What is cash flow forecasting?

It’s a projection of your business’s financial future by estimating its cash flow in and out. An accurate forecast can help you avoid cash shortages and use any cash surpluses wisely.

Forecasts are imperative to your business’s growth because they act as a guide for financial and strategic decisions. Cash flow forecasting can shape your company's future and help increase the bottom line.

Read on to learn about cash flow forecasting, including its use, benefits and more.

The unspoken power of cash flow forecasting

Since cash flow forecasting predicts the ins and outs of cash and projected cash balances, businesses must harness its power to ensure excellent financial health. Here is what it’s mainly used for:

Business plans

Forecasting your business’s cash flow should have been included in your business plan. Why? Because it’s used as a guide and can be shared with potential investors to raise capital.

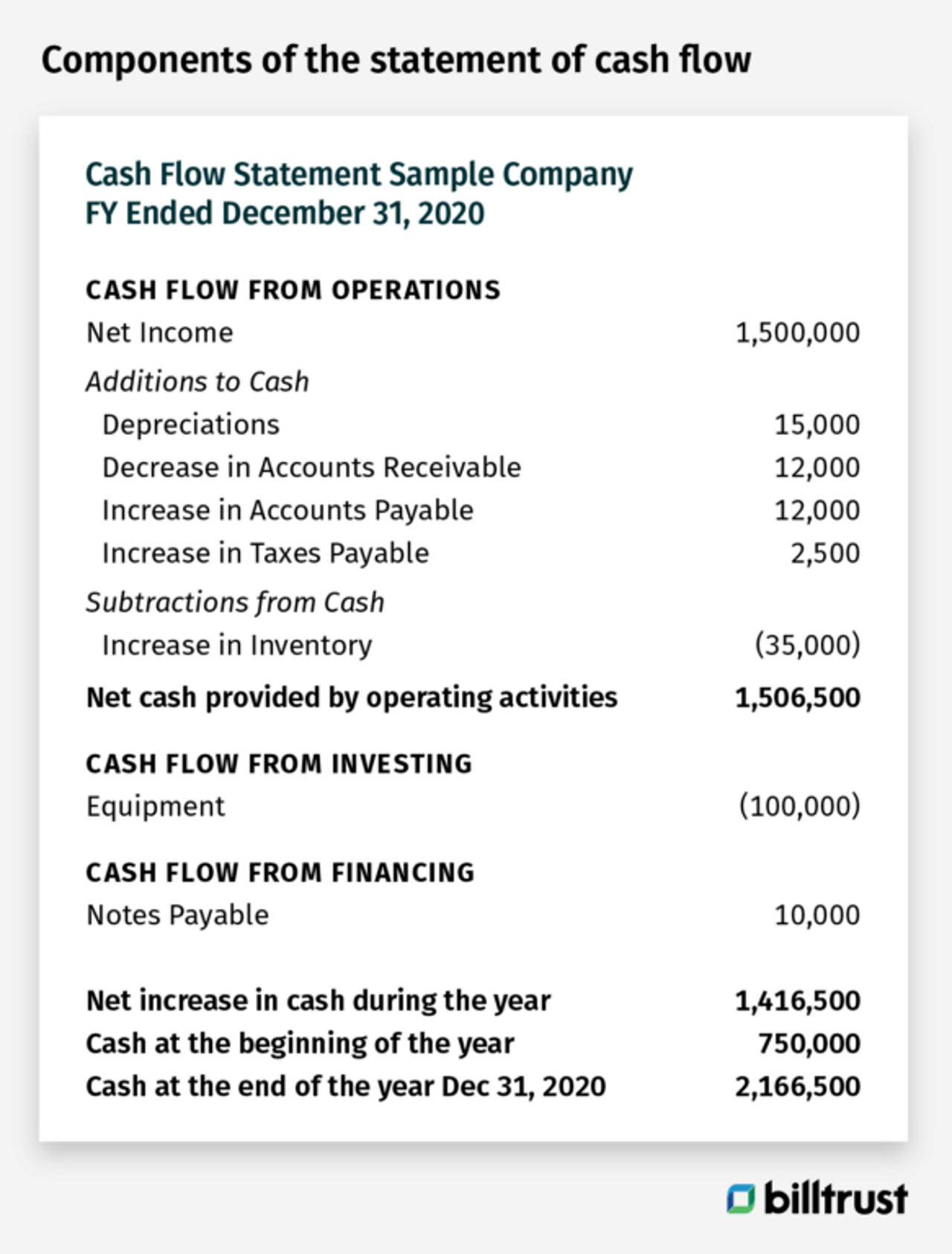

Cash flow statement

A cash flow statement (CFS) is a financial document that analyzes cash coming in and out of a company along with cash equivalents. It also shows the areas where a business has used or received cash, along with how well a company manages its cash position or how well it generates cash to pay its obligations. The bottom line is that the cash flow statement reconciles the beginning and ending cash balances.

Cash flow management

Cash management is a vital process for ensuring the viability of your business. If your cash-on-hand goes below the level of your current financial obligations, you may need to liquidate assets to raise money or get a loan. If your business has insufficient inventory, you can miss out on potential sales.

Cash flow management includes the following:

- Expediting accounts receivable collections.

- Obtaining financing.

- Using a business credit line.

- Taking advantage of early payment discounts on vendor invoices.

- Implementing cash control procedures, especially to reduce fraudulent payments.

Opportunity and Project Evaluations

Finance leaders forecast cash flows to make business decisions and recommendations about potential projects and use financial analysis methods such as net present value (NPV) and internal rate of return (IRR) are used.

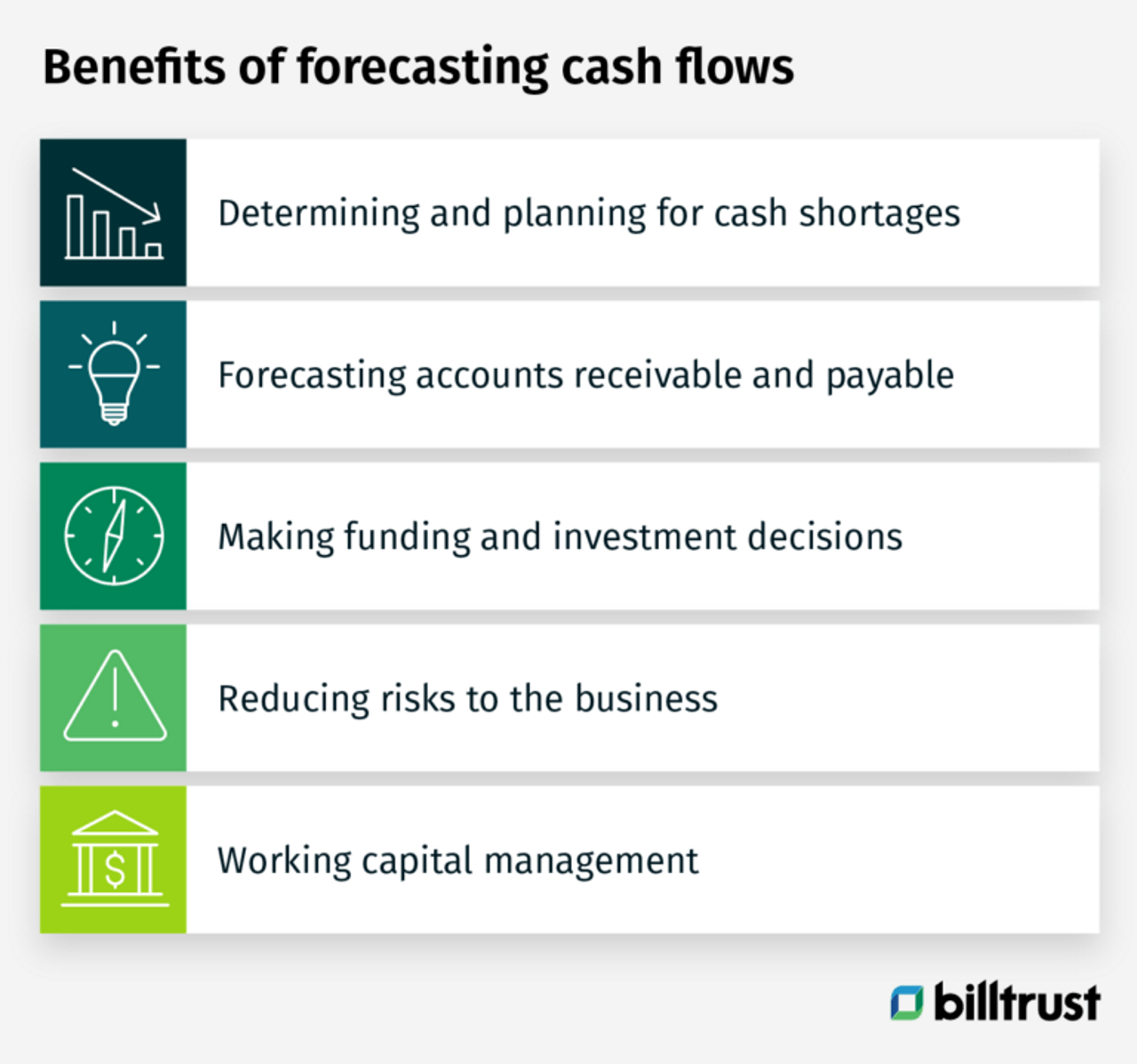

Take advantage of the top benefits of forecasting cash flows

Cash flow projections allow your chief financial officer, finance manager, and team to understand your business’s cash flow better. Forecasts can also point to potential problem areas and help boost your business’s success.

Projecting cash flows has many benefits, some of which include:

Determining and planning for cash shortages

Forecasts help your business’s finance team understand the investment and operating cash flows. This enables the proper time needed to plan for or anticipate financing requirements. It also helps to prevent unfavorable penalties and terms.

Forecasting accounts receivable and payable

Forecasting operational cash flows like accounts receivable and accounts payable are challenging because of the factors involved. These include credit quality score, customer payment behavior, payment methods, rebates, etc. Including these variables in your forecast can help you stay on top of your cash flow.

Making funding and investment decisions

If you want to expand your business, your finance team needs to use accurate cash forecasting to enable investments. This way, funding can be done more efficiently and ensure short-term and long-term growth objectives.

Reducing risks to the business

Changes in foreign exchange rates, interest rates, or commodity prices can potentially affect cash flow and can inform business strategies, including hedging–a risk management strategy.

Working capital management

Working capital management determines whether or not your business can pay its current liabilities with its current assets. It also provides a good indication of your company’s short-term financial health and operational efficiency. If your business's working capital is out of balance, you’ll have trouble paying creditors and maintaining growth or even go bankrupt.

What does the future look like for your business’s cash flow?

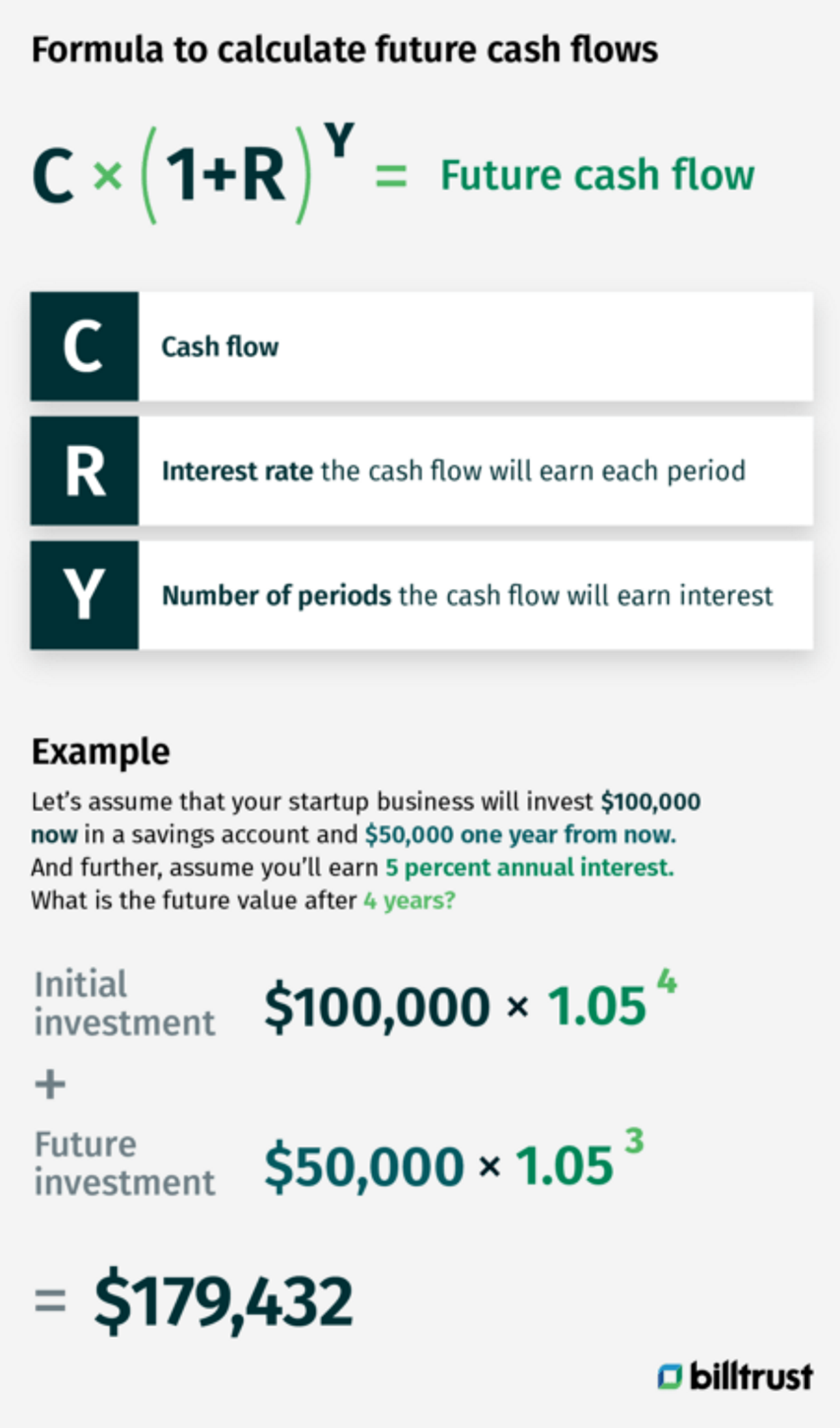

Situations in your small business (a new business’s startup cash flow may be limited) may prompt your financial manager to calculate the future value of a series of cash flows. For example, cash surpluses may be invested periodically to pay future expenses. Because of this, you need to know an investment’s future value for your budget.

Use the future value formula to calculate future cash flows

Finance teams everywhere calculate cash flows. Let’s take a look at the formula and example below.

C(1 + R)^Y

- C - Cash flow.

- R - Interest rate the cash flow will earn each period

- Y - The number of periods the cash flow will earn interest.

Let’s assume that your startup business will invest $100,000 in a savings account and $50,000 from one year from now. And further, assume you’ll earn 5 percent annual interest. What is the future value of your cash in four years?

The first cash flow will earn interest in four years, so the formula is ($100,000(1 + 0.05)^4. The first cash flow will earn interest in four years, so the formula is ($100,000(1 + 0.05)^4. Remember, the longer the investment period grows, the higher the future cash value potential.

What about subsequent cash flows?

To find the second cash flow value and each subsequent cash flow, your financial analyst will plug the amounts into the same formula, resulting in a different Y value for each formula.

In our example, the second cash flow will earn interest for three years–from the beginning of next year until four years from now. The formula is $50,000(1 + 0.05)^3.

Your financial analyst will calculate each formula to determine the future value of each cash flow. In our example, add 1 to 0.05. Raise 1.05 to the fourth power to get 1.216. Multiply 1.216 by $100,000 to get a future value of $121,551 for the first cash flow. The second cash flow’s future value is calculated by multiplying $50,000 by 1.157 [1.05 to the third power] for $57,881.

What is needed to make a cash flow forecast?

To forecast cash flow for your business, review your business objectives, investor requirements and the availability of pertinent information within your company. For instance, if your business needs to manage its debt repayments every month or wants more visibility over quarter-end covenant positions, these require different forecasting. Remember that forecasting cash flows for more extensive, multinational companies is a more involved process.

Create your forecasting objectives

What is your business objective that your forecast should support? It may be one of the following:

Focusing on reporting dates

What are your important reporting dates? Whether yearly, quarterly or monthly (month-end), you must have projected cash flow levels to perform comprehensive reporting.

Managing the risk to liquidity

Zeroing in on potential liquidity issues that may arise in the future gives you the opportunity and time to address them now.

Overseeing daily cash management

Ensuring that your business can meet its short-term obligations requires your finance team to manage the cash available regularly.

Reducing interest and debt

Make sure your business has enough cash to pay debt or loans that were taken on recently.

Working capital

Ensure that your business has enough working capital now and in the future to fund activities that will help your business grow its revenues.

Select your forecasting period

Once you’ve chosen your business objective, you’ll want to consider what your future forecast will look like. Remember that the amount of information available to your finance team may be limited depending on the forecast period. Here are some ideas to help you:

Short-period

These are typically two to four weeks into the future with cash payments and cash receipts breakdown. The short-period forecast is best for short-term liquidity planning, where you focus on ensuring that your business can meet its financial obligations.

Medium-period

This is usually a two to six-month forecast into the future that’s useful for debt and interest reduction, reporting date visibility and liquidity risk management. However, the most common forecast used in this category is the rolling 13-week forecast.

Long-period

These forecasts look about 6-12 months (calendar or business year) into the future and are often used for the annual budgeting processes and essential for determining the cash needed for capital expenditures and long-term growth strategies.

Mixed-period

This is a mix of three forecasting methods above and used to analyze a business’s liquidity risk. Forecasting takes place for the first three months then converts to a month-to-month basis for six months.

Choose a forecasting method

Two types of cash flow forecasting methods are direct and indirect with the former using actual flow data, while the latter uses projected balance sheets and income statements. Choosing the proper forecasting method depends on your business’s forecasting period, along with the data available for your financial analyst (or data scientist) to build your forecast model. Here’s a breakdown of each method:

Direct method

- What is the length of time? - Short-term.

- What does it show? - The cash needed to fund working capital.

- How is it created? - Reviewing and analyzing any upcoming receipts (debtors) and payments (creditors).

Indirect method

- What is the length of time? - Long-term.

- What does it show? - The cash required for long-term growth projects and strategies.

- How is it created? - By reviewing various income statement and balance derivations, including adjusting gross income, pro forma balance sheet, etc.

Compiling the correct data for creating a cash flow forecast

Since the direct forecasting methods give you the greatest accuracy and apply to most business objectives, we’ll show you how to find actual cash flow data. But most can be found in your accounts payable, accounts receivable, bank accounts or accounts receivable automation software you use. Here’s what your accounting or finance team will need to pull:

Opening cash balance for the forecast period

This should be taken from your business’s most current position.

Cash inflows for the forecasting period

Sales receipts within your forecasting period are the primary source of cash inflows. Other sources include dividend income, inflows from third parties, intercompany funding and proceeds of divestments.

Cash outflows for the forecast period

Bank charges, wages and salaries, debt payments and investments are captured in cash outflows. However, you may include whatever is relevant to your business.

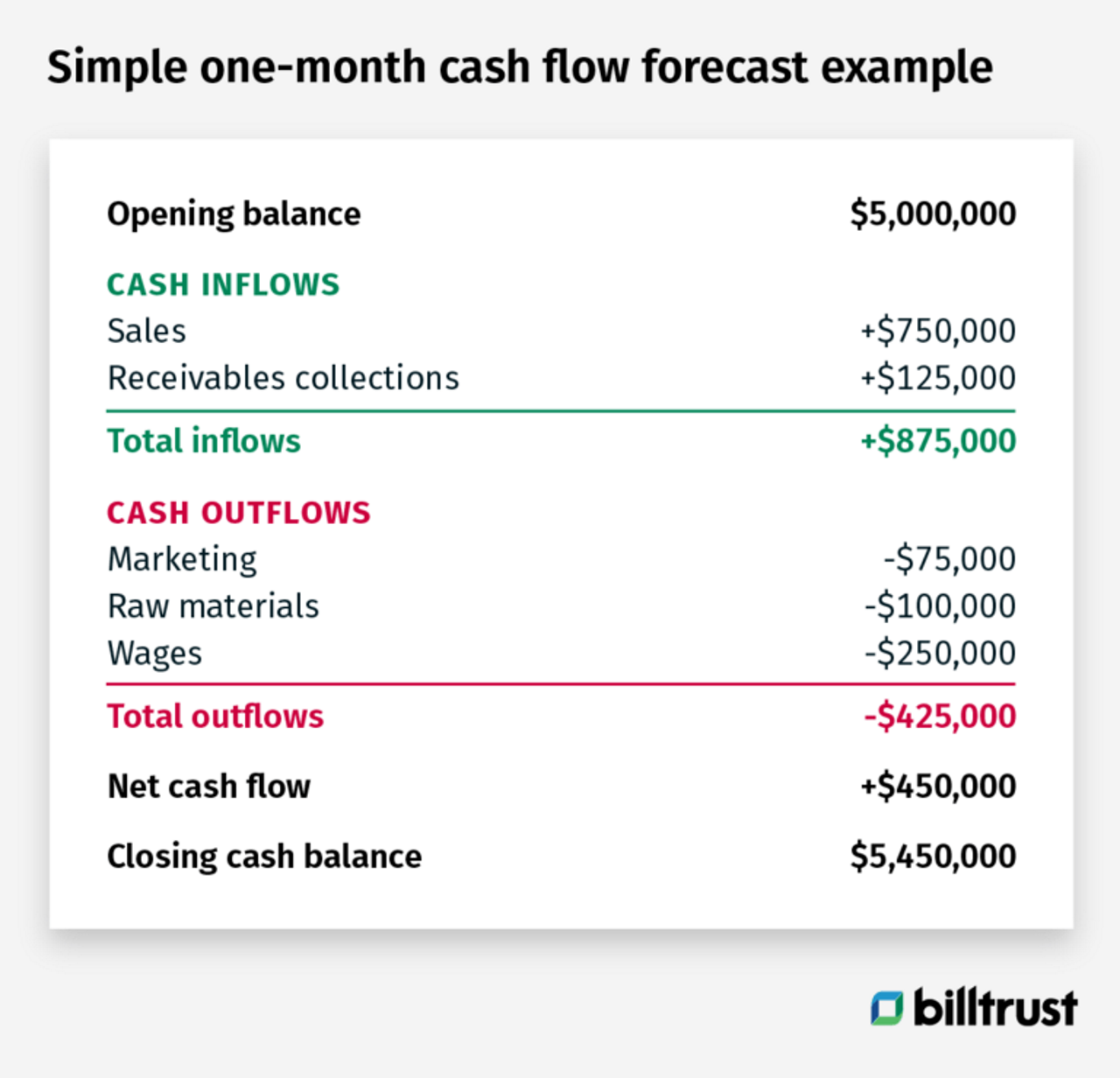

How to calculate and make a cash flow forecast

The simple one-month (January) cash flow forecast example below provides a good illustration of net cash flow calculated. It’s important to note that some financial teams still use Excel spreadsheets to calculate cash flow forecasts while others use automated accounting software. Something we’ll touch on in the next section.

Opening balance $5,000,000

Cash inflows

Sales 750,000

Receivables collections 125,000

Total inflows $ 875,000

Cash outflows

Marketing 75,000

Raw materials 100,000

Wages 250,000

Total outflows $ 425,000

Net cash flow $ 450,000

Closing cash balance $ 5,450,000

Three rock-solid ways automation streamlines cash flow forecasting and benefits financial and treasury teams

Many large and enterprise companies invest time, money and energy in forecasting. But most of the time is spent on data collection and manipulation in spreadsheets. It also doesn’t make sense to fund cash flow forecasting to ignore high-level activities like analyzing and getting valuable insights from the data.

Finance and treasury functions can’t run without spreadsheets. However, automating the cash flow management process can save your business about 90% of the manual work needed to build and analyze a forecast via a spreadsheet. Plus, as your business grows, it will be easier to scale cash flow forecasting.

Here are three ways automation benefits cash flow forecasting:

Better efficiency

Whether they're in larger companies, treasury teams are usually small. Automation can increase your team’s efficiency and reduce their workload to focus on analysis vs. administrative tasks.

Reduce risk

Human error happens. You can reduce that risk by automating your cash flow forecast and gaining greater confidence in your projections.

Greater quality

Once designed and mapped out from the beginning, automated cash flow forecasting can use data already collected within your business’s technology infrastructure (bank systems, ERP systems, etc.). When combined with the above benefits, it means you can expect better quality forecasts.

Go ahead and tackle your cash flow and improve your business’s bottom line

Cash flow forecasting provides you with a deeper, more precise picture of where your company is headed. It shows you where you need to reduce spending and make improvements. However, cash flow forecasting isn’t for every business because of the expense involved, which makes it costly. And remember that cash flow predictions aren’t perfect. But you can use projected cash flows to help better manage your cash. To improve your cash on hand, review your order-to-cash best practices to increase your cash inflows.