Distribution companies make the complexity of global manufacturing and trade simple for their customers. But who is making the business of getting paid simple for them? At Billtrust, we pride ourselves as the experts in AR optimization for the distribution business worldwide.

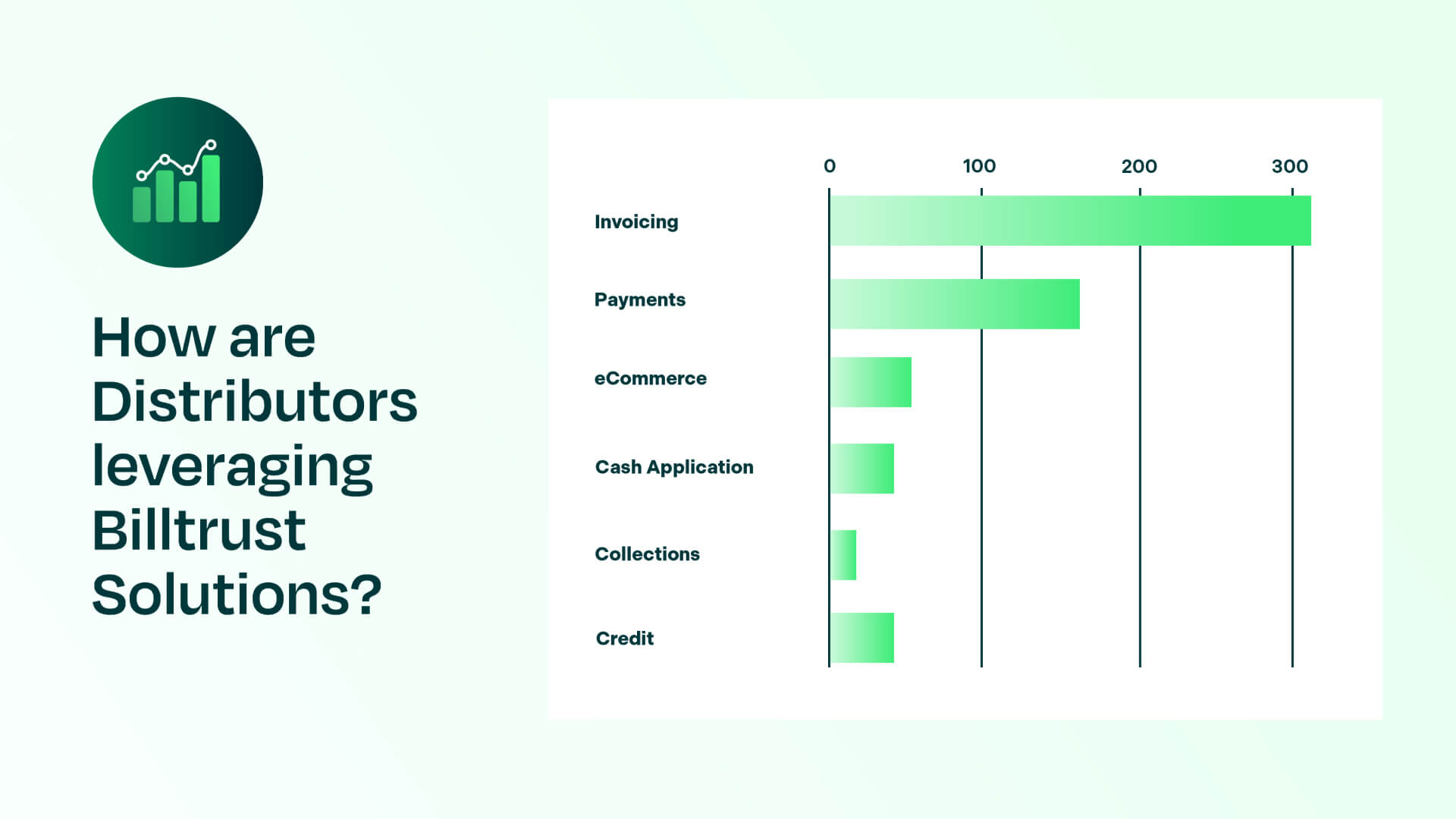

We serve 440+ distribution companies globally, totaling over $748 billion in revenue. And we work across 15 unique industries. We've got the experience, the solutions, and the benchmarks to help you revolutionize your accounts receivable (AR) operations.

Achieve faster, more cost-effective invoice delivery with AR automation

The days of manually created and mailed invoices are dwindling. Invoices must be generated and distributed digitally, and AR automation makes that possible.

Delivery times can be cut down from days to minutes when you move your customers away from printed and mail invoices and toward emailed invoices and billing & payment portals. The cost savings are immediate, and the countdown clock to payment starts sooner – speeding the path to revenue.

For your larger customers who require you to log into AP portals to invoice them, Billtrust has a unique solution that allows you to upload all of your invoices in one place and automatically have them entered into your customer's AP portals. You'll even get a daily report into AP portal invoice statuses that will help you handle any exceptions in your customers' systems.

Adapt to (and influence) customer payment methods

One of the significant benefits of AR automation is the ability to offer a variety of payment methods, adapting to customer preferences. Including options like ACH and credit card payments can influence customers to settle their invoices more quickly. Additionally, distributors can encourage the use of preferred, cost-effective payment methods through discounts or reward programs.

Make sure you’re processing your credit card payments using level 2 or level 3 data. The higher levels of customer data makes credit card networks more comfortable with the veracity of your transactions, and, in turn, they will charge you lower interchange fees.

Billtrust has unique features that make processing emailed credit card payments easier. Billtrust's Business Payments Network technology automatically opens emails containing credit card payments, securely processes them, and then sends the remittance data to your cash application solution.

Explore surcharging to reduce the cost of credit card payments

Credit card transactions come at a cost, usually in the form of processing fees charged to the distributor. However, AR automation platforms can include surcharging capabilities, allowing businesses to pass on some or all of the transaction fees to the end customer, thereby reducing the cost burden on the distributor.

You'll need to consider whether or not you'll get customer buy-in. But Billtrust can make the surcharging process easy while ensuring that you will always be compliant with state and national laws and credit card rules.

Surcharging: the key to unlocking credit card payments

Download the solution guide

Improve and automate cash application

Automating the cash application process involves matching incoming payments to the correct invoices. Advanced AR software can use artificial intelligence (AI) to recognize patterns and accurately apply payments at a much faster pace than manual application, freeing up valuable resources and decreasing human error.

Billtrust boasts an industry industry-leading match rate and employs a powerful exception handling engine that makes it easy to quickly correct and apply payments that need extra attention.

Institute smart collections technology

Smart collections technology can prioritize receivables based on the risk and value of the accounts, ensuring that the most critical receivables receive attention first. Automated payment reminders and personalized collection campaigns can also be structured around customer behavior to improve payment timeliness.

And collectors are supported with a daily list of prioritized tasks and a system that will help them log customer contacts and promises to pay.

Ditch the spreadsheet for purpose-built AR software

Spreadsheets might offer a comfort zone for many, but they are prone to errors and inefficiencies. Purpose-built AR software provides real-time data, better visibility into AR processes, and decreases the chances of mistakes which, in turn, accelerates the order-to-cash cycle.

Track and resolve disputes quickly

Disputes can slow down payments and impact cash flow. AR automation offers dedicated modules to manage disputes efficiently. These systems can log disputes, track their resolution, and provide insights to prevent similar issues from occurring again.

Provide a seamless experience with AR automation from order to payment

Finally, AR automation can ensure that the customer experiences a seamless process across their journey. By integrating eCommerce platforms, ERP systems, and other operational tools, distributors can provide a consistent and intuitive customer experience that minimizes errors.

AR automation solutions for distributors

You’ve mastered logistics, marketing, and your customer relationships. Now, master your order-to-cash process by integrating best-in-class solutions from Billtrust.

Join the hundreds of successful distribution companies that have reduced their days sales outstanding (DSO), accelerated their cashflow and lowered their error rate with Billtrust AR automation.

Take control of your order-to-cash process today!

Get started by talking with an expert and discover how Billtrust’s AR automation software can boost your efficiency, optimize your cash flow, and more.

Schedule your discovery call now!