Finance leaders are constantly seeking ways to improve their organization's financial health and drive growth. One of the most powerful tools at their disposal is effective revenue cycle management (RCM). In today's fast-paced business environment, mastering RCM is essential for staying competitive and achieving sustainable growth.

Revenue cycle management is the financial process that businesses use to track customer transactions through final payment of a balance. It's a crucial process for any business that wants to optimize its financial operations and maintain consistent cash flow.

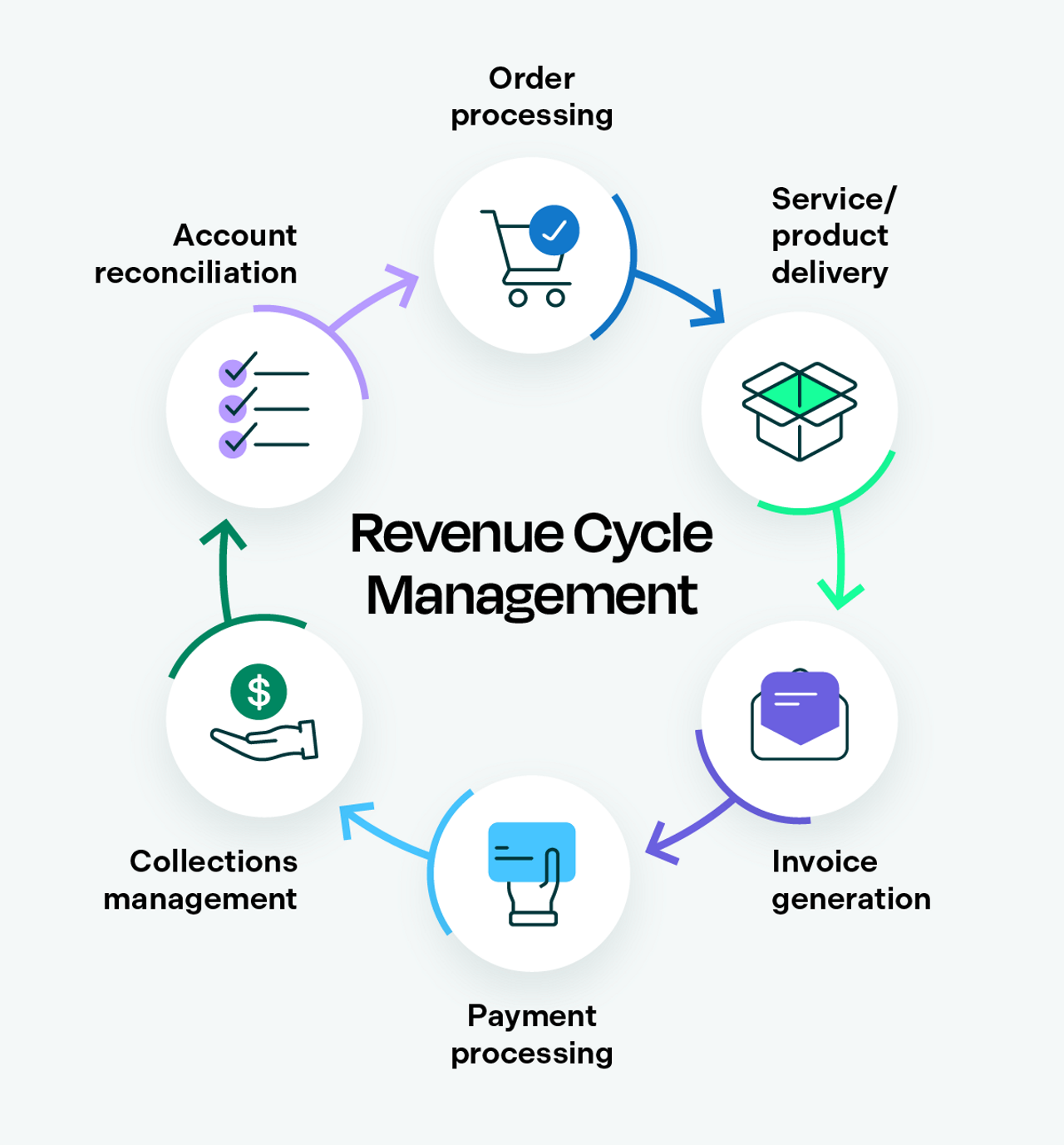

The revenue cycle management process

At its core, RCM ensures that your organization receives full and timely payment for its products or services. It encompasses all administrative and operational functions that contribute to capturing, managing, and collecting revenue, from initial customer contact through final payment processing and reporting.

Understanding the RCM process is crucial for optimizing it. While the exact steps may vary depending on your industry, a typical RCM process includes:

- Order processing: Capturing customer orders and verifying all necessary information is complete.

- Service/product delivery: Accurately documenting the delivery of products or services provided.

- Invoice generation: Creating and distributing accurate invoices through preferred channels.

- Payment processing: Recording and applying incoming payments to the correct accounts.

- Collections management: Following up on overdue accounts and managing payment disputes.

- Account reconciliation: Ensuring all transactions are properly recorded and accounts are balanced.

Key components of effective revenue cycle management

The importance of RCM in business operations cannot be overstated. A well-managed revenue cycle can improve your cash flow, maintain accurate billing, minimize revenue leakage, and boost your bottom line. It's the lifeblood of your financial operations, directly impacting your ability to invest in growth, innovation, and talent retention.

To truly excel at RCM, you need to focus on several key components:

- Order-to-cash solutions: It is crucial to implement a system that manages accounts receivable services and the entire process from order placement to payment receipt. This includes order management, credit management, invoicing, collections, and cash application.

- Invoicing: Accurate and timely invoicing is the foundation of a healthy revenue cycle. Modern invoicing solutions should support multiple delivery channels and provide real-time visibility into invoice status.

- Payments: Offering diverse payment options and streamlining payment processes can accelerate cash flow. This includes supporting electronic payments, credit cards, and emerging payment technologies.

- Cash application: Automating matching incoming payments with open invoices can dramatically improve efficiency and reduce errors.

- Analytics and reporting: Robust analytics capabilities provide insights into your RCM performance, helping you identify areas for improvement and make data-driven decisions.

Challenges in revenue cycle management

While revenue cycle management is crucial for financial success, many organizations face hurdles in optimizing their RCM processes. These challenges can impact efficiency, cash flow, and the bottom line. Let's explore some of the most common obstacles businesses encounter in their RCM journey.

- Manual processes: Reliance on manual data entry and paper-based systems leads to errors, delays, and inefficiencies.

- Fragmented systems: Using multiple disconnected systems for different parts of the RCM process creates data silos and hinders visibility.

- Changing regulations: Keeping up with evolving industry regulations and compliance requirements can be challenging.

- Customer expectations: Meeting rising customer expectations for straightforward digital experiences in billing and payments.

- Data quality issues: Poor data quality can lead to billing errors, payment delays, and customer dissatisfaction.

- Lack of visibility: Limited visibility into the entire revenue cycle makes it difficult to identify and address bottlenecks.

Read our white paper → Transforming accounts receivable: ERP systems aren't enough

Benefits of optimizing revenue cycle management

Optimizing your revenue cycle management can transform your financial operations and drive substantial business growth. The benefits extend far beyond just improved cash flow, touching every aspect of your financial health. Here's a look at the key advantages you can expect from well-optimized RCM systems.

- Improved cash flow: Faster invoicing, payment processing, and cash application accelerate cash flow.

- Reduced days sales outstanding (DSO): Efficient RCM processes can reduce the time it takes to collect payments.

- Increased revenue: By minimizing revenue leakage and improving collection rates, you can boost revenue.

- Enhanced customer satisfaction: Streamlined billing and payment processes improve the customer experience.

- Improved compliance: Automated systems help ensure adherence to industry regulations and standards.

- Better decision-making: Real-time data and analytics enable more informed financial decisions.

- Cost reduction: Automation and efficiency gains can minimize operational costs.

Best practices for revenue cycle management

To truly harness the power of revenue cycle management, it's essential to implement industry-proven best practices. These strategies can help you overcome common challenges and maximize the benefits of your RCM efforts. Consider incorporating these key practices into your RCM approach.

- Implement a unified RCM platform: Use an integrated solution that covers the entire order-to-cash process for better visibility and efficiency.

- Prioritize data quality: Invest in systems and processes that ensure accurate data capture from the start.

- Embrace automation: Automate as many RCM processes as possible to reduce errors and improve efficiency.

- Focus on the customer experience: Improve revenue cycle processes with the customer in mind, offering clear communication and easy payment options.

- Leverage analytics: Use data analytics to continually monitor and improve your RCM performance.

- Invest in staff training: Ensure your team is well-trained on RCM best practices and technologies.

- Regularly review and update processes: Continuously assess and refine your RCM processes to adapt to changing business needs and technologies.

Read our industry report → AI pushing the boundaries of what's possible for OTC

Measuring success in revenue cycle management

Effective revenue cycle management isn't just about implementing processes – it's about continuously measuring and improving your performance. By tracking key performance indicators (KPIs), you can gain valuable insights into your RCM effectiveness and identify areas for improvement. Here are the essential metrics you should be monitoring.

- Days sales outstanding (DSO): Measures the average number of days it takes to collect payment after a sale.

- Net collection rate: The percentage of reimbursement collected out of the total amount allowed by payers.

- First-pass resolution rate: The percentage of claims paid on the first submission.

- Denial rate: The percentage of claims denied by payers.

- Cost to collect: The total cost of collection efforts divided by total collections.

- Cash collection as a percentage of net patient service revenue: Measures how much of your revenue is actually collected.

- Bad debt ratio: The percentage of receivables that are written off as uncollectible.

Regularly monitoring these metrics will help you identify areas for improvement and track the impact of your optimization efforts.

How Billtrust enhances revenue cycle management

At Billtrust, we understand the complexities of RCM and the challenges finance leaders face in optimizing their processes. Our comprehensive order-to-cash platform is designed to address these challenges head-on, providing a unified solution that covers every aspect of the accounts receivable cycle.

Our platform offers:

- Advanced invoicing solutions: Our multi-channel invoicing capabilities ensure your invoices reach customers quickly and efficiently, supporting both electronic and traditional delivery methods.

- Streamlined payments: We offer a range of payment options alongside our Business Payments Network, which simplifies B2B payments and accelerates cash flow.

- Intelligent cash application: Our AI-powered Cash Application solution achieves industry-leading match rates, reducing manual work and improving accuracy.

- Robust analytics: Our platform provides real-time insights into your RCM performance, helping you make data-driven decisions to continually improve your processes.

- Integration: Our solutions integrate with major ERP systems, ensuring a smooth flow of data across your financial operations.

By leveraging Billtrust's expertise and technology, you can transform your RCM processes, driving efficiency, improving cash flow, and fueling business growth.

Revenue cycle management is a critical function that can impact your organization's financial health and growth potential. By understanding the RCM process, leveraging technology, and implementing best practices, you can optimize your revenue cycle to drive efficiency, improve cash flow, and boost profitability. As you embark on your RCM optimization journey, remember that it's an ongoing process. With the right strategies and tools, you can turn your revenue cycle into a powerful engine for business growth.

Billtrust empowering financial excellence

At Billtrust, we're your partner in financial success. As the leading provider of order-to-cash solutions, we're committed to helping businesses like yours gain efficiencies, grow revenue, and increase profitability.

What sets us apart? It's our unique blend of cutting-edge technology, deep industry expertise, and an unwavering commitment to our customers. We believe in the power of innovation to solve complex financial challenges, and we're constantly pushing the boundaries of what's possible in accounts receivable automation.

Whether you're looking to accelerate cash flow, reduce DSO, or transform your entire order-to-cash process, Billtrust has the solutions and expertise to help you succeed. Join us in shaping the future of financial operations – because with Billtrust, the possibilities are limitless.

Frequently Asked Questions

Check out the FAQs for general questions. Find helpful answers quickly to get the information you need.

The main goal of RCM is to optimize billing processes and collect payment for services or products, ensuring timely and complete reimbursement while minimizing revenue leakage.

Technology can automate manual processes, reduce errors, provide real-time visibility into RCM performance, and enable data-driven decision-making.

It's best to continuously monitor RCM performance and conduct thorough reviews at least quarterly to identify areas for improvement.