Let’s get into learning about Days Deduction Outstanding (DDO) and how it may negatively and positively impact your business.

What is Days Deduction Outstanding (DDO)?

What is the meaning of Days Deduction Outstanding (DDO) in finance? It’s a metric that measures a company's financial health and how well it can resolve deductions. It’s a crucial cadent within the accounts receivable (AR) deduction management process. Like Days Sales Outstanding (DSO), it may have huge implications for its overall profitability.

How to calculate DDO

A deduction in accounts receivable may refer to an invoice dispute made by a company’s customer. When a customer doesn’t pay their invoice, a company opens a case to investigate the claim. The longer a customer’s dispute is open, the days deduction outstanding (DDO) increases. In fact, research shows that 5 percent to 15 percent of invoices are affected by deductions.

DDO formulas

To measure your days deduction outstanding (DDO), you may use the following formulas:

By dollars

Calculating DDO is similar to DSO for invoice collections—add the average daily deductions amounts received during a period (for instance: 80 days), and divide the total outstanding deductions by the average per day.

DDO = Total outstanding deductions / Average per day

Here’s an example:

If your deductions at the end of a month total $1,500,000 and you receive an average of $50,000 per day, your DDO = 30 days.

By the number of deductions

Another way to calculate DDO is to use the number of open deductions because the usual DDO key performance indicator (KPI) tends to look better. After all, it focuses on larger dollar items.

DDO = Number of Open Deductions / (Average Deduction Value) * (# of days in the Period)

Here’s an example:

If your company’s deductions at the end of a month total 8,000 items, and you receive an average of 100 deductions per day, the DDO equals 80 days.

The formula above is the basic measure for calculating deductions, but how do you know your DDO is in conjunction with your company’s profitability?

The AR deductions and the DDO metric indicate your company’s ability to resolve disputes, investigate claims and collect on your invoices. Basically, it measures your cash intake. Every open deduction on your balance sheet indicates your invoices that haven’t been paid in full.

How do open deductions impact order-to-cash?

The longer deductions are open, the harder they may be to collect, which can impact your company’s order-to-cash cycle. If your company has a thin profit margin, the more prolonged disputes put your company in a precarious financial position. Not only will your cash flow and revenue decrease, but it will also result in a higher DDO rate. This indicates that there are problems with your deduction management.

On the other hand, if your company has a lower days deduction outstanding rate, it shows that your collections team works efficiently to resolve disputes. The impact on your bottom line isn’t that substantial. Based on this, it’s better to have a lower DDO rate.

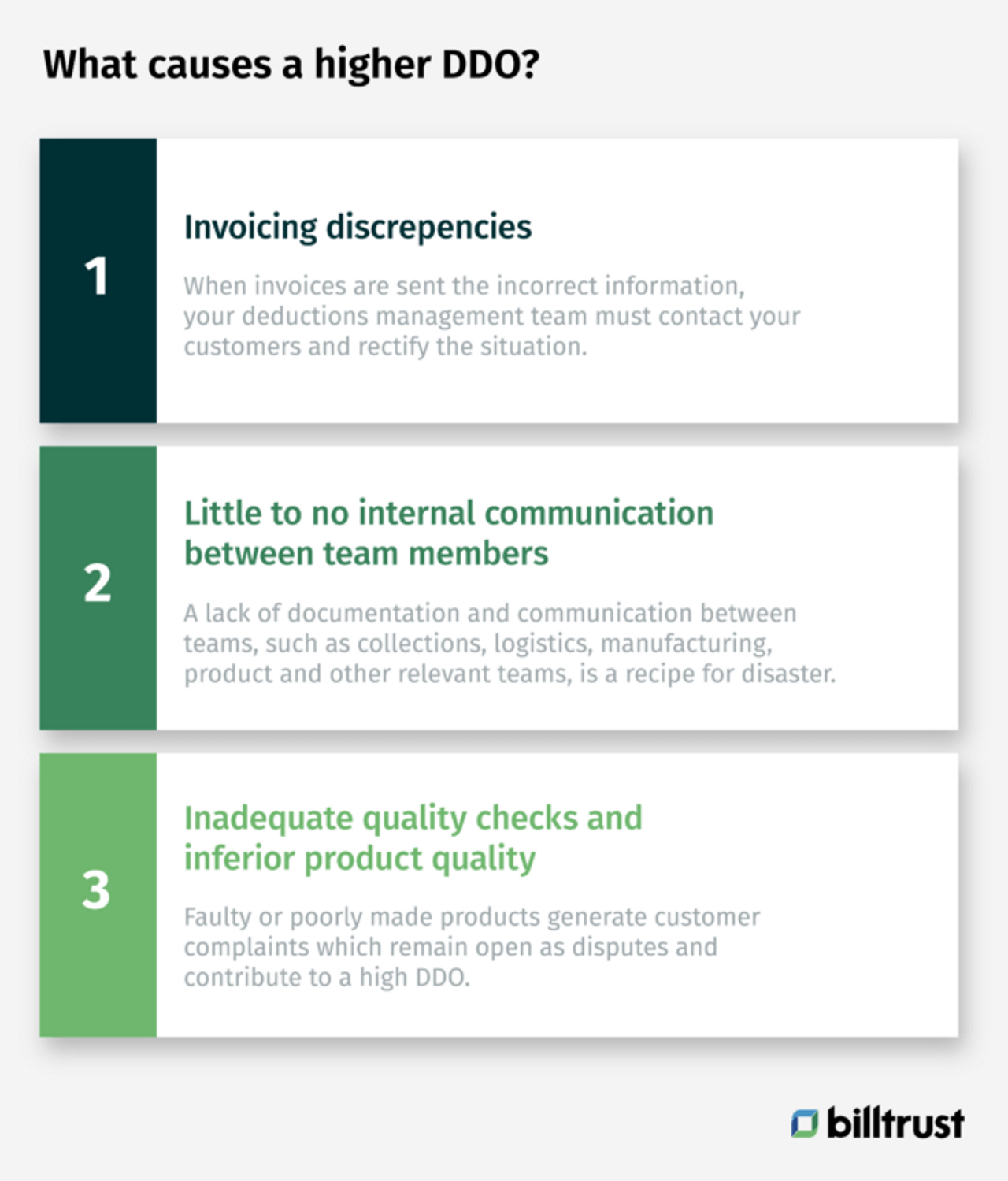

What causes a higher DDO?

When your company has a higher DDO than your competitors, it can indicate that your deductions management system is inefficient and needs streamlining. Remember that any unresolved deductions aren’t profitable and show a gap in collaboration, deduction coding, research and resolution.

Here are a few reasons why your company may have a higher DDO.

Invoicing discrepancies

One of the most important tasks for your company is invoicing customers correctly. It’s why many companies use accounts receivable (AR) automation management software so that they can avoid billing errors and a bad customer experience.

When invoices are sent the incorrect information, your deductions management team must contact your customers and rectify the situation. After all, it’s not your customer’s fault that they may have been under or overcharged. This is why it’s imperative that your billing and invoicing and deductions team communicate to ensure customers receive the correct invoices. If they don’t, it may hurt your company’s cash flow, reputation and customer experience.

Little to no internal communication between team members

A lack of documentation and communication between teams, such as collections, logistics, manufacturing, product and other relevant teams, is a recipe for disaster. Not only does it make it challenging to track deductions, but it extends the resolution time for disputes, which creates DDO.

Keep in mind that if you can’t validate deductions, they remain open deductions on your company’s balance sheet. This is why companies implement accounts receivable management software. If you're looking to expand your business, investors will want to know that your company is profitable.

Inadequate quality checks and inferior product quality

Faulty or poorly made products generate customer complaints which remain open as disputes and contribute to a high DDO. But if your company’s inventory, logistics and shipping teams collaborate effectively, it should result in better documentation (bill of ladings), freight bills and POD.

Having regular quality checks can help you gain visibility in your order management process and system. It will also help to reduce the number of deductions that remain open. Otherwise, your deductions team may face many issues when trying to resolve open deductions.

What is the difference between DDO and DSO?

DDO and DSO are similar key performance indicators (KPIs). The metrics show the number of days, but the difference is that DSO indicates how many days it will take your company to collect its accounts receivables. DDO illustrates how many days it takes to efficiently and effectively resolve open deductions.

Senior management analyzes and evaluates days deduction outstanding (DDO) and DSO together to gain a bigger picture of and understanding of a company’s accounts receivable (AR) processes.

What are the best practices for reducing days deduction outstanding?

Deductions management requires continued analysis and validation of disputes, so days deduction outstanding (DDO) is calculated annually or quarterly. And when you figure DDO on an account level, the data can show you customers who constantly raise disputes.

Keep in mind that deductions can decrease cash flow and impact working capital. And according to statistics from Credit Research Foundation’s (CRF) Benchmark Survey on Customer Deductions, the overall industry DDO value is 38 days. The following best practices can help to lower your days deduction outstanding.

Use an electronic workflow

Having a standardized workflow can enhance communication between the deductions management team, accounts receivable and other teams. An electronic workflow allows for fewer random emails between team members.

Automate reason coding

If your deductions management team spends time matching customer reason codes, there’s a more efficient way to work. Automating the entire process frees up your team to analyze and research deductions.

Keep a central repository of data

Creating a central repository of data for bills of lading, deal sheets, proof of delivery and documents will make it easier for your deductions and other teams to find the information they need. It also makes collaboration and data sharing easier between teams.

Automate correspondence for better communication

Envision your team using pre-defined templates for different communication emails, including missing backup documents or invoice numbers. These templates can reduce the amount of time your analyst spends on everyday tasks and increase their focus on high-value decision making and deduction analysis.

Implement a deduction validity predictor and tracker

Analysts spend much of their time separating valid deductions from invalid ones. If your company used a deduction validity predictor that would automatically validate deductions, it would save time and speed up the process.

Wrapping up days deduction outstanding

Days deduction outstanding is an essential metric in deduction management that shows how effectively your company manages deductions.

A higher days deduction outstanding (DDO) can lead to cash flow issues and impact your company’s financial performance and profitability.

Reduce DDO by using best practices, including an electronic workflow, automating reason coding, keeping a central data repository, automating correspondence for better communication and implementing a deduction validity predictor and tracker.