Accounts receivable management is a cornerstone of financial operation. High-performing AR management accelerates cash flow, enabling sustainable business growth. It encompasses more than payment collection—it directly impacts your company's financial health, customer relationships, and competitive position in the market.

The demands on AR teams continue to grow, from managing diverse payment methods and customer preferences to maintaining compliance with evolving regulations. These challenges make it essential to adopt modern accounts receivable management approaches that can scale with your business.

Fundamentals of modern AR management

The evolution of accounts receivable management reflects the broader digital transformation reshaping finance operations. Traditional manual processes that once dominated AR departments have given way to accounts receivable automation software, prioritizing accuracy and customer experience. This transformation hasn't just changed how we process payments—it's revolutionized the entire order-to-cash cycle.

Modern AR management operates as an integrated function within your broader finance operations. This integration ensures data flow between systems, provides better visibility into financial performance, and enables more accurate forecasting and strategic planning. By connecting AR processes with other financial operations, organizations can make more informed decisions and respond more quickly to changing business conditions.

Core AR management strategies

Successful accounts receivable management requires an approach that addresses every aspect of the order-to-cash cycle. While each organization's specific needs vary, certain core strategies have proven essential for optimizing AR operations and maintaining healthy cash flow. Finance leaders who master these strategies can reduce costs and enhance customer satisfaction while maintaining strong financial controls. Let's examine key strategic areas that form the foundation of modern AR management and how each contributes to financial success.

- Credit policy optimization: A well-designed credit policy forms the foundation of accounts receivable management. Modern credit management strategies should balance risk mitigation with business growth opportunities. This involves establishing clear crediting criteria, implementing automated credit decisioning systems, and maintaining ongoing credit monitoring processes. Your credit policy should be dynamic, regularly reviewed, and updated to reflect changing market conditions and business objectives.

- Invoice delivery and management: How you deliver and manage invoices can significantly impact payment speed and customer satisfaction. Modern invoice management involves implementing electronic invoicing systems, ensuring accuracy through automated verification processes, and providing customers with self-service access to their invoice history and payment options. By optimizing these processes, you can reduce payment delays and improve customer experience.

- Payment processing optimization: In today's digital economy, payment processing is crucial for maintaining healthy cash flow. This involves supporting multiple payment channels, encouraging electronic payment adoption, and implementing automated processing systems. Your payment processing strategy should focus on removing friction from the payment process while maintaining security measures and compliance standards.

- Collections management: Collections management requires a balanced approach that maintains positive customer relationships while ensuring timely payment. This involves implementing automated collection workflows, developing priority-based collection strategies, and maintaining proactive customer communication. Modern collections management uses data analytics to predict payment behavior and optimize collection efforts.

- Cash application processes: Streamlining cash application processes ensures faster cash flow and reduces manual effort. This involves implementing automated payment matching systems, developing exception handling workflows, and maintaining accurate customer records. Modern cash application solutions use artificial intelligence and machine learning to achieve higher match rates and reduce manual intervention.

- Risk management approaches: Risk management protects your organization while supporting growth objectives. This involves regular customer risk assessments, dynamic credit limit management, and fraud prevention measures. Your risk management strategy should adapt to changing market conditions while maintaining compliance with relevant regulations.

Read the blog → Forward-thinking accounts receivable management

Technology's role in AR management

Integrating advanced AR automation software in accounts receivable management has transformed how organizations handle financial operations. Artificial intelligence and machine learning now power everything from cash application to predictive analytics, enabling more accurate forecasting and operations. These technologies don't just automate routine tasks—they provide insights that help companies make better strategic decisions.

AI and machine learning can help organizations with:

- Automated cash application and reconciliation.

- Predictive analytics for payment behavior.

- Intelligent customer segmentation.

- Risk assessment and fraud detection.

- Process optimization recommendations.

Organizations that embrace these advanced technologies position themselves for better customer relationships and improved financial performance. As technology continues to evolve, staying current with these innovations prepares your company for the future of finance. The key to success lies in selecting solutions that align with your needs while ensuring integration with your existing systems and processes.

Process optimization strategies

Optimizing your accounts receivable processes requires a strategic approach that combines automation, exception handling, and customer communication. Modern AR departments are moving away from reactive, manual processes toward accounts receivable automation solutions that scale with business growth.

To achieve meaningful process optimization, focus on these key workflow automation priorities that create the foundation for productive operations:

- End-to-end process mapping and standardization.

- Automated task routing and assignment.

- Real-time status tracking and reporting.

- Document management and version control.

- Approval workflow optimization.

- System integration and data synchronization.

With these strategies, organizations can transform AR operations into more customer-focused functions that deliver better results with fewer resources.

Key performance indicators (KPIs)

Measuring and monitoring AR performance means tracking specific metrics that indicate the health of your AR operations. Essential KPI metrics include days sales outstanding, collection ratios, and invoice accuracy rates. These metrics provide insights into operational efficiency and highlight areas for improvement.

Benchmarking against industry standards and historical performance helps organizations identify improvement opportunities and set realistic goals. Regular performance monitoring through real-time dashboards and scheduled reports ensures that issues are identified and addressed promptly.

Read the blog → Strategies for optimizing your accounts receivable

Best practices for implementation

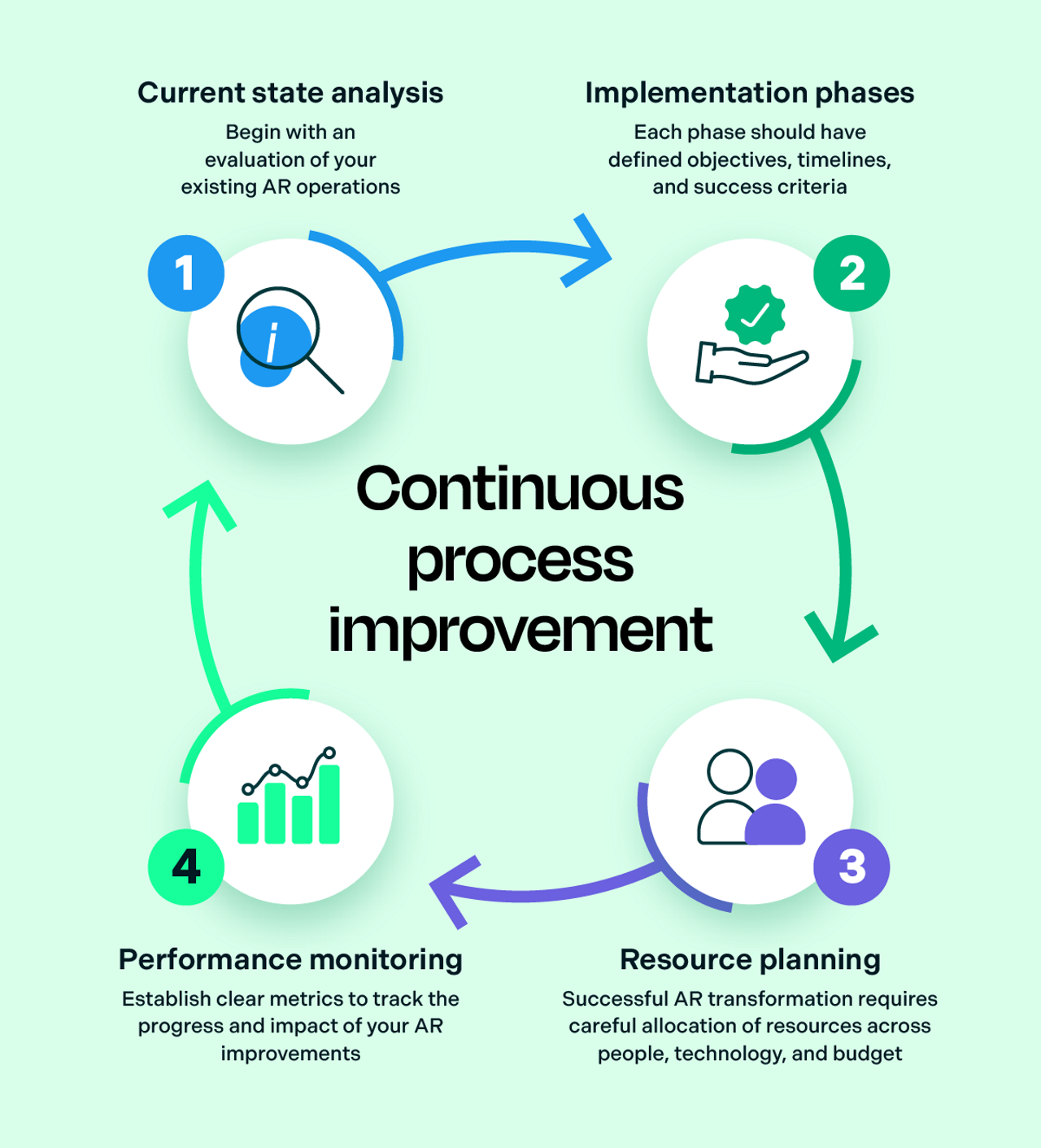

Creating an action plan for AR requires evaluating existing processes, technologies, and team capabilities against industry best practices and your business objectives. Let's break down the key components of a successful AR improvement plan:

- Current state analysis: Begin with an evaluation of your existing AR operations. This means documenting your current processes, identifying pain points, and understanding where manual work creates bottlenecks. A thorough analysis should examine your technology infrastructure, team capabilities, current performance metrics, and customer satisfaction levels. This baseline understanding helps prioritize improvement initiatives and establish realistic goals for your transformation.

- Implementation phases: Your implementation strategy should follow a clear, phased approach that balances quick wins with longer-term transformation goals. Start by identifying opportunities for immediate improvement while building toward changes. Each phase should have defined objectives, timelines, and success criteria.

- Resource planning: Successful AR transformation requires careful allocation of resources across people, technology, and budget. Consider both immediate needs and long-term requirements when planning resource allocation. This includes evaluating internal team capacity, identifying technology investments, determining training needs, and assessing where external expertise might be beneficial. A well-thought-out resource plan helps ensure your transformation initiative has the support it needs to succeed.

- Performance monitoring: Establish clear metrics to track the progress and impact of your AR improvements. These metrics should align with your business objectives and provide meaningful insights into the effectiveness of your changes. Regular monitoring helps identify areas needing adjustment and demonstrates the value of your improvement initiatives to stakeholders. Key metrics might include processing times, error rates, customer adoption rates, and return on investment calculations.

By following these strategies and best practices, organizations can build better accounts receivable operations that support their business objectives while maintaining strong customer relationships. Success requires ongoing attention to process improvement, technology adoption, and team development, but the benefits in terms of improved cash flow and reduced costs make this investment worthwhile.

Billtrust: Moving Finance Forward™

Billtrust has been at the forefront of transforming how businesses manage their order-to-cash processes for over two decades. As the leading provider of AR automation solutions, we help businesses control costs, accelerate cash flow, and improve your customers' satisfaction through our AI-powered platform.

Our unified accounts receivable platform combines cutting-edge technology with deep industry expertise to deliver unmatched results. Whether you're a mid-market company or an enterprise organization, our solutions scale to meet your needs while maintaining the highest security and compliance standards.

Our team of financial technology experts understands the unique challenges facing finance leaders today. We work closely with our customers to implement solutions that drive real business value, backed by our extensive experience and industry-leading AI capabilities. We've built one of the largest B2B payment networks, streamlining transactions and reducing friction between buyers and suppliers.

At Billtrust, we believe in moving finance forward through innovation, expertise, and partnership. Our commitment to customer success, combined with our platform capabilities, make us the trusted choice for organizations looking to transform their accounts receivable services.

Frequently Asked Questions

Check out the FAQs for general questions. Find helpful answers quickly to get the information you need.

Success can be measured through key metrics like days sales outstanding (DSO), collections processes, and customer satisfaction scores. Organizations should also track operational metrics like processing times and exception rates.

Customer experience is increasingly critical in AR management. Providing multiple payment options, clear communication, and responsive support helps improve customer satisfaction and accelerate payments.

Organizations should maintain flexible systems that adapt to new technologies and changing requirements. This includes staying informed about industry trends, maintaining strong customer relationships, and regularly reviewing and updating AR processes.