flow. This includes forecasting cash flow impacts of AR policies and procedures. Cash flow analysis helps ensure AR strategies support financial objectives.

- Collection costs: The expense of collecting payments affects AR processes. Organizations must optimize collection processes to minimize costs. This includes evaluating staff time, technology investments, and third-party services.

- Processing fees: Payment processing costs impact profitability and influence payment method preferences. Organizations must understand and optimize various payment processing fees. This includes negotiating favorable processing rates and encouraging cost-effective payment methods.

Measuring and monitoring AR factors

In AR, the key is knowing which metrics matter most and how to use them to drive real improvements. Here's how successful finance leaders stay on top of their AR performance:

- Key performance indicators (KPIs): Measurement guides improvement efforts and demonstrates progress. Organizations must identify and track relevant KPIs across all AR functions. This includes establishing benchmarks and targets for key metrics. Regular KPI review helps ensure focus on critical performance factors.

- Benchmarking methods: Comparison with industry standards provides valuable context for performance assessment. Organizations must establish relevant benchmarks and regular measurement processes. This includes internal and external performance comparisons.

- Analytics and reporting: Data-driven insights enable better decision-making and process improvement. Organizations must implement analytics capabilities across AR operations. This includes developing meaningful reports and analysis tools.

- Performance tracking: Consistent monitoring enables proactive management and timely adjustments. Organizations must establish regular performance review processes across AR functions. This includes tracking trends and identifying improvement opportunities.

- Success metrics: A clear definition of success supports strategy development and execution. Organizations must establish relevant success metrics aligned with business objectives. This includes both quantitative and qualitative measures.

Optimizing accounts receivable factors

Ready to take your AR operations to the next level? Whether you're dealing with process inefficiencies or looking to scale your operations, a systematic approach to improvement is key. Let's explore practical steps that can help you achieve sustainable, long-term results:

- Strategy development: Comprehensive AR strategy aligns processes with business objectives. Organizations must develop clear plans for optimizing each AR factor. This includes setting priorities, establishing timelines, and allocating resources appropriately.

- Process improvement: Continuous refinement of AR processes drives better performance. Organizations must regularly evaluate and enhance existing procedures. This includes identifying bottlenecks, streamlining workflows, and implementing best practices.

- Technology adoption: Strategic technology implementation enables process optimization and innovation. Organizations must carefully evaluate and implement appropriate technology solutions. This includes assessing new technologies, planning implementations, and managing change.

- Staff development: Skilled personnel are essential for AR management. Organizations must invest in ongoing training and professional development. This includes technical skills, customer service capabilities, and industry knowledge. Skill assessments help identify training needs and opportunities for advancement.

- Customer experience enhancement: Positive customer experiences support better payment behavior. Organizations must continuously work to improve customer interactions across all AR touchpoints. This includes streamlining processes, enhancing communication, and providing better self-service options.

Managing accounts receivable factors balances multiple competing priorities. Organizations that optimize these factors can improve cash flow and customer satisfaction.

Ready to optimize your accounts receivable financing operations? Schedule a consultation with our AR experts to discover how Billtrust's unified platform can help you control costs, accelerate cash flow, and improve customer satisfaction. Let's move finance forward together.

The Billtrust advantage

For over two decades, Billtrust has partnered with finance leaders to optimize accounts receivable operations through innovative technology and deep industry expertise. As the leading provider of order-to-cash solutions, we've helped thousands of organizations accelerate cash flow, reduce costs, and improve customer satisfaction.

We've helped thousands of finance leaders not just solve immediate problems but transform their entire order-to-cash process. The result? Faster cash flow, lower costs, and happier customers. Through our unified AR platform, powered by advanced AI and machine learning, we process over $1T in invoice dollars annually. That gives us unique insights into what makes AR operations truly exceptional, and we're excited to share these insights with you.

Whether you're just starting to optimize your AR processes or looking to take your operation to the next level, you'll find practical, proven strategies in this guide.

Take the next step in your AR optimization journey. Join the thousands of finance leaders who trust Billtrust to streamline their accounts receivable processes. Schedule a demo to see our unified platform in action.

Frequently Asked Questions

Check out the FAQs for general questions. Find helpful answers quickly to get the information you need.

Accounts receivable factors directly influence cash flow, working capital, customer satisfaction, and operational costs. Management of these factors supports business success and growth opportunities.

Success measurement should include both quantitative metrics like DSO and qualitative factors like customer satisfaction. Regular monitoring of performance indicators helps track progress and guide continued improvement.

Common challenges include technology integration, change management, resource constraints, and balancing competing priorities. Success requires careful planning, clear communication, and sustained commitment to improvement.