AR automated accounting software, or AI-powered AR automation software, is an advanced form of productivity software used to create, manage and analyze financial data and can 'automatically' do the work of accountants. This is a significant change for business owners who are struggling to find qualified accountants.

In addition, automated programs can comb through large amounts of data to produce comprehensive reports that are more accurate than what an accountant could do in a day. This innovative technology eliminates the need for accounts receivable bookkeeping and manual data entry, saving businesses both time and money.

Read on to learn more about how automated accounting software can revolutionize your company!

What can automated accounting software do?

Automated accounting software is an application that can help simplify keeping track of your company's financial transactions by providing you with accurate and up-to-date data to manage your business. With these applications, you can automate many of the tasks related to accounting, like calculating payroll, tracking inventory, payments, managing finances, accounts receivable (AR) bookkeeping and more.

Automated accounting software is often called the 'Robot-Accountant.' It can do tasks that are repetitive, tedious or time-consuming for humans to complete. These tasks are usually based on GAAP (Generally Accepted Accounting Principles). An example of this is adding up columns of numbers for accountants. Automated accounting software simplifies managing a business by eliminating manual data entry and streamlining the entire accounting process. Plus, it optimizes the time and reduces mistakes from manual processes.

How robotic process automation is transforming accounting and auditing

Robotic process automation (RPA) is a form of artificial intelligence used to reduce the need for human labor or intellectual tasks. Industries such as manufacturing, healthcare, and now accounting and auditing use RBA. Accounting and auditing, for example, are two of the most critical functions in any business, but they rely heavily on human labor.

With so much time and money spent on routine, repeatable tasks in business processes, it's no wonder that automating accounting software is such a hot topic. Thanks to robotic process automation, formerly tedious accounting and auditing functions can be handled by machines. Robotic process automation (RPA) is transforming the world of accounting and auditing from manual, time-consuming processes to automated ones. How?

RPA can:

- Reduce the number of errors made by humans, freeing them up to focus on higher-value tasks like strategic planning.

- Produce significantly more work with lower costs, resulting in a drastic fall in labor costs. AI-driven programs allow for quicker data entry.

- Automated tools don’t need to sleep or take breaks, which means they can work 24/7.

Automated process technology, such as robotic process automation (RPA), can automate and streamline routine, repeatable tasks. It makes it easier than ever to reduce costs, while increasing accuracy and ensuring that everything stays compliant with regulatory guidelines. This is most helpful with repetitive tasks that are not very creative such as reconciling accounts, data entry and more.

What does automation mean for the accounting profession

Accounting has been around for a long time. However, it was the first job to be automated with ledger books and other accounting machines, a far cry from what many perceive as the world of automation. We often think of robots and machines replacing humans when we think of automation. Today, automation is a buzzword with many meanings.

What does this mean for the future of accounting?

Because accountants use AR automation, they’ve alleviated many manual tasks. They can now focus on more complicated work like compiling financial (data) statements and tax returns, completing financial reports, etc. This saves time and provides more accurate information; it's taking over functions that accountants used to have to do themselves. The increased focus on more complicated tasks has boosted the number of accountants at smaller firms willing to handle these jobs.

The rise of the automated accountant

Accountants are one of the most common professions in the workforce. Over one million accountants currently work in the United States and that number will continue to grow. Accounting software has been around for a while, and with the rise of artificial intelligence (AI), it is only expected to grow. For one thing, they can do basic math faster than humans can. This makes them more accurate and saves time. They also help by generating automatic reports that help in taxes and auditing and provide valuable insights into how a company is performing financially.

Accountants are now using AI to replace mundane data entry and record-keeping duties. AI can calculate basic figures much faster than humans and without the errors that may occur. Automation can handle the tedious jobs of accountants, with more sophisticated tasks, such as accounts receivable strategy performed by humans.

While the use of artificial intelligence programs will allow accountants to make decisions faster and more efficiently and transform the tasks that human accountants are responsible for, the work of the human accountant remains an invaluable tool for any organization. Accountants need a lot of training and education to do their job. They’re also better at higher-level tasks. For instance collaboration, creativity, strategy and more, so it may seem unlikely to be replaced by robots anytime soon.

Tips for choosing accounts receivable automation software for your business

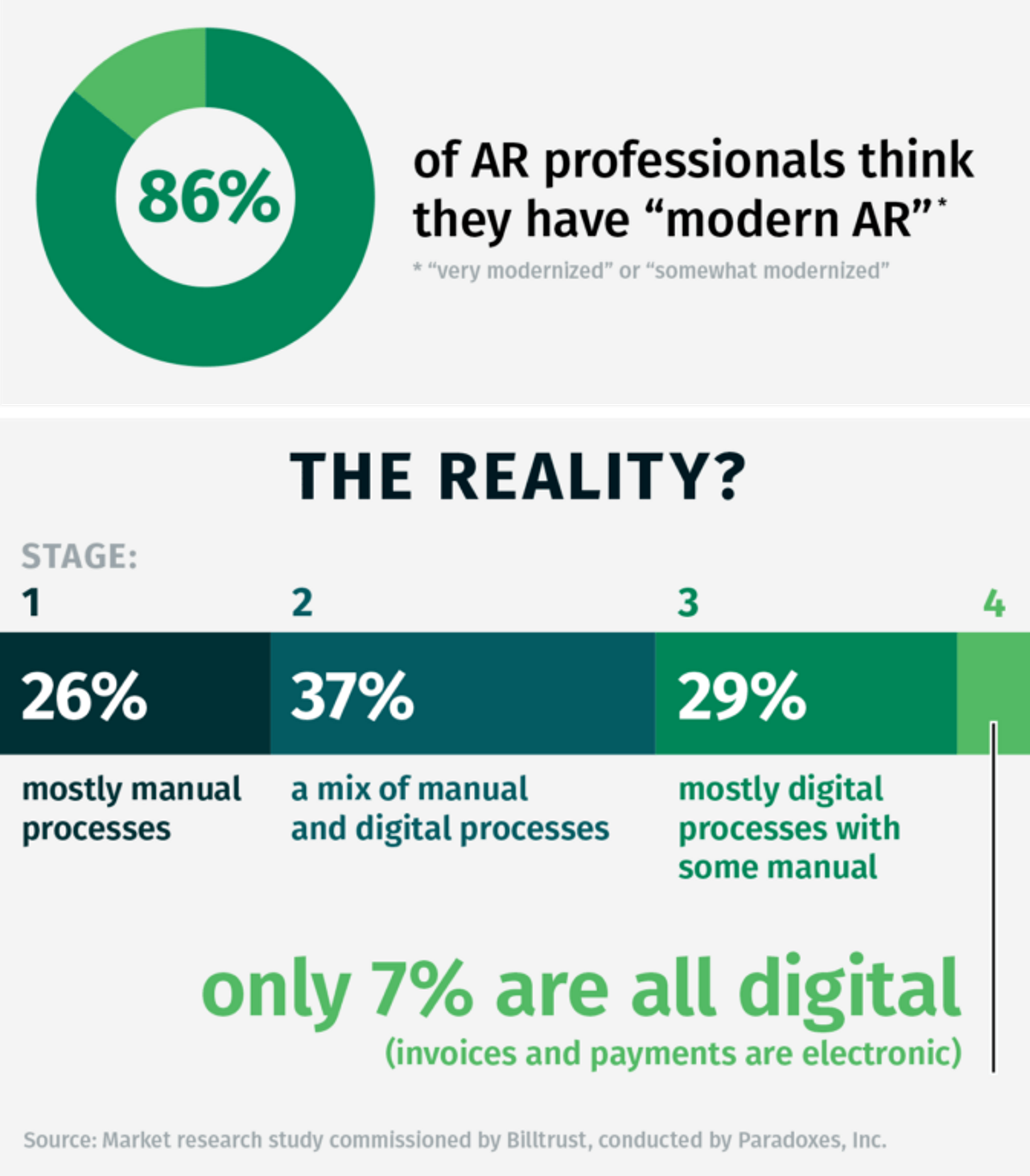

Accounts receivable automation software and the journey to modernize has become a key component in the success of many organizations, helping accountants do the work of sifting through invoices, running reports and more. While choosing accounts receivable automation software for your business can be a time-consuming and challenging task, there are a few key factors to consider:

- Find a platform that will work with your current system and integrate into your workflow.

- Consider the cost and the features offered.

- Choose accounts receivable software to automate the process.

- Consider the purpose of the software.

- How much data will the accounts receivable software need to process?

- How many users will you have?

- Do you need integration with other programs, such as CRM and ERP?

- Choose an automation software that makes it easier to hit your overall goals.

Automating your accounts receivable process can significantly affect your bottom line. It will save you time and money and allow you to grow faster. However, choosing the correct accounts receivable automation software for your business can be daunting.

In addition to the key features, it’s important to note that there are two basic types of systems: outsourcing and on-site.

Onsite: On-site solutions install on your company's servers and provide you with all the features you need to run your in-house credit card processing operation.

Outsourcing: Outsourcing solutions typically work with third-party processing companies to handle accounting tasks.

Final thoughts on AR automated accounting software

The task of accounting can be a tedious and time-consuming process if done manually. The introduction of AR automated software makes this job much easier and more efficient for accountants and has led to the modernization of accounts receivable processes. Think about this. If you're a business owner, it can be challenging to have the time and resources to produce accurate financial reports. However, AI programs can generate precise and up-to-date financials in just a few minutes.

AR automation software can 'automatically' process data, report on financial transactions, calculate taxes, and perform other tasks at the click of a button. You can customize these programs to suit your company's needs, so you always have the latest information at your fingertips.

It’s no wonder that AI is making waves in the accounting world, especially for accurately tracking accounts receivables. Accounting professionals can use automated AR automation software for routine data entry and report generation tasks. These programs can be customized to suit the needs of a given business and generate accurate, up-to-date financials for any industry, which is a significant aspect of any business. Automating your company's accounts receivable process improves efficiency and security. This makes it easier to save time and money while growing your business faster!