The Hackett Group recognizes Billtrust as a Digital World Class® provider

Industry Report

Licensed to Billtrust

Improving “cash flow performance / liquidity / working capital” is the #2 objective of surveyed finance leaders*. And software solutions can significantly aid in the accomplishment of those objectives. But the process of choosing a provider can require combing through extensive feature sets, conducting peer research and performing internal analysis.

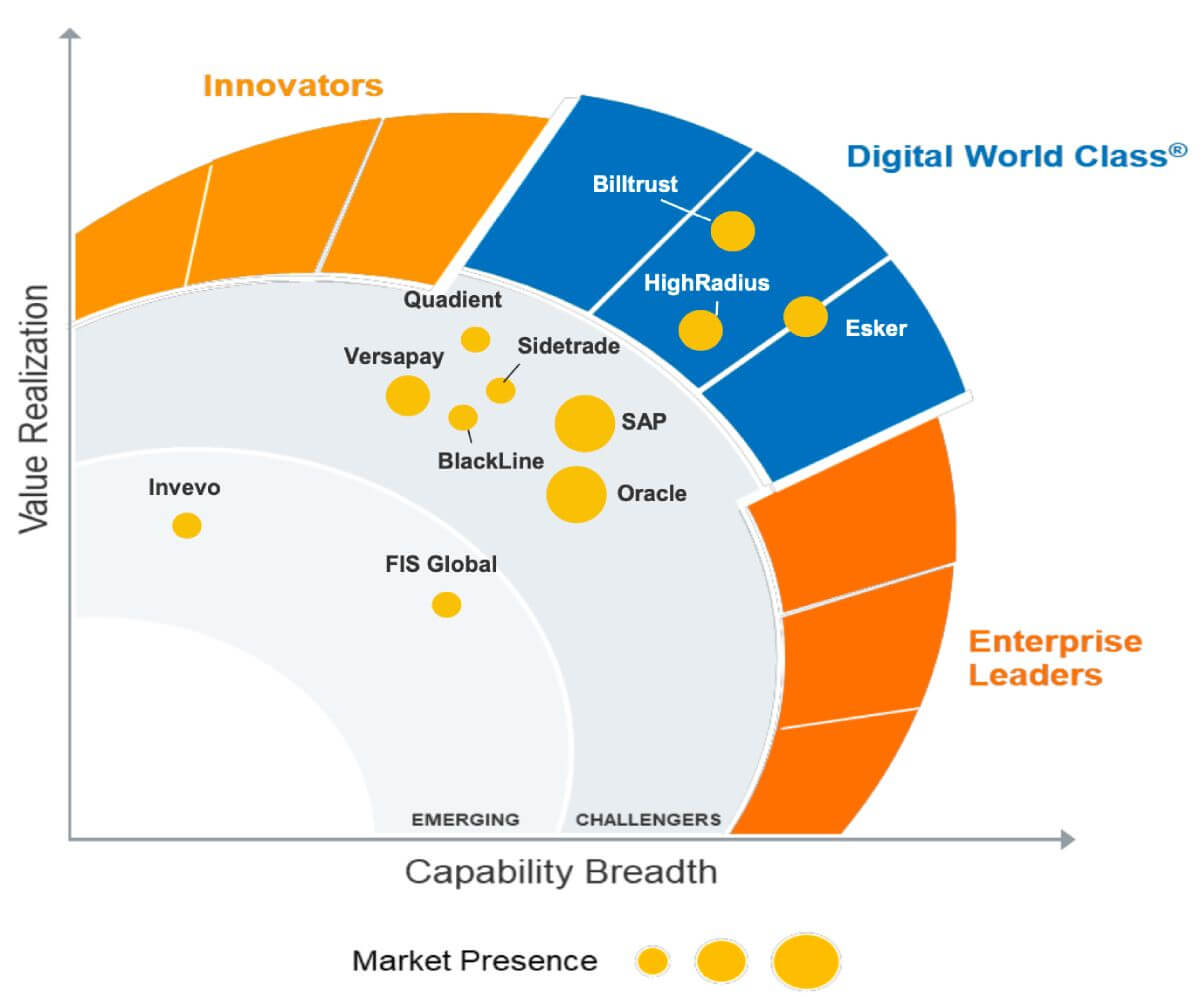

The Hackett Digital World Class Matrix™ endeavors to analyze the leading receivables software providers and summarize the breadth of their capabilities alongside their level of value realization.

This can prove a vital tool for finance leaders as they assemble new software partners.

Billtrust is proud to have been recognized as a Digital World Class® provider in the Customer billing / EIPP software provider category.

Download the report to see Hackett’s in-depth assessment of Billtrust solutions across multiple categories.

Receivables software can deliver reduced cost, increased productivity, accelerated cash flow & delighted customers.

| Value realization opportunity for $5B - $10B organizations | |

|---|---|

| 3 days ▼ | Reduction in the cycle time to complete transactions |

|

8 ▼FTEs per $B

|

Reallocation of full-time equivalent (FTE) staff through automation, increased accuracy and reduced cycle times |

| 50% ▼ | Up to 50% process cost savings |

“Billtrust’s suite of C2C [Customer-to-cash] process software features dynamic reporting and dashboards with modern looking and intuitive visualizations. Billtrust’s AI strategy includes providing cognitive workflows and prescriptive analytics, such as its innovative “Days to Pay” index derived by data within its data ecosystem.”

Fill out the form to get your free copy of the The Hackett Digital World Class Matrix™ Customer-to-Cash (C2C) Receivables Creation Software Provider Perspective.

*The Hackett Group’s 2024 Finance Key Issues study