This post was originally published in September 2021 and was updated with additional information in December 2024 to reflect the latest insights on accounts receivable and balance sheets.

What is accounts receivable?

Accounts receivable (AR) refers to the outstanding payments your customers owe for products or services they've already received. When your company extends credit terms to customers, these unpaid invoices become accounts receivable—a current asset on your balance sheet that's expected to convert to cash within your normal business cycle, usually within a year. Think of AR as a financial bridge between delivering value to your customers and receiving payment. For AR teams, actively managing this asset through strategic billing practices, credit assessments, and collections processes is essential for maintaining healthy cash flow and supporting business growth.

Read the blog → What is accounts receivable? Definition, importance, and examples

What are assets?

Is accounts receivable an asset? In financial accounting, assets are resources owned or controlled by individuals, corporations, or governments to create a positive economic benefit. Think of them as something that can generate, in the future, cash flow, decrease expenses or improve sales, no matter if it’s a patent (intellectual property) or equipment.

If a company needs more liquidity to support its operations, assets can provide more leeway. In lean times, a company with solid accounts receivable may use it to get a bank loan at a reasonable rate.

How are assets different from liabilities?

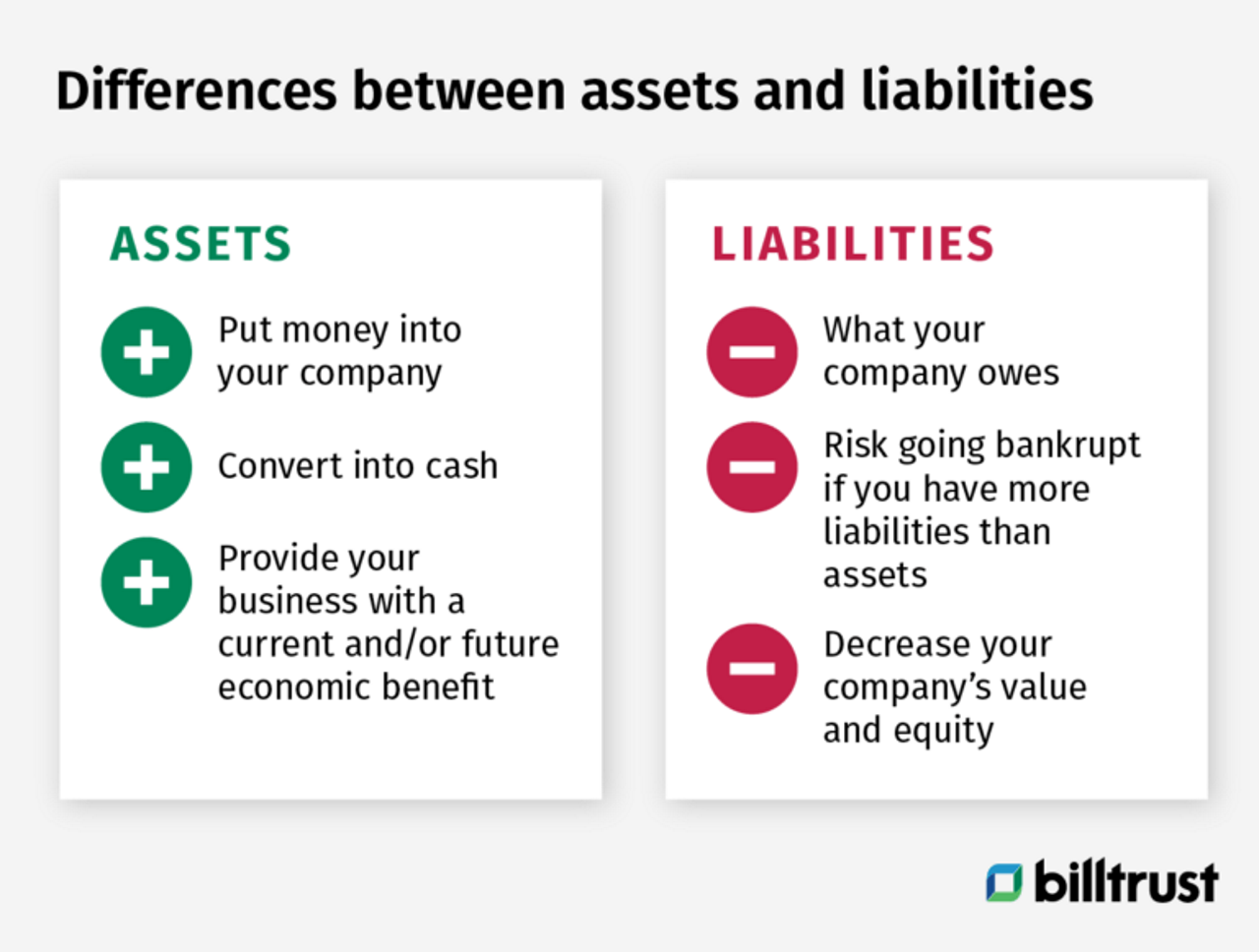

Assets differ from liabilities because they put money into your company, while liabilities take it out. This is why it’s crucial to convert assets into cash within a short period so that you can pay off liabilities quicker.

Assets provide your business with a current and / or future economic benefit. You may group assets based on how liquid they are or how quickly they may be converted into cash. The most liquid asset is cash because you can use it immediately to pay off liabilities. On the other hand, an illiquid asset like a factory will take more time to sell so the cash conversion may be longer.

Liabilities are what your company owes, i.e., bank debt and mortgage debt, so it’s essential to have more assets than liabilities to create a strong financial position. If your company has more liabilities than assets, you risk going bankrupt and out of business.

How do you determine the value of assets?

Asset valuation involves determining the fair market or present value of assets. You use book values, absolute valuation models like discounted cash flow analysis, option pricing models, or comparables to determine this.

To calculate your net asset value (tangible assets), you take the book value of tangible assets (historical costs minus accumulated depreciation) on the balance sheet minus intangible assets and liabilities.

Keep in mind that the market value of an asset will most likely differ from its book value and even shareholder’s equity (based on historical cost). For some companies, their most significant value is in their intangible assets. Examples include brand recognition, copyrights, goodwill, patents, trademarks and more. These are the opposite of tangible assets, which consist of equipment, inventory, land and vehicles.

Read our blog → Stress-free accounts receivable solutions for smoother cash flow

Is accounts receivable a cash asset?

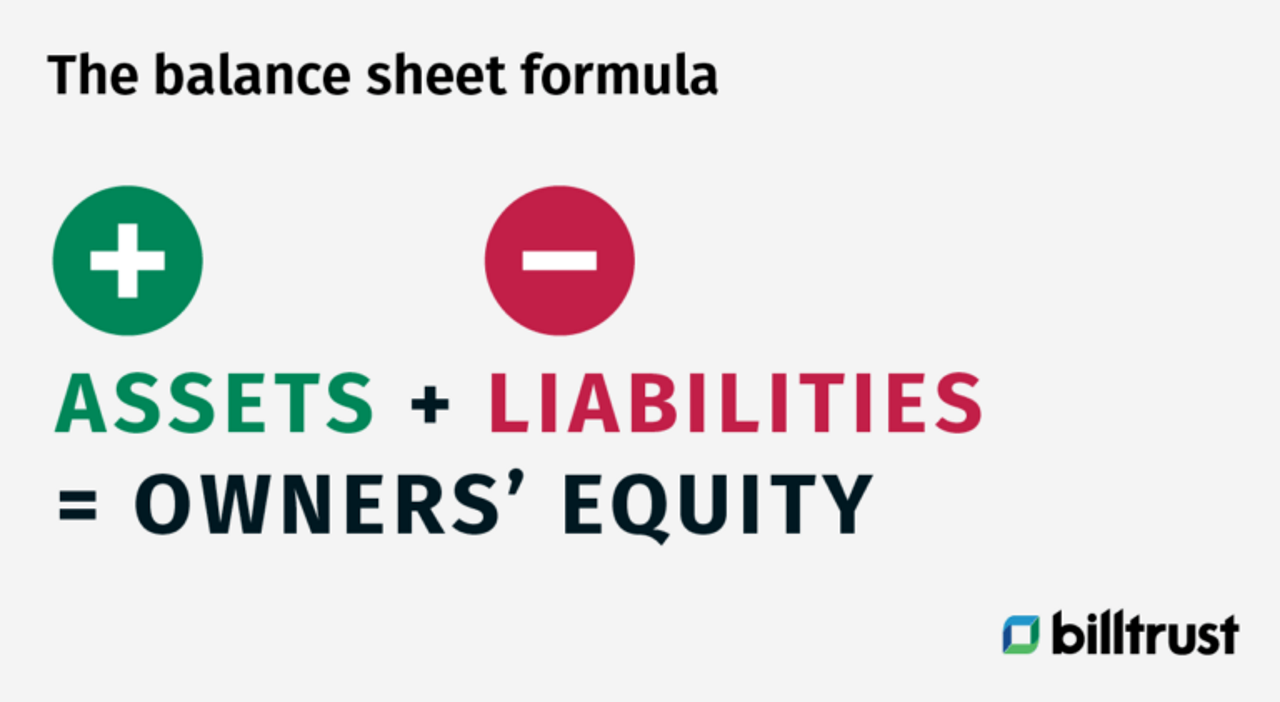

Extending credit to customers for goods and services creates accounts receivable on the balance sheet. Therefore, it’s an asset because it will be convertible into cash sometime in the future. On the other hand, liabilities are what a company owes, and equity is the difference between the two. The balance sheet formula is assets plus liabilities equals owners’ equity.

A receivable that converts into cash after more than one year will be recorded as a long-term asset on the balance sheet and may be classified as a note receivable.

Unfortunately, a company may never collect all of its accounts receivable. Under accrual basis accounting, these will be offset by an allowance for doubtful accounts. The allowance estimates the amount of bad debt related to the receivables.

Suppose a customer pays you the $5,000 they owe your business. In that case, you’d have to put the receivable back on your balance sheet by debiting “accounts receivable” for $5,000 and crediting “revenue” for $5,000. To record the cash payment, you would debit “cash” for $5,000 and credit “accounts receivable” for $5,000 to close it out once again.

Circling back to, “Is accounts receivable an asset?” The best way to ensure you collect your receivables on time (or at least within 60 days) is to automate the collection process. Not only can accounts receivable automation save you time, but it can save you money in the long run because you can schedule communications with your customers, which may help them to pay you faster.

Is accounts receivable a current asset?

Current assets are essential to a business because they may be used to support day-to-day operations and pay for operating expenses. They also represent a company’s liquid assets because they convert into cash in a short period.

Accounts receivable are considered a current asset because they usually convert into cash within one year. When a receivable takes longer than one year to convert, it will be recorded as a long-term asset.

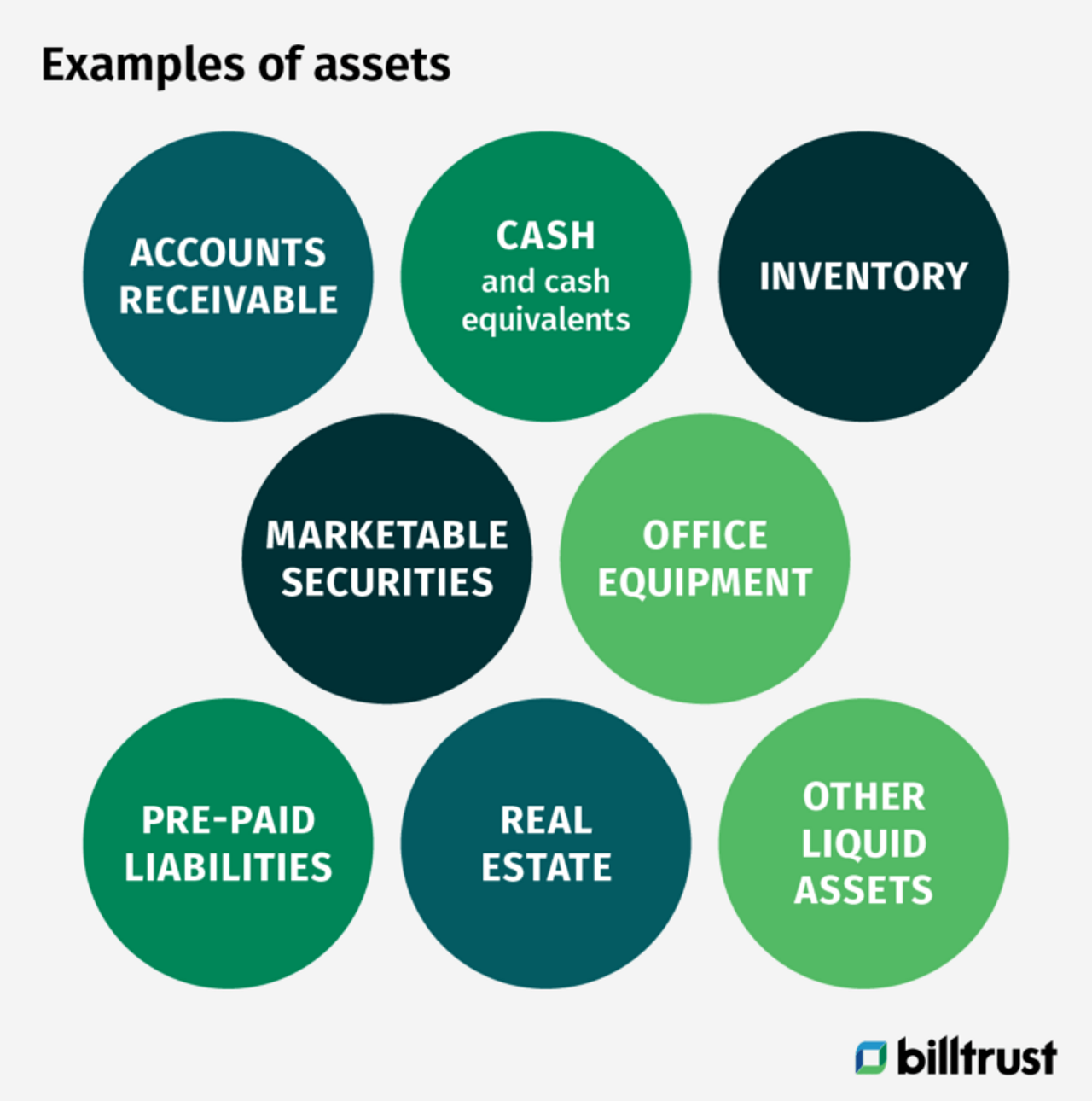

In addition to accounts receivable, there are other current assets found on the balance sheet. Here are some examples:

- Accounts receivable

- Cash

- Cash equivalents

- Inventory

- Marketable securities

- Office equipment

- Pre-paid liabilities

- Real estate

- Other liquid assets

Companies may use cash and cash equivalents (may be converted to cash) to pay their short-term debt obligations. Accounts receivable are expected to be collected from customers within one year. Inventory includes raw materials and finished goods that may be sold quickly.

Even though you may be reluctant to sell to your customers on credit, accounts receivable can help your company grow over time. After all, the more receivables you receive, the more valuable your business will be. Plus, assets like receivables can help you to:

- Run a business easier because you may sell and transfer assets or use them to lower your taxes.

- Generate more revenue because assets may be invested in a business that may help it to become more profitable throughout the years. This makes a company more attractive to buyers.

Why accounts receivable is not a liability or equity?

Accounts receivable do not fall under current/long-term liabilities or equity (the difference between assets and liabilities). Why? Because it’s money that is contractually owed to a company and shown on the balance sheet. A company has a risk because customers may reduce payments or not pay at all. This may create uncertainty for a company because it may not cover its daily operating expenses.

Since accounts receivable get converted into cash in the future, usually 30, 60 or 90 days post invoice, it may negatively impact a business. For instance, liquidity and financial flexibility may suffer and reduce the opportunity to maximize revenue. A company’s executives may consider short-term borrowing, but it’s not ideal. It’s better to have a steady cash flow to cover obligations and expenses.

Automate your accounts receivable

Want to learn more about accounts receivable automation software from Billtrust? Fill out the contact form.

Frequently Asked Questions

Check out the FAQs for general questions. Find helpful answers quickly to get the information you need.

Accounts receivable is considered a current asset, not a fixed asset, because it is expected to convert to cash within one operating cycle (typically less than 12 months). Current assets are resources that can be readily converted to cash or used up within a year, while fixed assets (also called long-term assets) are permanent or long-term resources like buildings, equipment, or land that provide value over multiple years. Unlike fixed assets that support business operations over the long term, AR is part of your working capital and contributes to your company's short-term position, making it an important component of day-to-day business operations.

Accounts receivable appears under the current accounts receivable assets section of the balance sheet, typically listed after cash and cash equivalents. This placement reflects its high liquidity status and indicates to stakeholders that these funds are expected to convert to cash within the current fiscal year.

Modern AR automation solutions help protect the value of your AR as an asset by accelerating collection cycles, reducing DSO (Days Sales Outstanding), and providing better visibility into aging receivables. This technology helps ensure your AR remains a liquid, valuable asset rather than becoming a collection risk.