Picture this: You've delivered exceptional products or services to your B2B clients, but the money you've earned seems to be caught in a labyrinth of processes. Sound familiar? That's where revenue cycle management (RCM) steps in. With the rise of automation, powerful accounts receivable software has become an essential ally in taming this financial maze. Whether you're a CFO aiming to streamline operations or a finance director looking to boost cash flow, mastering RCM and harnessing the right technology is your ticket to financial success.

Definition of revenue cycle management

Revenue cycle management is the financial process that organizations use to administer all the functions associated with capturing revenue from the point of service to the final payment. In the B2B context, RCM encompasses a series of strategic steps designed to streamline the order-to-cash cycle, ensuring that businesses receive payment for their products or services as efficiently as possible.

But why does RCM matter so much in B2B operations? Simply put, it's the lifeblood of your business's financial health. Effective RCM can:

- Accelerate cash flow, providing the liquidity needed for growth and operations.

- Reduce administrative costs associated with accurate billing and collections.

- Improve customer relationships through transparent and efficient financial interactions.

- Provide valuable insights into financial performance and areas for improvement.

In essence, RCM is not just about getting paid—it's about optimizing every step of the financial process to create a more robust, efficient, and profitable business.

The stages of the revenue cycle in B2B

Understanding the stages of the revenue cycle is essential for identifying areas of improvement and implementing effective strategies. In B2B transactions, the revenue cycle typically consists of three main stages:

1. Pre-service: order processing and credit checks

This initial stage sets the foundation for a smooth transaction. Key activities include:

- Receiving and validating customer orders.

- Performing credit checks to assess customer creditworthiness.

- Establishing payment terms based on credit history and business policies.

- Verifying pricing and contract details.

Efficient pre-service processes can significantly reduce issues later in the cycle, such as payment delays or disputes.

2. Service: delivery of goods or services

While this stage primarily involves fulfilling the order, it's crucial for RCM because it impacts customer satisfaction and, ultimately, payment. Key aspects include:

- Accurate and timely delivery of goods or services.

- Proper documentation of the delivery or service completion.

- Addressing any issues or discrepancies promptly.

A smooth service stage helps prevent disputes and ensures that the subsequent invoicing process runs without hitches.

3. Post-service: invoicing, payment processing, and follow-up

This stage is where the financial transaction takes place. It involves:

- Generating and sending accurate invoices.

- Processing incoming payments.

- Reconciling payments with invoices.

- Following up on unpaid or partially paid invoices.

- Managing disputes or questions about billing.

Efficient post-service processes are critical for maintaining healthy cash flow and customer relationships.

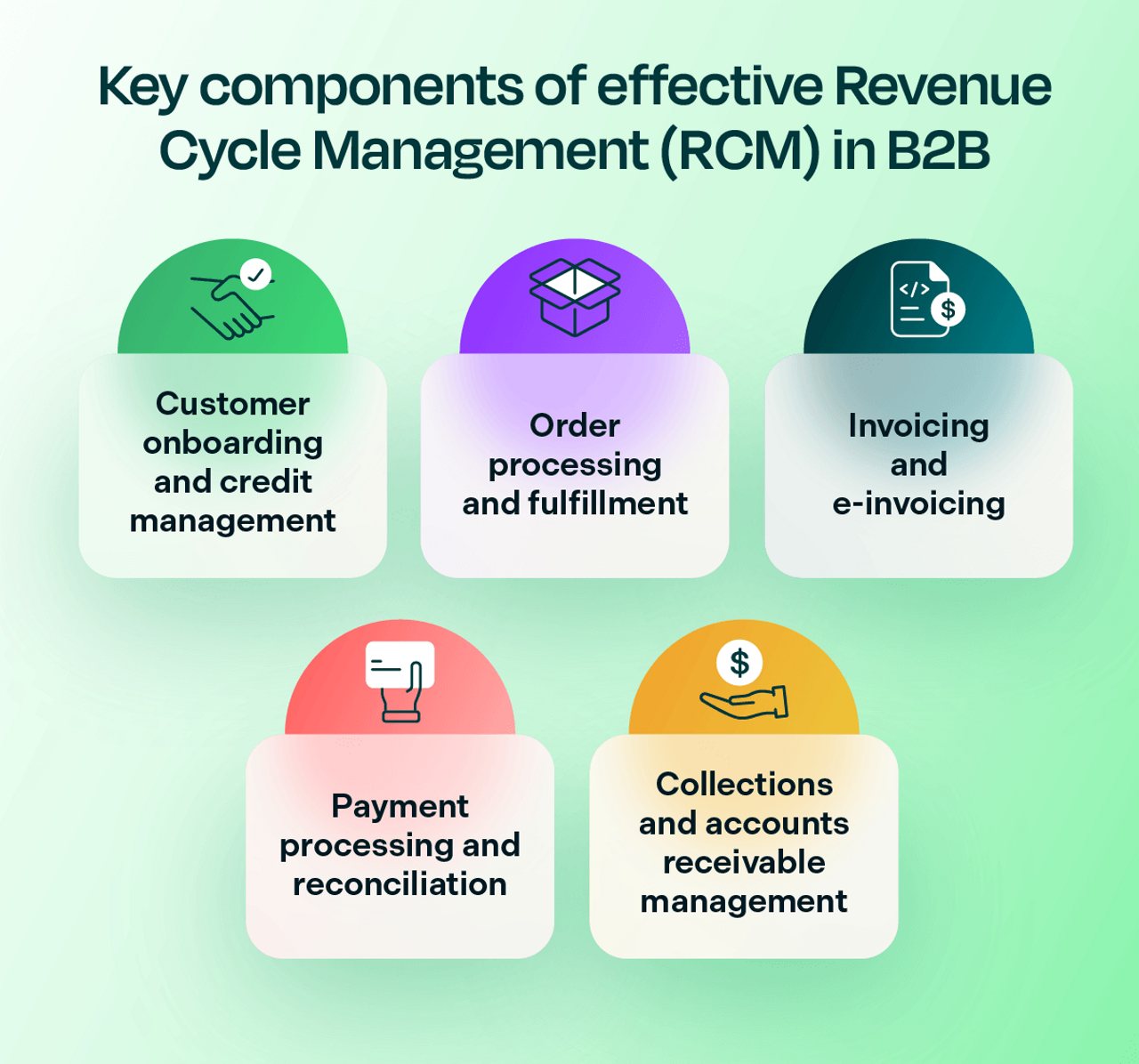

Key components of effective RCM in B2B

To optimize your RCM and improve revenue cycle processes, focus on these pivotal components:

Customer onboarding and credit management

Smooth customer onboarding sets the stage for successful financial relationships. Implement a thorough yet efficient process for new customers, conduct regular credit checks, and establish clear credit policies. Leverage data analytics to predict credit risks and adjust terms accordingly, ensuring a balance between growth and financial security.

Order processing and fulfillment

Streamline your order-to-cash cycle by automating order entry to reduce errors and speed up processing. Implement real-time inventory management for accurate order fulfillment, and use electronic data interchange (EDI) for seamless communication with customers and suppliers. Regular reviews of your order fulfillment processes can uncover opportunities for improvement and efficiency gains.

Invoicing and e-invoicing

Generate clear, accurate, and timely invoices to keep your revenue cycle moving. Adopt e-invoicing to speed up delivery and reduce costs. Ensure your invoices comply with regulatory requirements, especially for international transactions. Offering multiple invoice delivery options caters to customer preferences and can accelerate payments.

Payment processing and reconciliation

Diversify your payment options to accommodate customer preferences, potentially increasing the speed (and volume) of payments. Implement automated payment posting to accelerate reconciliation and use advanced matching algorithms to handle complex payment scenarios. Providing real-time payment status updates to customers enhances transparency and trust.

Collections and accounts receivable management

Develop a strategic collections process with clear escalation procedures for accounts receivable management. Harness data analytics to prioritize collection efforts effectively. Implement automated reminders for overdue payments, reducing the need for time-consuming phone calls. Train your staff in effective and professional collection techniques to maintain positive customer relationships.

Accounts receivable software: your RCM powerhouse

At the heart of modern RCM lies robust accounts receivable software. This technology serves as the central nervous system of your revenue cycle, connecting and optimizing various components. Quality AR software automates repetitive tasks, provides real-time insights, and helps manage the entire order-to-cash process more efficiently.

When selecting AR software to improve your revenue cycle processes, look for these key features:

- Integration capabilities with your existing systems

- Customizable workflows to match your unique business processes

- Powerful analytics tools for data-driven decision-making

- Automated invoice generation and delivery

- Real-time cash application and reconciliation

- Customer self-service portals for easy payment and invoice access

- Compliance with industry standards and regulations

The right AR software solution can transform your RCM processes, turning a once-cumbersome task into a streamlined, data-driven operation. It acts as a central hub, connecting all aspects of your revenue cycle and providing a unified view of your financial operations.

The role of technology in modern RCM

Technology has revolutionized revenue cycle management, transforming it from a labor-intensive process into a sophisticated, data-driven system. Let's explore how cutting-edge solutions are reshaping RCM:

Automation in invoicing and payment processing

Automation serves as the backbone of modern RCM, offering a multitude of advantages:

- Minimized human errors in invoice creation and payment handling.

- Lightning-fast invoice delivery and payment processing.

- Consistent application of payment terms and late fees.

- Scalability to manage high transaction volumes without expanding staff.

For instance, smart systems can generate invoices the moment goods ship or services conclude, dramatically shrinking the gap between service completion and billing.

AI and machine learning in cash application

Artificial Intelligence (AI) and Machine Learning (ML) are game-changers in cash application:

- Intelligent pairing of payments with invoices, even when some remittance data is lacking.

- Seamless handling of complex scenarios like partial payments or multi-invoice settlements.

- Self-improving accuracy in matching over time.

- Empowering staff to tackle strategic tasks by automating routine work.

These innovations significantly slash the time and effort needed for cash application, boosting both efficiency and precision.

Read the blog → Use cash application analytics for smart matching

Data analytics for performance improvement

Advanced analytics unlock crucial insights for RCM optimization:

- Spotting trends in payment behavior and forecasting late payments.

- Evaluating the impact of different collection strategies.

- Offering real-time visibility into key performance metrics.

- Enabling fact-based decision-making for credit policies and terms.

Leveraging these technological advancements allows businesses to shift their RCM approach from reactive to proactive, anticipating challenges before they materialize and continuously refining their processes.

Best practices for optimizing B2B RCM

Elevating your revenue cycle management demands a comprehensive approach that goes beyond new tools. It's about crafting a strategy that streamlines processes, harnesses technology, and transforms data into actionable insights.

Here's how to take your RCM systems to the next level:

- Streamline order-to-cash processes: Map out your entire workflow, identify bottlenecks, and standardize procedures across departments. Regularly review and optimize these processes for continuous improvement.

- Embrace e-invoicing and digital payments: Transition to electronic invoicing and encourage customers to adopt digital payment methods. This approach speeds up transactions and reduces processing costs.

- Leverage data analytics: Use predictive analytics to forecast cash flow, analyze customer payment behaviors, and monitor key performance indicators in real time. These insights drive informed decision-making.

- Automate collections and dispute resolution: Implement systems for sending automated payment reminders and use AI-powered chatbots for routine inquiries. Develop a clear escalation process for complex disputes.

- Utilize accounts receivable software: Invest in comprehensive AR software that automates key processes, provides real-time insights, and offers customizable workflows tailored to your business needs.

- Integrate systems seamlessly: Ensure your RCM solution integrates smoothly with existing ERP and CRM systems. This integration facilitates data flow and provides a holistic view of your financial operations.

- Monitor and benchmark performance: Regularly assess your RCM performance against industry standards. Use these insights to set realistic improvement goals and track progress.

Optimizing your RCM is an ongoing journey. As you put these practices into action, you'll likely uncover new opportunities for refinement. Stay nimble, keep learning, and don't shy away from expert guidance when needed. Your refined RCM processes will set the stage for robust cash flow and enhanced financial performance.

Measuring RCM performance

Keeping tabs on your RCM performance isn't just a good idea—it's a game-changer for your business. Let's dive into the key aspects you should be tracking:

Key performance indicators (KPIs) for accounts receivable

Your AR metrics are the pulse of your RCM health. Keep a close eye on these essential KPIs:

- Days sales outstanding (DSO): How quickly are you converting sales into cash?

- Collection effectiveness index (CEI): How efficient is your collections process?

- Bad debt to sales ratio: Are you effectively managing credit risk?

- Invoice accuracy rate: How often are your invoices error-free?

- Average time to resolve disputes: How quickly can you settle disagreements?

These numbers tell a story. They reveal where you're excelling and where your RCM processes need improvement.

Benchmarking against industry standards

Ever wonder how you stack up against your peers? Industry benchmarks offer valuable context:

- Dig into industry-specific RCM benchmarks.

- Join industry surveys or benchmark studies.

- Connect with professional associations for benchmark data.

- Use these comparisons to set ambitious yet achievable improvement goals.

Remember, you're not just trying to keep up—you're aiming to lead the pack.

Continuous monitoring and improvement

RCM isn't a "set it and forget it" deal. It requires ongoing attention:

- Set up real-time dashboards for your key RCM metrics.

- Schedule regular deep dives into your RCM processes and outcomes.

- Encourage feedback from your team and customers on RCM processes.

- Create and implement action plans based on your performance insights.

This ongoing cycle of measurement, analysis, and refinement keeps your RCM processes sharp and effective.

Streamline your RCM with our accounts receivable solutions

As you look to put these RCM insights into action, Billtrust stands out as a leader in B2B payments and accounts receivable automation. With over two decades of experience, we've revolutionized RCM for businesses across 40+ industries. Our comprehensive AR software solutions address the challenges of B2B transactions, offering solutions that cover the entire order-to-cash cycle.

What sets us apart?

- End-to-end solution: From credit management to collections, our platform covers every aspect of the RCM process.

- AI-powered innovations: We leverage cutting-edge AI and machine learning for smarter cash applications and predictive analytics.

- Seamless integrations: Our ERP-agnostic software integrates smoothly with your existing systems.

- Global capabilities: We're compliant with various e-invoicing regulations, perfect for businesses with an international footprint.

- Proven track record: We serve 2,400+ customers worldwide and process over $1T in invoice dollars annually.

Our AR software transforms your entire approach to RCM. Here's what you can expect:

- Automate outreach and collections

- Invoice anywhere, anytime

- Gain deep insights into your payment cycles

- Collect payments on time, every time

- Realize company-wide ROI

- Access robust reporting for data-driven decisions

Implementing our solutions sets your business up for financial success. Our software helps reduce DSO, improve electronic payment adoption, and accelerate cash application—all while providing a better customer experience.

Take your RCM to the next level with Billtrust. Don't let outdated processes hold you back. Get started today and experience the power of truly optimized revenue cycle management. Your future self (and your bottom line) will thank you.

Frequently Asked Questions

Check out the FAQs for general questions. Find helpful answers quickly to get the information you need.

Revenue cycle management's main goal is to optimize the process of receiving payments for goods or services provided. It aims to accelerate cash flow, reduce administrative costs, and improve overall financial performance.

RCM encompasses the entire financial process from initial patient contact through balance payment. Unlike traditional billing, which focuses solely on invoicing and collections, RCM takes a holistic approach to financial management, including insurance verification, coding, and denial management.