Modern finance leaders are most successful when they understand the impact of collecting cash from accounts receivable – while needing intelligent solutions that transform their entire AR process. Today's sophisticated debt collection software represents a shift from manual processes to AI-powered automation that helps organizations control costs, accelerate cash flow, and deliver exceptional customer experiences.

As order-to-cash cycles become more complex and transaction volumes grow, finance teams are discovering that automated collection solutions aren't just helpful – they're essential for maintaining competitive advantage. By leveraging artificial intelligence (AI) and machine learning, these solutions empower teams to streamline processes, predict payment behavior, and optimize resources in ways that create strategic advantages for the organization.

Key features driving modern debt collection solutions

As the world of financial operations grows and changes, the features that define modern debt collection software have evolved dramatically. Today's solutions go beyond simple payment tracking and reminder systems, incorporating AI capabilities and automated workflows that transform how organizations manage their collections processes.

- AI-powered workflow automation: Advanced AI capabilities automate routine collection tasks, from payment reminders to follow-up communications. This automation ensures consistent outreach while allowing collection teams to focus on strategic activities that require human insight and relationship management.

- Predictive analytics for payment behavior: Modern solutions analyze business credit history, payment patterns, and other credit data to predict payment likelihood and optimize collection strategies. This data-driven approach helps teams prioritize their efforts and tailor their collection strategies for maximum effectiveness.

- Customizable collection strategies: Every business has unique requirements for managing collections. Leading debt collection products offer customizable workflows, communication templates, and collection rules that align with specific business needs and customer segments.

- Compliance tools: Built-in compliance features help organizations navigate complex regulatory requirements while maintaining appropriate documentation and audit trails. This systematic approach helps reduce risk while ensuring consistent policy adherence.

Benefits for enterprise organizations

While traditional collection methods often struggle to scale efficiently, today's automated solutions offer transformative advantages that extend far beyond simple cost savings. For enterprise organizations managing complex payment operations across multiple channels and customer segments, these benefits can create substantial competitive advantages.

- Enhanced operational efficiency: By automating routine tasks and providing intelligent workflow management, collection teams can handle larger volumes of accounts without proportional increases in headcount. This scalability is crucial for growing organizations.

- Improved cash flow management: Through automated follow-ups and optimized collection strategies, organizations can reduce Days Sales Outstanding (DSO) and improve working capital efficiency. Predictive analytics help finance teams better forecast cash flow and manage resources.

- Strengthened customer relationships: Modern collection software enables personalized communication approaches that maintain professional relationships while encouraging prompt payment. Self-service options and flexible payment channels improve the customer experience.

Read the blog → Maximizing ROI: Optimizing accounts receivable with software

The power of AI and machine learning

Artificial intelligence and machine learning have revolutionized the collections landscape. For finance leaders looking to modernize their operations, AI and machine learning capabilities represent a fundamental shift in how collections can be managed and optimized.

- Intelligent prioritization: Acting as a decision management solution, AI-driven systems analyze multiple factors to prioritize accounts requiring attention, ensuring collection teams focus their efforts where they'll have the most impact.

- Automated outreach optimization: Machine learning algorithms continuously analyze response patterns to determine the most effective timing and channels for customer communications, improving collection success rates.

- Advanced pattern recognition: AI systems identify subtle patterns in payment behavior that might escape human notice, enabling proactive intervention before accounts become seriously delinquent.

Security and compliance considerations

Modern collection software must balance the need for efficient operations with increasingly stringent requirements for data protection and privacy. As organizations handle sensitive financial information across multiple jurisdictions, the importance of security features and compliance capabilities has never been greater.

- Security measures: Enterprise-grade security features protect sensitive financial data and customer information, with regular updates to address emerging threats.

- Audit capabilities: Detailed audit trails track all collection activities, providing documentation for compliance purposes and enabling process improvement analysis.

- Privacy protection: Advanced systems incorporate privacy protection measures that align with various regulatory requirements while maintaining operational efficiency.

Integration capabilities

The ability to connect and synchronize with various business systems has become a defining factor in the effectiveness of collection software implementations. Modern enterprises rely on complex networks of interconnected systems, making straightforward integration capabilities essential for maintaining efficient operations.

- ERP integration: Modern solutions offer integration with major ERP systems, ensuring smooth data flow and consistent information across platforms.

- AP portal connectivity: Direct connections with accounts payable portals streamline payment processing and reduce manual intervention requirements.

- API flexibility: API capabilities enable custom integrations and data synchronization with other business systems, supporting complex enterprise environments.

Read the blog → Data-driven decisions with Billtrust analytics

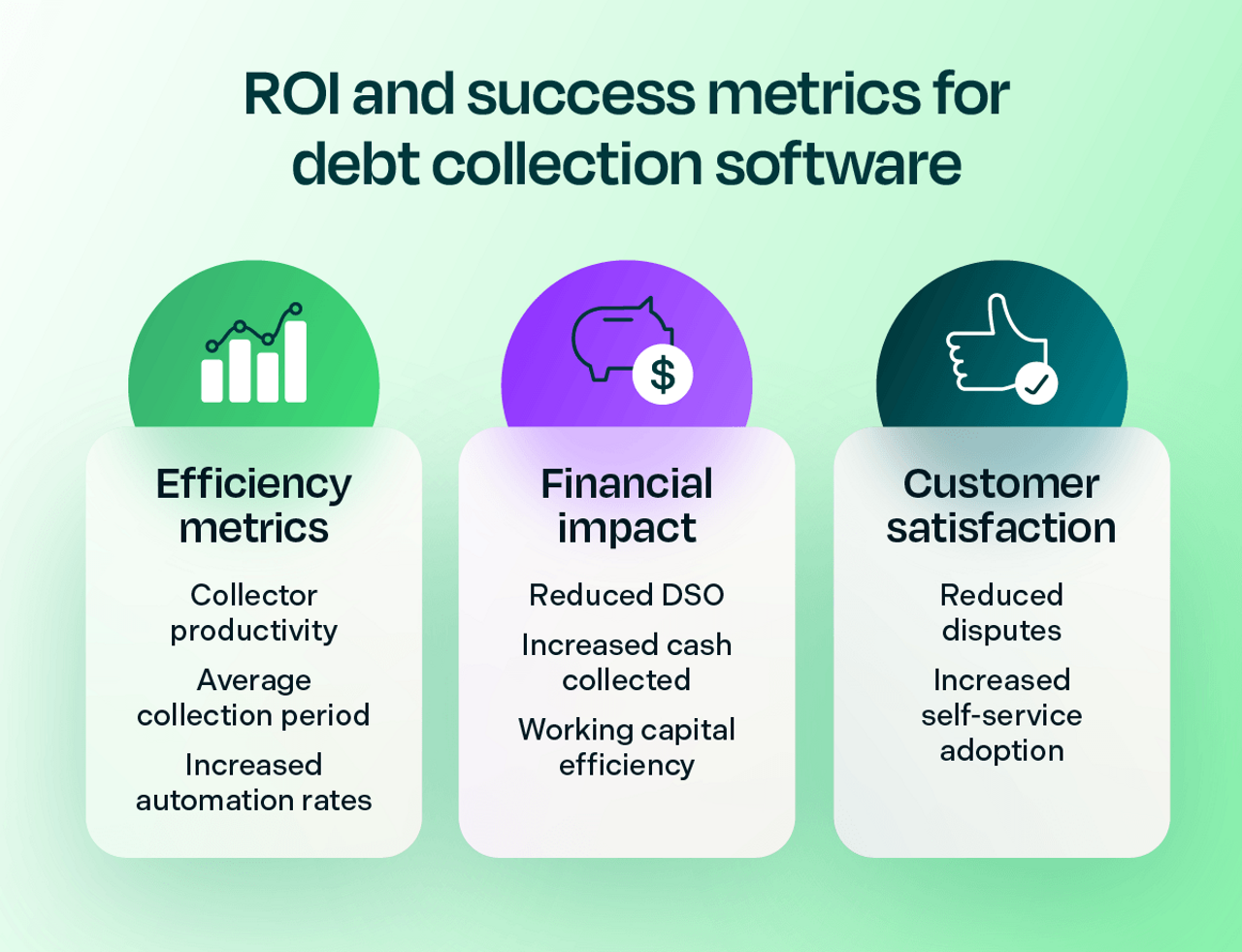

Measuring success and ROI

The key to maximizing ROI lies in identifying and monitoring the right combination of performance indicators that align with organizational objectives.

- Efficiency metrics: Track improvements in collector productivity, average collection periods, and increased automation rates.

- Financial impact: Monitor changes in DSO, calculate cash collected from accounts receivable, and track working capital efficiency.

- Customer satisfaction: Measure improvements in customer satisfaction and payment experiences through reduced disputes and increased self-service adoption.

By implementing modern debt collection software, finance leaders can transform their collection processes, improving efficiency while maintaining strong customer relationships. The key lies in selecting a solution that combines powerful automation capabilities with the flexibility to adapt to specific business needs and integration requirements.

Transform your accounts receivable with Billtrust

For over two decades, Billtrust has been at the forefront of transforming how businesses manage their order-to-cash processes. As the leading provider of accounts receivable automation solutions, we help organizations control costs, accelerate cash flow, and create exceptional customer experiences. Our mission is simple yet powerful: we empower financial leaders to transform their operations through innovative technology.

Our success is built on a foundation of customer commitment, innovation, and accountability. Our customer-first mindset drives our AI and machine learning innovation, helping organizations stay ahead in an increasingly complex business landscape. We believe in delivering more than just software – we create partnerships built on deep industry expertise and an unwavering commitment to customer success.

As businesses face evolving financial operations and regulatory requirements, we continue to expand our capabilities while maintaining our core values. Our dedication drives us to develop new solutions that help organizations thrive in an evolving business landscape, all while ensuring that our commitment to our people and their families remains at the heart of everything we do.

Frequently Asked Questions

Check out the FAQs for general questions. Find helpful answers quickly to get the information you need.

Modern solutions leverage AI and machine learning to automate processes, predict payment behavior, and optimize collection strategies, moving beyond simple database management and reminder systems.

AI analyzes payment patterns, prioritizes accounts, optimizes communication timing, and predicts payment behavior, enabling more efficient and effective collection processes.

Look for solutions with data encryption, secure authentication, audit trails, and regular security updates that align with industry standards.