This post was originally published in January 2022 and updated in December 2024 with additional information on digitizing your accounts receivable process, the 10 rules for accounts receivable, and more.

Accounts receivable (AR) collections are the lifeblood of any business. When a company doesn't collect on its accounts, it's impossible to maintain its cash flow. Collecting unpaid invoices is a struggle for every company, however. The time and effort spent to recover unpaid invoices can be significant and exhausting.

How do you make the AR collections process easier? Adhering to best practices for accounts receivable collections can help you avoid this problem at the outset, such as implementing an accounts receivable process when writing invoices or making it easy for customers to pay their bills. Automating your AR collections is another way to ensure that you never miss a beat tracking your accounts receivable.

Read on to discover more about how to level up your accounts receivable collections to ensure that your company makes the most of its finances.

What are collections on accounts receivable?

Accounts receivable is the total value of the invoices that a company has not yet collected from customers. These accounts receivable typically take three forms: trade, cash and others. Trade receivables are invoices that have been sent out and have not been paid for yet. Cash receivables are invoices that have been received but not yet collected. Other receivables are a combination of both trade and cash. These receivables are a company's future assets. The balance sheet lists the value of receivables in the form of current liabilities, which must be paid out in cash, and current assets, including cash, marketable securities and receivables.

Accounts receivable are classified as current or non-current receivables. Current accounts receivable are those that will be collected in less than one year, as opposed to non-current receivables, which are any receivables that are not currently due or payable, such as invoices dated more than one year ago. The process of collecting accounts receivable is called "collections,” which are typically done by phone, email, or in person. However, an outside agency may specialize in collections and help to collect on invoices.

What happens when a business collects accounts receivable?

Receivables are the money owed to a company for products or services they have already provided. Businesses collect accounts receivable to help generate cash flow. Many companies have a mix of both current and non-current receivables, an account on the balance sheet that represents the amount of money owed by customers to the business.

The accounts receivable process starts when a customer pays for a product or service and ends when the company sends the funds. The company collects these accounts receivable by:

1) Sending out invoices. The easiest and most common method is to send an invoice for the work done to the client.

2) Sending collection letters. Following up with customers by phone, email, letters, etc., is the next step to acquiring past-due payments.

3) Legal action. Some companies take a more aggressive approach and turn to legal action when they haven't received payment after sending an invoice over time, but this will often fail. The best way for a business to collect money owed to them is by hiring an account receivable collections agency.

Once payments are ready to transfer, businesses collect accounts receivables in various ways. For instance, via an ACH transfer. These are electronic payments that are processed via bank account numbers. Businesses also process credit cards, checks or wire transfers depending on their customers' preferences.

A business will collect accounts receivable in various ways, which can depend on the type of business. The type of industry the company is in will have an impact on what kind of collection methods they use. For example, depending on your organization, additional steps for unpaid accounts could include: monitoring customer creditworthiness, using credit reports and credit scores, determining terms of trade with customers and collecting from customers who cannot pay.

Regardless of your industry, the process of collecting accounts receivable is often a lengthy one. Nevertheless, it’s worth the effort and planning to align with these best practices for accounts receivable collections to maintain your organization’s cash flow.

Why does cash collection in business matter?

Cash collection in business is one of the biggest challenges that business owners face. It is the blood that keeps it alive. Without cash, a company cannot pay for its expenses, including payroll. In order to make a profit or stay afloat, a company needs money to pay for expenses and expand operations. Late payment of invoices can cause major issues for a business, including late fees, loss of reputation and struggling to meet payroll. If you are not collecting enough cash, you are not generating profit.

While running a business in and of itself is challenging, cash flow is one of the most vital things to manage. If you don't have enough money coming in regularly, your business will suffer cash flow problems. With the right financial management strategy in place, you can make sure that cash is coming into your business regularly and leaving your company for necessary expenses. The faster that cash can be collected, the more quickly it can be leveraged to reinvest in growth.

One of the most common errors that small businesses make is not following up with customers (delinquent accounts) who owe them money. Therefore, it's important to maintain a strong credit policy, a robust collections process and keep on top of collections to grow your business. The alternative, ineffective collections, means that you spend a lot of time and energy on collections, contacting customers and following up on old invoices, rather than on growing your business.

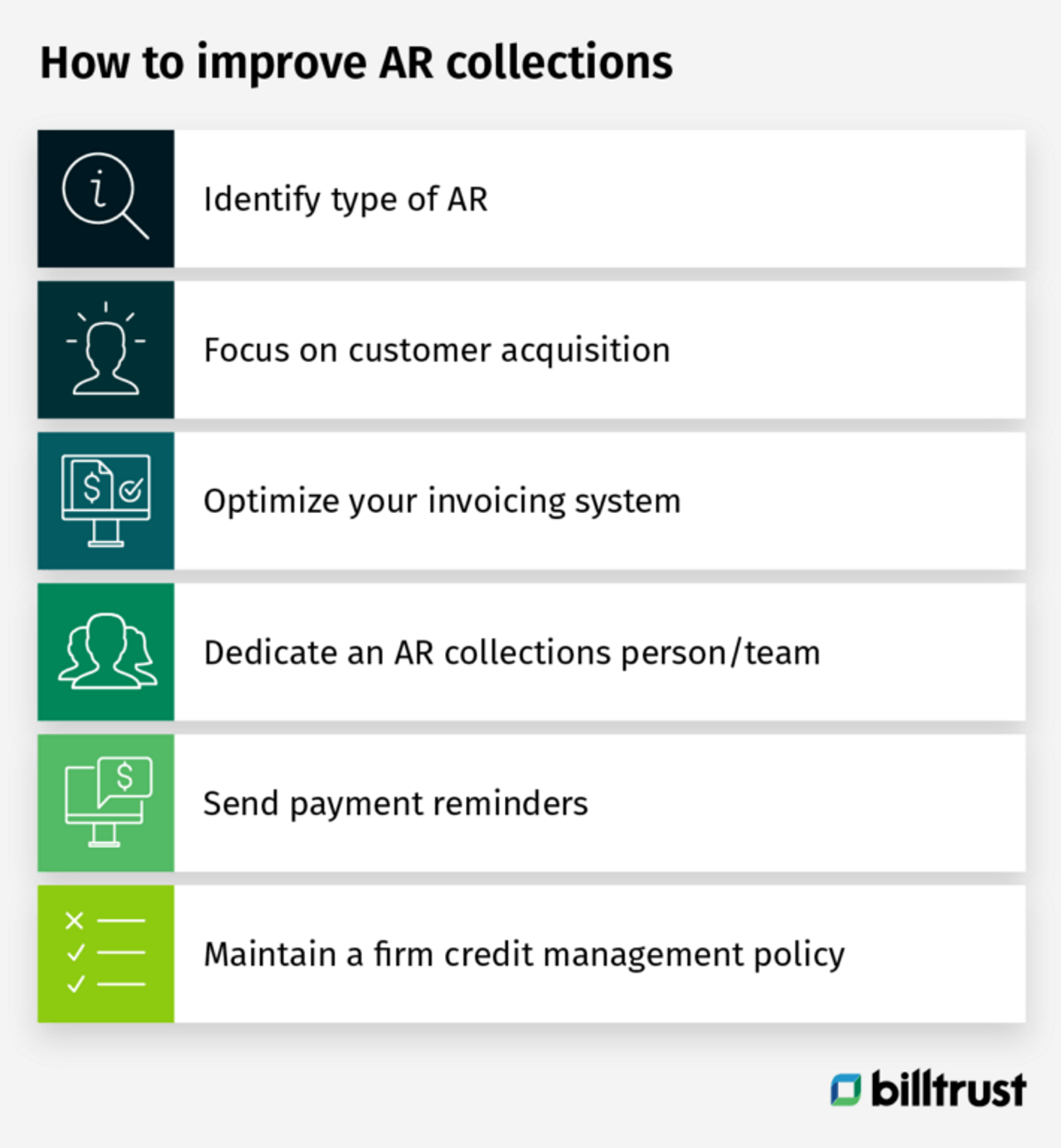

How can you improve collections on your accounts receivable?

Collections on accounts receivable are a crucial part of the health and success of any business. Without adequate cash flow management, your company may not be able to maintain its operations. As a result, accountants often rely on collection techniques such as phone calls, letters, and email follow-ups. Unfortunately, these techniques can be time-consuming and costly to execute. However, there are alternatives. Below are a handful of best practices for accounts receivable collections to optimize your collections process.

Identify type of AR

The first step to improving your collections is identifying the accounts receivable types. There are three different types: business-to-business, business-to-consumer and consumer. A business will be different from collecting from consumers as they have other buying habits and decision-making processes, for example.

Focus on customer acquisition

You can improve your collections by focusing on customer acquisition. This is crucial because customer acquisition is always more profitable than collection.

Optimize

Optimize your invoicing system so it's easier for clients to pay their bills. Outdated methods such as phone calls and letters aren’t the most efficient way of collecting overdue payments, so some companies have found better ways to automate the process. Likewise, the quicker a company collects on accounts receivable, the better. A solid way to optimize invoices is to digitize your entire accounts receivable (AR) process with AR software.

Dedicate an AR collections person/team

Dedicate a person or collections team in charge of collecting overdue payments. For example, you can ensure that your employees remember to ask for payment when they take an order over the phone or in-person to keep track of any late payments/overdue balances and oversee an automated system for sending out reminders.

Send payment reminders

You can create a system (and use AR software) where you remind customers about their outstanding balance. The first step is to identify which customers are overdue on their payments, provide customers with clear instructions on how to pay and then contact them with a payment request. Follow up with a phone call or email if they don't pay. If they still don’t pay, send out a final notice before taking legal action.

Maintain a firm credit management policy

To improve accounts receivable (AR) collections, your business needs to have a firm credit management policy in place. Create a system for managing credit and checking past payment history

Collecting past-due accounts can be a lengthy and complicated process. However, with a few simple steps, you’ll be able to adopt a system-wide approach and implement new policies and procedures for AR optimization and credit management that will help you get paid faster.

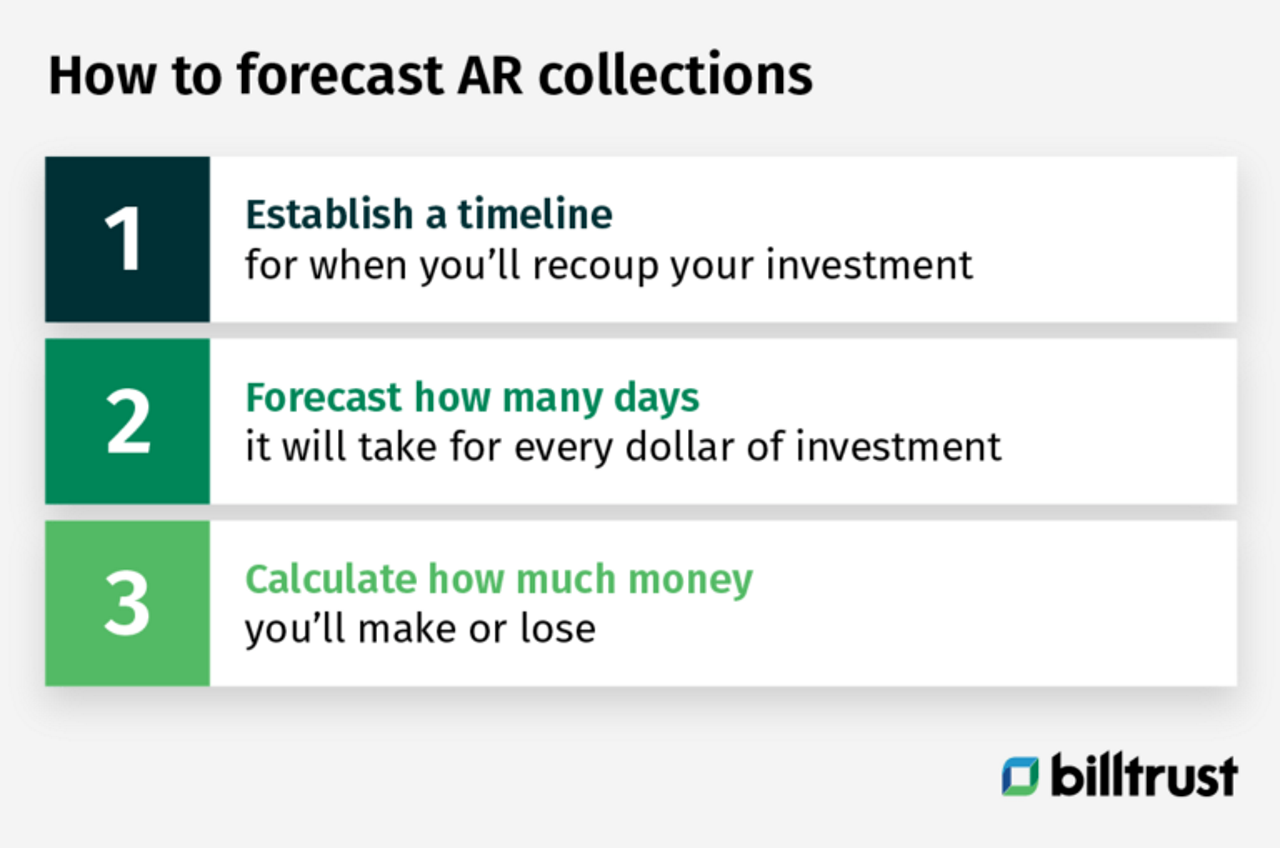

How to forecast collections on accounts receivables

When a company does not pay according to the agreed-upon terms, its account becomes delinquent. The most common way that creditors find out about delinquencies is through collections agents. This is where collection forecast software comes in handy. One of the most crucial tasks for accounting professionals is forecasting collections on accounts receivable to anticipate future courses of action and prepare for any coming changes.

Using collection forecast software, accountants can predict when an account will be paid and by how much. There are two ways in which this is done: an estimation forecast or a projection forecast. Using these forecasts can help creditors determine whether or not they should write off the account (where it is deemed unlikely that they will ever get paid).

Three easy steps to forecasting your accounts receivable:

1) Establishing a timeline for when you'll recoup your investment.

2) Forecasting how many days it will take for every dollar of investment.

3) Calculating how much money you'll make or lose.

Collections forecasting provides a way to estimate and forecast the volume and value of unpaid invoices at a given point in time. As a result, further forecasting helps with decision making about the number of goods to procure, availability of funds, planned expenditures, staffing requirements and production scheduling.

Read the blog → How to improve accounts receivable: strategies and best practices

Digitizing your AR process A key way to improve accounts receivable collections

Transform your accounts receivable collections by embracing digital transformation. In today's dynamic business environment, manual AR processes simply can't keep pace with modern payment complexities. Finance leaders who digitize their AR operations consistently report faster payments, improved accuracy, and stronger cash flow. The transition from manual to digital AR isn't just an upgrade—it's a strategic imperative for maintaining competitive advantage and financial health.

Digital tools that transform invoice-to-cash

Modern AR platforms revolutionize how businesses handle invoicing and payments. By implementing electronic invoicing, you eliminate the delays and errors inherent in paper-based systems. Your customers gain the flexibility to pay through their preferred channels, whether that's ACH, credit card, or other digital payment methods. The result? Faster settlements and improved cash flow for your business.

Smart automation for better collection rates

Stop letting overdue payments slip through the cracks. Automated reminder systems act as a tireless collections team, sending perfectly timed payment reminders and follow-ups. This systematic approach to collections ensures consistent communication while freeing your AR team to focus on strategic activities rather than manual tracking and outreach.

Data-driven decisions through real-time analytics

Transform your collections strategy with powerful analytics and reporting. Modern AR platforms provide immediate visibility into key metrics like DSO (Days Sales Outstanding), collection performance, and payment trends. These insights enable finance leaders to make informed decisions about credit policies and collection strategies, ultimately improving accounts receivable performance.

Elevate the customer payment experience

The best way to improve accounts receivable collections is to make it easier for customers to pay. Digital AR platforms offer intuitive payment interfaces and flexible options that customers actually want to use. When you provide a smooth, professional payment experience, you not only accelerate collections but also strengthen valuable business relationships.

Bottom line: Technology drives collection success

For finance leaders serious about improving their accounts receivable collections, digitization offers the clearest path to success. Modern AR software combines automation, analytics, and customer-friendly interfaces to optimize the entire collections process. The result is a more predictable and profitable accounts receivable operation that scales with your business growth.

Driving results through innovation

With over two decades of experience, Billtrust leads the industry in accounts receivable automation. Our unified platform helps finance leaders control costs, accelerate cash flow, and deliver exceptional customer experiences. By combining AI-powered automation with deep industry expertise, we transform the order-to-cash process for mid-market and enterprise organizations worldwide. From credit assessment and invoicing to payments and collections, our end-to-end solution streamlines every aspect of accounts receivable management. We're revolutionizing how B2B payments happen, making it easier than ever for businesses to get paid faster while reducing costs and complexity.

Frequently Asked Questions

Check out the FAQs for general questions. Find helpful answers quickly to get the information you need.

An accounts receivable aging report breaks down receivables by time periods (typically 0-30, 31-60, 61-90, and 90+ days). Focus on the percentage of receivables in each period to identify collection issues early. Higher percentages in older categories often indicate a need to improve collection processes.

Leading cash management tools include AR automation platforms, digital payment portals, and real-time analytics dashboards. Look for solutions that offer integrated invoicing, payment processing, and collections management to optimize your entire cash flow cycle.

To improve AR turnover, implement clear payment terms, offer early payment discounts, use automated collection processes, and provide multiple payment options. A higher turnover ratio indicates more efficient collection of receivables and better cash flow management.